Raiz pioneers micro investing for new class of investors

Founded by our good friend George Lucas in 2016, and listed on the ASX in June 2018, Raiz Invest Limited (ASX: RZI) has a market capitalisation of around $140 million and is the mobile-first platform and app that focuses on millennials to automatically invest and save. The company has been steadily growing its funds under management and has recorded an 82 per cent increase in the year to April 2021 to $738 million.

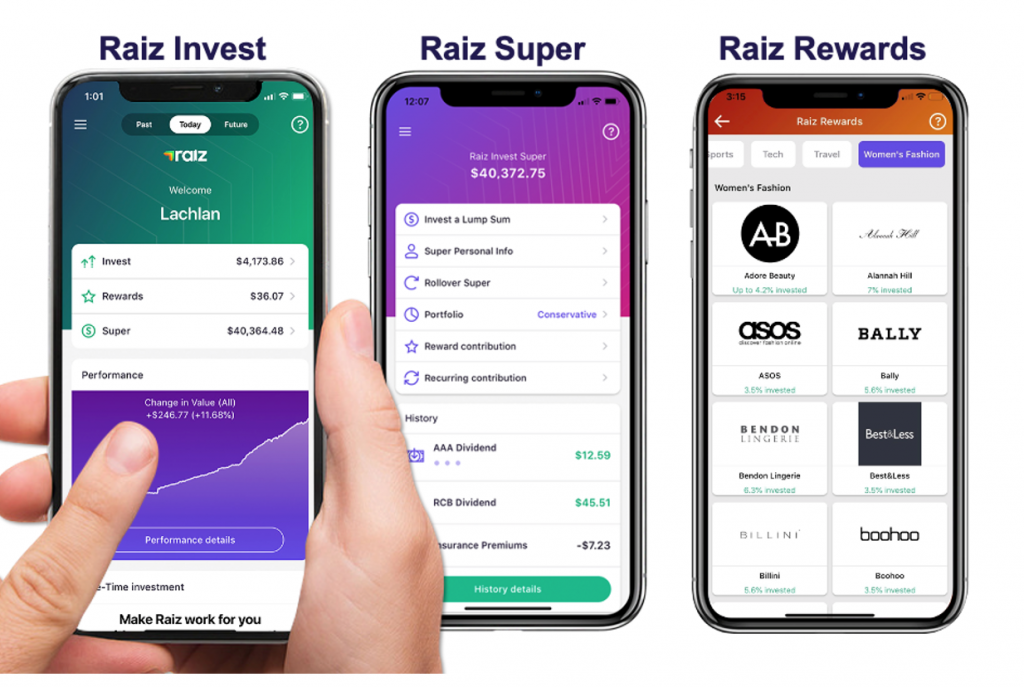

The company’s proprietary investment platform has made micro investing possible. Raiz’s philosophy is about investing small amounts automatically and regularly to encourage users to form healthy saving habits and start thinking about long-term financial goals.

The most popular way is the Round-Up feature, which enables users to automatically invest their spare change from everyday purchases with one-off investments from as little as $5.00. Users can invest automatically via a Savings Goal or Recurring Investments. Raiz also offers cashback invested from shopping through the Raiz Rewards feature, which has more than 320 brand partners.

In 2018, Raiz introduced Raiz Invest Super, allowing users to invest their super in the same portfolio options.

Customers can invest in one of seven diversified portfolios, or through a custom portfolio option. Introduced to the Raiz platform in 2021, the custom portfolio allows users to construct their own portfolio from 14 ETFs and up to a 5 per cent target weight in Bitcoin, which was introduced as an alternative asset class in 2020.

Raiz invest operates in Australia, Indonesia and Malaysia.

First mover advantage

Raiz is the only Australian online platform and app that enables the automatic round-up of virtual spare change from daily purchases into diversified portfolios facilitating seamless investing.

Customers have the ability for users to choose their asset allocations and to change their allocations as often as they like for a low flat monthly fee and no brokerage. Raiz has attracted 268,000 customers with normalised revenue increasing by 39 per cent to around $3.2 million over the March 2021 quarter, compared to the previous corresponding period. However, net cash outflow from operating and investing activities was $1.2 million for the March 2021 quarter and $2.5 million for the nine months to March 2021.

The company is looking for continued growth over the foreseeable future, and that will be required before Raiz Invest is in a sustainably positive cashflow position.

With a fully owned end-to-end technology stack, which includes administration, operations and registry and fund management functions, the scalable business model is positioned for future growth including expanding into overseas markets.

Continued innovation to future growth

Since launching in 2016, Raiz has achieved solid growth, amassing more than 1.2 million downloads, over 1 million sign-ups, with over 268,000 active monthly customers and over $738 million funds under management in Australia. With low interest rates, many Australians are dipping their toe into the share-market for the first time, in search of a higher return on their savings, ideally positioning the “micro-investing” apps which essentially act as a broker, to enter the market with smaller sums.

With an experienced management team at the helm, the company is focussed on growing its Southeast Asia operations in Malaysia and Indonesia offering the same customer experience offered Australia.

You can read more about Raiz at their investor centre.