Property: Don’t bet on a crash because it ain’t coming

I have previously suggested that a very large correction in property prices could occur if the generation of baby boomers, whose wealth is broadly stored in real estate, were required to sell in order to fund their retirement and healthcare expenses.

The reason for the lower prices is that the generation below are unable to afford to acquire the property at present prices.

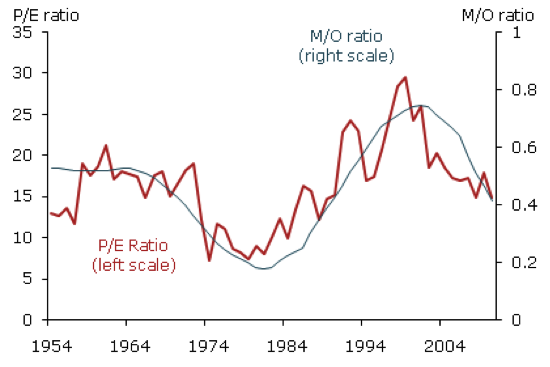

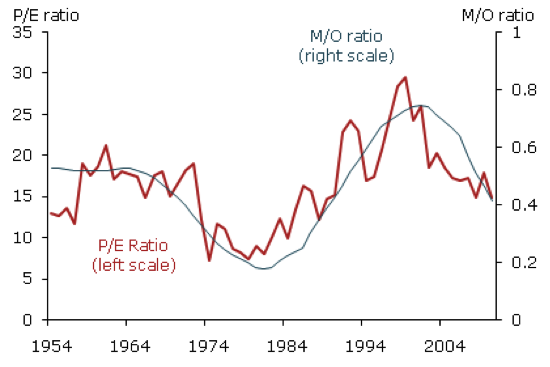

You might recall in our blog post here we articulated the evidence that US equity values are closely related to the age distribution of the population. We presented the following plot of US price earnings multiples against the ratio of 40-somethings to 60-somethings. With the number of 40-somethings compared to 60-somethings declining, the number of accumulators compared to dissevers was also declining. And with that decline came declining price earnings multiples investors were willing to pay for stocks. This makes sense, as the fewer years you have to live, the fewer years’ multiple of earnings you might want to pay.

My logical mind also tells me that most asset classes should behave the same way, but I have a sneaking suspicion Australian residential real estate may buck the trend.

We will flesh out this out a little more in coming days, so stay tuned to find out why we think you might be acting irrationally waiting for any correction before entering the property market

Of course, in the meantime if you want to take a stab at why I now believe baby boomer property investors won’t suffer a calamitous sell-off, submit your thoughts here…

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

I would ask anyone championing an end to ‘reprehensible’ negative gearing just who they expect to invest in the 200,000 or so new homes needed per year to house our ever burgeoning population? The government? We have all seen how dismal a failure public housing has been in the past and how current governments seem incapable of running a successful chook raffle let alone a major infrastructure project. Take away negative gearing and you will take away the largest investor in new homes, the mum and dad investor.

During my house hunting in the inner suburbs of Sydney I couldn’t help noticing how many parents were helping their children buy (if not buying out right for them). Perhaps we are seeing a cultural shift where there will be inter-generational housing support. This would help support prices as property would pass to the younger generations or perhaps remain in family trusts and not go to market.

Our property prices won’t fall meaningfully while interest rates remain low current yield is supportive ie attractive compared to the risk free rate.

I believe that the reprehensible negative gearing regime is to blame. The elderly are forced to subsidise this pyramid scheme through the unfair low interest rate environment which is foisted upon them. So while the vulnerable, in their retirement years, are cheated out of a fair return on their investments, to prop up this creaky behemoth, the wealthier part of society gratefully receive subsidies in the form of reduced tax payments. Investment properties should be ringfenced and losses should not be offset against other income. This would bring some sanity to one of the most overpriced property markets in the world. May the tulips blossom and the elderly have their dignity restored.

Spectacular Andrew

The change in tax treatment in the US was the primary reason for property crash there in the late 1980s. Most speculators and investors tend to over look the government role. These things tend to come out of the blue when no one expects it. That’s why such events are particularly painful. They happen when everyone is one side of the boat and market is at its most vulnerable. No one can predict what the government will do, but stranger things have happened. Absent government tinkering, I agree all sings point to stable residential property prices.

Roger, I am delighted you may have come around to my way of thinking. The reason we are not going to have a property crash is very simple, and in its simplicity it is lost on our American friends who delight in telling us the end in neigh.

Simply put, we have a massive amount of equity built in our homes. It has been well over 40 years since we have had any sort of death duty, gift tax, inheritance tax or other such tax. The ongoing inheritance of homes and turn over of property ensures each following generation has significant equity in their own home. As such we don’t have the majority of the population leveraged to the hilt.

As those retiring in the next 5 years have enjoyed over 20 years of compulsory super, the pressure to sell the family pile to fund a retirement is significantly lessened, thus fewer properties are put on the market that “must” be sold.

Whilst a minority of people who have bought their home in the past 1 to 3 years may suffer some mortgage stress if interest rates go up in the next year or so, this is not a significant portion of the market, and will not lead to a deluge of properties hitting the market at fire-sale prices. It is the sudden surge in supply that can send prices falling rapidly, and this is not going to happen.

Further, we have had decades of prudent bank lending policies requiring significant deposits and that a serviceability test be met, to protect both the borrower and the lender. These are the protections that were missing from the US market that led to the very concept of “Sub-Prime” mortgages.

We may indeed be in for a number of years of flat performance of the property market, even -1% P.A. for 5 years in a row, but a massive crash? No way.

All the best

Scott T

Property is not about prices per se – it’s about values more so and that connotes a whole range of other attributes that influence buyers choice and sellers have to respond accordingly if they wish to realise equity.

They will rent out their properties to us young ones and live off that income instead.

• With superannuation going to 12%, equities will benefit so much that Baby Boomers won’t need to sell the mansion?

• Contributing to the above point, Baby Boomers die and this M/O increases, driving up P/Es and reducing the need to sell the mansion as equities should fund all those European cruises?

• The Reserve Bank can’t raise interest rates because our economy couldn’t take it, but prolonged low interest rates will cause increased inflation, further increasing asset prices?

• It’s so expensive to sell and buy property that a Baby Boomer might be better off with a reverse mortgage? Especially since real house prices in Australia have roughly tripled over 40 years.

• Without high house prices our banks’ balance sheets would be horrible, so any falls would ruin our economy thus forcing the government to intervene, meaning property prices will simply track sideways at worst?

• It seems more expensive to build than buy established?

• Foreign investors would step in at any sign of price weakness?

• Gen X will take a while to blow-up due to buying property through SMSF?

• Because there’s clearly not an inch of land in Australia without a building on it?

• Because ‘this time it’s different’ and we won’t have a massive property bust following a mining boom, like we did after the Gold Rush? Noting that now being post-federation, the entire country relies heavily on the mining states.

• Resmed will make sure we all live to 140?

• None of the above?

My stab; because they know that the government has its hands tied – in spite of inflationary pressure caused by rising property prices, interest rates must remain low in order to keep the Aussie dollar down and keep our economy afloat.

That, and perhaps the fact that a lot of the buying pressure is coming through foreign investors (e.g. Chinese capitalising on loosely policed foreign investment rules).

Looking forward to hearing your thoughts Roger.

Hi

Interesting article. I don’t believe there will be a crash or a heavy correction. Though I do believe prices will sooner rather then later dampen and soften for a long period.

The RBA has already flagged income growth to shift down gears.

Money is cheap at the present moment but as all things this too shall pass.

I noticed you mentioned that Australia May buck the trend ?

Just be mindful of those four words, ” this time it’s different”.

Recent ABS figures puts the net migration levels at about 5000 – 6000 per month. Studies have shown that about 900,000 dwellings will be needed over the next three years. Last year 183,000 were built. I think it’s a case of supply and demand, and while demand is there, and interest rates are at historic lows, prices should remain strong.

That’s my 2c.

The usual? – shortage of property, migration/population growth, low interest rates here to stay for longer?

My personal opinion is that central banker owned governments will do ‘whatever it takes’ to keep the prices artificially high via first home owner grants, continuation of negative gearing and other market distorting techniques.

My prediction would be that overseas property buyers will hold the Aus property market at high levels for the medium to long term.