Our process in practice

Today’s blog post is an example of our investment process in practice, the result of which has enforced our commitment to investing in quality companies with bright prospects at attractive discounts to our estimates of their intrinsic value.

Montgomery Investment Management uses a sophisticated screen to identify companies with strong fundamentals. While the screen is a comprehensive analysis of the market, it is not a complete valuation tool, which means that we are always open to investment ideas from a variety of sources.

With this in mind, let’s return to October 2013, when a common investment idea amongst brokers was Transpacific Industries Group (ASX: TPI), the provider of recycling and waste management services. The buy case was built on the following arguments:

- Transpacific had sold its New Zealand assets to repay debt.

- It was considered to be well-positioned to benefit from an economic rebalance away from mining to infrastructure.

- It was anticipated that management would make material cost reductions.

We weren’t as optimistic about Transpacific’s prospects, particularly as the company had not screened well with our internal processes. Still, we may have been missing something, so we decided to do a brief assessment of the company. From this, we quickly concluded that:

- Paying down debt by selling assets is not the same as generating value.

- We felt that Transpacific would be materially impacted by the slowdown in the mining sector.

- We felt that it would take considerable time to regain market share.

Ultimately, we considered that Transpacific was not a compelling value proposition and were comfortable sitting on the sidelines. As I mentioned in a blog post in May 2014:

“If you were to consider Transpacific as an investment, you should never lose sight of the business’ fundamentals. You see, waste management is a capital-intensive, low-margin business. Due to the stability of the industry, it is highly competitive to secure long-dated contracts. While the service that is provided is critical, the client would have little concern over which operator takes away their waste, so long as it’s gone.”

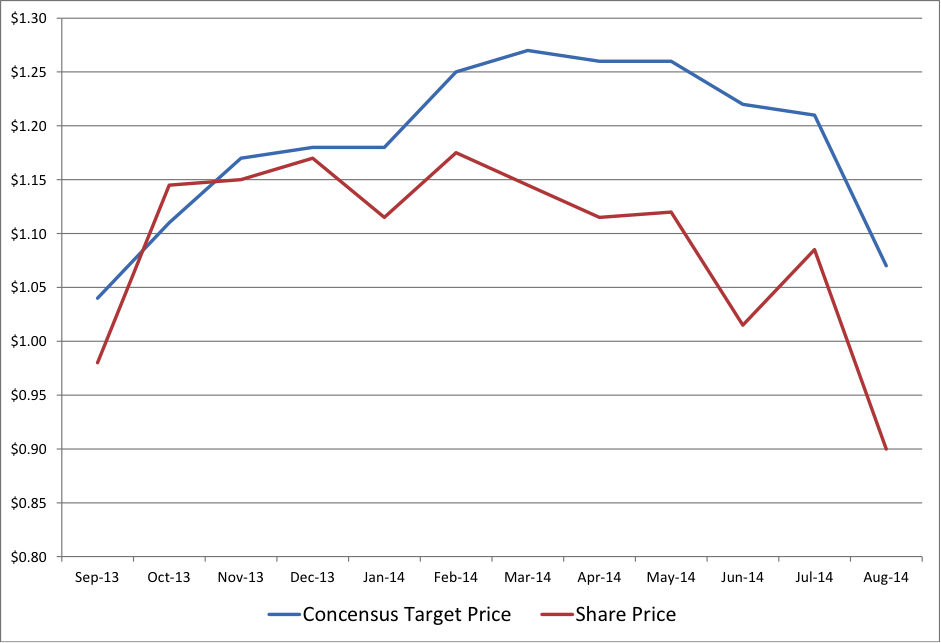

Consensus analysts continued to expect that the price would materially appreciate, evidenced by the chart below.

However, Transpacific reported results for the 2014 financial year that were materially below market expectations. This was predominantly due to an evaluation of the company’s landfill facilities, which determined that $232 million of additional capital would be required to achieve best practice.

It didn’t take long for the underlying economics of the company to emerge. Consensus targets have since fallen to the same levels of a year ago, and the share price is materially lower.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I always like posts like this as it allows me to judge my thoughts and actions with those of a team that i respect very well. Especially as i am currently in the middle of analysing and valuing a bunch of companies (Twitter, Woolworths and Cardno) for different reasons, it is a good guide as to how i am doing.

My first thought as i was reading your article was “since when has selling assets to pay down debt” been a good thing and there for indicate a buy opportunity. I want my businesses to be able to fund their debt obligations through the ordinary profitability of the business. The fact that you chaps at Montgomery came to the same conclusion is encouraging.

Thanks Andrew.

Nice instructive story…could you give us details on recent example of a positive case where you decided to invest?