Not so High at JB Hi-Fi?

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…

Many of you have heard me discuss JB Hi-Fi and its preferred status among retailers – I believe if JBH is doing it tough everyone else is doing it even tougher. But we sold JBH from our holdings at $15.50 recently and I thought the story of why (ahead of a downgrade as it turns out) would be a good insight into the way we think. Hopefully other investors can gain some insight into the process and fill in the 1) ‘bright prospects’ part of the equation that also requires 2) extraordinary businesses and 3) discounts to intrinsic value.

Starting way back in February 2010 we commented on the impending retirement of JBH’s Richard Uechtritz (now looking as well-timed as other prominent CEO departures, such as the Moss departure from Macquarie and I am sure you can list a few more – go right ahead) and the maturing outlook for the business itself.

“If JB Hi-Fi could re-employ all of its profits at the returns of about 45% it is generating now, its value would be over $38. That’s a pipe dream. The company is generating cash faster than it can ask its employees and contractors and landlords to employ the funds to open new stores. And because the profits also produce taxes and associated franking credits that have no value for the company, shareholders are being handed back the funds, which is a disappointment. However, as chairman Patrick Elliott implied when I spoke with him on radio this week, this is a function of growth and the limited size of the Australian population.

It happens eventually to all retailers and it will happen to JB Hi-Fi in the next five to seven years. The best you can hope for is that once the stores have saturated the market, directors stick to their knitting, and the company continues to generate high returns but pays out all of those earnings out as a dividend (becoming like a bond) rather than make some grand attempt to buy something offshore or diversify too far away from their core expertise (often at the behest of some institutional shareholder) and blow up the returns.

The result of not employing as much retained earnings at 45% is that the intrinsic value declines. It is still going up but not as much.”

In August here at the blog we wrote:

“The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.”

and

“JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.”

and

“Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.”

and

“JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).”

In addition to these comments I wrote more recently:

“The release of the iPhone 4S seemed to underwhelm technology reviewers when launched and a portion of the population do take their purchasing cues from such quarters.

The 4S is apparently an evolution in the iPhone series, rather than a revolution, and as such, fewer users of the most recent release – the iPhone 4 – will upgrade. Instead, it is likely that they will wait until the iPhone 5 is released next year (owners of the previous model the iPhone 3GS, however, should be coming off their two-year contracts about now and are expected to upgrade). We’ll come back to that shortly.

The iPhone doesn’t contribute anything like a majority profit to JB Hi-Fi’s bottom line. This is because margins on Apple products are slim. But the iPhone does generate foot traffic and phone upgraders also buy protective covers and other accessories on which JB Hi-Fi makes much more significant margins.

So why do we care so much about the iPhone?

It’s because when JB Hi-Fi announced its full-year results the company forecast more than $3 billion in sales and management cited growth from computing, telco, and accessories. They said:

“While we anticipate the market to remain challenging, our diversified product portfolio, particularly the categories of computers, telco and accessories, from which we expect strong growth, will assist JB Hi-Fi in delivering another year of solid sales and earnings in FY12. Assuming trading conditions are comparable with FY11, we expect sales in FY12 to be circa $3.2b, an 8% increase on prior year.”

It’s the lower “telco and accessories” sales that are expected to stem from the iPhone 4S underwhelming so-called early adopters and its most ardent fans that may put pressure on that sales forecast.”

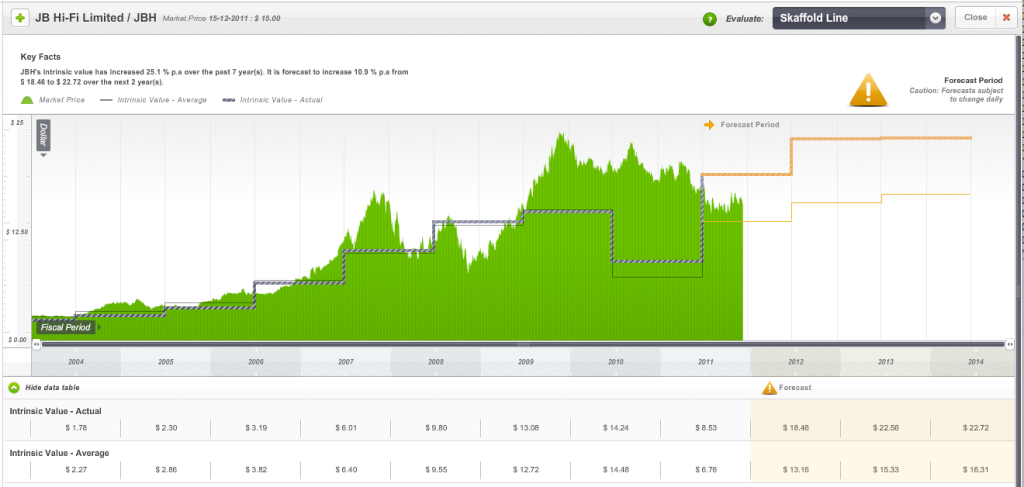

Indeed the only thing that was going for JB Hi-Fi was its discount to intrinsic value. Many investors believe that a stock I mention is below intrinsic value is a “darling’ of mine. It isn’t. A company must meet all of our criteria and it will only be held for as long as it does. Those of you using Skaffold will however have seen JBH was trading only at a discount to one of the intrinsic value estimates – the intrinsic value based on analyst forecasts – but not the more conservative Skaffold Line valuation estimate of $13.16. See Figure 1.

Figure 1.

Both valuations are now likely to decline further in coming days -even the more conservative $13.16 valuation SKaffold has been displaying – and the downgrade may also be reflected in pressure on the company’s cash flow which Skaffold members would have already seen in the 2011 results and which prompted some of the above comments. (See Figure 2. and note the negative funding gap line (international patents pending))

Figure 2. Showing declining operation cash flow and a growing Funding Gap (patents pending).

JB Hi-Fi was 5 per cent of our portfolio however we sold all of our position at $15.50 recently. Our reasoning was simple; Given present circumstances and expectations for retailing (having spoken to many retailers recently) many retailers JB Hi-Fi would have to revise their earlier outlook statements and this would produce lower future valuations. At the same time analyst forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JBH was not offering that margin of safety. We also commented to our peers in conversations over the phone and in person that the delfation story – as explained by Gerry Harvey who noted selling plasma TVs for $399 this year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs. Finally we also believed that ANZ’s profit growth being dominated by bad debt provisioning writedowns meant that credit growth was non-existant. When you take away growth in credit card purchases – thats got to hurt discretionary retailers.

On November 7 we wrote to our Montgomery [Private] Fund investors thus:

A prominent media commentator and broker however wrote on December 6

“Our No.1 discretionary retail recommendation remains JB Hi-Fi (JBH). We all know 21% of JBH’s register is currently shorted, a massive short position usually reserved for financial impaired or structurally stuffed stocks. JBH is neither, and that is why we continue to be aggressively recommending buying the stock which generates 25% of its annual profit in December. JBH is trading on 11.2x bottom of the cycle earnings. Nowadays, the P/E’s of cyclical stocks compress with their earnings, meaning that both P/E and E bottom concurrently.”

So, JBH still has long term prospects that surpass many of its peers and I believe it still has a competitive advantage. And if all those short sellers cover their position, the stock could rally. That however would be speculating. On the flip side, changes to accounting reporting standards will give it a lot more liabilities – contingent liabilities such as operating leases will need to come onto the balance sheet. Also, the medium outlook, which includes deflation continuing, will put pressure on JB to sell more volume at precisely the time everyone may just have enough stuff. Finally, the market may now finally catch up to the maturity story we described way back in 2010. Of course consumers will return at some point and spending and credit growth will recover, but given the current weakness and fear among consumers the idea of requiring very, very large discounts to the more conservative estimates of intrinsic value dominates our thinking.

As always be sure to do your own research and seek and take personal professional advice.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

Roger

In your discussion of JBH, both at this site and Eureka Report, you did not mentioned the massive debt load taken on by management in the last quarter last year. The ROE doubled and Debt to equity went from ~25% to about 150%. The debt loading undertaken was the sell indicator for me as to my knowledge they wasn’t a satisfactory explanation for the need for the borrowing. I don’t understand why this isn’t the single biggest reason not to hold them now? but I didn’t see you mention this issue?

Hi Ray, My recollection is that we did discuss the debt that was used to fund the buyback.

A few more thoughts on JBH i have had recently when trying to look through the windscreen in front of me at future years.

Do Australian’s still care about the Olympics enough that they will want to buy the latest technology in order to watch it?

Will JB Hi Fi now get enough followers to be successful and if so could it in fact generate a type of “network effect”?

Will 2012 see an iphone 5, ipad 3 and other new releases of popular mobiles?

Will 2012 be the year in which the gaming console makers bring out a new console or will they keep trying to add value to their existing consoles like Xbox did with kinect?

I am thinking about the above and other similar questions as rolling out new stores cannot be counted on to anymore to provide the type of sales and profit growth needed to sustain its return on equity. Instead, JB have to look at new innovative ways to bring in new growth or find ways to get better value and sales from its existing stores.

The final options are to increase dividends again, not a bad thing but not the best when looking at ways to increase intrinsic value or by buying back its own stock when the opportunity to intelligently do so comes up.

JB will always i believe outperform its competitors, when the retail landscape gets a headwind JB will likely shoot out in front again but it still won’t hide the issues of maturity and where future growth will come from.

And the latest from our friends at Patersons: “Retailers getting smashed again this morning as the other market darling Kathmandu (KMD) falls 20% on a profit warning saying Christmas is below expectations. This follows the very recent warnings from JB Hi-Fi and Billabong and confirms the expectations that the sector has a number of profit warnings in the pipeline although some of the bigger retailers are expected to wait until they report 2nd Q sales numbers in early January to spill the beans. With Billabong going from a consensus yield of 7.6% to probably no dividend at all it is hard to judge the sector on PE or yield until the downgrade cycle shows signs of bottoming. The downgrade risk is high in most of the majors. For traders – sentiment is terrible ands sentiment is volatile. The sector is close to GFC lows from which it rallied 147% in six months.”

I just got back from finishing my Christmas shopping. I was dreading that I wouldn’t find a parking spot and if was I able to find one, there would be so many people that it would be an unpleasant experience.

What actually occurred was I found a parking space easily and the crowd inside wasn’t so big. I am not suprised by the retail downgrades coming through – it looks like a bleak Christmas for them.

It is exactly what i have been seeing and hearing as well. Thats why i like retail companies. You have the ability to analyse the company by just going to the local shopping mall. One thing i do know as well, the more unloved the retailing sector gets, the more opportunity that will come out and one day sentiment will change for some of these companies.

Boxing day public holiday sale here is Adelaide (1st day most shops opened in SA post-Christmas) – I visited Gepps Cross Home Maker Centre – newest and largest in Adelaide – JB Hi-Fi and Harvey Norman were both packed, all tills doing very busy trade. JBH didn’t sell whitegoods, so we ended up buying a new upright freezer and a clothes dryer from an electrical retailer called “The Good Guys”. Their (reduced) ticket price was already lower than HVN, then they dropped another $200 off the freezer and another $100 off the dryer to lock in the sale. The salesman there take you through to a till to organise everything (including delivery) for you, but all tills busy (including back-office and service-desk tills) and we had to wait. Hard to move around in all three stores, due to quantity of people. Hundreds of people leaving with boxed goods or bagged goods and many others leaving with A4 sized receipts, as we did, for larger items (to be delivered or picked-up around at their loading dock).

Radio Rentals (TGA) also doing a lot of business, but we didn’t go in to that particular store. We did however purchase a flat screen 55inch Sony TV and wireless home theatre system from the Modbury RR store a couple of months ago, and found the range, service & price were all acceptable. Only gripe with RR (TGA) is that they wasted about 15 mins of our time trying to sell us gold-plated cables, screen-cleaning gels & Wipes, and extended service warranties, after they had already closed the initial sale. That must be where the real money is! We got none of that with “The Good Guys”, and the whole process of getting in, getting what we wanted, and getting out, was must faster and satisfying at TGG.

We noticed that every single item in the Harvey Norman store (that we looked at) had a red “Does NOT include surge protection” sticker on the front – an obvious ploy to sell surge protectors to customers along with the white goods. Seeing as our house has a safety switch and a surge protector at the metre box and that all of our power boards do also, we wouldn’t have been caught in that trap. Plenty of others would though.

Quick comment on customer service – at Radio Rentals (TGA), and The Good Guys, we had more than one salesperson come up and ask if we needed assistance (which we did), then we got their (almost undivided) attention through until sale completion (including payment). At Harvey Norman this did not occur. There were some sales staff around but they were all too busy talking to people who had found THEM, rather than the other way around. Harvey Norman wasn’t any busier than the others, they just have less sales staff on the floor. We left HVN without talking to anybody or buying anything (we just noted down their prices for the models we were interested in), because we needed to buy a freezer that day, and just wanted to secure a good price and cheap delivery.

In summary, based on that tiny sample, I’m glad to own shares in TGA and JBH, and am glad to NOT own any HVN. Also, I wish I COULD buy shares in The Good Guys business, because they were by far the best and were selling the most. My understanding is that TGG is a franchise operation, where franchisees own the stores and pay fees to the franchisor for using the name and the systems (buying power, advertising, etc..). It sounds like it’s a good franchise to be in if you secure the right area. I know a guy who bought a Jim’s Antennas franchise who has been doing it tough at times.

Have a great New Year everybody!

Cheers!

John C.

The essential issue is that are we gouged on music, video and computers and people have found ways of buying them cheaper. Its is so easy these days and the rents people like JB Ho are charged makes it worse

Hi Roger,

Just a general question about skaffold.

When is the latest i can register to buy and still be considered

a founding member. ie: get 13 months instead of 12.

Thanks,

Michael

Only the Skaffold Team know for sure, so give them a call.

Hi all,

sorry this is just a question about CSL that i thought a few here might know the answer to. I own shares in CSL and noticed (just today) that they paid a sum of money into my account on the 18/10/2011. NOTE, this amount was not the dividend, which I received on the 14/10/2011.

Did any other holders of CSL receive a payment from CSL (on top of the div payment), and if so can you please let me know what it is for?

I have called my broker and computershare, and neither were able to indicate what the deposit was for.

Thanks,

Chris

I have often commented on TGA, which I hold, and I still regard it as the best stock in the retail sector, although it is of mixed bloodline, being both a retailer and a financial services company.

Sucking inputs from Morningstar gives misleading signals – for instance: a) TGA did not retreat in 2008, the adjusted EPS for 2007 is 5.05 cents, whereas Morningstar has 11 cents; b) decline in sales recently is not relevant, because the increase in operating leases spreads revenue recognition over the life of the contract – in TGA’s case it is revenue that is significant; and c) the debt/equity ratio at 30/3/2011 was a short-term blip, not a reflection of trading cash-flow deficiency.

Many retailers soon push themselves to the point of optimal market penetration, and can only expand by pushing into poorer quality sites. By extrapolating percentages obtained from Lifeline, I reckon that of the 8.5 million households in Australia, at least 1 million fit TGA’s target demographic, the cash and credit constrained households. With 100,000 customers, TGA has headroom to expand for a number of years yet, and because its product range is so narrow, it can easily find a few more products to replicate the success of the lounge and dining room sets that have been so successful in the recent past (what a pity one cannot repossess coffins and headstones!).

Anyhow, although I am not buying TGA, I am not selling either, and I am happy to pick up some $40K in dividends between January and July to keep me happy while I wait for the YE 30/3/2012 to prove me right or wrong.

Thanks Michael.

I have sinned. I lied when I averred that I would buy no more TGA shares – I bought another 9000 today. By coincidence TGA was featured as Dean Morel’s Australian stock pick for January 2012 in a blurb that Motely Fool issued today.

All the adverse noise about the retail sector has spooked investors, so there is no shortage of panicked sellers of TGA shares. I would buy more if I were liquid.

OK. Thanks Michael. You don’t get bargains when everyone’s excited about the future.

Thanks Roger,

Your article highlighted a couple questions I have related to Skaffold. What exactly is the difference between average and actual intrinsic value and what are the metrics for the ratings system A1 – C5? Ive heard you say before there are 37 metrics you look at, with ROE being one of the most important, but Im curious how companies go from A1 to A3 (in JBH’s case) and not to B1 or B2 etc? Other companies have went from C4 to A1 in one year.

Thanks

Hi Peter,

Thats an easy one, give the Skaffold team a call and have a very happy Christmas. Did everyone see Cochlear’s announcement today?

Looks like COH are handling the situation well

Do you think this highlights the difficulty of projecting ROE out into the future? Or perhaps how the more qualitative aspects of a business effect valuation?

Cheers,

Jason.

Thanks Jason,

If you read the above post again you will see two valuation estimates and two Skaffold lines. Both are based on ROE projections. One is based on analyst projections and one is based on recent historicals continuing. Don’t forget its SUSTAINABLE competitive advantages that drive ROE. But don’t mistake a normal dip in the market, economic or business cycle of a company for a permanent impairment to its competitive advantage.

Hi Roger,

I noticed the profit downgrade announcement as well which contained some good information about how the current landscape is looking.

What you say is correct, if JB are doing it tough, than all the others will be doing it much tougher. I would hatre to see Dick Smith’s performance, no wonder rumours are that Woolies are looking at it and potentially interested in flogging it off. I wonder if that was a bit of a hint hint to JB who seem to be interested opening Tech stores (as in Level 6 in Pitt Street) but thats all specualtion.

I do believe that JB Hi Fi is still a strong business with a strong competitive advantage. Like Cochlear after the recall, i believe they are at a decent discount to future value, but i am unsure when in the future that will be.

But i will not simply just think that, the retailing game is hard, and saturation comes quick in Australia. The assignment i have given myself now is to look at upcoming releases tech wise and see what potential affect these might have in the future and what financial eyar JB will receive this affect.

I can already see hints that there is a playstation 4 and Nintendo Wii 2 coming in 2012 but no concrete evidence. There are always rumours about an iPhone 5 and if the 5 comes out than no doubt an ipad 3.

I will be watching the Jb Hi Fi NOW service with interest. At the moment i have not heard anyone mention it (who i feel are the type of customer who would want it).

So far i don’t think it is yet time to pull the trigger. I get the feeling they don’t expect the downgrade situation to be improved by Christmas and if Christmas isn’t what they wanted than the whole year won’t be.

Just my thoughts, i have heard from numerous sources. I am happy to wait for the HY and FY presentation and results for updated information on their future strategy and/or some potential catalyst that will drive a lot of foot traffic into their stores generating sales.

This post prompted me to have a peek for myself how JB is fairing. It is the last week before christmas so most people would have all their presents bought already.

This is in reference to the JB Hi-Fi in the Strand as well as the technology only store in Pitt Street Westfields.

There was an above average amount of foot traffic in the Strand JB Hi-Fi. There was a decent queue at the registers with most people appearing to buy either gift cards, cd’s, DVD’s or the major console games. I would say the average sale would be around the $20 mark.

Whats the revenue recognition of gift cards is it when the person buys the gift card or when the receiver uses the gift cards to purchase goods? I think it is the former.

the technology store had a fair few people in there, most i have ever seen in this store however due to the lay out it is hard to see how much money is being brought in and who is just there to play around with gadgets. I think this store is the future of physical JB stores with CD’s, games and movies moving online.

I saw something i haven’t before which i was very pleased with from a business sense. There were area’s throughout the store for online pickup. Basically allowing someone to purchase a laptop, tv etc online and then go to the store to pick it up. This is a good way of using online stores to drive foot traffic into the physical stores where hopefully they buy an extra DVD player, cables, rechargers, software etc.

…a corresponding liability raised on the balance sheet until claimed.

The other Woolies-related rumour is that they have been running the ruler over JBH to buy it. Be aware such rumours have done the rounds before…

I have been using the now.jbhifi.com.au site for a few days on their free trial.

My early assessment is positive. I was able to find all the artists I wanted, the quality was good and I’ll be buying the service when the tablet/phone version launches next year. I like that it will cache to my iPhone and won’t be tapping my data plan all the time.

In the recent announcement, CEO Terry Smart stated an average of over 900,000 people visit their website every week. I also recall reading they need 30,000 account holders to break even. I’m optimistic for them that the referral from the main site to the jbhifinow site will be sufficient to make that number, especially if they pump up the advertising.

Considering gta 5 isnt being released until the 3rd quarter of 2012 I very much doubt a ps4 or new x box console will be released any time soon.

Roger,

Regarding JBH you refer to “Skaffolds more conservative valuation” of some $13.50. On the chart this line is labelled as the average valuation. Can you please clarify?

Yes. The actual forecast is based on consensus analyst estimates. There are many many hundreds of companies for which stats are available and updated automatically daily. For all companies, Skaffold also produces an average line which is based on historical performance continuing. There is an algorithm behind the average Skaffold line that weights more recent years more heavily and performs a few other adjustments. Importantly, one thinks of the two valuations as being reflective of how optimistic or pessimistic analysts are compared to recent company performance. The closer the two lines are to each other the more likely expectations by analysts are aligned to historical norms. The more divergent, the more you need to be satisfied that changes to performance are afoot. These are great questions. Feel free to send them through to the Skaffold Help Team which is manned by a bunch of experienced guys including a CFA.

Money Magazine: September 2010 Issue 127 p.90

“Retailing maturity” Roger Montgomery now has reservations about JB HI-FI

Quote below is from second last para.

“JB HI-FI is an outstanding business and while its intrinsic value continues to rise, there is no reason to make changes to any holdings. If the share price were to fall to $13 or $14 it would be sensible to consider the purchase of further shares.”

So there you have it! As far back as Sep. 2010 Roger had given fair warning, only question is wheather Roger will take his own advice and purchase shares come Monday morning if they trade below $13 ?

Hi Simon,

That will now depend on the new facts at hand.

Hi Roger and everyone. A semi-rhetorical question for all: Taking the recent history of JBH, Roger’s detailed analysis above, and Simon’s quoting of Roger’s commentary from Sept 2010, and the fact that JBH’s share price is now where it was in 2007, would it be fair to say that share trading now requires a permanently vigilant, daily reappraisal of anyone’s holdings and a readiness to trade in and out of shares at a moment’s notice? Because that’s precisely what I’ve been doing, and I thank heaven I have the basic skills to do my own on-line trades, and the time needed for the necessary constant vigilance. For me, “Set and forget” is now ancient history, and the only thing reducing peril for me has been Roger’s Value.able and my interpretation of its principles that have helped me successfully trade in and out of FGE, MCE, ORL, MIN, COH and others.

I have in front of me Macquarie’s prediction made on 7 June 2011 for the ASX 200 at December 2011. Ready for this? 5387! Not 5380 or 5195, no, 5387! I also have yesterday’s Sydney Sun-Herald where David Potts reports Shane Oliver’s prediction of an 18% rise next year to 4950, while AMP Capital Investors of which I understand Shane is the head predicts a 12% rise. (Which is it to be?) If I were a prophet, which I am not, I wouldn’t be predicting anything of the sort. “Shares are now very cheap” reports Mr Potts as having been said by Shane. As Value.able investors, dare we ask “which ones are those”? Personally I’m trading nothing for the present, but when I resume, I can imagine Skaffold will be a big help in determining what I will and won’t do.

Well done David and thank you.

I was pondering the exact same thing recently. My answer is that no, you do not need to be constantly (almost daily) re-evaluating your position. The amount of time needed to be spent to evaluate your investments is in direct correlation to the complexity of the business or industry you are investing in and goes to the heart of your investing philosphy and whether it is more quantitative (Graham) or qualitative (modern day buffet/munger).

My thoughts were a lot clearer then so forgive me if i have or do not explain it well.

I am very qualitative, i seek market leading company’s with a strong castle (strong competitive advantage, strong financials etc). in theory a company that has this will need to be watched less than one that doesn’t. I can simply wait for news to come up regarding this letting me know and make my decisions then or it will be easy to tell changes are happening by observation. i think JB falls into this category. I also know that in most cases if the business i am interested in is struggling than its competitors would be worse, i then just have to decide if at some point the market will improve or if it is terminal.

However, the more rapidly changing the market environment, more it is affected by external issues or quality of its castle changes rapidly month to month or year to year, than the more you will need to pay closer attention and constantly re-evaluate what is happening. Instead of waiting for news to come up for this company, i would need to seek out information.

I have chosen to ignore these companys, as i do not have the time nor in most cases, the knowledge to make informed decisions or be in control of my investment.

You simply need to make a decision about what companys you do want and do not want to invest in and then you can come up with an appropriate strategy as to how to manage it.

i wish i wrote it down, amongst my other musings on investing, when i was thinking about it as i wanted to share it and see what others think but it is loosley summed up above.

Hi ANdrew,

You are building a nice body of ideas here, well done.

JBH_

If everything was good as in the past,would JBH fall below $ 13.

I dont think so.

Making statements that “I will buy below $13” are easy to make till share gets there.

Zoran

You make a good point their Zoran. Its the old “be careful what you wish for” dilemma. When share prices are much higher, we dream of them being cheaper. Generally, for shares to become cheaper an event that causes the market to questions its previous assumptions. Likewise the alert investor must reappraise. WIth some (Cochelar) the decision can be much easier.

There is a lot of time between September 2010 and December 2011.

By the way Roger is Skaffold covering international equities???

With the high AU$ coupled with a limited pool of ‘buy and hold’ type australian equities i am increasing exposure to overseas equities.

This is much harder for me than reviewing Australian stocks (where i can create my own intrinsic value models).

So is the Skaffold database including overseas shares???

I saw the IT team pull up an overseas exchange last week – we immediately went looking for bargains…Stay tuned Rici.

Can’t wait until international equities are included. I’ll need no other resource for the rest of my investing days!

Great Scotty.

My sole significant exposure to retail is Myer (MRY).

I bought into this stock just prior to the dividend which gave me an effective buy in point (if one deducts the dividend from the purchase price) of close to $2.00

I chose MYR because most importantly its trading at a discount to my intrinsic value. But also because it is a multi-category player. Its sales are not limited to a single category.

A number of purchases at its stores are made becasue of what i term DISCRETIONARY REPLACEMENT requirements (i need a new pair of jeans, i need a new kettle, i need a new ironing board, all items i have purchased over the last year at Myer). Previously bought a cheap ironing board from Target, well never again. For $20 price difference i get a much better quality ironing board from Myer. I only purchase an ironing board every 10 years, why do i care about $20 (for a difference in quality).

Comes to Christmas shopping, i bought some christmas hampers from Myer, reasonably priced, looked good.

The internet will definately take away from the margins. But at least at Myer (unlike JBH which is selling very much pure substitution goods such as TV’s, DVD’s, consol games etc) its harder to qualify pricing differences, especially when my time is precious and i need a replacement item.

MYR is NOT a growth stock. It opperates in a mature market. Its profits will rise and fall with overall consumer spending.

But at current prices and with a look through the cycle approach, i feel at current prices it will provide a reasonable return on investment (especially when the dividend is included) on a whole cycle approach.

If for whatever reason the share price appreciates significantly, then i will exit. ie MYR is not a ‘buy and hold’ stock, future intrinsic value will probably not increase significantly over time (a key characteristic if one wants to hold a stock in perpetuity). Therefore in my opinion MYR should be treated a bit like some form of a bond. If the interest rate drops too much (and conversily there will be capital appreciation in the bond price), move on.

A rising tide will lift all boats. The question is do you want to own businesses that demands the rising tide? I wonder whether JBH now fits that description too.

Except those with holes in them!

I can see how you came to your decision regarding Myer and i can’t fault it, it’s your strategy and as long as your happy with it, i agree with a lot of your comments, the below is not a critiscism at all of your purchase and i wish you well.

I thought i would just post my opinion on Myer just to help stir some debate. Myer isn’t for me, I think you are right with the whole idea that it isn’t a buy and hold stock and what Roger says about it needing a rising tide. The frequent profit downgrades that have been coming pretty much constantly since the float are one reason why.

I have always said that i think Myer still does not know what it is meant to be and this means that it is not the first port of call for a customer when buying something.

I don’t think there is anything that could be termed as a competitive advantage in their market place. DJ’s have the better labels, they appear to have better buyers and the stores have a better feel and atmosphere than the generic Myer’s.

I think Myer need to change strategy and rebrand themselves. I think if they get smart about their buying they could turn themselves into quite a decent retailer and give them a new lease on life.

I have actually been watching David Jones closely and think it is starting to get close to offering value and a very good dividend yield. This is the more interesting out of the two big “fashion” retailers for me. There are issues for both but i think DJ’s is better placed and is a decent company.

also, i forgot to add, i don’t like how Myer are buying brands (basciallyto get them away from DJ’s) and although i have no proof, my gut tells me they paid a huge amount (way way way too much) for Sass and Bide.

That seems to be the consensus view.

Thanks ANdrew

This may be fairly simplistic in a world of valuation models, earnings growth, momentum trading, etc, but what would happen if JBH gave away it’s growth desires? On last year’s earnings and the current market capitalisation, it would pay a 15 per cent dividend. Pretty handy return for the asset owner to reinvest even with the zero profit growth.

Hi Jason better to use the cash flow surplus/gap in Skaffold as an estimate of what could be paid as a dividend rather than the reported profit. But in essence you make a very valid point!

Those interested in Cochlear may be interested in this article from fnarena:

Analysts at Macquarie took a little break from covering Cochlear ((COH)). They paused just long enough to do a full review of the company, of the cochlear implant (CI) marketplace and they also surveyed 389 US-based Audiologists. Profit forecasts dropped, the price target fell, but the Buy call and the rationale behind it remain the same.

The big question must be: what did Macquarie learn? In a nutshell, they learned that despite an embarrassing product recall, despite supply constraints and despite the ongoing economic weakness in the US and Europe, people will still go deaf and most of them don’t even know about, or aren’t using CI devices and that Cochlear is still the world leader in that technology.

Cochlear sells its products in more than 100 countries and with a 60% market share, it is the global leader in implantable hearing devices. As you can imagine, this is a great position to be in, so why would Macquarie have to completely reassess its view on such a seemingly straight forward story?

The answer is simple: Cochlear has taken a beating over recent months due to the recall of its Nucleus 5 product, announced back in September. In fact, the share price has shed 25% over the past three months. The broker notes management moved fast to fund the recall, putting aside up to $150 at the AGM in October. Macquarie thinks the amount will be more than sufficient to cover the costs.

But the problem is far from just being the cost of what in the CI industry was a very, very big recall. The broker estimates that 1500 units are going to have to be removed from people’s skulls and another 2800 units have been pulled from shelves. However, the bigger problems are an inventory shortfall across the entire market and thus the threat of market share loss from insufficient inventory and from the reputational damage that was caused by the recall.

Macquarie feels, however, that Cochlear has, is and will recover from both of these issues and in fairly short order.

Looking at the supply constraint, or inventory issue, Macquarie notes the company moved quickly to ramp up production, tripling output in just three months. The company has also been able to push back implants, given most patients moving from an initial implant to a Nucleus 5 implant will want to be sticking with the same brand. The company has also moved to on-demand supply, which the broker notes has been working out well. All up, Macquarie sees all of 2012 demand being met.

The big thing helping Cochlear fill the near term shortfall is its Freedom product, which does pretty much the same thing as Nucleus 5. The product is still very popular. So much so that Macquarie thinks it’s really not important when the Nucleus 5 gets back on the shelf, as the Freedom is still better and more popular than what competitors are offering.

The reputational damage is a little stickier, but again, the broker is little concerned. Peers have had the same sort of issues, with many doctors surveyed saying that while the Cochlear recall is larger than any before, it doesn’t raise the same sort of concerns. In fact, the broker thinks the recall may have a counterintuitive effect, pushing doctors into a flight to quality, a metric which Cochlear still leads.

In fact, 93% of doctors surveyed seem to feel that Cochlear handled the recall well, while only 8% believe the company’s reputation has been tarnished.

Still, with fewer Cochlear units on the shelf, the broker admits the recall will result in minor market share increases for some of Cochlear’s peers. And while some of these practitioners will come back once supply is restored, there is a chance that some will be lost. Again, the broker thinks this will prove to be only a short to medium term issue, with Macquarie thinking that only 7% of market share will be shed in 2011.

And with Macquarie expecting the CI market to continue growing at 12% a year, and also expecting Cochlear to remain the market leader, the earnings potential for Cochlear remain solid. That said, margins, once the company’s strong suit, will take time to recover to their old growth trajectory, notes the broker. In constant currency terms, gross margin growth has run at around 17% per year over the past 10 years.

Given the N5 recall and the uncertainty as to when the company will return to automated assembly, the broker has pencilled in flat gross margins going forward on a constant currency basis. This has caused the broker to cut its FY12-15 net profit expectations by 40%, 15% and 24% respectively. Macquarie admits it’s probably being a bit too conservative and expects that much of these cuts will be peeled back once Cochlear gets back in to the groove.

That takes us to the maintained Buy call. With Macquarie of the opinion that Cochlear’s current woes will soon be history, the broker simply thinks that the current price is just too good to pass up.

Investors should note Macquarie’s new price target is the highest of the eight stockbrokers monitored daily by FNArena. Six out of the remaining seven stockbrokers have a more cautious stance (Neutral) or are negative on the shares with most price targets set well below the current share price. RBS is the only one who shares Macquarie’s positive view.

Thank you for sharing Matthew

Hi Matthew,

Great piece – thanks for taking the time to share it. One aspect which many people considering COH perhaps overlook is the “mapping” of the implant and support after the operation by audiologists and speech pathologists. A family member is a key member of a large Australian charity that does a lot of work with children that are deaf and many get the implants. All the equipment they use to “map” or finetune the device after implanting is specific to that company. For example the only brand they have is Cochlear. Recently they had a child from the US that they began to support that had a different brand implanted – they had to change many things to be able to help them. When thinking about market share with these devices I think it is important to know that the decision isn’t solely with the surgeon or specialist, because all of the support people have to change too. I don’t think market share will change quickly or by very much because of these barriers.

My knowledge is only about Australia and understanding the US and European systems is important. Another aspect is that the funding for these devices comes from the Government and health funds. My understanding is that the Government has a cap on the number funded per year. My concern is that as Governments everywhere wind back funding for pretty much everything will Cochlear be vulnerable?

The windscreen is never fully clear is it?

Regards,

Michael S

Thanks Roger. Very timely post indeed. I posted a comment on the FWD & MND story thread a couple of hours ago about JBH (not knowing where else to post it), and then this post of yours popped up. I think I may hold off a little longer now before topping up my JBH holdings (not next week as I had intended).

I do think that they will still outperform Harvey Norman and the others, in the short, medium, and long term, but that may not be enough.

The JB Hi-Fi NOW music streaming service that they’ve just launched could be a game changer. They’ve contacted everybody on their e-mailing-list and offered 1 month’s free access to this new service, so there will be a lot of people trying it out, and if it’s good, word will spread rapidly. We’ll have to wait and see how that pans out.

Innovation is the key. They still have a competitive advantage, but they need to keep finding new ones too.

On balance, I’m coming around to your way of thinking Roger, that perhaps it might be a good time to steer clear of discretionary retailing (the electronic/entertainment variety at least), for a while, until things become a little clearer and brighter. However, I am unlikely to sell my current holding in JBH at this time. I’m just going to hold off on adding to it.

I don’t suppose you’d be willing to discuss if your views on Oroton’s current and future prospects have changed in recent times? I sold out of Oroton a few weeks ago, because I was concerned with where the growth was going to come from within Australia in 2 to 3 years time. I know they’re expanding into Asia, but if that doesn’t go as well as they hope, and the market becomes saturated here in Oz in a couple of years…

Hi John,

Remember do your own research and seek and take personal professional advice. I will try and put something up about Oroton in the week leading up the Christmas, but I can’t guarantee I will get time.

Merry Christmas Roger. Yes, I will continue to do my own research, and my latest efforts convinced me to change my mind (yet again) and to buy another 3000 JBH (at $11.77 on Friday – 23/12/11). They’ve now moved up to become my 2nd largest holding (behind FWD). I’m now looking at them as a yield stock, and I don’t mind if they drop further, or take a year or two to recover. I had sold out of CAB (at a profit), earlier in the week (while on holiday), so was looking for somewhere to park that cash. Obviously, by putting it all into JBH at $11.77, I may not be able to access that $35,000 again for quite a while (unless I’m prepared to take a loss on the trade), as JBH may (and probably will) drift lower for a while, or go nowhere, but I think the chances of getting a 7%+ return on my investment just through the dividends (plus franking credits on top) is reasonably high, and I believe that I’ll get the capital gain down the track in a year or three. I therefore believe that, for me, it is a better option than leaving the money in the bank. And yes, I do realise that JBH will probably reduce their dividend in March 2012, but (as long as they don’t go making silly aquisitions) I’m counting on them maintaining or increasing their dividends after that. The Woolworths rumour would also be a nice bonus, if it happened… As usual – no advice here – just a short story of personal experience and personal choices. Hope my guesses are better than whoever sold the stock to me!

A quick comment on JB Hi-Fi Now. It only launched last week and although I admit it is a very small sample, every person on my floor at work subscribed and started building their playlist by Friday (work performance on the other hand was greatly reduced). While I expected the younger age group to be excited by it, what surprised me most was that all ages up to the 50-60 age group loved the concept. All staff also talked about telling their firneds and family about it. Now it will be interesting to see how many continue to use the service once it it becomes user pays, but i think the majority will, especially in the younger age group. I think it’s popularity will also increase once it becomes functional as a mobile app. Roger talked about need for JB Hi-Fi “‘to establish new and emerging business models to try and counter the shift away from physical music unit sales” and i think this might be a great move in this direction. Interested in hearing other people’s views on the new service and seeing the takeup rate.

Great Scuttlebutt Matt C.

Hi John,

My view on Oroton, which i think shares some similar issues as JB and i agree with what you have said.

Oroton, like JB Hi-Fi, in Australia is very close (some might argue quite reasonably it already is) to saturation point. This makes it hard to drive sales growth by opening new retails stores.

So we have come to the question, if physical stores in Australia can’t be counted on to drive sales growth where will it come from?

We obviously have the expansion into Asia. We are as yet unable to see how successfully this will be. This is the key area i think people interested in Oroton should be watching as this will be the key to future growth. if this goes well than i think Oroton will remain a very interesting company and open up a whole new period of growth.

The internet is another area, by accounts this has been a very good growing part of their business and now their biggest store by sales. One can ask the question whether they could use the successful online store as an excuse to close lesser performing retail stores and whether this will cause any reputational damage but should have a nice affect on reducing costs. This could be a key to introducing themselves to new global markets, but i should emphasise the COULD and may not be successful.

There is always the introduction of new lines, but this would probably have a very small affect on increasing sales.

One thing i think all people interestecd in Oroton should do, is take that 80%+ ROE out of their valuation formulas. I cannot see how Oroton can continue to earn over the mid to long term a sustainable ROE of that amount. The ship has sailed on that one. I currently have them (and JB funnily enough) on my list of companys to re-visit and re-value.

As with JB, i believe the company is now mature which means that we can expect some future things to happen:

-increase in the dividends paid out

-M&A activity

-Off shore expansion (we have already seen this)

The increase in dividends is the less risky but will see the valuation decline as money is paid out to shareholders rather than invested in the company at an attractive rate (however slowly diminishing) of return.

M&A Activity is always a risky exercise and one thing Sally at oroton should be aware of seeing how many different businesses the got rid of to get Oroton to where they are.

We have already discussed the off shore expansion into Asia. This is where the game is at now, how this works out will very much set the future for Oroton.

Some excellent points Andrew. JBH’s payout ratio has been ticking up. You left out the possibility of a takeover by Woolies. Or maybe not.

Thanks for sharing your views Andrew. That’s a good perspective. I’ve meanwhile added to my JBH holdings, maintained my TGA holding, and continue to watch and wait, with a view to buying back into Oroton if and when I’m more confident that their Asian stores are going to provide ORL with that next stage of growth. It’s a pity that they don’t have much to say between their biannual reports, but then 6 months isn’t a huge amount of time to a patient investor I guess.