New data confirms the meteoric rise of online shopping

The government-imposed COVID-19 lockdown accelerated a number of social trends. One of those was our increasing preference for online shopping. Recent data shows that even though the lockdown pushed total retail sales off a cliff in April, online sales shot up. And one retailer – Kogan – stood out from the pack.

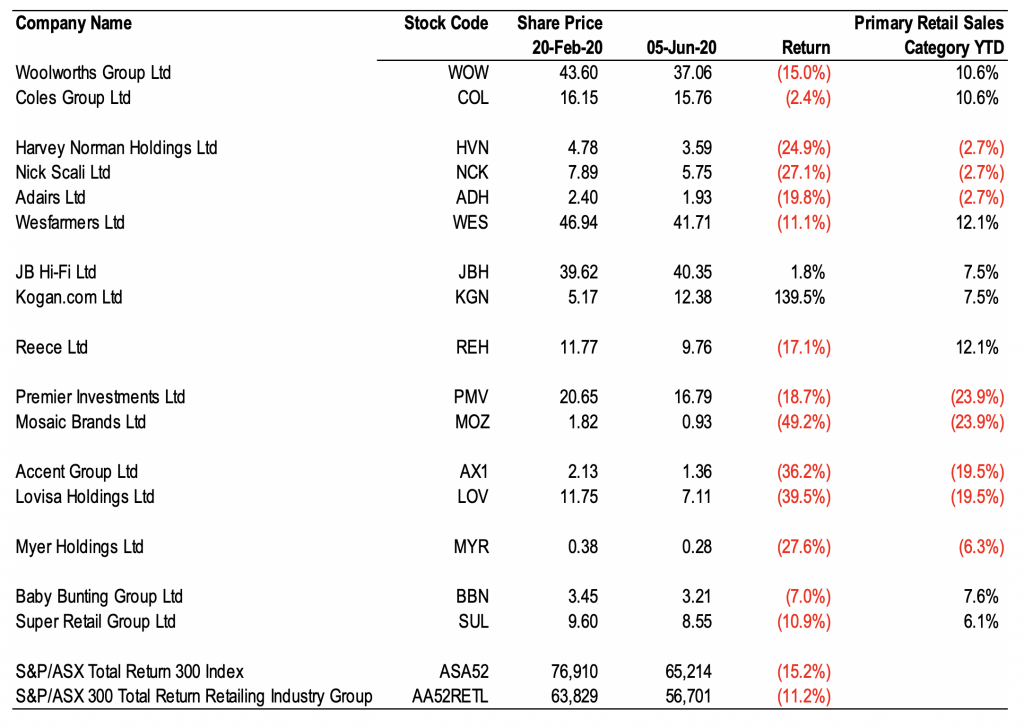

One of the more surprising performances within the market this year has been the retailer. According to the ASX 300 Retail Accumulation Index, this group of 14 discretionary retailers has been one of the best performing sector indices in the Australian market, falling just 0.7 per cent this calendar year. This compares to the broader market fall of 9.1 per cent, as measured by the ASX 300 Accumulation Index.

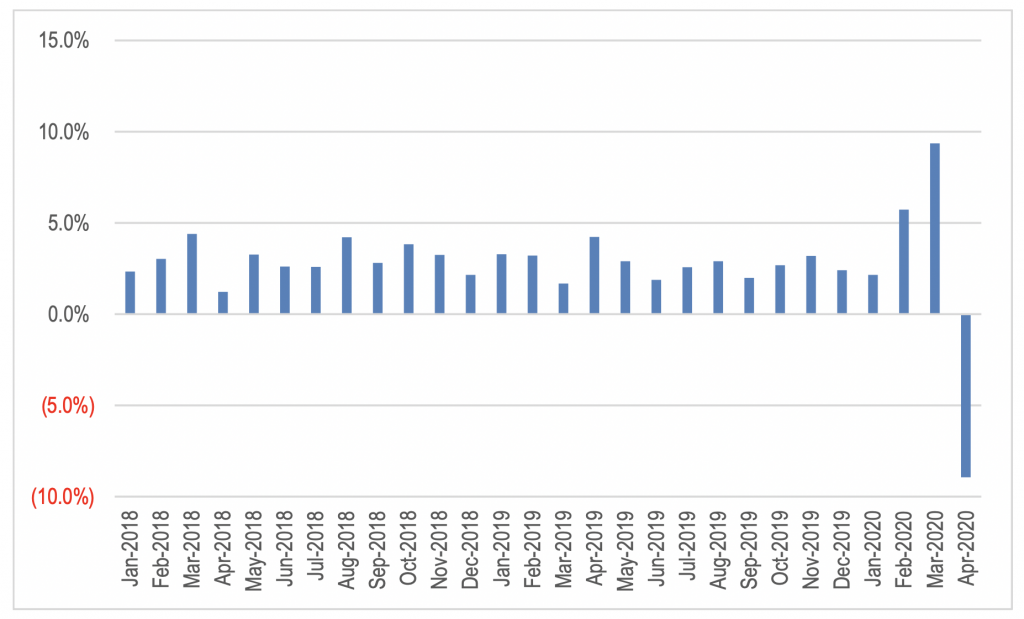

Given the direct impact of the lockdowns on retailers and their high degree of fixed cost leverage, this might appear to be aberrant. The recently released final retail sales data for April reveals that retail sales exhibit a steep decline in overall spending in April even as the country went into lockdown.

Figure 1: % Change in Total Australian Retail Sales YoY – Original Data

Source: ABS

When we calculate the growth over the 4 months to the end of April relative to the prior year (which matches up with the 2H20 reporting period for most listed retailers), overall retail sales were still higher by 2.1 per cent.

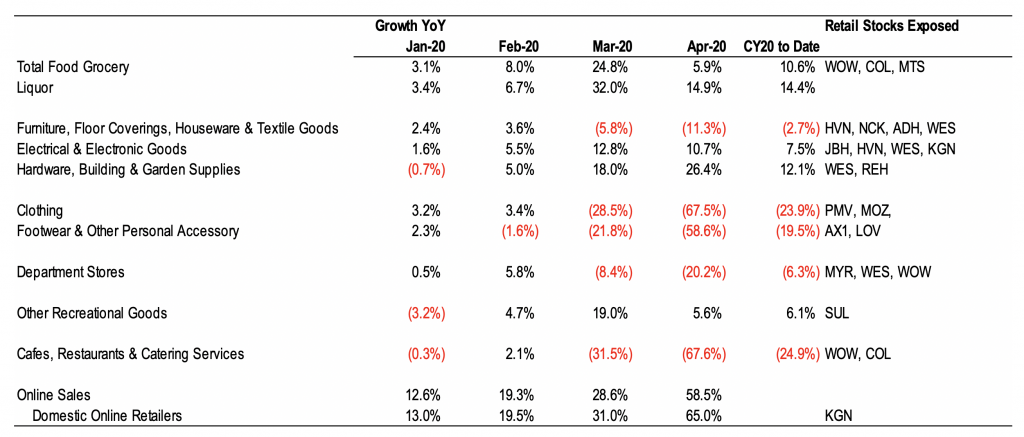

Not all categories have performed uniformly. The table below shows the rate of growth in retail sales (by category) for each month this year, along with the cumulative rate of growth in CY20 to date, and listed companies that are exposed to each category.

Table 1: Monthly Change in Retail Sales by Category – Original Data

Source: ABS, NAB

If this data is lined up with the performance of the individual stocks since the market peaked on 20 February 2020, Kogan and JB HiFi are the only retailers from this list which have generated positive returns over that period.

Table 2: Listed Stock Performance Since the Market Peak

Source: Bloomberg

Relative to the broader market, 7 of 16 stocks have outperformed the broader market since the peak. This is a surprising outcome given the operating leverage and the likely losses generated by retailers during the lockdown period will have the enterprise value of these business shift from equity toward debt. Even if the retailing operations are worth the same amount as they were prior to COVID-19 lockdowns, the increase in debt caused by cash outflows during this period means the equity has had a permanent reduction in value. In the case of those companies that have raised fresh equity, the increase in debt has been mitigated. However, the increase in share count reduces the value of the equity per share.

Wesfarmers has released a very strong trading update with both Bunnings and Officeworks delivering extremely strong sales growth for the 5 months to May. These formats have benefited from their classification as essential, enabling the stores to remain open through the lockdown and the jump in growth in the DIY and home entertainment markets on the back of the increased time spent at home. This is reflected in the strength of the ABS retail sales data for the Hardware, Building & Garden and the Electrical & Electronic Goods categories.

Wesfarmers has benefited from its strong positioning in online retailing across its formats together with their timely acquisition of Catch.com.au last year. Wesfarmers also noted that apparel sales at Kmart and Target have improved materially in the last few weeks due to cooling weather and increased mall traffic.

The data shows that individual segments of the retailing market are performing differently resulting in individual retail stocks experiencing differing conditions and positioning.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

There is a major flaw with online shopping – aside from books an item viewed via a computer screen is very different from in person. Clothing in particular, a shirt marked large will be differently sized for different brands. It was reported the other the day from a survery 53% of online shoppers couldn’t be bothered in returning items. You would hope it goes to charity, more than likely it is contributing to the growing level of landfill. Perhaps why such a ludicrous amount of clothing was being disposed of in the ABC ‘war on waste’ – a huge pile in martin place representing what is thrown out every few minutes, the technology is too expensive here to be able to recycle a mix of different textiles, although it is being done in other countries.

Having renovated a home from top to bottom the last few years Bunnings has benefited from Masters going bankrupt – practically every item on the shelf is being constantly marked up. Window bolts bought 5 years age $16 now $22 for the same item, for example.

Looking at youtube you can find many examples of abandoned malls in America due to Amazon. Walking thru a shopping centre here, listing how many businesses could simply be run online, I fail to see how we won’t experience the same fate as Amazon or Kogan becomes more entrenched.

Instead of expensive shop fittings and exorbitant rents I would like to see online warehouses where 1 of each item is stocked for viewing.

Shopping Centres could be re-zoned to a mix of residential and business, first floor homes built over carparks to provide private parking, and the centre a mix of rental office space, day care, gym, medical centre etc, encouraging work from home with a private gated park area exclusive to the residents at your doorstop, reducing the need for a car, commute etc.

Your vision may indeed come to pass Paul.