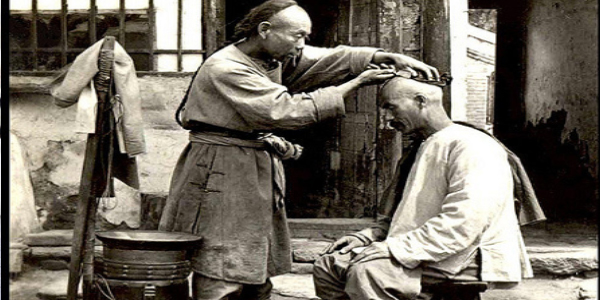

Don’t ask the barber if you need a haircut

Some analysts say you shouldn’t ask your broker whether or not to buy stocks, as they have a conflict of interest – they will always tell you to buy. So, who should you ask? Perhaps J. Kyle Bass, the man who profited handsomely from predicting the subprime mortgage meltdown. Bass is convinced China will need to devalue the renminbi, which would be bad for equities. We think it may pay to read what he says.

In April 2008, D Magazine, the Dallas city magazine, profiled one J. Kyle Bass in an article entitled, Cashing in on Subprime: “The subprime crisis in the housing market has led to a financial crisis and fears of a recession. If only someone could have predicted it. Someone did. His name is Kyle Bass, and he made about half a billion dollars from it.

In 2011 I read Michael Lewis’s book, The Big Short. In it Lewis acknowledged Kyle Bass, among others, thus: “A small number of people—more than ten, fewer than twenty—made a straightforward bet against the entire multi-trillion-dollar subprime mortgage market, and, by extension, the global financial system. In and of itself it was a remarkable fact: The catastrophe was foreseeable, yet only a handful noticed.”

Since then we’ve been following some of the utterances of Bass who runs the Dallas-based hedge fund Hayman Capital, focused on global event-driven opportunities. ‘Global events’ encapsulates ‘black swans’ – those events that have the potential to derail markets and the life savings of investors.

Before we head any further, lets discuss the recent history of China. You might recall that since 2010 here at the blog we have been warning investors that their adoration of China’s “economic miracle” was misplaced. A quick history lesson is useful here.

Largely unnoticed, China’s exchange rate has been strong since 2004, rising more than 60% and eroding China’s competitiveness against Japan, Europe, Russia, and even some Southeast Asian countries.

As we have been reporting here for years, as the Yuan appreciated and China’s competitiveness eroded, China undertook an infrastructure spending program that was reported here in Australia as being solely responsible for the resources boom and which would be sustained for the next 100 years. Of course China was merely attempting to maintain politically-determined GDP growth targets in the face of headwinds created by the strengthening currency.

As we all now know policy determinations distorted incentives and misallocated capital. Returns on investment were unimportant, if not completely ignored.

According to one analyst, in 2005, exports constituted 34% of China’s GDP and investment 42%. A decade later investment had grown to 46%, probably because exports had fallen to 23%.

Importantly, the investment was funded by rapid credit expansion in China’s banking system, which grew from $3 trillion in 2006 to $34 trillion in 2015. Many of these loans however will turn bad.

For China to achieve the required clawback of its real effective exchange rate, the renminbi will need to devalue. Such an event would unleash mayhem in financial markets and most investor are not prepared.

Legendary hedge fund manager Kyle Bass is 100% certain this will happen.

Here’s a number of KB’s observations that are worth considering.

In the last ten years China has seen GDP rise 500% but this has been exceeded by credit growth of 1100%. It now takes seven credit units to generate one unit of GDP. Bass believes China has reached an “atrophy” level that will have significant implications for the USD/CNY.

For short term traders it matters whether the US Federal Reserve Bank raises rates or not. But, according to Bass, US monetary policy will be overcome by how many bad loans China has made. The Fed has nowhere to go after setting accommodative monetary policy at emergency levels for seven years. With unemployment at just 4.5% wages moving higher, if oil stays around $50, Bass believes we will see “integers” on CPI in the fourth quarter.

According to Bass, the US Federal Reserve will have to engage in some incremental helicopter money but it won’t work and it will trigger inflation but it will be the ‘bad’ cost-push inflation not demand-pull inflation.

Before that however, China will have its “comeuppance”. Its credit system is coming to a halt. A non-performing loan cycle has begun, the banks will need to be re-capitalised and it will cause the US dollar to move significantly higher against Asian currencies.

Again, according to Bass, credit excesses in China have already been built. Asset/Liability mismatches in wealth management products are more than 10% of the system. In the US before the subprime crisis the asset/liability mismatches amounted to 2.5% of the system and Bass notes; “look what that did”!

China’s credit excesses are now way ahead of any other country in the world ahead of their crises.

Bass believes “we are facing the world’s largest macro imbalance in history” adding, “to this day I cannot figure out why people don’t see it for what it is.”

Here’s how China will unravel according to Bass (keep in mind he is betting that it has already started):

- China Banks will have a loss cycle

- Those banks will need to be recapitalised

- China will then do what is best for China, which will be to devalue their currency.

- China will then export deflation to the world “one last time”.

He adds “if you have any money left, it will be the greatest time to invest in Asia ever.”

He expects China’s unwinding to occur before US inflation emerges, which will be followed by higher rates and a continuation of a rising USD.

In the medium term expect a much higher USD against Asian currencies.

One sign of the Chinese machine breaking down can be seen in the corporate bond market.

In 2014 there was one default. In 2015 there were 15. In 2016 to April there were 19 and half were ‘standard enterprises’.

Out of 210 announced corporate bond deals there have already been 150 cancellations.

According to Bass, the Chinese corporate bond market is freezing up and this is relevant because many of these corporate bonds are put into wealth management products – funds from the purchase of which are used to pay the yields promised to prior investors.

Now, companies can, in some cases, arrange a debt-for-equity swap, but the problem for the banks that have sold these wealth management products is how do you put equity into something that is levered 4-10 times and where the investor is trying to make a yield?

According to Bass, a “Chinese comeuppance would not be good for equities” adding he doesn’t own any risk assets.

“China’s current situation reminds us of Ireland and Spain, where construction, real estate, and infrastructure investment activity constituted a disproportionate share of economic activity, government revenue, and bank lending. A cyclical downturn in these sectors will have a profound impact on the Chinese economy just as it did in Spain. In fact, Chinese residential real estate investment as a percentage of GDP, which peaked in 2013, was the second highest in global history, only after Spain in 2006, and 60% higher than the US peak in 2005.”

“Consider the past quarter century: a credit boom in Japan that collapsed after 1990; a credit boom in Asian emerging economies that collapsed in 1997; a credit boom in the north Atlantic economies that collapsed after 2007; and finally in China. Each is greeted as a new era of prosperity, to collapse into crisis and post-crisis malaise.” – Martin Wolf, Financial Times

In summary, J Kyle Bass is “100% certain” that:

1) There will be a loss cycle for Chinese banks, and

2) The Chinese will do things that cause their currency to devalue.

As an aside, for property investors in Australia, keep in mind it is foreign lenders to banks that ultimately influence the rates mortgagees pay on their home loans. If China’s credit market busts – as Bass is 100% certain it will – foreign lenders will presumably raise the cost of capital for Australian banks. What that does to leveraged property buyers who currently spill out on the street at property auctions, time will tell.

To balance these views, it is important to note that some institutions believe China’s bad-loan problems are “not as serious as” Hayman Capital Management’s Kyle Bass claims.

One of those institutions is China International Capital Corp., the investment bank Morgan Stanley helped establish in 1995.

Remembering the advice about not asking a barber whether you need a haircut is timely.

Nice article, many thanks.

One thing I’m trying to distill from the article; if the situation were to unfold as described (Chinese loss cycle, then global deflation) what impact would you expect that to have on the AUD in the lead up to the event and post? In the scenario described is there any weakness imagined in the USD before it starts to rise strongly?

Trying to pick the interim directional moves of currencies is nearly impossible because even the past is no guide as to how a market will react to an event.

Love the article on China – very thought provoking – even if Bass is 50% right the impact would seem to be significant – is it one of those things that people just think won’t / can’t happen – much like those that believe our economy is in great shape and that they can’t imagine we might be in danger of some kind of recession over the next 3-5 years. It seems that the populist view prevails presently.

Please excuse my ignorance. This sounds like we should putting cash under the mattress before stockbrokers start jumping out of windows… Should I read it that way?

No. It is a warning against the conventional investment strategies including index funds as well as the recent trend to high yield and so called ‘stable’ companies.

Thank you.

Hi Roger, yes it is virtually certain that Chinese growth will slow and the Yuan will devalue. Another person who’s opinion I value, Michael Pettis, is saying similar things:

http://blog.mpettis.com/2016/08/does-it-matter-if-china-cleans-up-its-banks/

1.) Professor Pettis says in his piece:

“The key in China, in other words, is not whether the banks have been cleaned up. It is how the losses are going to be allocated ………Until the losses are allocated, they will simply show up in one form or the other of government debt, either on bank balance sheets as a contingent liability for the government or as a direct liability of the government.

These are the major sectors of the Chinese economy within which the cost of debt-management policies can be absorbed: Creditors. The external sector. Ordinary households. Wealthy households. Small and medium enterprises. Local and provincial governments. The central government. The only question is the extent to which it is directed by Beijing”

So depending on Beijing’s policies on how and where credit losses will be allocated, shorting Chinese banks may or may not be the right move. While overall losses are certain, specific stock selection depends on China’s policy.

2.) While its very well to be certain that there will be a loss cycle for Chinese banks and that the Yuan will devalue (I am certain of that too), is Kyle Bass 100% certain that these things will happen in the next 18 – 24 months? Timing is absolutely crucial. Has he stated a time frame? What does he do to manage risk in his Yuan devaluation position in the mean time?

3.) The best quote I read as an approach to these risks is by Nassim Taleb in your recent post “The next Black Swan”. He says, “what matters is to be protected against those tail risks, something easier to do than trying to predict them. The idea is to focus on portfolio robustness rather than forecasts.” So don’t predict, hold stocks like CSL and Healthscope (which you’ve discussed in detail) whose businesses won’t be affected by the macro environment, and also hold lots of cash to take advantage of big dislocations if they come along.

Kelvin

Hi Roger

If you agreed with Kyle Bass’s opinion that the Chinese would devalue there currency, how would an Australian invest to benefit from this?

Regards Spiro

Hi Spiro,

Ensuring the tail risks are covered e.g. with a weighting to cash to take advantage of lower prices if they transpire and/or looking at alternative funds to invest in as well such as the Montgomery Alpha Plus Fund which we launched recently for those seeking uncorrelated returns for a part of their portfolio.

Thanks for the great article Roger!

A few quick question:

– Why did the Chinese let their currency appreciate so much in the first place? If they were doing ‘what’s best for China’, which is what central banks and policy makers usually do, then I don’t understand why they have let the value of the currency run this far. Perhaps once explanation is the need to shift from export based economy, to one where a rising middle class (i.e. internal demand) starts to play a more important role?

– In terms of addressing the coming wave of bad loans coming out of China, and mitigating the impact on the corporate bond market, wealth management products, etc. What’s the stop the Bank of China from simply announcing an ’emergency support package’ where it prints a bunch of money, provides emergency funds to banks and other state-owned entities impacted by bad loans, and takes an active role in injecting new ‘liquidity’ (i.e. printed money) directly into corporate bond markets? This wouldn’t be a cure-all, but perhaps it would mitigate the ‘disaster’ scenario painted above?

Would love to know your thoughts

Hi Joe, Be sure to read up on the Chinese currency being pegged. And yes a bailout of the banks is precisely what would be associated with the devaluation of the currency scenario. Its the currency devaluation that is expected would unleash mayhem on markets

Assuming Kyle Bass’ prediction pans out, will you be taking full advantage of China’s loss cycle for the Global Fund? From memory it doesn’t have any significant exposure in China.

Hi Jay, Its business as usual at Montgomery, we seek quality and value.