My take on the meteoric rise of EV makers

The valuations of electric vehicle makers, like Tesla and NIO, have risen spectacularly over the past year. But, given that car manufacturing is a very competitive, low margin business, have their share prices run too hard?

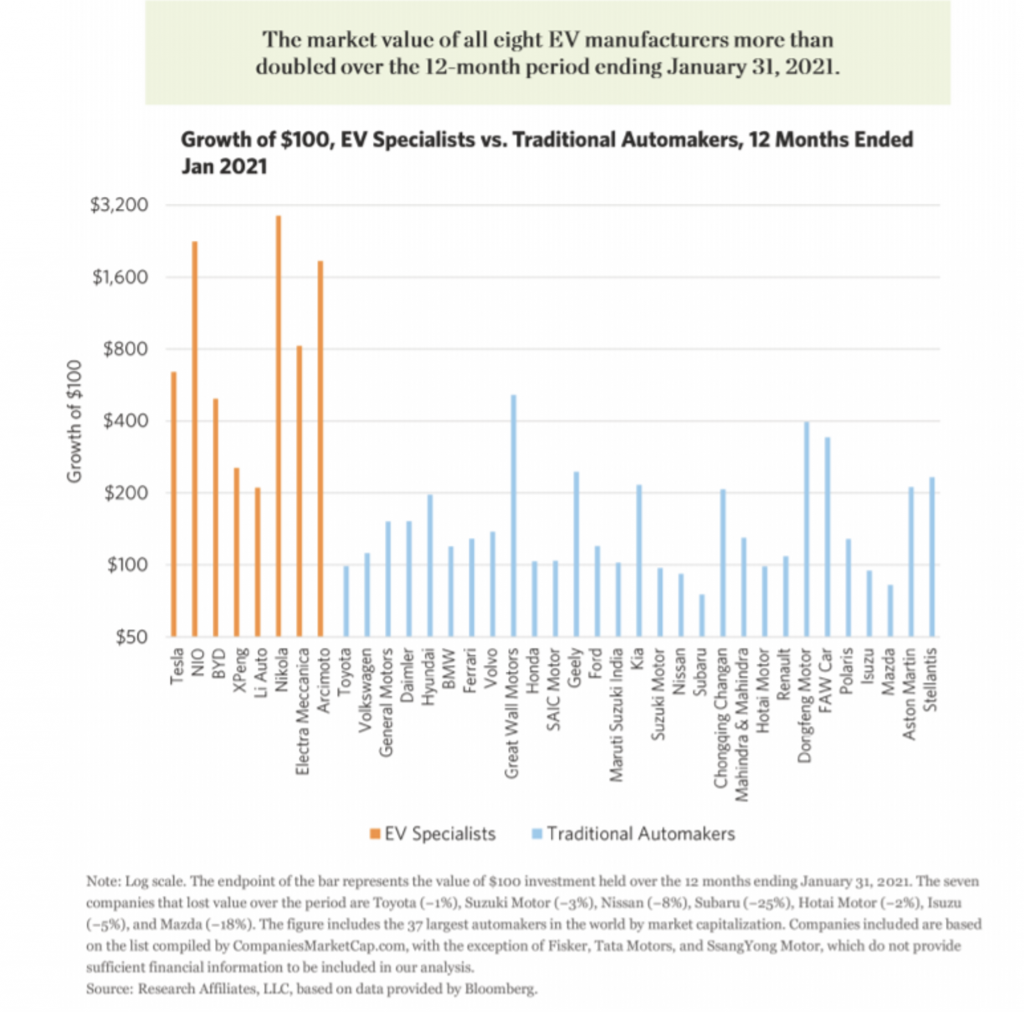

The spectacular share price performance of Tesla and other companies in the electric vehicles (EV) space during 2020 can be seen from the chart below, from US research group Research Affiliates who recently published a note on the EV industry that contained three very interesting charts.

Source: Research Affiliates

As you can see, the “EV Specialists” significantly outperformed the rest of the Automakers in share price growth with several being up over 10x; traditional automakers in general moved more in line with the overall stock market.

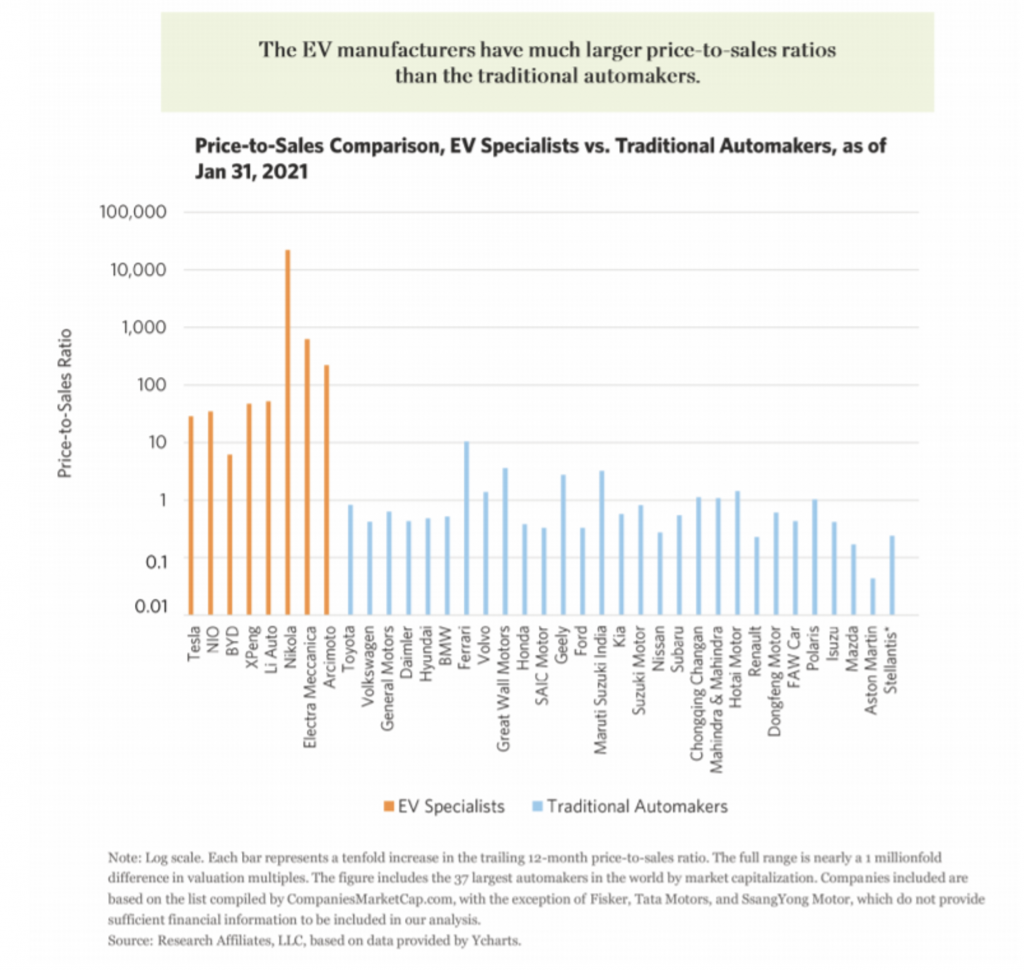

This has resulted in the valuation of the “EV Specialists” being orders of magnitude above traditional automakers. As the following chart shows (note the logarithmic scale!) Tesla, for example, is trading at around 28x P/sales compared to the average of traditional automakers at around 1.1x P/sales:

Source: Research Affiliates

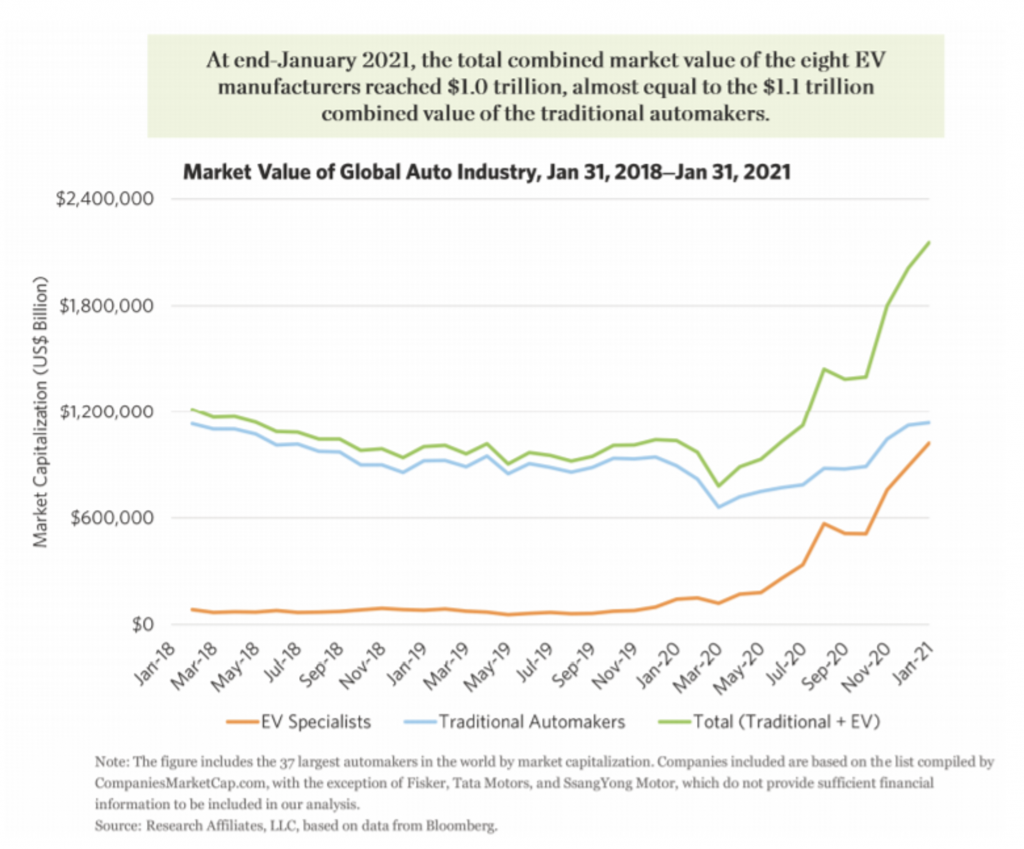

The last chart is probably the most interesting and shows the total market capitalisation development of the whole industry:

Source: Research Affiliates

From these charts, there are a few things that immediately stand out to me:

- It is clear the market is saying that the transition to electric vehicles will significantly increase the total industry profit pool. In fact, since the market bottom in March 2020 to the end of the year, the market’s perception of the present value of the future industry profitability has more than doubled!

- Add the increase in share prices for raw material producers of metals that benefit from EVs (Copper, Lithium, Nickel etc.), the total increase in forecasted profit pool from this technology transition is even larger. This strikes me as very odd as I cannot see why this should be the case, especially as electric vehicles are supposed to have longer life and less maintenance cost than ICE vehicles and, hence, this indicates to me that the market is mispricing the whole industry.

- The very high price/sales valuation for the “EV Specialists” means the market assumes all will be clear winners in the future and that they will be able to take significant market share from traditional auto manufacturers. The market is basically pricing the “EV Specialists” as a collective winner even though they are actually competitors and there will be winners and losers amongst them, but the market is not insightful enough to figure out which these will be.

- It is also interesting to see that since March last year, the collective market value of traditional auto manufacturers has increased rather than decreased which you would expect as they would conceivably be the losers from the “EV Specialists” all ending up as winners.

To me, this looks like a classic example of the stock market mispricing assets, both on a collective and individual basis as just changing technology in propulsion should not increase the total profit pool of the industry and change the fact that auto manufacturing is a very competitive and capital-intensive industry with generally low margins and returns. I suspect that as we see more of the traditional auto manufacturers launch their EV models, the market’s perception of the future industry profit pool in general, and the prospects for some of the new entrants, will dramatically change…

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY