Mortgage credit growth bounces back

Last month, REA Group chief executive Owen Wilson claimed that “the buyers are definitely back”. And recent data seem to back him up. House prices are rebounding, auction clearance rates are up, and mortgage credit growth has turned a corner.

Mortgage credit growth has been slowing over recent years due to a combination of slow wage growth, already high level of gearing in household balance sheets, weakening confidence, tightening prudential regulations and the effects of the Royal Commission.

In the last three months, three changes in conditions have occurred that could see a reversal of recent trends in the mortgage market. These were the surprise Coalition win in the May Federal Election, the June and July rate cuts by the RBA and the removal of APRA’s required interest rate floor in assessing mortgage serviceability in June. The market has been looking to see whether these factors have delivered a turning point for the mortgage market and the many segments of economy that are impacted by it.

The ABS released mortgage approvals data for the month of July which showed tentative signs of a bottoming and potential turn in the flow of mortgage credit.

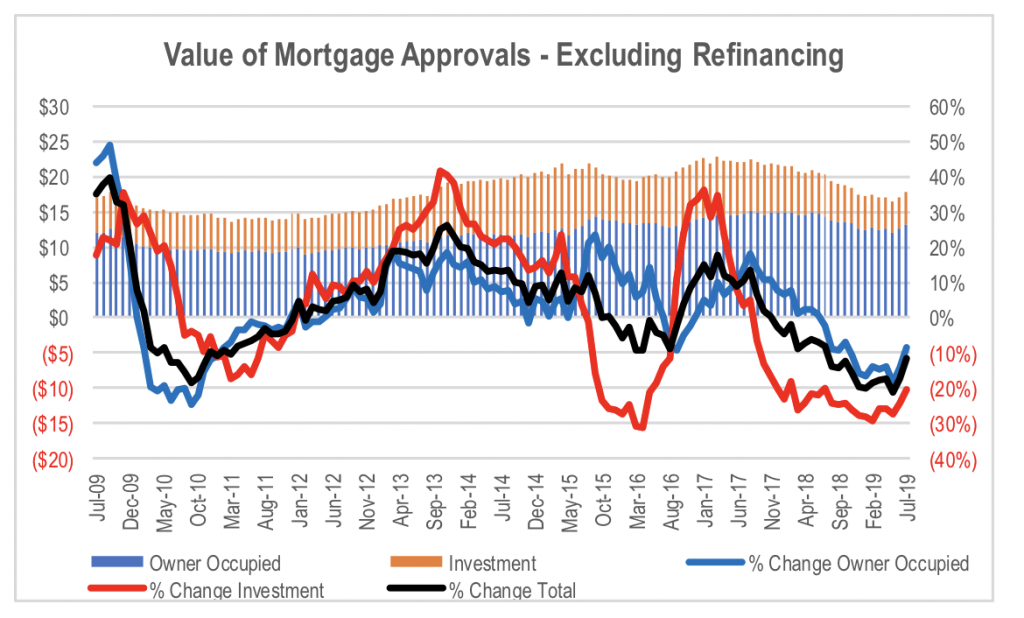

The value of new mortgages approved (excluding refinances) in the month of July grew 5.1 per cent relative to June on a seasonally adjusted basis. This came on top of the 3.2 per cent increase in June relative to May. Both new mortgages on owner occupied properties and well as investment properties improved during July. This does suggest that the availability of mortgage credit might have bottomed in May.

But before we get too excited, it is worth noting that while the flow of mortgage credit is up month on month, it is down 10 per cent year on year and still at levels from 2014.

Source: ABS

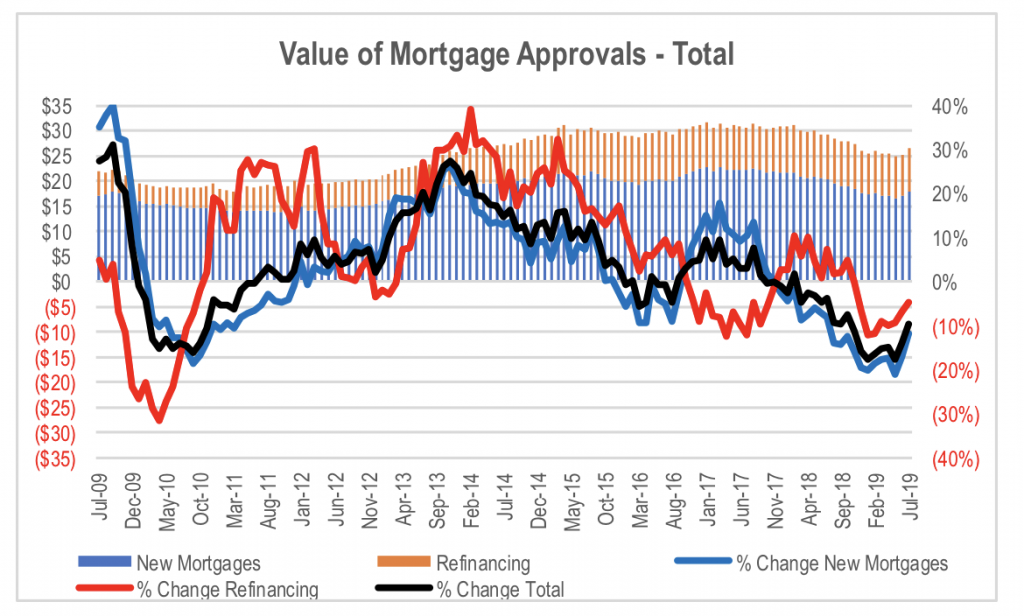

Mortgage approvals is the flow of new mortgages. There is a certain amount of new mortgage financials required to merely offset the repayment of existing mortgages. The flow needs to exceed this level below the total value of mortgages outstanding increases. Bank revenue growth is linked to growth in the overall amount of debt outstanding rather than the flow of new debt borrowed.

Refinancing volumes are also important for the banks in that more refinancing means an acceleration in the conversion of higher margin back book mortgages to lower margin front book loans.

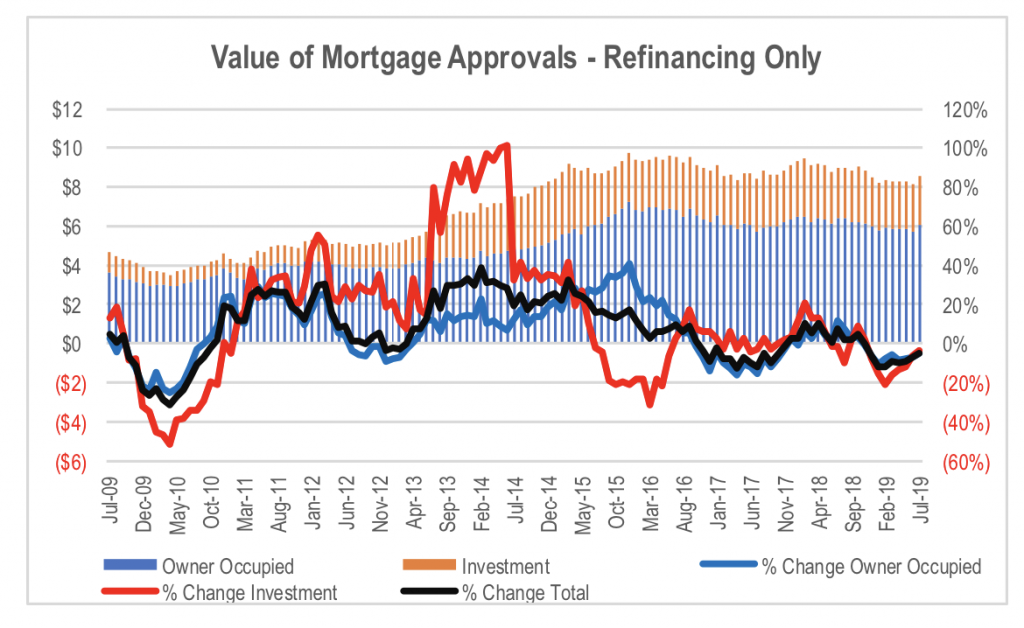

Refinancing volumes had also declined over the last couple of years as higher serviceability requirements made it more difficult for borrowers to qualify for an equivalent sized loan to the one they already had. This was a particularly significant factor for investment property borrowers. Refinancing activity also appears to be showing signs of turning following the removal of APRA’s minimum interest rate requirement in determining serviceability.

Despite the slowing rate of refinancing, widening front book discounts have kept bank net interest margins under material downward pressure in recent periods. With refinancing appearing to have bottomed, the downward pressure on net interest margins could increase, or force the banks to pull back on the depth of front book discounts.

Source: ABS

There is one group of companies that are directly exposed to the flow of new mortgages, the mortgage brokers Mortgage Choice, Yellow Brick Road and Australian Financial Group. Net commissions have been under pressure over the last couple of years, offset by increased trail commissions as average loan life increased on the back of slowing refinancing activity. With mortgage credit availability increasing, these stocks stand to benefit more directly from the turnaround in mortgage approvals.

Source: ABS

The Montgomery Funds own shares in Australian Financial Group. This article was prepared 18 September with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Australian Financial Group you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Gelt Financial

:

Well written and to the point. I appreciate the detail in this article!

https://geltfinancial.com/