Missed the Property Boom?

Global real estate agents are opening shop in China and becoming “gold digging” tour operators for wealthy Chinese to find and buy property around the world.

According to Bloomberg: “In Beijing, a marketing campaign sponsored by SouFun touts a 12-day ‘‘Gold-Digging U.S. tour.”

The Chinese capital was also host last weekend to a three-day foreign property and immigration exhibition, the second of its kind in four months. Among destinations on offer: Portugal (“get a residence permit for the whole family”); Japan (“pass on your ownership for generations”); and the U.S. (again, “invest by one person, get a green card for the whole family”).

You get the drift.

So here’s why your kids cannot currently afford a house in Sydney or Melbourne.

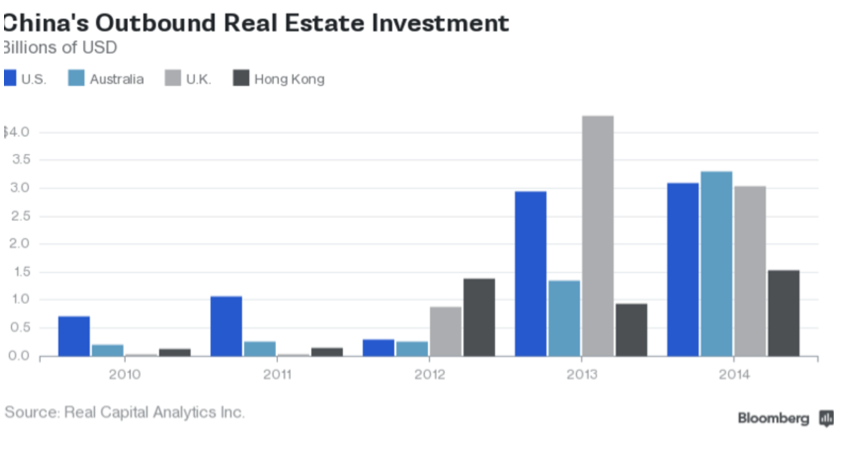

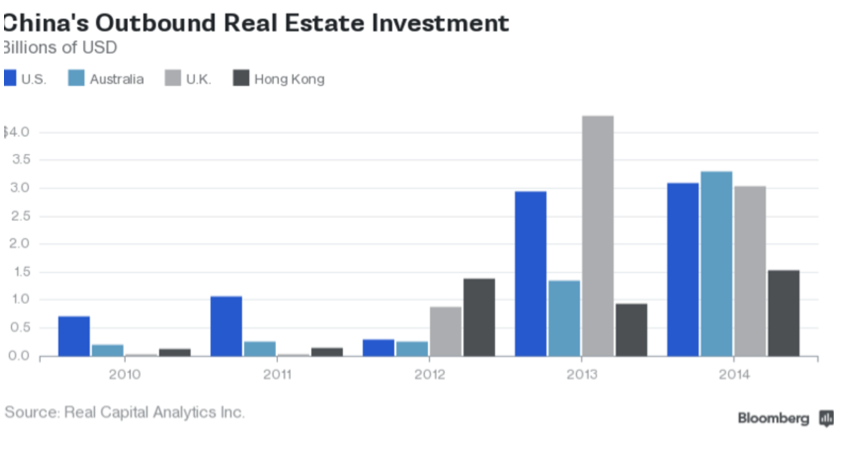

The chart speaks for itself.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger

As one of Australia’s best known and most respected value investors, I would value learning your initial thoughts on Berkshire Hathaway’s arrangement with IAG. Could I suggest a brief article?

I posted my own initial thoughts here – http://www.macrobusiness.com.au/2015/06/lowy-institute-warns-on-australias-ftas/#comment-1386231

Fact No. 1:

“the average house price in the capital cities is now equivalent to over seven years of average earnings; up from three in the 1950s to the early 1980s.”

Fact No.2:

No foreigner ( chinese or any other ) did stick a gun or a badge in our belly ant take any property from us. He offer us a deal and we take it. ( Competition for that house forced the selling price up )

Fact No.3: there is no FREE MARKET IN HOUSING IN AUSTRALIA ;and as result of this you are going to have glut or shortages.

Fact No.4: There is no land shortages ( only artificial because of laws and regulations ) like this : restrictions on the building of housing, under the banner of “open space” laws, “farmland protection” policies, preventing “urban sprawl,” and other politically soothing phrases.

Is it really too “complex” to figure out that taking vast amounts of land off the market will make the price of the remaining land far more expensive? Or that houses built on very expensive land will be very expensive housing?

It is not at all uncommon for land to cost more than the housing that is built on it, in those places where politicians have made housing unaffordable with land-use restrictions under pretty names

this is some other views from australia and world :

Some factors that may have contributed to the increase in prices are;

Low interest rates from 2008 onwards (increasing borrowing capacity due to lower repayments)

Limited government release of new land (reducing supply)

A tax system that favors investors and existing home owners.

Government restrictions on the use of land preventing higher density land use.

High population growth (now about double the world average – see Population growth rates chart).

2008 foreign investment rule changes for temporary visa holders.

Introduction by local councils of upfront infrastructure levies in the early 2000s.

or this:

We all know residential property in Sydney and Melbourne is very expensive ;

But high prices are because of one basic thing: people in Sydney and Melbourne like it like that. For generations, state governments have pursued policies that have choked off the availability of land and discouraged medium-density housing to pander to NIMBY voters, while the federal government has driven up the price of existing housing stock with negative gearing policies that help push the cost of housing beyond the reach of many Australians.

Who’s responsible? Local, state and federal politicians and (if you own a house or have an investment property) you.

or this:

How did this situation come about, and why does it continue?

Part of the reason is that it is newcomers who have to pay outrageous prices for houses, while it is existing homeowners who vote for laws and policies that drive up housing costs by obstructing the building of new homes.

Those who already own their own homes are not hurt by soaring housing prices. In fact, they benefit when the value of their homes rises.

Given this situation and these incentives, it is easy to understand why such things as planning commissions, “open space” laws and “historical preservation” policies proliferate. These roadblocks to building are essentially idealistic-sounding ways of being completely selfish.

Despite much liberal rhetoric about compassion for the poor, it is precisely in such overwhelmingly liberal enclaves as those in California where high housing costs resulting from restrictive laws have imposed the heaviest burden on lower income people.

All sorts of lofty talk about “open space” or “saving the green foothills” is used to disguise the plain fact that those who already have theirs want to keep other people out, especially other people not as upscale as themselves.

Ugly as such selfishness may be, it is no worse than the zealotry of the nature cultists who make life miserable for thousands of other people to give themselves a cheap sense of importance that some confuse with idealism.

The irony in much of California is that the “green foothills” that environmental zealots wax poetic about are in fact brown half the year. The absence of rainfall during the California summer means that these hills are covered with ugly withered grass.

The only places where there is green grass during these dry months are places watered by people – which is to say, mostly places where there is housing.

Some thought on multiculturalism and “cultural diversity”

Don’t we need multiculturalism to get people to understand each other and get along with each other?

You want to see multiculturalism in action? Look at Yugoslavia, at Lebanon, at Sri Lanka, at Northern Ireland, at Azerbaijan, or wherever else group “identity” has been hyped. There is no point in the multiculturalists’ saying that this is not what they have in mind. You might as well open the floodgates and then say that you don’t mean for people to drown. Once you have opened the floodgates, you can’t tell the water where to do.

How are we to be part of the global economy, or engage in all sorts of other international activities, without being multicultural?

Ask the Japanese. They are one of the most insular and self-complacent peoples on Earth today. Yet they dominate international markets, international finance, international scientific and technological advances, and send armies of tourists around the world. This is not a defense of insularity or of the Japanese. It is simply a plain statement of fact that contradicts one of the many lofty and arbitrary dogmas of multiculturalism.

Multiculturalism is not just a recognition that different groups have different cultures. We all knew that, long before multiculturalism became a cult that has spawned mindless rhapsodies about “diversity,” without a speck of evidence to substantiate its supposed benefits.

In Germany, as in other countries in Europe, welcoming millions of foreign workers who insist on remaining foreign has created problems so obvious that only the intelligentsia could fail to see them. It takes a high IQ to evade the obvious.

“We kidded ourselves for a while,” Chancellor Merkel said, but now it was clear that the attempt to build a society where people of very different languages and cultures could “live side-by-side” and “enjoy each other” has “failed, utterly failed.”

This is not a lesson for Germany alone. In countries around the world, and over the centuries, peoples with jarring differences in language, cultures and values have been a major problem and, too often, sources of major disasters for the societies in which they co-exist.

Even the tragedies and atrocities associated with racial differences in racist countries have been exceeded by the tragedies and atrocities among people with clashing cultures who are physically indistinguishable from one another, as in the Balkans or Rwanda.

The multicultural dogma is that we are to “celebrate” all cultures, not change them. In other words, people who lag educationally or economically are to keep on doing what they have been doing — but somehow have better results in the future than in the past. And, if they don’t have better results in the future, it is society’s fault.

Such notions have been tried, and failed, in other countries and times, long before they became a fashionable dogma called multiculturalism.

They wanted to be able to rise without having to learn a different language and culture.

— namely, to cling to their own culture and yet achieve the same success as people with a different culture.

Cultural differences matter. They have always mattered, however much that may be denied today by the multicultural cult.

Those who use the term “cultural diversity” to promote a multiplicity of segregated ethnic enclaves are doing an enormous harm to the people in those enclaves.

However they live socially, the people in those enclaves are going to have to compete economically for a livelihood. Even if they were not disadvantaged before, they will be very disadvantaged if their competitors from the general population are free to tap the knowledge, skills, and analytical techniques which Western civilization has drawn from all the other civilizations of the world, while those in the enclaves are restricted to what exists in the subculture immediately around them.

We need also to recognize that many great thinkers of the past– whether in medicine or philosophy, science or economics– labored not simply to advance whatever particular group they happened to have come from but to advance the human race.

Their legacies, whether cures for deadly diseases or dramatic increases in crop yields to fight the scourge of hunger, belong to all people– and all people need to claim that legacy, not seal themselves off in a dead-end of tribalism or in an emotional orgy of cultural vanity.

Thanks for taking the time to write that thought provoking comment. The blog is a better place for all of the terrific views being expressed and shared.

Hi

From someone that does’t live in either Sydney nor Melbourne some of these comments tell me some view Australia as the confines of 2 (mostly 1) cities.

Squeaky wheels get all the noise.

I’m not sure if I am seeing this correctly or not but the chart shows around 3 billion in real estate investment into Australia from China over 2014. Using round numbers of an average of $1 million per property we are talking 3 thousand properties approx, spread across at least 2 capital cities, maybe Bris & Perth as well. This does not seem to be enough foreign capital to elevate prices much given the size of the real estate market. Also the annual rate of foreign capital is not linear, meaning it can dissapear just as fast. I would also like to point out a few things about the so called property bubble. As long as the $A is falling there will be no bubble. Any foreign investor has been losing money on Aust real estate especially the Chinese as the $A has fallen from 7:1 in 2011 to 3.75:1. Thats around 45% fall. The property market has not risen anywhere near that. This is not a property bubble. When the boom arrives you will see property rise all around the country not just the financial capital (Sydney). As a person who lives in the country and has just purchased a property at 2x our household income I am thinking what bubble. If you look around the world any nations financial capital has expensive real estate that is rising in price. Auckland, London, New york, Shangai you name it, it’s the same all over the world. This is where rich people park their money and diversify their investments. I can tell you that people in the country regions are not thinking for one second that there is a bubble as prices are barely moving. The problem occurs when people think that the market is linear and they extrapolate the current trend into the future and think BUBBLE! All markets are dynamic they move up and down just like 2010-2011 where there was negative growth in Sydney, around -5% annual. The bear market in real estate will arrive in a couple of years and it will appear to be cheap and the whole cycle will start over again. Why we want to fight this natural cycle is just crazy. It has been here since the day the first settlers got of the boat. The real estate boom of the early 1890’s was just spectacular. It has never been any different. We are discussing the same concerns as 1988, one of the biggest booms ever and we are not even close, as that was 100% in one year!

Given a near record Auction weekend in Australia is close to 900 properties, it suggests there must be a Chinese influence over the course of a year. I doubt Chinese wealthy looking to leave China and starting to move wealth out care about the currency as much as getting out. You might like to also read our columns on the areas in OZ that have suffered 50% price falls and more in the last couple of years.

Thankyou Roger.

This confirms what i have suspected.Three properties have been sold in my small street in the last 12 months . They have all been bought by Chinese at very elevated prices . Two are empty with no grounds maintenance done since February 2014. The other is occupied but they have no contact with any neighbours.I am not against foreign investment or immigration but should our government not monitor and control the situation so that its own residents can still afford to live in their own cities!!

Once again we baby boomers profit at the expense of having our kids at home longer and some possibly FOREVER.!!!.

So much for multiculturalism?

I grieve for the lost Australia. As a Brit who came to Sydney in 1969 and quickly fell in love with Australia, I know how easy it was to buy a house in that era. Or you could buy a string of houses, buying one every time there was a recession. Negative gearing helped you along your way. Fast forward to today and the majority of workers are condemned to be wage slaves with no hope of ever buying a property particularly in Sydney. The question is, what could come along to ever change this situation. I think the sad fact is that there is nothing now that could ever help the bulk of average earners get on the property ladder.

Thanks Michael.

It’s good to read at least one respected financial commentator highlighting what is obvious to the layman… that Australia is simply experiencing an extension of China’s own property bubble. What’s even scarier is that those statistics are probably just the official figures. No doubt the numbers are exponentially greater if one includes the black market (illegal purchases by non-citizens/residents) and the grey market (purchased by Australian citizens with extended offshore family money). Then of course there is the ripple down effect from “investor visa” purchases of trophy homes/mega mansions. The incompetency of the Australian authorities in failing to quantify, never mind take some control of the situation is a disgrace.

The question is now whether the declining consumer and business confidence in China, slows the rate of offshore property purchasing or speeds it up!

Speed it up definitely!

I think what a lot of people are missing is that a significant proportion of what is perceived to be Chinese investors, are actually overseas Chinese (Malaysian, Indonesian, Singaporean, etc.) that have been in those countries for generations. Anecdotally, it seems the rate that they are investing in Australia is accelerating too.

I think most of the investment is driven by a desire to migrate to Australia because it is seen as a desirable place to live. This is evidenced by the large numbers of international students that come here even through most could study at a better university in the USA for less money.

Agreed. Those that already bought in Australia have lost 30% just in currency devaluation but it won’t slow them down one bit.

They are playing a long game for their kids. And the air over their sucks.

Australia – Chinas sometime quarry and clean-air accommodation for the ruling class.

Learn some mandarin or move.