Metallurgical coal: the decline continues

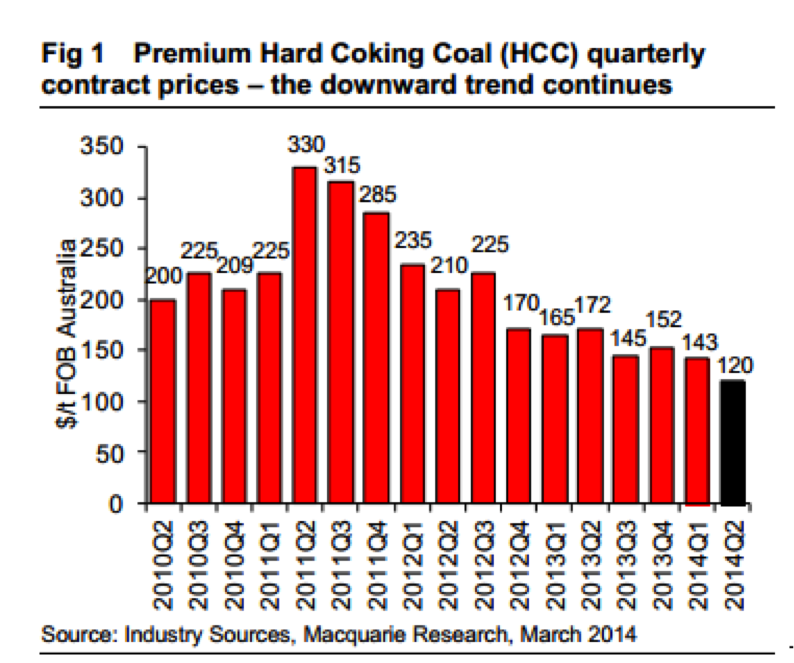

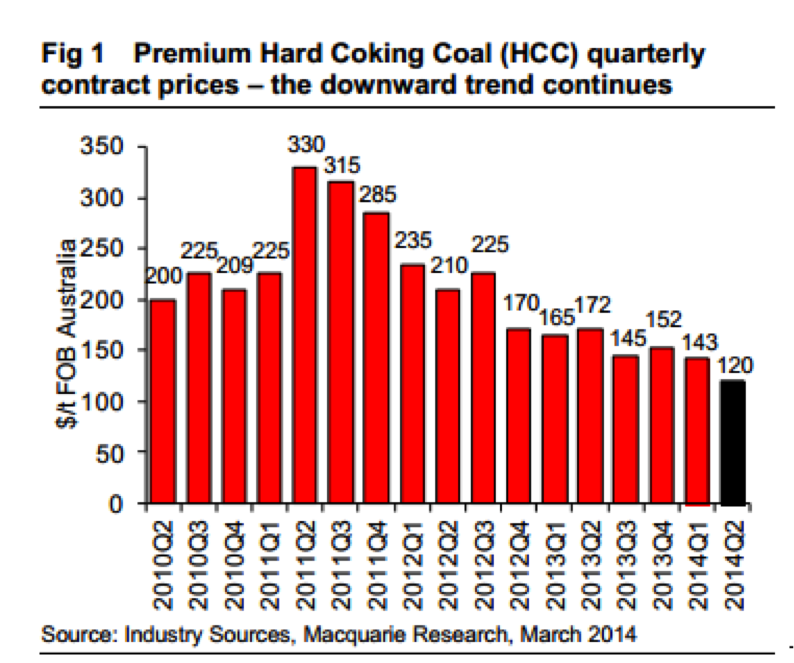

On Monday, we wrote a piece reporting the steady decrease in the price of thermal coal. For those who like to keep an eye on various key commodity prices, the metallurgical coal benchmark price for the June 2014 quarter is looking like $120/tonne.

This is a huge fall, down US$23/tonne, or 16 per cent on the March 2014 quarter, and down US$52/tonne, or 30 percent on the June 2013 quarter.

These levels are lower than those reached during the Global Financial Crisis (which saw metallurgical coal reach then-lows of US$129/tonne).

Readers should note two tonnes of steel generally requires one tonne of metallurgical coal, also known as coking coal.

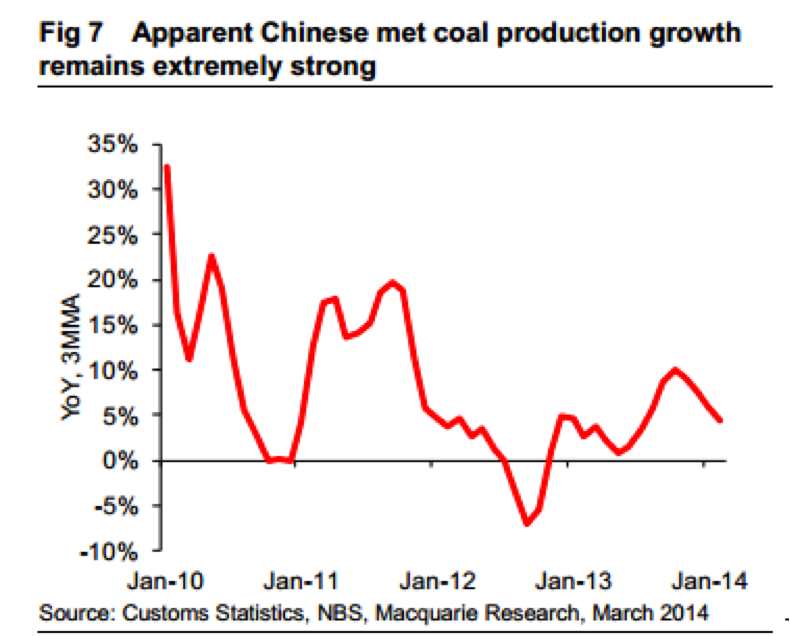

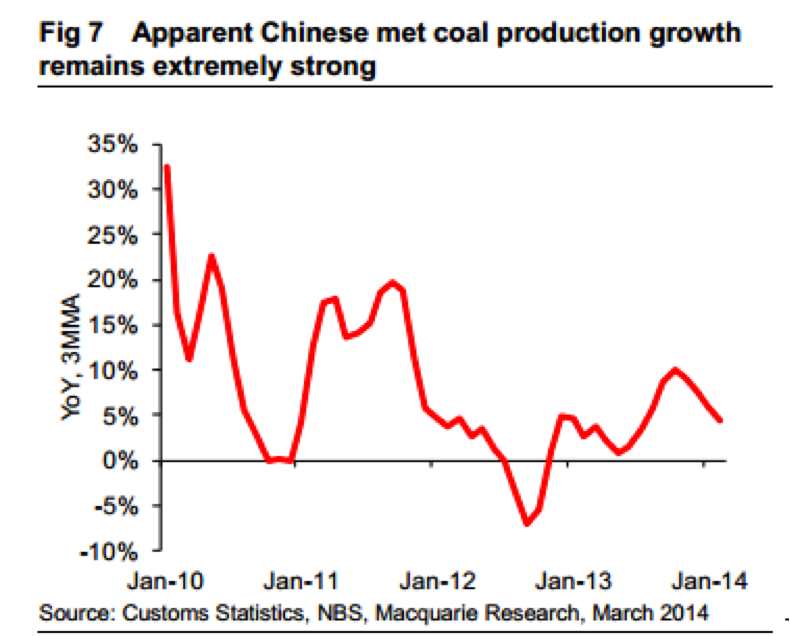

The primary reason for the decline actually relates to strong Chinese domestic production.

China produces nearly 4 billion tonnes of coal each year, nearly four times the next largest producer, the US; and roughly half the world’s total annual production.

Therefore, any small percentage oversupply in China equates to a very large oversupply as a percentage of the much smaller seaborne markets.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.