Thermal coal’s turn to edge downwards

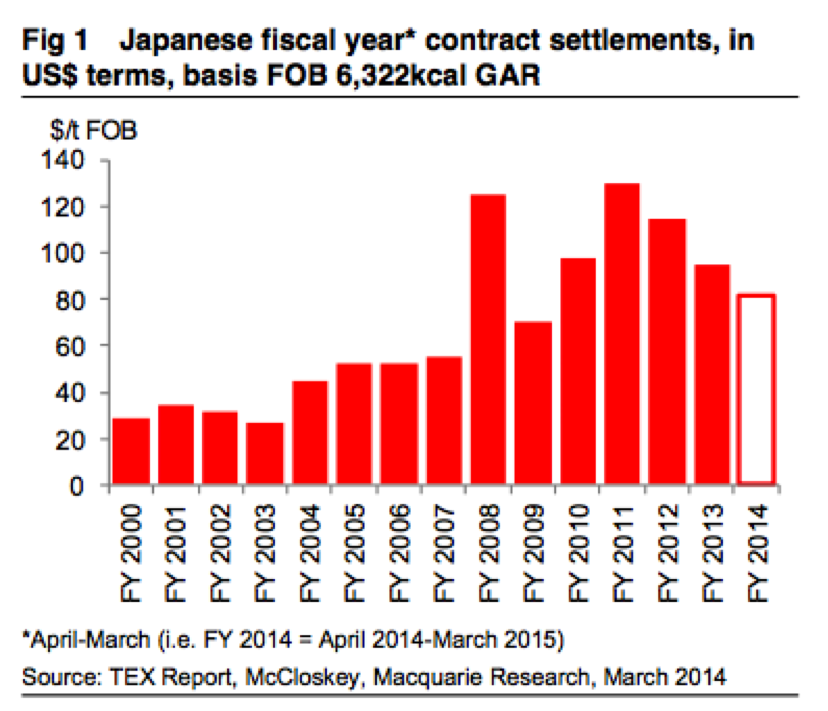

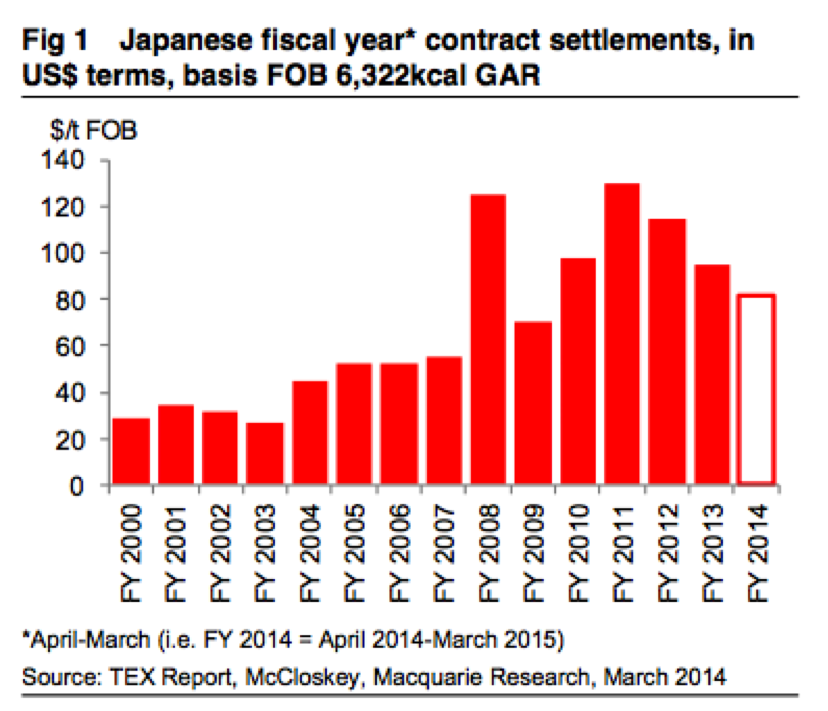

Recent negotiations with Japanese utilities is likely to see the thermal coal price contracted at US$82/tonne for the year to March 2015, according to Macquarie Research.

This is down 14 per cent from US$95/tonne in the current Japanese financial year (to 31 March 2014) and the lowest level in five years.

Over the past year, the AUD/USD exchange rate has declined nearly 14 per cent from US$1.04 to US$0.90, assisting Australian thermal coal producers.

The contracted price peaked in the year to March 2012 at US$136/tonne.

In recent months, the spot thermal coal price out of Newcastle has come back 13 per cent, from US$86/tonne to US$75/tonne, while the AUD/USD exchange rate has risen slightly.

Despite increased export volumes, it seems to us that earnings forecasts for Australia’s bulk commodity producers could edge down somewhat over the foreseeable future, unless the Australian dollar gaps down towards US$0.80.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.