Market valuation

We aren’t fond of correlation analysis and curve fitting as a basis for investing so you should immediately be careful about what you conclude from the following insight.

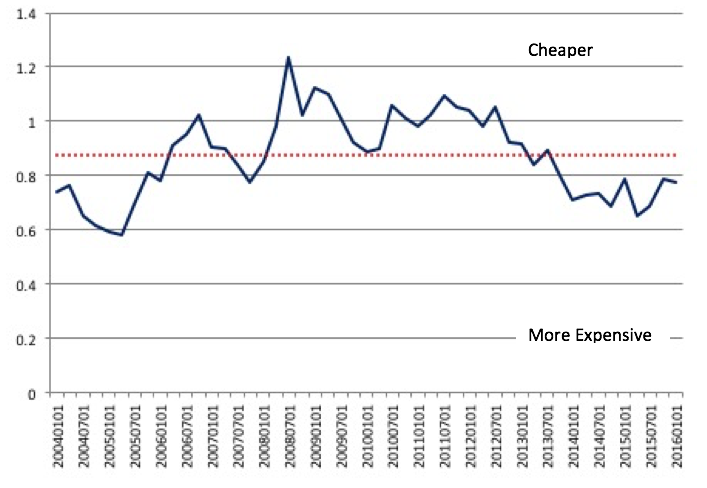

As you know we have our own proprietary method for working out whether the market, broadly speaking, is expensive or cheap. That method (see Figure. 1) involves assessing the relative margin of safety of a set of high quality companies. Such an approach can at best only ever be an estimate, however it currently suggests the market is a little expensive.

Of course if our estimates for earnings growth prove to be too optimistic, the market is even more expensive.

The counter argument however is that if we remove, from our data set, the period of extreme under-pricing that occurred during the GFC, the market currently is not too far from fair value.

Figure.1 Montgomery Broader Market Valuation Estimate

Periods of over pricing can persist for some time and as a result it does not make sense to react impulsively.

It is interesting that one of our more respected brokers has produced their own version of this hoped-for insight.

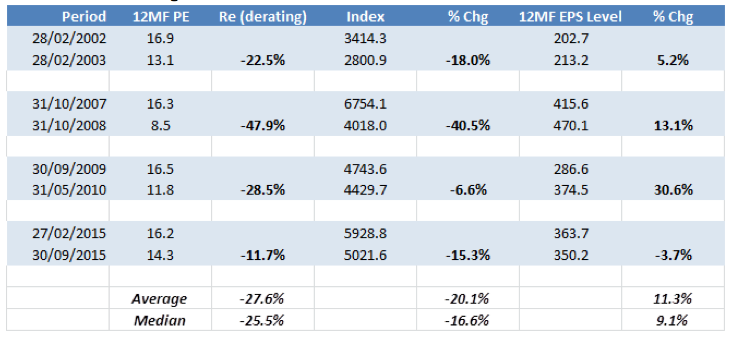

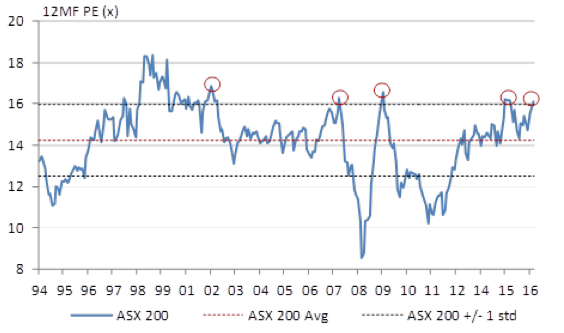

The analyst writes: “As of yesterday’s close the ASX 200 12MF PE [Month Forward Price Earnings Ratio] has once again traded above 16x, closing the day at 16.1x…we have highlighted four prior periods which the market traded above this level and the table below shows the breakdown from the peak (16x +) to the next trough in PE and the subsequent market and EPS changes (based on the market aggregate EPS level at these points) over this period.”

We display the table and chart in Table 1 and Figure 2 following.

Table. 1 Peak to Trough

Figure. 2. 12Month Forward PE with average and +/- 1 Standard Deviation bands.

Lower interest rates are supportive for asset values but they can still trade to extremes and set themselves up for corrections if the higher prices are not supported by earnings growth. The paradox in yesterday’s interest rate cut (supportive for valuations) is that it reflects deteriorating economic conditions (negative for earnings).

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

I’m not sure that “Lower interest rates are supportive for asset values” unless long term interest rates are expected to be lower than they are currently. Its about expectations and relative levels. Low per se says nothing about asset value support.

It does at the moment Nathan.