Market Insights for Trump’s presidency: historical trends and potential catalysts

Following the election of Donald Trump as the next U.S. president, a number of market analysts are crunching the numbers on what, if anything, it means for markets. Given there is an election every four years and most investors are investing over a longer time frame than that, who is in charge should matter relatively little. We will examine what might matter more, later in this post.

That there is measurable data coinciding with presidential terms means its inevitable investors will try to find patterns and correlations. And while many are now crunching the numbers following trump’s victory, we examined some of the correlations a few weeks back and republished those findings the day after the election.

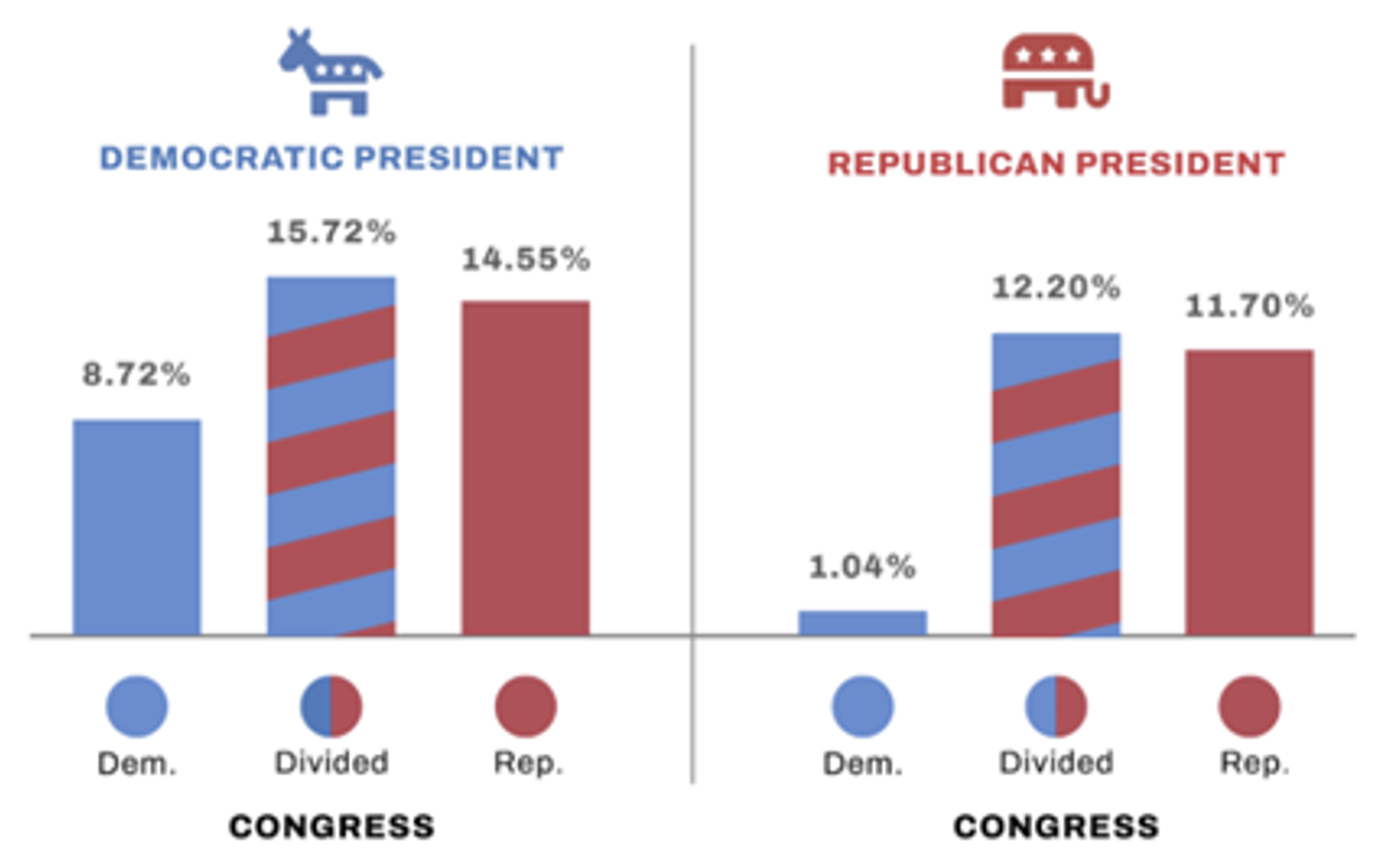

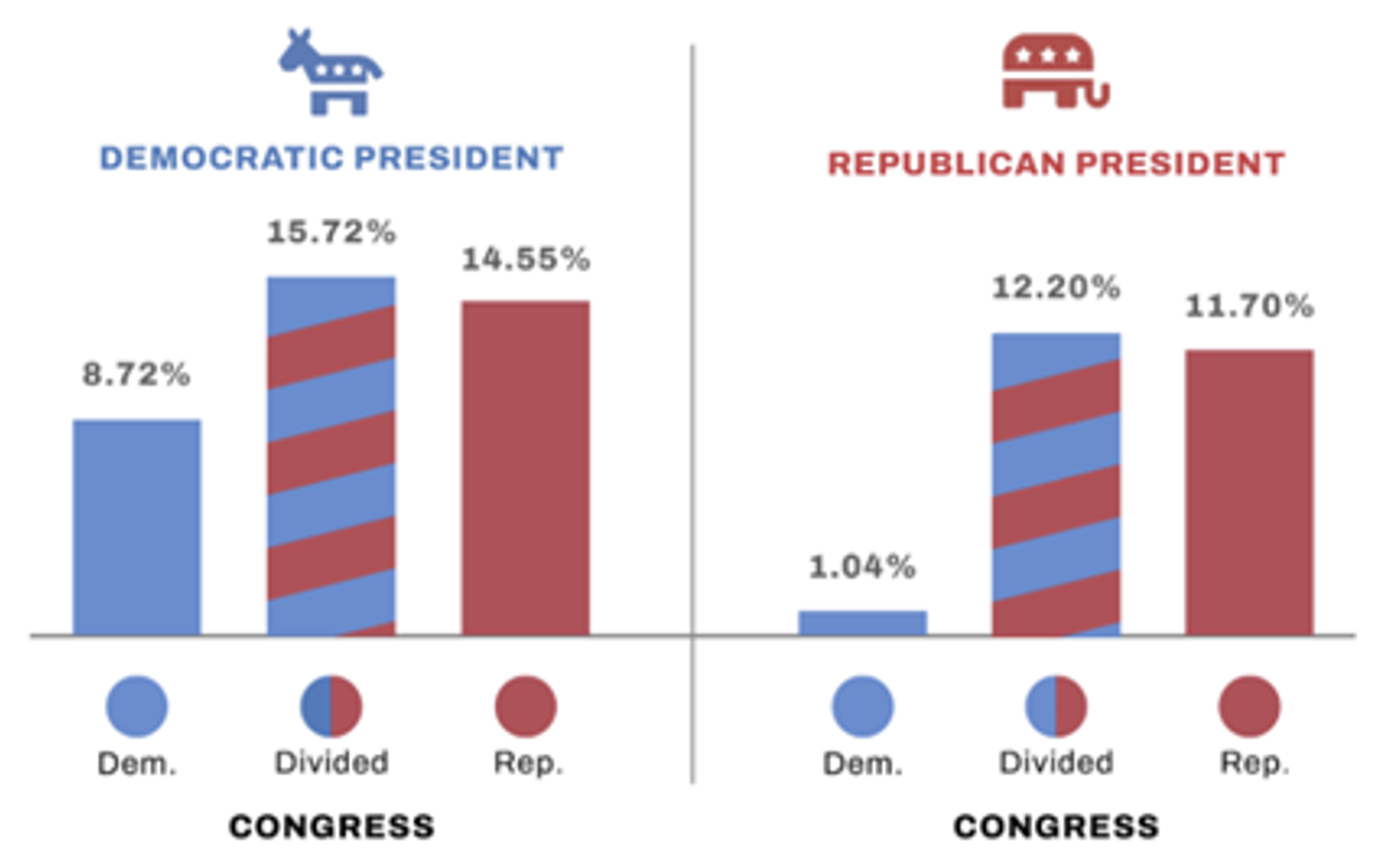

That blog post revealed the best returns from the U.S. S&P 500 occur when a democrat has been elected president and the congress is dividend (think a hung parliament).

Figure 1. Average annualised performance S&P500, 1950 – 2023

Figure 1., reveals the best and worst combinations of president and congress in terms of historical stock market returns, reported as average annual compounded returns over the four year term.

Figure 1., reveals the best and worst combinations of president and congress in terms of historical stock market returns, reported as average annual compounded returns over the four year term.

History suggests the 2024 Republican clean sweep will coincide with low double digit average annual returns for the next four years. That of course presumes no financial crisis, no recession, no armed conflict with China, perhaps nothing that would normally impact markets and disturb a smooth presidential term this time around. Indeed, as we will see in a moment, there is very likely to be a bump along the road and, under Trump, a bigger than-average bump.

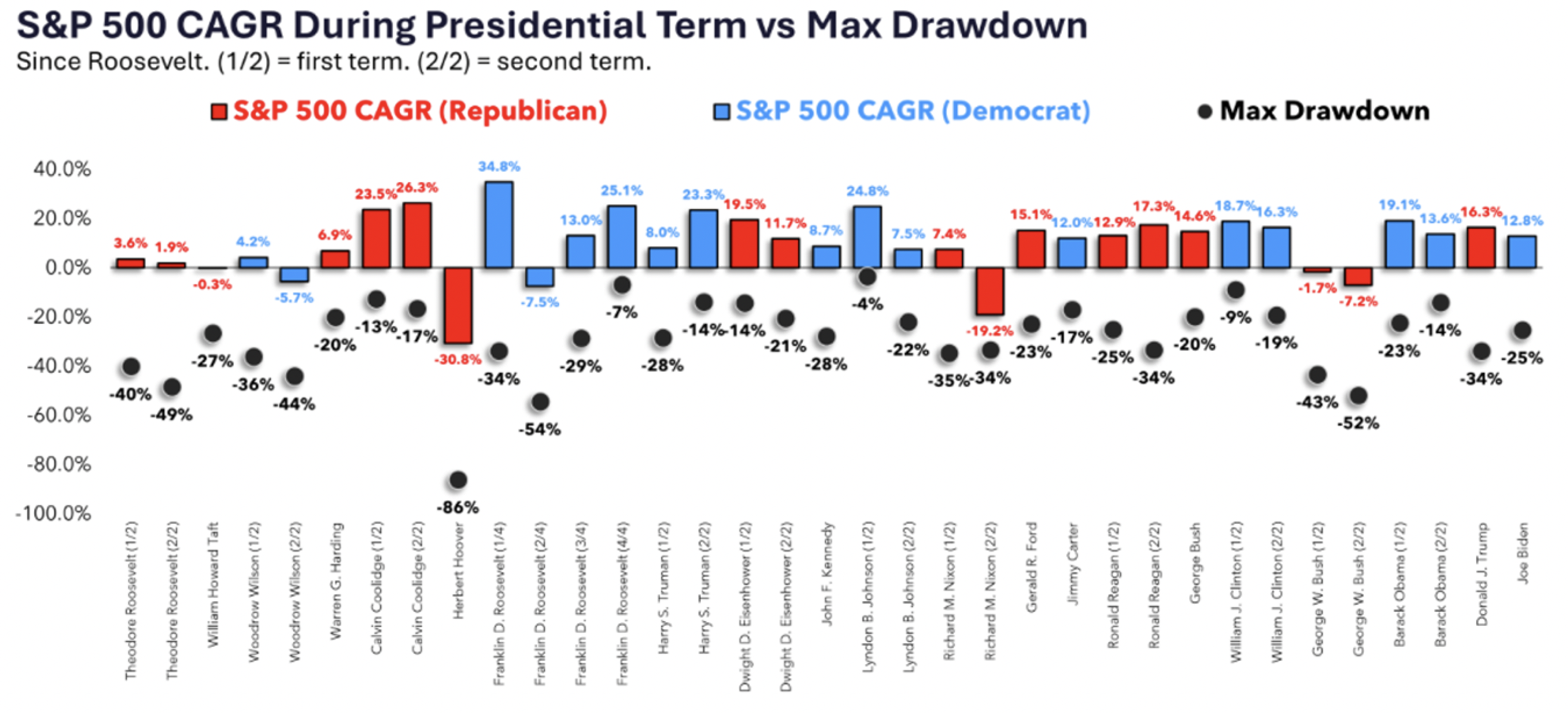

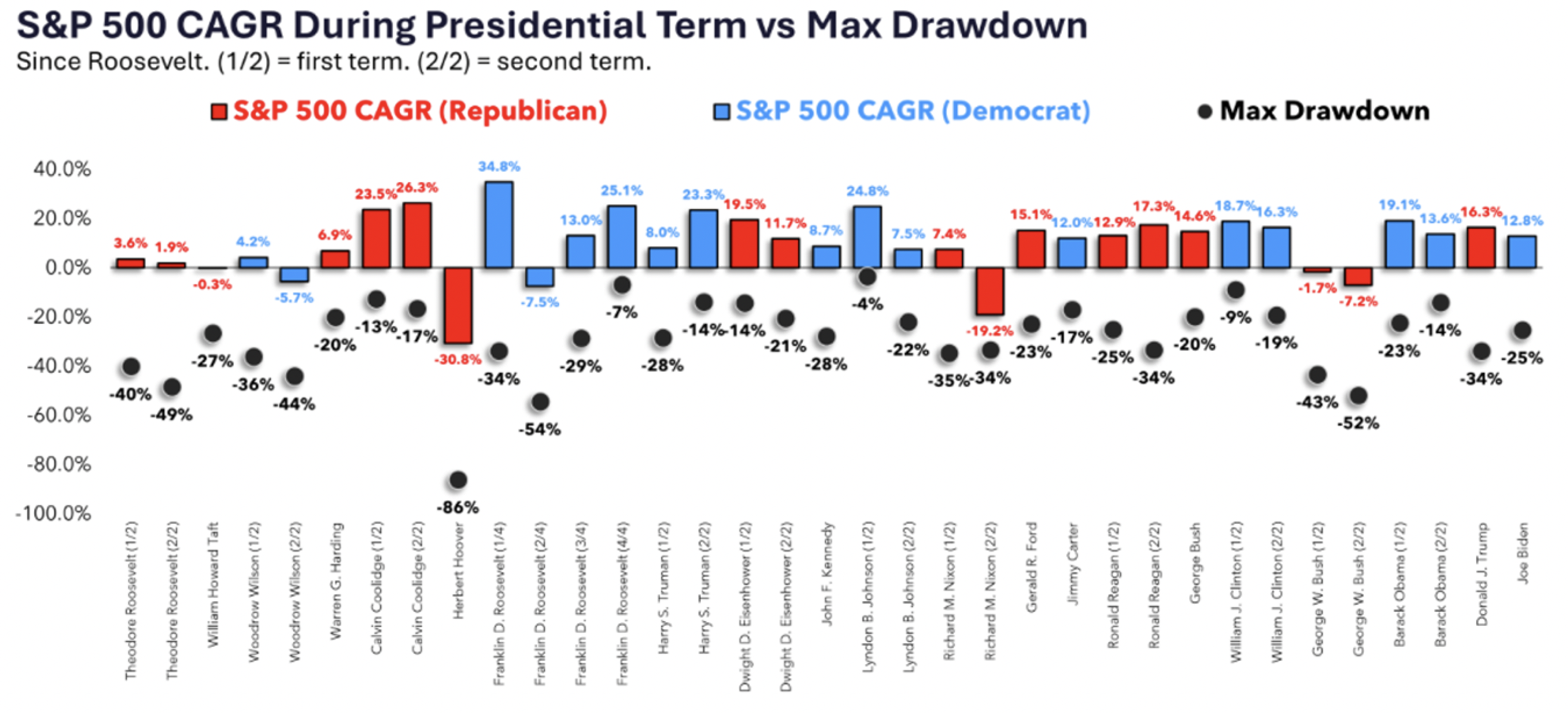

Going back to Theodore Roosevelt’s two terms as President, Figure 2., reveals the compounded average annual performance of the S&P500 during each presidential term alongside the maximum peak-to-valley drawdown.

Figure 2. It doesn’t matter who presides, there will be a drawdown

You will examine Figure 2., and make three prominent discoveries:

You will examine Figure 2., and make three prominent discoveries:

- Since Theodore Roosevelt, presidencies held by Democratic and Republican presidents were almost evenly split, with 17 of the 35 terms held by a Democrat and 18 by a Republican, and

- Republican presidents presided over all terms when the S&P 500 posted negative average annual returns.

- Only once was a presidential term that produced a negative average annual compounded return for the S&P 500, followed by another. And if a Democrat followed the negative Republican term, it was always a positive (CAGR) for the S&P 500.

But the biggest and perhaps most startling fact for me is that 100 per cent of presidential terms saw a drawdown, and except for three Democratic presidential terms that produced a single-digit drawdown, all other drawdowns were double-digit.

History suggests, rather strongly, the next four years will produce a double-digit drawdown while Trump is at the helm. And historically, under a Republican presidency, the average of the largest drawdowns is greater than under a Democrat President. The average of the biggest drawdowns under a Republican is 32.6 per cent with the smallest being 13 per cent and the largest being 86 per cent. This contrasts with a Democrat President where the average was 24 per cent, the smallest drawdown was just four per cent, and the largest was 54 per cent.

If we give Republican Presidents a little latitude and remove the 86 per cent drawdown, which coincided with the Great Depression, the average of the biggest drawdowns was 29.5 per cent – still inferior to the numbers under the Democrat presidents.

So, history suggests, that under Trump, we can expect a drawdown, we can expect a double-digit drawdown, and we can expect that drawdown to be larger than it would have been under Harris. If history proves prescient, given that a Democrat is not the President, we can rule out single-digit drawdowns. Of course, at all times, I am reminded of Charlie Munger’s observation, that if history was the secret to stock market success, librarians would be the richest people in the world.

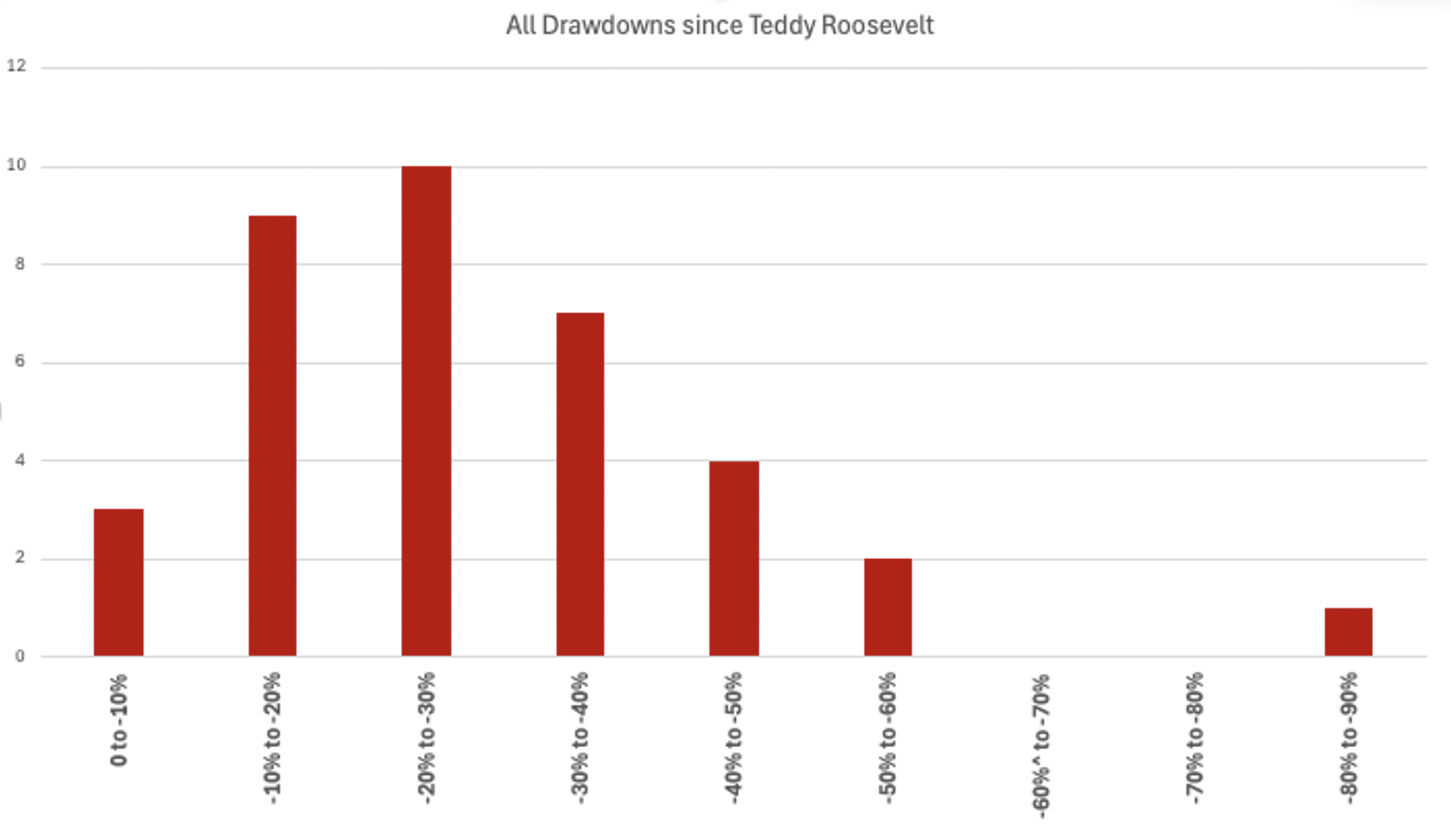

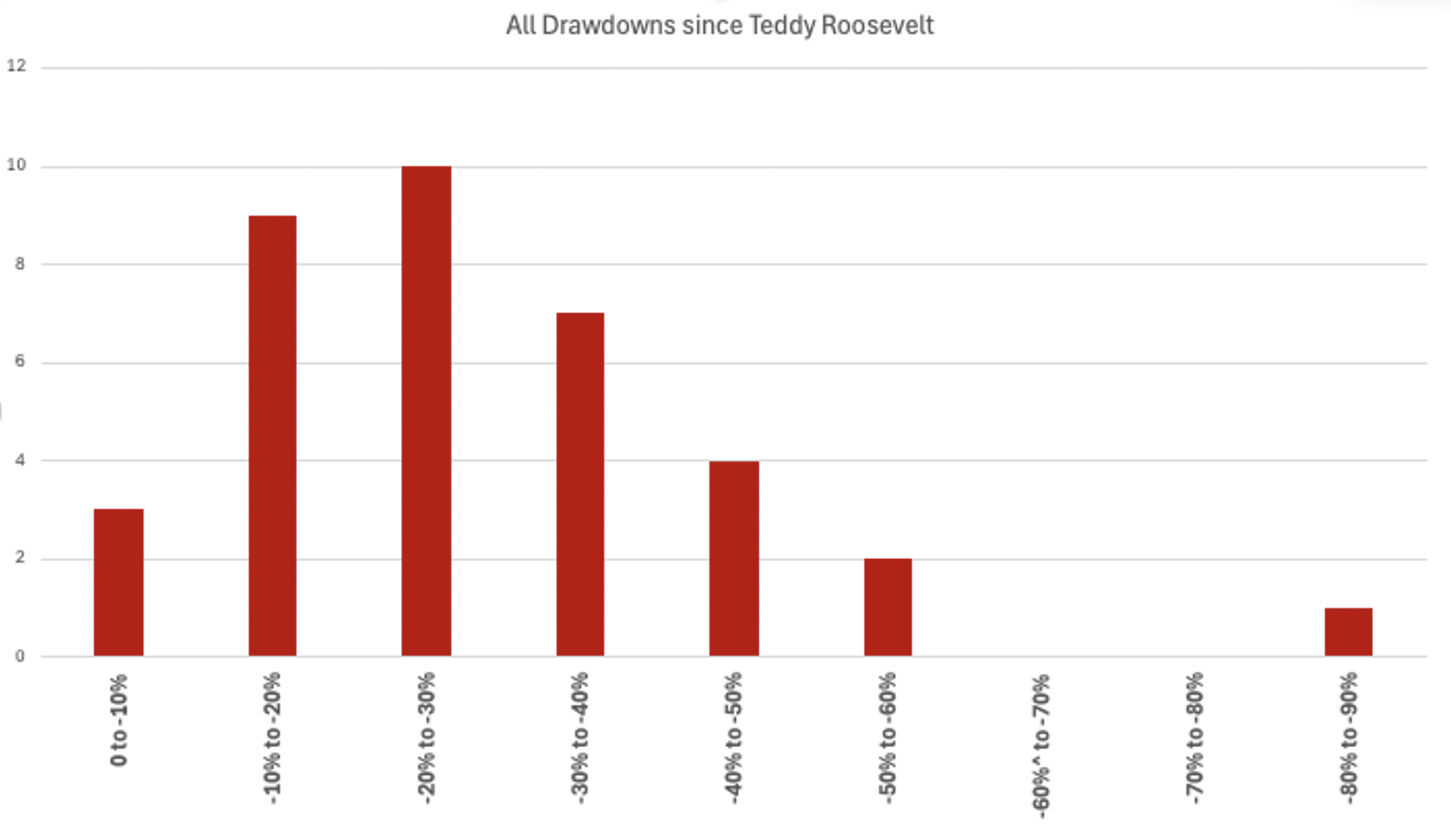

If, as we have done in Figure 3., politics is removed from the data and we look at the distribution of drawdowns, we discover the highest probability is for a drawdown this presidential term of between 20 and 30 per cent. if the pattern of history continues, the likelihood of a drawdown of between 10 and 30 per cent is double that for a decline of between 20 and 30 per cent.

Figure 3. Distribution of U.S. presidential term drawdowns The conclusions we might reach from the above insights are as follows: First, with a Republican at the helm of the ‘Goodship USA’, it is as good as certain there will be a drawdown in the next four years, and second, the probability is almost as high that the drawdown will be in the double digits. We can also conclude that with Trump at the helm, the drawdown will be worse than it would have been with a Democrat in charge, although a fascinating discussion could be had around whether Republicans are the cause of the correction or whether their election is the consequence of other socioeconomic and political factors that also lead to the market correcting). And finally, adding to the rather sombre conclusion is that from 35 presidential terms, seven produced a negative compounded average annual growth rate for the S&P 500. And of those seven, five were presided over by the Republicans.

The conclusions we might reach from the above insights are as follows: First, with a Republican at the helm of the ‘Goodship USA’, it is as good as certain there will be a drawdown in the next four years, and second, the probability is almost as high that the drawdown will be in the double digits. We can also conclude that with Trump at the helm, the drawdown will be worse than it would have been with a Democrat in charge, although a fascinating discussion could be had around whether Republicans are the cause of the correction or whether their election is the consequence of other socioeconomic and political factors that also lead to the market correcting). And finally, adding to the rather sombre conclusion is that from 35 presidential terms, seven produced a negative compounded average annual growth rate for the S&P 500. And of those seven, five were presided over by the Republicans.

Why 2026?

Nobody can accurately predict what the market is going to do and the reality is that investors should not be allocating capital based on who is president or who controls congress in the U.S..

That said, it is, if nothing else, a stimulating exercise to investigate what insights, if any, history can provide. We know, for example, that investing when equities in aggregate are cheap provides a better return irrespective of who the president is.

Investors must never forget that prices will follow the economic performance of the underlying business. Who the president is may or may not have anything to do with that. And for corrections to occur, there is usually some sort of catalyst that shocks investors out of a state of optimism or apathy.

If history repeats and the next presidential term delivers a drawdown or correction, we might ponder what the catalysts could be.

The first might be the delivery of Xi Jinping’s promise to take back Taiwan. We already know an emboldened China intends to fulfil its imperial and geostrategic objectives through expansionist behaviour against Taiwan, and while military strategists believe the PLA will be ready by 2027, intelligence agencies have said that Xi has directed the PLA to be prepared for a potential invasion of Taiwan by 2027.

A second possible catalyst is the refinancing of very large amounts of debt adopted during the period of ultra-low and zero rates and the consequent demand on liquidity to do it. As Michael Howell of Crossborder Capital write in the Financial Times on October 17, 2024;

“If bull markets always climb a wall of worry, then financial crises often smash into a wall of debt. We are already walking into the foothills of another crisis. It is not just the growing size of the interest bill that matters, but more so the task of rolling over a pile of maturing debts. Next year and particularly 2026 will prove challenging years for investors.

“Consider how, over the coming months, stock prices will not only have to defy growing investor doubts about growth and inflation, but by late 2025 they will have to scale a sizeable maturity wall of debts. This term describes the bunching in the refinancing of those debts mostly taken out, a few years back, when interest rates were at rock bottom. Similar refinancing tensions have helped trigger several past financial meltdowns such as the 1997-98 Asian crisis and the 2008-09 financial crisis.”

While history may not repeat it is said to rhyme. Nobody can know whether the market will follow patterns of the past, or change them and even the two possible catalysts are but possibilities rather than certainties.

While some might fret over even a slim possibility of the subject of this article being fulfilled, history suggests investors should expect corrections. Indeed, they should look forward to them. For investors with longer horizons, the delivery of cheaper prices should be seen as an opportunity to boost returns. Remember, the lower the price you pay, the higher your returns.

Following the election of Donald Trump as the next U.S. president, a number of market analysts are crunching the numbers on what, if anything, it means for markets. Given there is an election every four years and most investors are investing over a longer time frame than that, who is in charge should matter relatively little. We will examine what might matter more, later in this post.

That there is measurable data coinciding with presidential terms means its inevitable investors will try to find patterns and correlations. And while many are now crunching the numbers following trump’s victory, we examined some of the correlations a few weeks back and republished those findings the day after the election.

That blog post revealed the best returns from the U.S. S&P 500 occur when a democrat has been elected president and the congress is dividend (think a hung parliament).

Figure 1. Average annualised performance S&P500, 1950 – 2023

Figure 1., reveals the best and worst combinations of president and congress in terms of historical stock market returns, reported as average annual compounded returns over the four year term.

Figure 1., reveals the best and worst combinations of president and congress in terms of historical stock market returns, reported as average annual compounded returns over the four year term.

History suggests the 2024 Republican clean sweep will coincide with low double digit average annual returns for the next four years. That of course presumes no financial crisis, no recession, no armed conflict with China, perhaps nothing that would normally impact markets and disturb a smooth presidential term this time around. Indeed, as we will see in a moment there is very likely to be a bump along the road and, under Trump, a bigger than-average bump.

Going back to Theodore Roosevelt’s two terms as President, Figure 2., reveals the compounded average annual performance of the S&P500 during each presidential term alongside the maximum peak-to-valley drawdown

Figure 2. It doesn’t matter who presides, there will be a drawdown

You will examine Figure 2., and make three prominent discoveries:

You will examine Figure 2., and make three prominent discoveries:

- Since Theodore Roosevelt, presidencies held by Democratic and Republican presidents were almost evenly split, with 17 of the 35 terms held by a Democrat and 18 by a Republican, and

- Republican presidents presided over all terms when the S&P 500 posted negative average annual returns.

- Only once was a presidential term that produced a negative average annual compounded return for the S&P 500, followed by another. And if a Democrat followed the negative Republican term, it was always a positive (CAGR) for the S&P 500.

But the biggest and perhaps most startling fact for me is that 100 per cent of presidential terms saw a drawdown, and except for three Democratic presidential terms that produced a single-digit drawdown, all other drawdowns were double-digit.

History suggests, rather strongly, the next four years will produce a double-digit drawdown while Trump is at the helm. And historically, under a Republican presidency, the average of the largest drawdowns is greater than under a Democrat President. The average of the biggest drawdowns under a Republican is 32.6 per cent with the smallest being 13 per cent and the largest being 86 per cent. This contrasts with a Democrat President where the average was 24 per cent, the smallest drawdown was just four per cent and the largest was 54 per cent.

If we give Republican Presidents a little latitude and remove the 86 per cent drawdown, which coincided with the Great Depression, the average of the biggest drawdowns was 29.5 per cent – still inferior to the numbers under the Democrat presidents.

So, history suggests, that under Trump, we can expect a drawdown, we can expect a double-digit drawdown, and we can expect that drawdown to be larger than it would have been under Harris. If history proves prescient, given that a Democrat is not the President, we can rule out single-digit drawdowns. Of course, at all times, I am reminded of Charlie Munger’s observation, that if history was the secret to stock market success, librarians would be the richest people in the world.

If, as we have done in Figure 3., politics is removed from the data and we look at the distribution of drawdowns, we discover the highest probability is for a drawdown this presidential term of between 20 and 30 per cent. if the pattern of history continues, the likelihood of a drawdown of between 10 and 30 per cent is double that for a decline of between 20 and 30 per cent.

Figure 3. Distribution of U.S. presidential term drawdowns The conclusions we might reach from the above insights are as follows: First, with a Republican at the helm of the ‘Goodship USA’, it is as good as certain there will be a drawdown in the next four years, and second, the probability is almost as high that the drawdown will be in the double digits. We can also conclude that with Trump at the helm, the drawdown will be worse than it would have been with a Democrat in charge, although a fascinating discussion could be had around whether Republicans are the cause of the correction or whether their election is the consequence of other socioeconomic and political factors that also lead to the market correcting). And finally, adding to the rather sombre conclusion is that from 35 presidential terms, seven produced a negative compounded average annual growth rate for the S&P 500. And of those seven, five were presided over by the Republicans.

The conclusions we might reach from the above insights are as follows: First, with a Republican at the helm of the ‘Goodship USA’, it is as good as certain there will be a drawdown in the next four years, and second, the probability is almost as high that the drawdown will be in the double digits. We can also conclude that with Trump at the helm, the drawdown will be worse than it would have been with a Democrat in charge, although a fascinating discussion could be had around whether Republicans are the cause of the correction or whether their election is the consequence of other socioeconomic and political factors that also lead to the market correcting). And finally, adding to the rather sombre conclusion is that from 35 presidential terms, seven produced a negative compounded average annual growth rate for the S&P 500. And of those seven, five were presided over by the Republicans.

Why 2026?

Nobody can accurately predict what the market is going to do and the reality is that investors should not be allocating capital based on who is president or who controls congress in the United States

That said, it is, if nothing else, a stimulating exercise to investigate what insights, if any, history can provide. We know, for example, that investing when equities in aggregate are cheap provides a better return irrespective of who the president is.

Investors must never forget that prices will follow the economic performance of the underlying business. Who the president is may or may not have anything to do with that. And for corrections to occur, there is usually some sort of catalyst that shocks investors out of a state of optimism or apathy.

If history repeats and the next presidential term delivers a drawdown or correction, we might ponder what the catalysts could be.

The first might be the delivery of Xi Jinping’s promise to take back Taiwan. We already know an emboldened China intends to fulfil its imperial and geostrategic objectives through expansionist behaviour against Taiwan, and while military strategists believe the PLA will be ready by 2027, intelligence agencies have said that Xi has directed the PLA to be prepared for a potential invasion of Taiwan by 2027.

A second possible catalyst is the refinancing of very large amounts of debt adopted during the period of ultra-low and zero rates and the consequent demand on liquidity to do it. As Michael Howell of Crossborder Capital write in the Financial Times on October 17, 2024;

“If bull markets always climb a wall of worry, then financial crises often smash into a wall of debt. We are already walking into the foothills of another crisis. It is not just the growing size of the interest bill that matters, but more so the task of rolling over a pile of maturing debts. Next year and particularly 2026 will prove challenging years for investors.

“Consider how, over the coming months, stock prices will not only have to defy growing investor doubts about growth and inflation, but by late 2025 they will have to scale a sizeable maturity wall of debts. This term describes the bunching in the refinancing of those debts mostly taken out, a few years back, when interest rates were rock bottom. Similar refinancing tensions have helped trigger several past financial meltdowns such as the 1997-98 Asian crisis and the 2008-09 financial crisis.”

While history may not repeat it is said to rhyme. Nobody can know whether the market will follow patterns of the past, or change them and even the two possible catalysts are but possibilities rather than certainties.

While some might fret over even a slim possibility of the subject of this article being fulfilled, history suggests investors should expect corrections. Indeed, they should look forward to them. For investors with longer horizons, the delivery of cheaper prices should be seen as an opportunity to boost returns. Remember, the lower the price you pay, the higher your returns.