The unprecedented spending by government

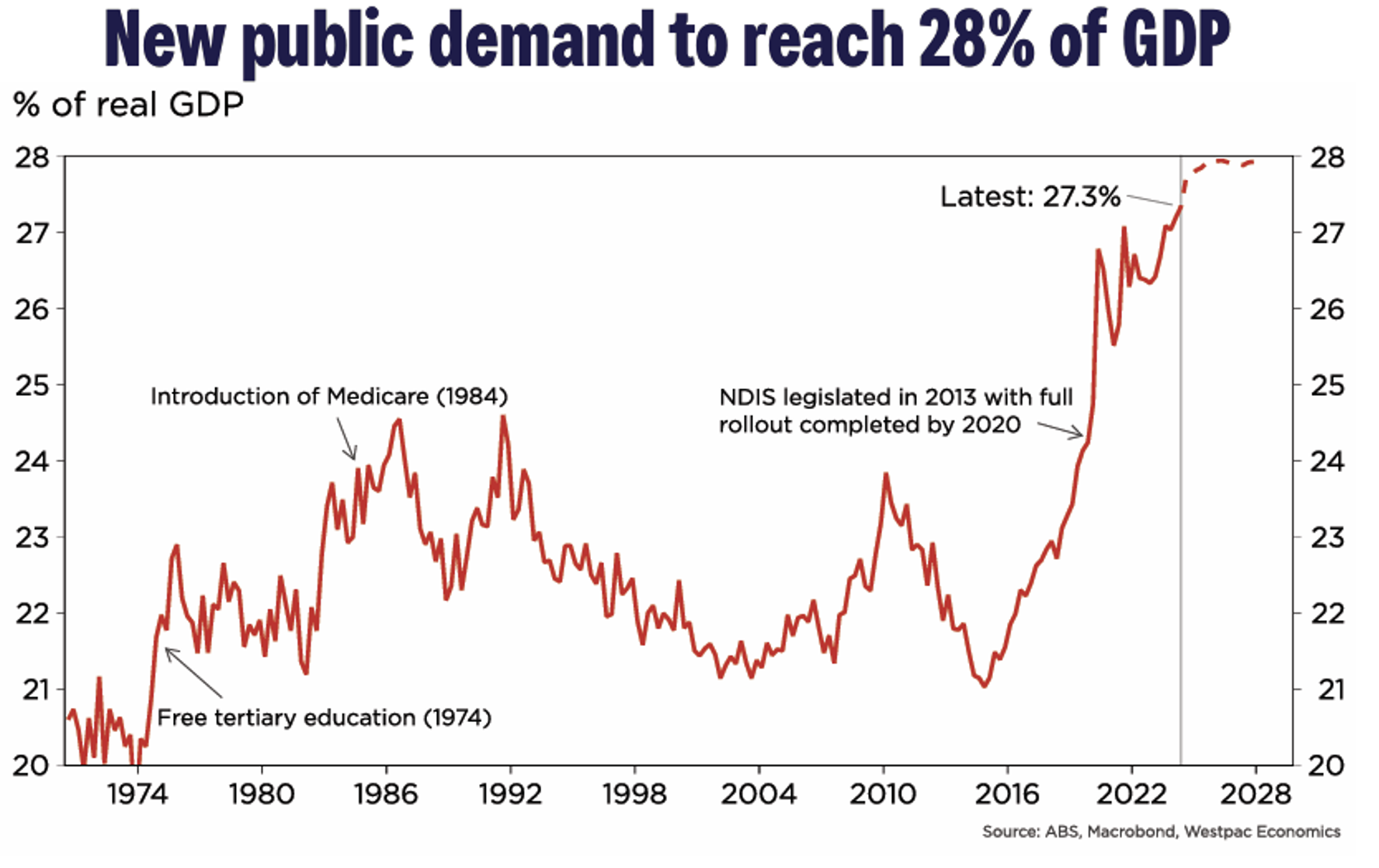

The Reserve Bank of Australia (RBA) is fighting the government sctor where aggregate expenditure has jumped from a long-term average of 22.5 per cent of gross domestic product (GDP) for the five decades from 1970 to a forecast 28 per cent of GDP. “Underlying inflation” is running at 3.5 per cent, and the strength of public spending has been underappreciated, assisting aggregate demand and keeping unemployment low.

According to the Australian Bureau of Statistics, Australian public sector wages jumped to $232 billion in fiscal 2024, an eight per cent increase, the fastest pace since fiscal 2009, which coincided with the global financial crisis. Over that 15-year period, growth in the public sector has easily exceeded the general population growth, and the growth in wages has exceeded the size of the economy by 2.6X in NSW, 3.0X in Queensland and 3.5X in Victoria.

According to the Australian Bureau of Statistics, Australian public sector wages jumped to $232 billion in fiscal 2024, an eight per cent increase, the fastest pace since fiscal 2009, which coincided with the global financial crisis. Over that 15-year period, growth in the public sector has easily exceeded the general population growth, and the growth in wages has exceeded the size of the economy by 2.6X in NSW, 3.0X in Queensland and 3.5X in Victoria.

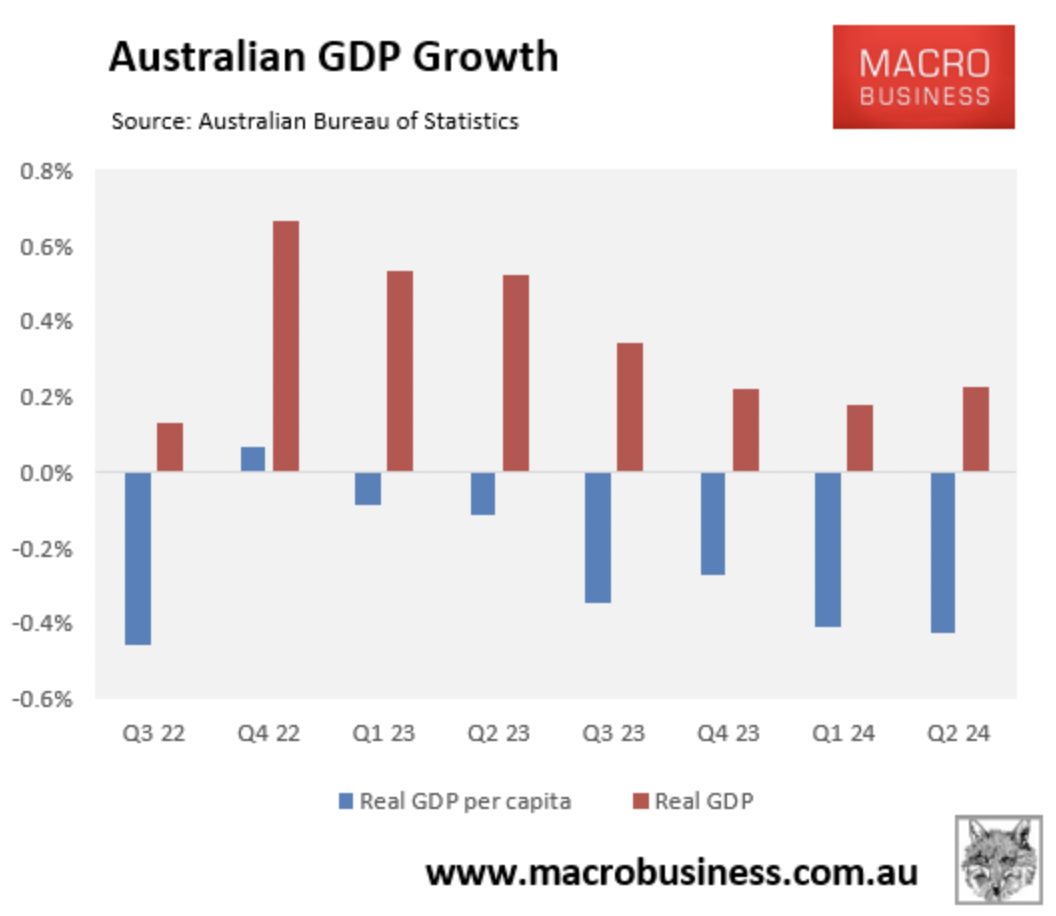

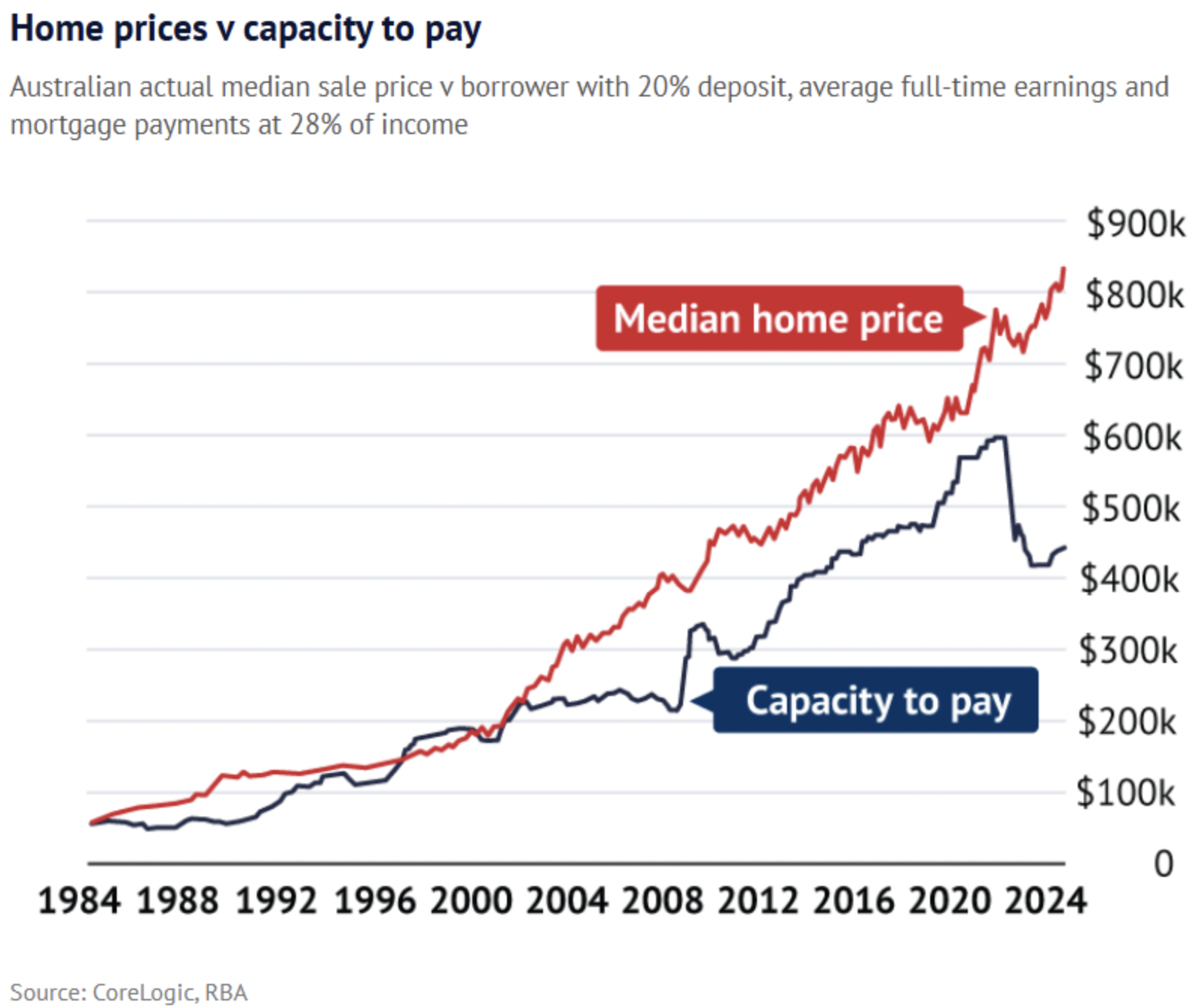

Hence, a lot of our relatively recent economic growth is coming from a less productive public sector, and that growth has been negative when we consider our population growth. In short, Australian real GDP per capita has been negative in seven of the past eight quarters, and given the poor productivity record it seems that is likely to persist for some time. The Organisation for Economic Co-operation and Development (OECD), for example, is forecasting the Australian economy will grow by 1.1 per cent in 2024 and 1.8 per cent in 2025. Meanwhile, the housing crisis is worsening with Australia’s politicians remaining obsessed with “a big Australia” – from a population perspective – whilst home building (apartments and houses) is running at approximately an annual 160,000. And based on the median property price, home buyers need to be in the top 20 per cent of earners to be able to afford a median priced home. Put another way, home buyers with a median income can only afford the cheapest 20 per cent of homes. The aussie dream is dead for most young Australians!

Meanwhile, the housing crisis is worsening with Australia’s politicians remaining obsessed with “a big Australia” – from a population perspective – whilst home building (apartments and houses) is running at approximately an annual 160,000. And based on the median property price, home buyers need to be in the top 20 per cent of earners to be able to afford a median priced home. Put another way, home buyers with a median income can only afford the cheapest 20 per cent of homes. The aussie dream is dead for most young Australians! With unprecedented spending from government, one wonders whether we can take an Elon Musk type approach in boosting government efficiency? Make Australia great again? Post the initial shock of job losses, the objective is to drive down government expenditure by utilising technology, reducing duplication, improving productivity, reducing inflation, boosting governments’ finances whilst improving the delivery of essential services.

With unprecedented spending from government, one wonders whether we can take an Elon Musk type approach in boosting government efficiency? Make Australia great again? Post the initial shock of job losses, the objective is to drive down government expenditure by utilising technology, reducing duplication, improving productivity, reducing inflation, boosting governments’ finances whilst improving the delivery of essential services.

With the unambitious political leadership, it appears the younger generation will be the first in many where they go backwards relative to their parents.