Macro researchers are Bullish on equities

Macroeconomic research house Alpine Macro has recently published an argument that should reassure bullish equity investors.

Alpine Macro’s analysts note U.S. recessions since the 1990s have been triggered by deflationary shocks requiring the Federal Reserve to cut rates deeply to stimulate a recovery in economic activity. One example Alpine Macro may be alluding to is the substantial deflationary shock following the 2001 entry of China into world markets. Coinciding with the aftermath of the tech wreck, central bankers feared an economic collapse or a 1930s-style deflationary shock and slashed rates to zero.

Since the 1990s periods of weak real growth and low inflation have resulted in a positive correlation between rates and stocks. Equities fall until rates are cut sufficiently such that expectations of an economic recovery emerge.

Prior to the 1990s, economic shocks were inflationary rather than deflationary. The 1970s and 1980s saw the Fed raise rates to temper excess demand and cool inflation. When the tightening cycle ended and began reversing, equities bounced.

So, after the 1990s, equities only rallied after rates were cut substantially and for long enough. Prior to the 1990s, equities rallied only after rates stopped rising and began being cut.

Today, the Fed is dealing with an inflationary shock. Weak real growth and low inflation no longer prevail. Alpine Macro argue the current cycle resembles the 1970s and 1980s and they suggest that is why the correlation between rates and equities may currently be negative. And because the investors have become more anticipatory than in the past, risk assets are front running changes in the Federal Reserve’s rate posture. This should mean that equities could rally on any sign the Fed has reached its peak rate for this cycle.

There are of course risks. One risk is that Alpine Macro have isolated correlations that happen to be coincidental only. The sample sizes are very small and therefore confidence that the current scenario will mirror a past experience should be low.

Alpine Macro suggest the possibility of inflation recommencing its upward much is the key risk to their bullish thesis. A jump in inflation would require more monetary tightening, provoke a deep recession, and a ‘double-dip’ in equities.

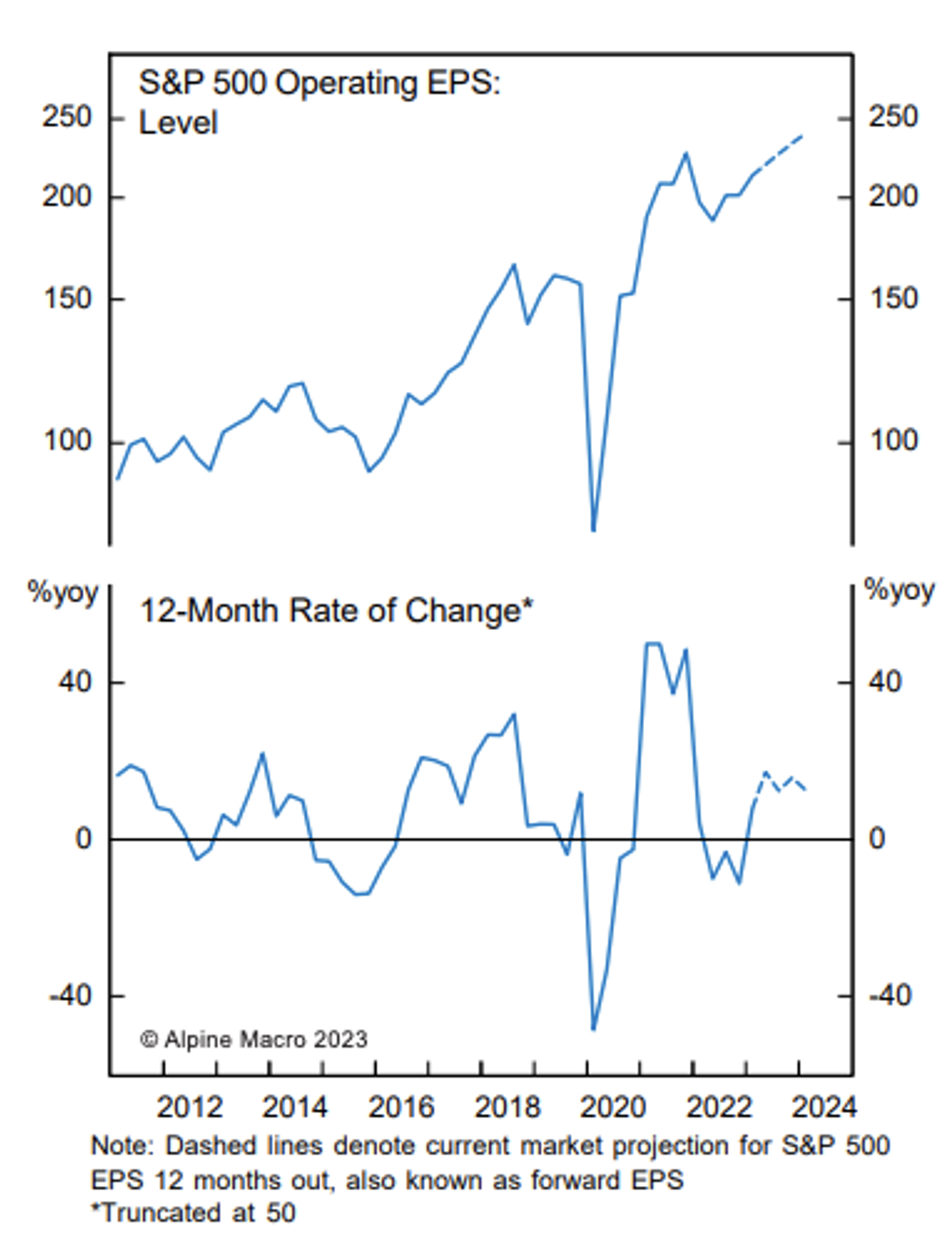

Figure 1. S&P500 Operating earnings appear to have bottomed in Q4 2022

Source: Alpine Macro

The better-than-expected corporate earnings reported for the first quarter in the U.S., may be a function of still elevated levels of inflation, albeit declining. This suggests a transitional period of disinflation and perhaps a very mild recession with continued earnings growth is possible.

The deeply negative U.S. yield curve suggests bond investors currently expect an ongoing slowing in economic growth, and certainly not a resurgence of economic activity and prices. The absence of resurgent inflation and economic activity should remove the risk of a recommencement in rate hikes, which is a positive for equities.