Macquarie analysts issue a warning about the rising debt wave

Analysts at Macquarie Research, Viktor Shvets and Chetan Seth, have just released an excellent piece titled ‘Surfing the debt wave. Don’t look down’. In it, they focus on global debt, wealth inequality, weak productivity growth, the velocity of money and the balance sheets of central banks. For investors, it’s a timely reminder of the big issues facing the world’s main economies.

Let’s look at some of their key points.

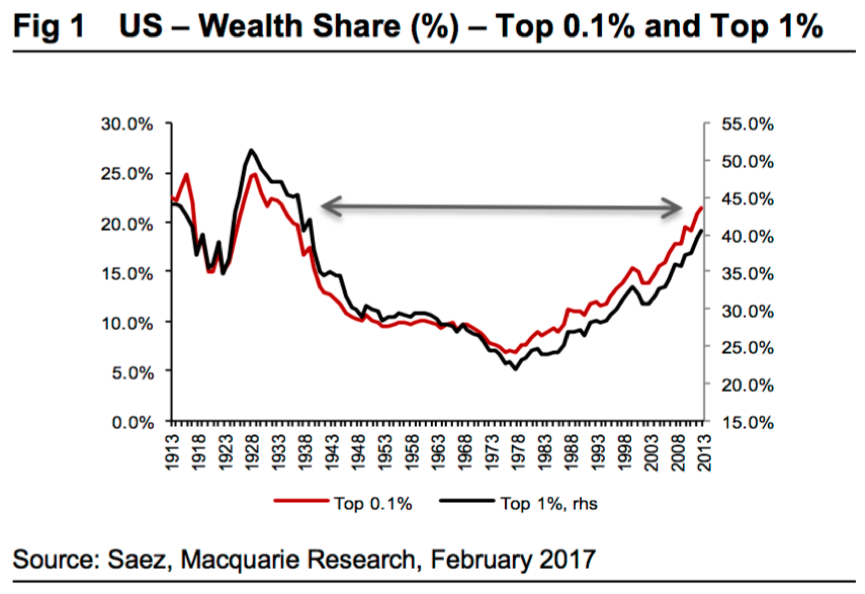

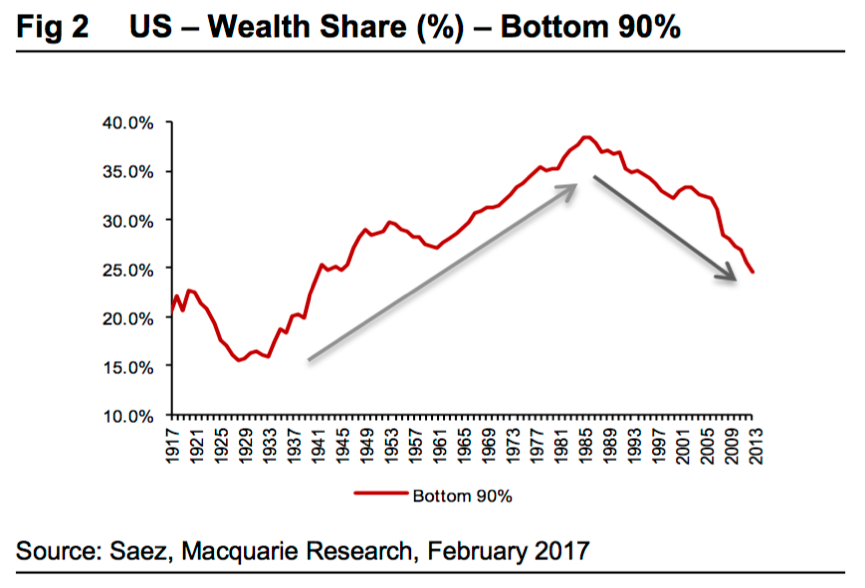

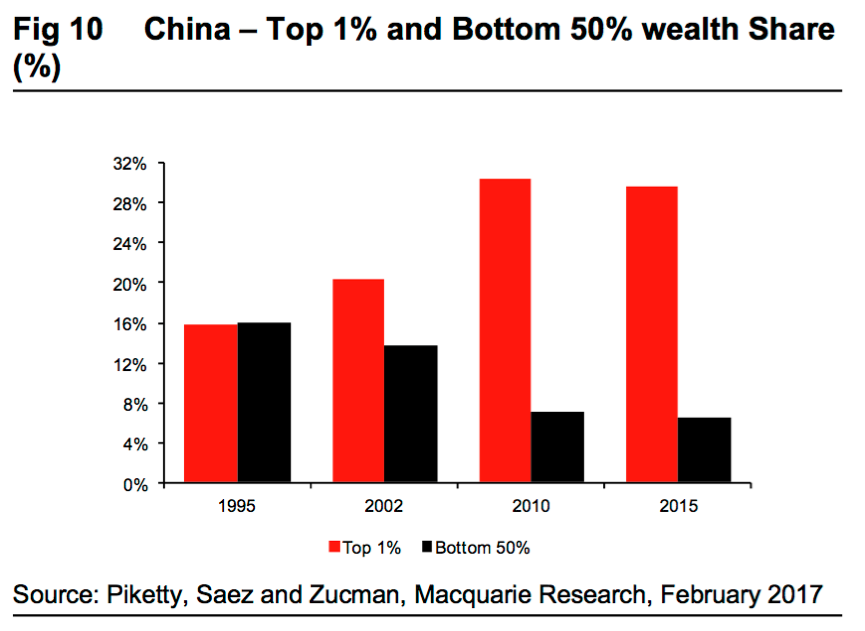

- Wealth inequality has increased over recent decades: blame globalisation and technological improvement.

US: Wealth attributable to the top 1 per cent of the population has doubled from 21% to 41% since the late 1970s. Record high at 50% in 1929. (Note, the top 0.1 per of the population typically accounts for close to 50% of the top 1 per cent of the population).

Wealth attributable to the bottom 90 per cent of the population is down from 38% (1985) to 25%.

China: Wealth attributable to the top 1 per cent of the population has doubled from 16% (1995) to 30% in 2015.

Wealth attributable to the bottom 50 per cent of the population has declined from 16% (1995) to 6% in 2015.

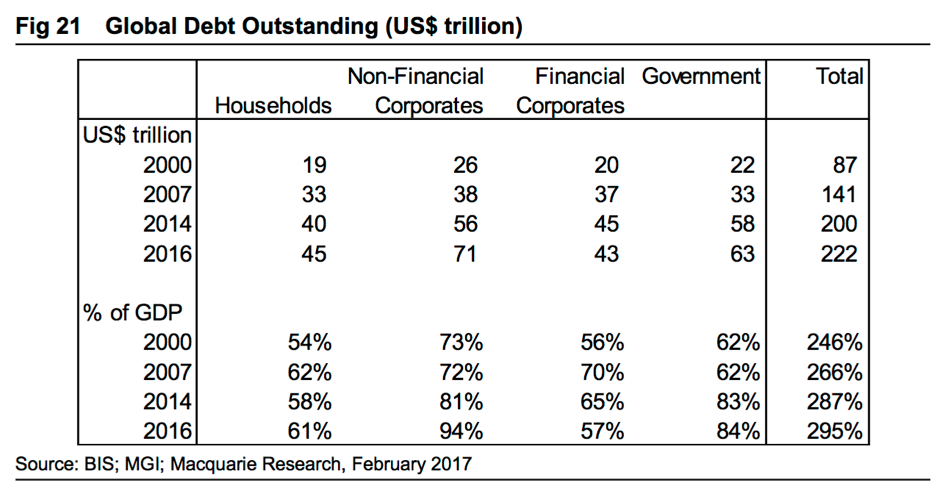

- Global Debt at 300 per cent of Global GDP, and in the US and China it requires $3-$4 of debt to produce $1 of GDP.

Inefficiency of capital allocation can be attributable to the velocity of money, and the record low figures, as measured by GDP/M2, in the US and China generally indicates poor productivity growth and high leverage. While productivity remains low, enhancing aggregate demand generally requires greater leverage.

3A. Case Study 1: US Student Loans

The value of outstanding US student loans has jumped from US$480 billion to US$1,400 billion in the past ten years. This is growth of 11 per cent per annum and represents an average loan for each of the 44 million US students of US$32,000. According to the US Department of Education, 1.2m or 3 per cent of students have defaulted (thus damaging their credit history) while a further 8m-9m or 20 per cent of students have not paid the monthly requirement in over 12 months.

3B. Case Study 2: Central banks trying to bring forward consumption

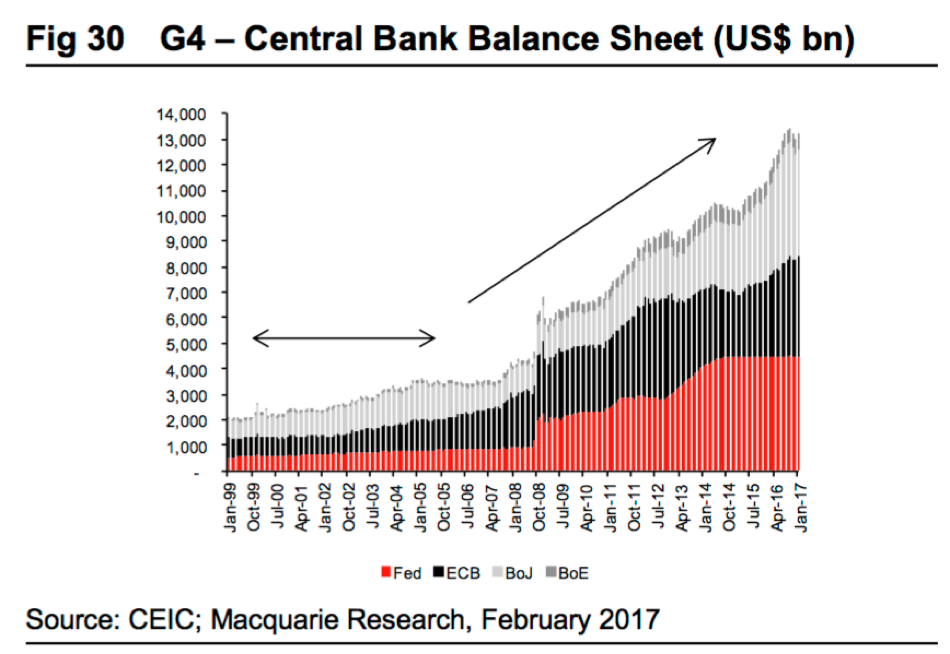

The balance sheet of the G4 (US, UK, Eurozone and Japan) has increased from US$10.4 trillion to US$13.2 trillion (+27%) since October 2014. Relative to the aggregate G4 GDP, this is a jump from 26% to 35%.

hi Roger

speaking of things to worry about …

ISENTIA looks terrible today /will it ever recover from this?

Id say everyone will need to consider cutting losses including yourself?

Im glad I cut my losses at $2.85

rgds

simon

“Wealth inequality has increased over recent decades: blame globalisation and technological improvement.”

blame globalization:

1) The Pareto principle is known since 1896.

2) If there is any deviation from Pareto principle it is because

we have laws which give advantage to one group of people over another.

central bank’s monopoly control of money creation and interest rates

are one such set of laws.

When men decided that “thou shalt not steal” means “thou shalt not steal, except by majority vote,”

To win this battle, we must persuade men that “thou shalt not steal” means this: it is immoral to steal, with or without majority vote.

Gary North

technological improvement :

If You Want Jobs Then Give These Workers Spoons Instead of Shovels

Milton Friedman?

Wow the future looks rosy