They’ve done it again!

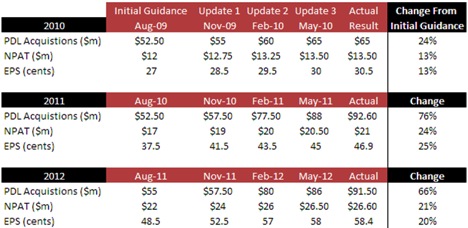

Back in January (you can find our older post here), we produced the following table showing how, since 2010, Credit Corp Group (ASX: CCP) management have generally been conservative when providing initial guidance on the year ahead, and then how they have announced upgrades in a useful, if not predictable, way each November, February and May.

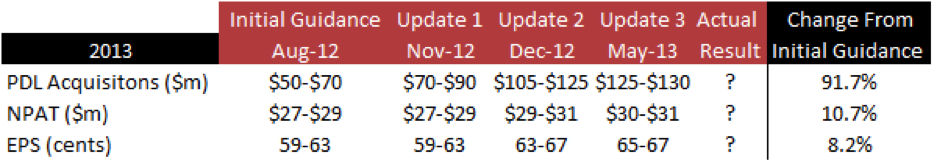

After noting this historical trend, we followed up with the below table which we have the pleasure of updating following the release of CCP’s 16 May 2013 presentation:

The latest update continues the trend of management upgrading both Purchased Debt Ledgers (PDL) and Earnings guidance throughout the year. As a result of the pattern continuing, our views on the business’ prospects remain unchanged, remembering Montgomery Funds hold the shares.

Indeed the strong and rising levels of purchasing during 2011, 2012, and now a record in 2013, should not only continue to contribute to earnings growth in 2013, but also provide confidence that 2014 will also grow.

The May update only lifted the bottom end of the forecast earnings range, however we believe this is a signal that the result could be at the top end of the range and perhaps exceed it, when announced in August.

This would be a fantastic outcome, as our own estimates for net profit after tax of $30m at the start of the year – were well ahead of the consensus estimates at the time. We now forecast NPAT of $32m or higher being reported in 3-4 months. Keep in mind we could be wrong.

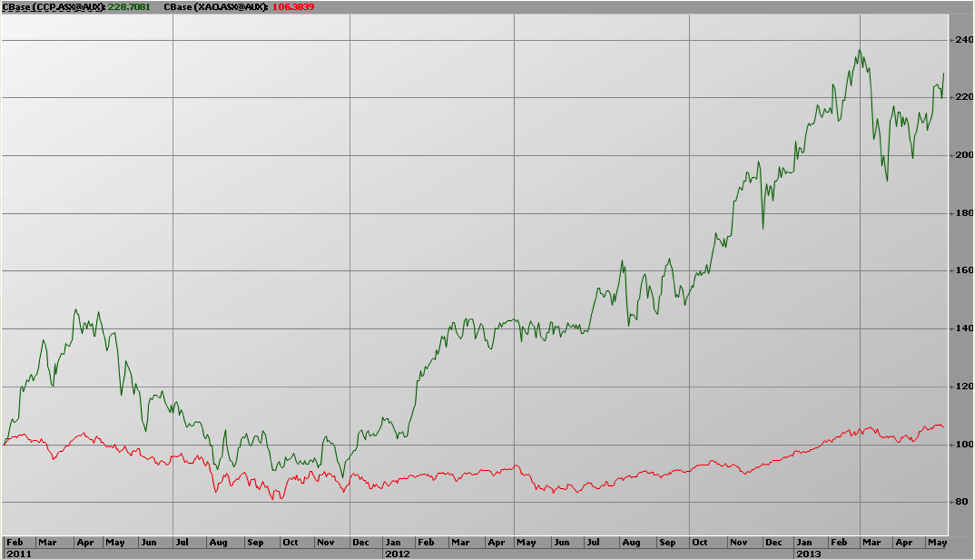

The Montgomery [Private] Fund has held Credit Corp Group Limited, on behalf of its investors and clients, since inception (Dec 2010), and has accumulated a meaningful and material holding since then. Every $100 The Montgomery [Private] Fund invested in CCP has grown to $229. Conversely, an investment in The All Ordinaries Index over the same period has turned the same $100 into $106.

Score a 1 for our investors, and for investing in extraordinary businesses trading at a discount to estimated intrinsic value, and score zero (or 0.06) for the efficient market theory and index tracking.

Excellent returns over such a short time period are encouraging but should never be expected nor projected into the future. Montgomery’s focus continues to be on that future and on finding quality businesses where the market has misjudged their prospects.

Credit Corp Group remains on our quality business list.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thank you, Roger.

I’m sorry, but I didn’t understand your answer.

In your opinion is DCF a useful method to evaluate stocks?

Alex.

Yes it can be but you need to understand its history and usage to understand its limitations, thats why I suggested you need to do some more work…

Hi Roger. I apreciate you book. My question: what do you think about using “Discounted Cash Flow” to calculate stock’s intrinsic value ? Do you incorporate this tool to calculate intrinsic value? Do Software skaffold use “Discounted Cash Flow” to calcule NPV/intrinsic value?

Thank you very much.

Alex Abreu.

Check out the history of DCF and Excess return models!