Credit Corp – Underpromise, Overdeliver

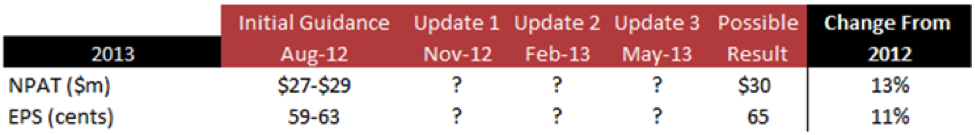

Back in August 2012 when CCP’s share price was falling, following what we considered to be conservative guidance for the full year, internally we prepared the following table:

This is a reproduction of:

• Management’s initial guidance made at the presentation of their full year results,

• Management’s regular updates throughout the year (for CCP, three updates have historically occurred in November, February and May), and then,

• The businesses actual full year results over a three-year period.

When compared in a single table and with the midpoints of the guidance at each date, a clear trend emerges – management have consistently under-promised and over-delivered on their initial guidance figures.

Armed with this knowledge and a large holding in our portfolios, we waited to fill out the below scorecard throughout the year:

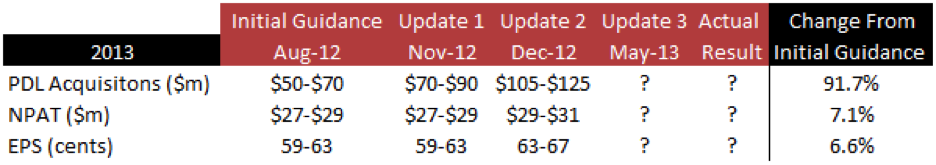

Breaking with tradition slightly, CCP management has already provided two updates for what 2013 may hold. One occurred in November which represented little change. The most recent one in mid-December was an early Christmas present. The above table has been updated as follows:

Back when management made their initial 2013 guidance, they flagged that business conditions were tough – lots of competition and aggressive pricing were making it particularly difficult to deliver a strong purchasing outlook for the coming year.

That being said, we were always of the view that the strong levels of purchasing during 2011 and 2012, along with additional purchased debt ledgers (PDL’s) this financial year of between $80 million-$90m (admittedly versus guidance of $50m-$70m), would continue to contribute to earnings growth in 2013 and produce profits in excess of the 61 cents earnings per share – or a net profit of $28m guided.

Indeed, coupled with 71% of customer accounts already on recurring revenue payment plans and our own modeling, on our estimates they could produce 65 cents in earnings per share, or a net profit after tax of $30m without much additional effort. This ties up with management’s recent guidance perfectly.

If management again produces results that exceed even current company guidance (we still have at least two more updates (upgrades?) for the 2013 financial year to go), we can add archeology to the list of skills required to be a successful investor.

Our new estimate is for the business to produce a result at the top end of the current forecast with the 2014 year being an even bigger and better outcome for shareholders. We will continue updating the table as and when new forecasts come through.

All things being equal, this is a business we plan on holding at Montgomery for some time yet.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Matthew Bell

:

Thanks for the guidance Roger and thankyou very much for my first 10 bagger!

I have been following you for quite some time and this one I bought during the crisis years. Thanks to Skaffold I maintained the faith during the last youple of years of stellar performance. Sold part of my holding and look forward to finding something just as promising when the opportunity arises. I really don’t want to overdo it, but must say you really changed my investing philosophy and will be forever in gratitude.

Roger Montgomery

:

Simply delighted for you! Please feel free to tell everyone about Skaffold!

Matthew Bell

:

What does the team think about the current CCP market valuation? How much overdeliver is being built into the share price? Been a stelllar performer in my portfolio and is now representing a big %. If I sold down I would not know what to put it into. May be a case of a little bit of cash for any market wobbles this year…

Roger Montgomery

:

G’day Matt,

Portfolio management is as important as stock selection in determining your returns. You need to have established rules for how large a position you establish initially and how large you let it become. Those rules may be related to price and intrinsic value or not…

umeshbanga

:

good strategy

Greg McLennan

:

CCP’s guidance for PDL acquisitions this year is a long way ahead of previous years (despite their usual grumbles about competition and pricing). Providing they are maintaining their purchasing discipline and they obtain similar returns from their PDLs as previously, it will auger well for the next couple of years.

It took me a long time to forgive CCP after what happened five years ago, but they have now built an enviable record again.