Looking back but forward

Here is a simple investing rule: share prices will follow a business’ profitability over the long term. In the words of Warren Buffett, “Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value”.

If the market is confident that a business will meaningfully grow its profits in the years ahead, the share price will inevitably rise to reflect that investment’s perceived higher value. Conversely, if the market loses confidence with the sustainability of current profits, then the shares will either tread water or fall, as investors consider the opportunity cost of maintaining an investment.

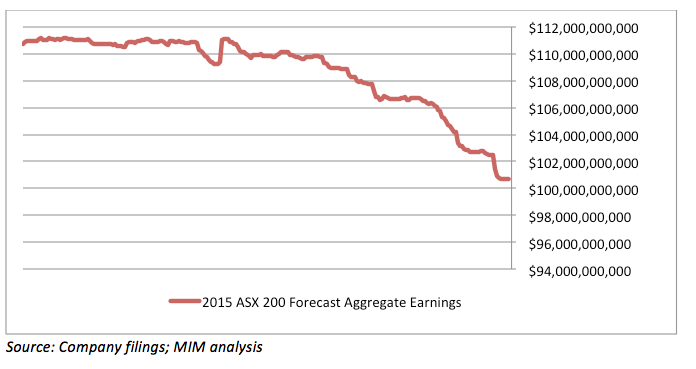

This turns us to the aggregate earnings estimates for the Top 200 companies listed on the Australian Stock Exchange (by market capitalisation). If, over the past twelve months, you have been wondering why overseas markets seem to be posting record highs on a daily basis, while the Australian market has struggled to follow suit, the chart below tells you all you need to know – aggregate earnings for the 2015 fiscal year have steadily been revised lower.

Twelve months ago, consensus estimates for the aggregate 2015 earnings of ASX200 companies totalled $111 billion. Today, the same aggregate estimate sits at $101 billion, some 10 per cent lower.

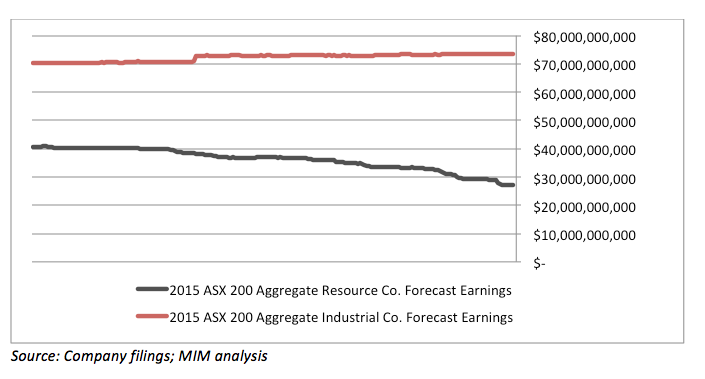

This aggregate revision hides the havoc that extremely weak commodity and energy prices (iron ore, coal, copper, oil, natural gas etc) have had on the earnings of resource companies, which comprise a large share of the index. Twelve months ago, the consensus estimate of aggregate earnings for the energy and resource sectors was $40.8 billion. Today, this figure is $27.2 billion, or 33.3 per cent lower.

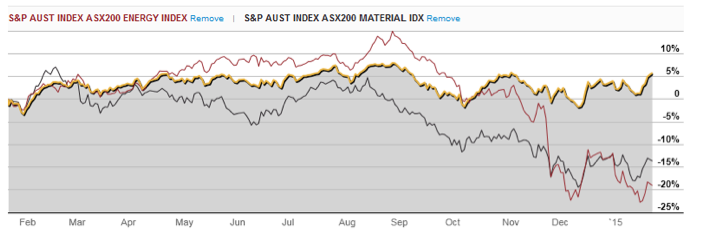

The gradual reduction in forward estimates to energy and resource company earnings has put immense pressure on their stock prices.

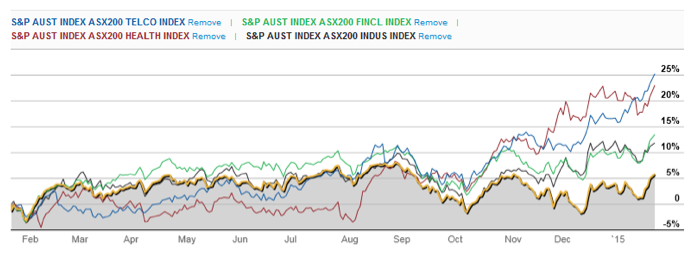

Conversely, the remaining balance of the ASX 200 (loosely classified as Industrials) has actually experienced earnings upgrades in aggregate. Over the same twelve month period, forecasts have increased by 4.5 per cent, from $70.3 billion to $73.5 billion. These earnings revisions, along with the decreasing appetite for resource and energy companies, have spurned share price increases in the healthcare, telecommunications and financials sectors.

Price Follows Earnings is a powerful concept that drives our investment decisions at Montgomery. It is for this reason that the team chose to minimise the funds’ exposures to Energy and Resources at the end of 2012. As evidenced by the considerable time it has taken for the aggregate forecasts to adjust, we consider there is ample scope to outperform over the long run if you employ this philosophy with your portfolio.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

“Here is a simple investing rule: share prices will follow a business’ profitability over the long term.”

I cannot agree more with this statement. I have been doing my research and experiments and have found that this is particularly true, the key part is over the long term. I am yet to find any evidence of fundamental factors really impacting the 1 year return for shareholders.

The factor that seems to have the highest correlation with long term (10 year) shareholder returns is what i call excess return on equity. Not surprised with the excess return on equity result as is it is the key driver of value if you are using an excess return method to value companies.

As for the rest of your interesting post, i think Australia is really suffering from its concentrated economy.

I think you have uncovered another simple investing rule:

“Seek businesses who can deploy large amounts of incremental capital at above average rates of return”.

Yep, thats the one i have followed mostly. I think the key takeawayi have learned over my time is that at the end of the day, investing is best done simply. Don’t overcomplicate matters.