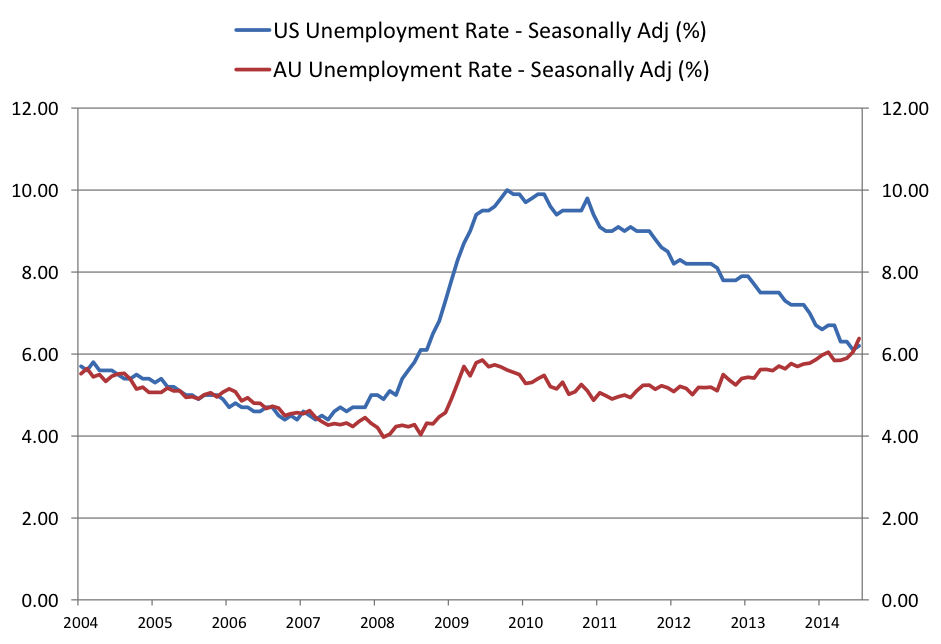

Looking at: the unemployment rate

In July, Australia’s unemployment rate on a seasonally adjusted basis increased to 6.4 per cent, which is above the US unemployment rate. This trend has important implications for the economy and the share market.

(Source: Bureau of Labor Statistics; Australian Bureau of Statistics)

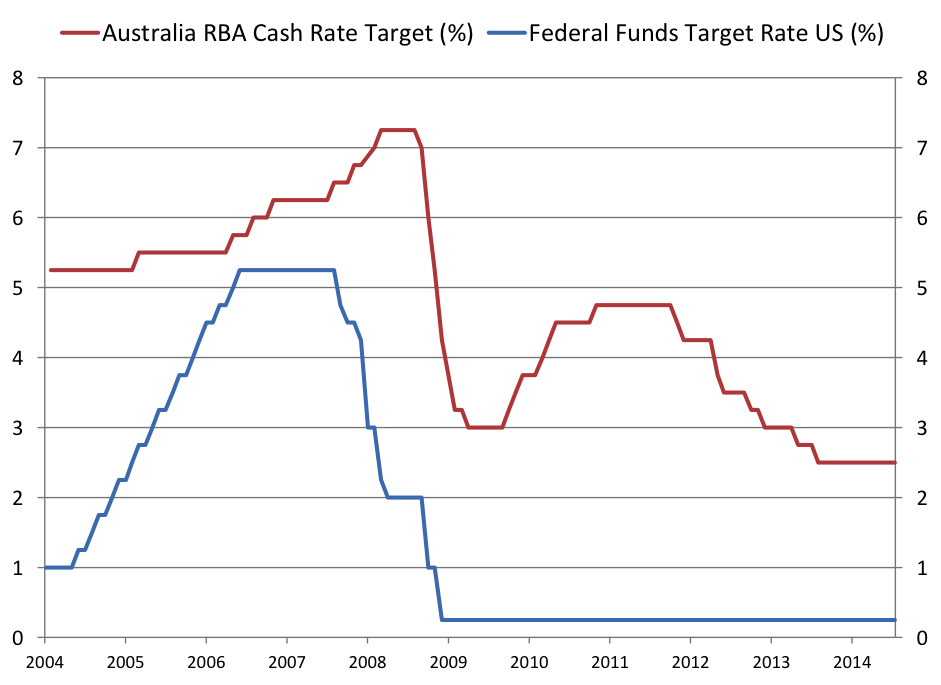

We note the contrast between the US and the Australian unemployment rates in the past five years. Both the Federal Reserve and the Reserve Bank of Australia (RBA) lowered their cash rates considerably during the GFC, yet a favourable mining boom in Australia allowed the RBA to keep more powder in the keg.

(Source: Bloomberg)

While the RBA does not expressly target an unemployment rate like its US counterpart, it is a key consideration with monetary policy decisions. A rising unemployment rate, combined with a Federal Government that has a view to restrict spending, means that the RBA may need to some heavy lifting to stimulate the economy.

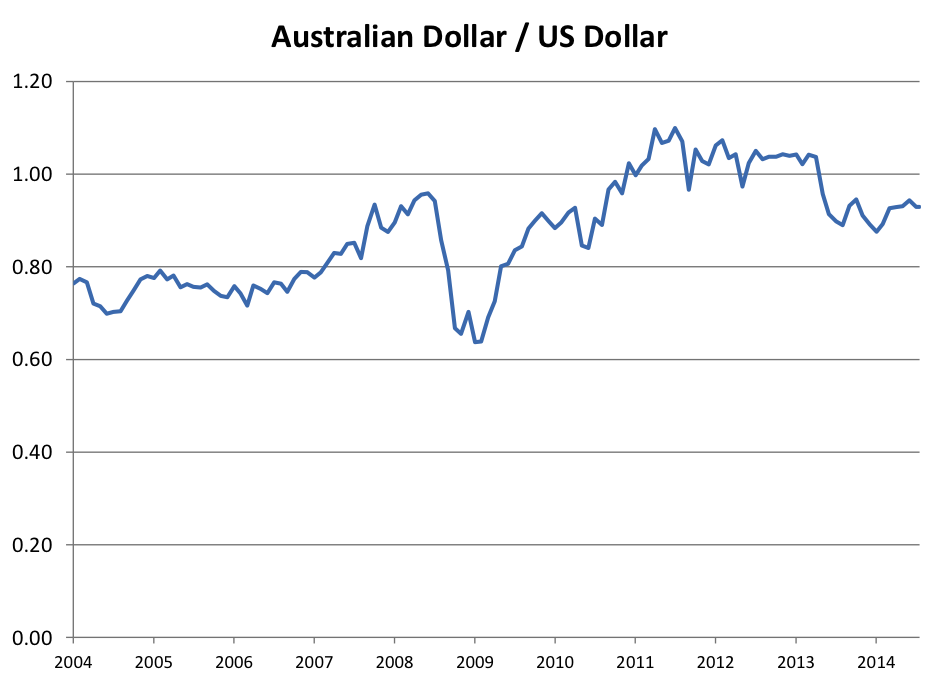

With the cash rate being the primary tool for the RBA to effect change, it seems that interest rates will remain subdued in Australia for a while. If the Federal Reserve increases rates, this may relieve the pressure on the RBA to act, as a falling Australian dollar would encourage exports.

(Source: Bloomberg)

Either way, it does not seem that the next cash rate move by the RBA will be upwards. What is the implication for the share market? If you’re only able to earn about 4 per cent on your money in the bank, you would expect investors to continue pursuing investments that are perceived to offer higher returns.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

jefferey nelson

:

Can the unemployment rate can also be driven by other factors besides economic?

Roger Montgomery

:

That depends only on your definition of ‘economic’. For example if a business owner has two or three businesses and they are competing for his/her time and the decision is made to close two down and make the staff redundant, there is an impact on employment levels and arguably it wasn’t a macro-economic influence but could it be argued it was a micro-economic influence?