Keeping Tabs on Property

Home loan declines accelerated in January, falling 2.1 per cent in the month and 20.6 per cent compared to January 2018. This is the worst year-on-year fall since the GFC and loans are now down almost 25 per cent from their peak. How does this impact the mortgage system growth for the banks?

Economists expected investor loans to decline 1.5 per cent for the month, however they slid 4.1 per cent compared to the previous month and fell 28.6 per cent compared to the same time last year.

Owner occupier loans declined 1.5 per cent for the month and 17.1 per cent for the year. Economists had expected no monthly decline.

Finally, developer loans lifted slightly for the month but are now down 30 per cent year on year.

Obviously, the picture has negative implications for mortgage system growth for the banks. Credit growth is now expected to grow between 1.5 and 2 per cent for the next year or two with a lack of visibility beyond that.

Given this slowdown has little to do with rising interest rates, it cannot be compared to previous declines and so it is difficult to forecast how deep or how wide the current malaise will last. I maintain the long-held view that prices will drop further than many expect with the consequence being a deleveraging or ‘belt-tightening’ by the consumer.

Sydney and Melbourne property could fall between 15 and 20 per cent and individual opportunities to buy at even bigger discounts should be available. In my suburb on Sydney’s North Shore it is widely accepted by owners that a minimum price drop of 20 to 25 per cent from the peak is required to move a property.

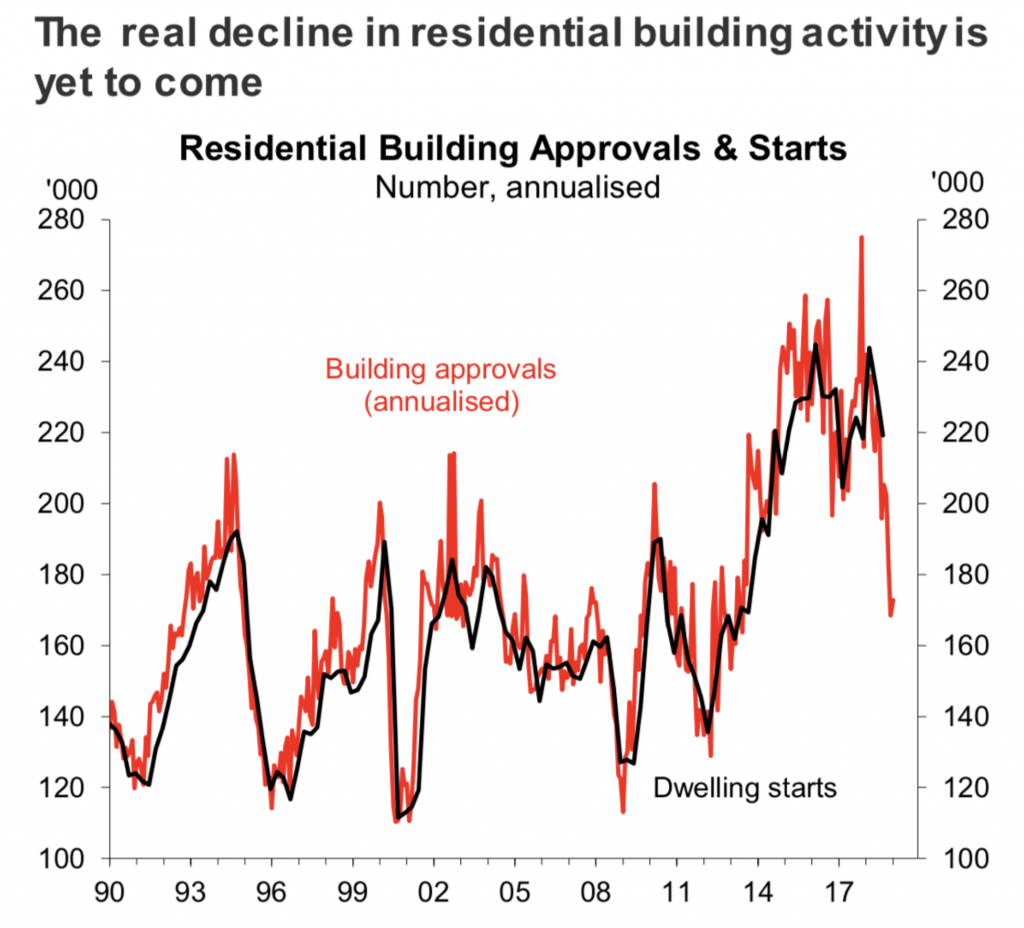

The following chart from Macquarie Research shows the correlation between development approvals and subsequent construction. It is clear that a sharp fall in construction activity is about to impact the building industry with implications for incomes and jobs as well as business confidence.

Source: Macquarie