Joe’s mid year economic and fiscal outlook

Australia is now facing a commodity bust and the outlook is for lower growth and pressure on public finances with the budget deficit for Fiscal 2015 blowing out to $40 billion. Meanwhile, the Australian Dollar has declined from US$1.05 to $0.82 in the past twenty months and a low of US$0.75 is on the cards.

Australia’s terms of trade, the ratio of export prices to import prices, which peaked at 106.4 in the September 2011 quarter declined to 89.5 in the September 2014 quarter, still well above its 55 year average of 60.

Unfortunately, our political leaders did not focus on “drought proofing the farm” during the mining boom and we Australians have started to pay for this in the current financial year with consumer confidence levels now at their lowest point since the Global Financial Crisis, while wages are growing at the lowest rate in 15 years.

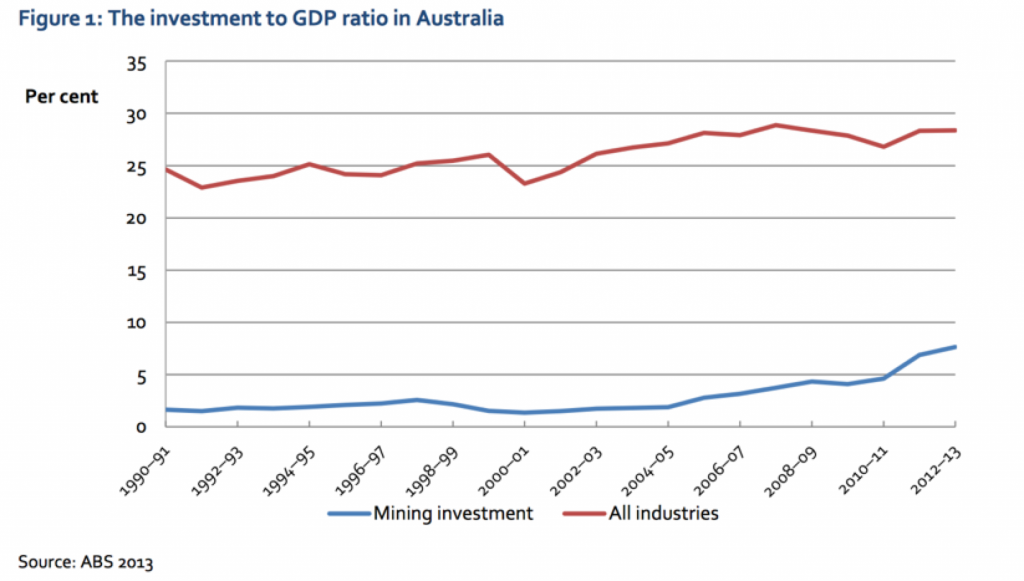

The unprecedented mining-related investment, from sub two percent of GDP to eight percent of GDP over the ten years to 2013, is now in steep reversal and the sharp decline in the iron-ore and oil prices will see many proposed projects deferred. We believe there will be question marks over the credit worthiness of several mostly smaller resource and resource service companies.

An unemployment rate approaching 7 per cent and the Reserve Bank cash rate of 2.0 per cent now seem probable in 2015.