It’s ok to say no

According to today’s Australian Financial Review, “a perfect storm for deal making has Australia on track for a record year of merger and acquisition activity.” In our February blog post RBA lays out welcome mat for takeover mania! Who might be next? we predicted this year’s wave of corporate activity.

Dealogic analysis, commissioned by the AFR in the last few days, reveals $US64.3 billion ($82.8 billion) of deals announced year-to-date, well above the average over the past five years of $US20 billion (excluding COVID-impacted 2020).

The heightened activity, combined with the human desire to belong, can inspire a FOMO (Fear of Missing Out) but each deal must be considered on its merits and not every deal is desirable as I’ll demonstrate here.

One important thing to remember when receiving a takeover offer

A very wealthy and dear friend once advised me; “Roger, you can become rich buying and selling, but you only become wealthy buying and holding.”

When a small handful of extraordinary investments can take a lifetime to assemble, selling one of them has serious consequences. Quite simply, it has to be replaced.

Takeovers are therefore a mixed blessing for investors. On the one hand, there’s a little satisfaction one’s investment thesis was right. On the other hand, a successful takeover means the loss of a great investment and the onerous obligation to find another. Selling means having to work harder to find an investment to replace the one already held, which of course required little or no further work at all.

On extremely rare occasions, when an asset is so extraordinary as to be irreplaceable, there’s an unassailable case for ignoring a takeover proposal. It is at those times I find myself incensed that someone should be so insolent as to try and steal the asset from me.

Australian Unity Healthcare Property Trust v NorthWest

That is the situation I, and some of my friends, now find ourselves in following a bid, by Canada-based NorthWest Healthcare Properties Real Estate Investment Trust (REIT), backed by Singapore’s Sovereign Wealth Fund, GIC, to acquire the assets of the Australian Unity Healthcare Property Trust (AUHPT) for about $2.7 billion.

So how could it be that we would reject a takeover offer that provides an immediate uplift to returns? Invest for enough time and it’s a question you too must answer. Fortunately, putting aside the case against our hospitals falling into foreign hands, the answer, in this case, is simple arithmetic.

First, some background

The western world is ageing, and hence becoming increasingly dependent on non-discretionary healthcare. Consequently, hospital, medical centre and aged care operators are reliable tenants under long-term leases, controlling essential, if not critical social infrastructure that provides property holders with stable and long-term income streams.

And the long-term, stable nature of the tenant/landlord relationship means the reliable, consistent, and sustainable income stream is accompanied by very low volatility.

Hard to find, even harder to replace

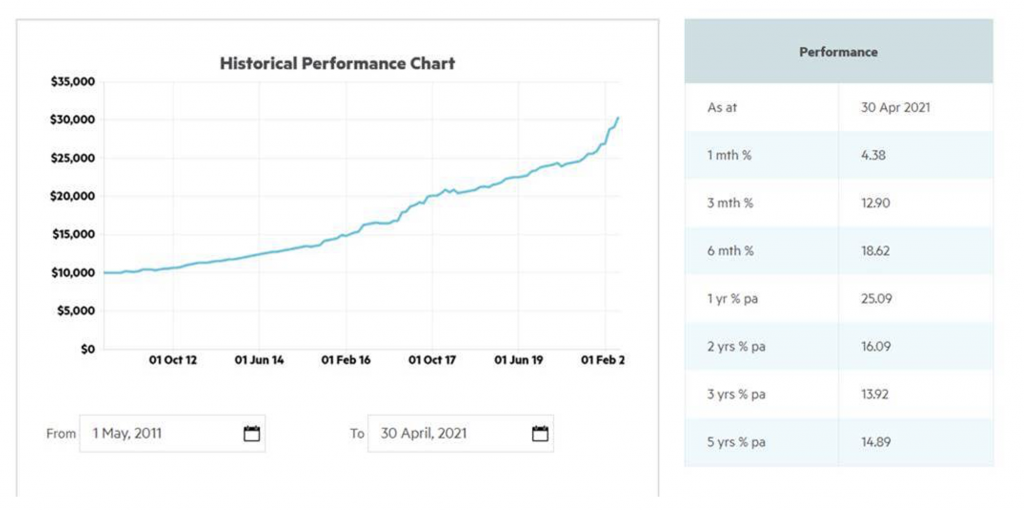

Before you conclude that I must be talking about a boring low-yield investment, look at the history of returns, over the last decade, for wholesale unitholders in the Australian Unity Healthcare Property Trust (Figure 1.).

Figure 1. Performance of Australian Unity Property Healthcare Fund 1/5/2011 to 30/4/2021

Source: AUHPT

If you had invested $100,000 on 1 May 2011 your investment, at 30 April 2021 has tripled – and today would be worth $303,400. That’s 11.7 per cent per annum after all fees and expenses, assuming you reinvested your distributions. It’s a darned sight better than a term deposit (a comparison that should make sense momentarily).

Existing management, under the stable long-term governance structure, has delivered investors a total return of 25.09 per cent over the last twelve months and 14.89 per cent per annum over the past five years.

But notice something even more impressive? There was very little, if any, negative volatility. Even during the outbreak of the COVID-19 pandemic, arguably the most volatile period for many markets in the last thirty years, the trust recorded barely a blip, hence the earlier comparison to term deposits.

High returns with almost zero negative volatility are manna from heaven.

How often do you find defensive assets on long-term leases, generating extraordinary returns, and managed by high calibre people, with deep experience in healthcare and a track record of delivering those solid returns?

The answer is ‘not very’.

Indeed, highly respected fund researchers, Zenith, suggested AUHPT “continues to represent one of the few ways for investors to access this specialist asset class directly.”

And both Zenith, and their equally reputable peers at Lonsec, give their highest possible research rating of Highly Recommended to AUHPT.

No wonder the Canadians and Singaporeans want it.

But don’t let them have it. The fund has been closed to new investment for several years. Even if you wanted to put invest more you can’t. So why sell such a hard-to-get investment?

Of course, NorthWest will make a big song and dance about how attractive their offer is and how lucky you are to receive it. All one has to do is ask; why are they being so ‘generous’? Is their offer so generous they’ll make a low return on their money? Of course not. They know they can generate very attractive returns even after paying you a little more.

Oh, and they’ll keep pestering. But the more they pester, the more they reinforce my point that we’re holding on to something very special. So why sell it to them, ever?

The numbers

NorthWest is offering $2.55 per unit. The current unit price (net of income) is, let’s say, $2.21. Add on roughly 20 cents per unit in 2022 financial year property revaluations, and another 10 cents per unit of income for 2022, and we arrive at a unit price that is just shy of NorthWest’s offer.

In other words, I will have the same amount of money, as NorthWest’s offer, in my hand in 12 months but I will still own the asset and all the income and revaluations that are to come on the existing properties as well as the returns from the pipeline of developments and redevelopments.

Speaking of potential, the weighted average lease expiry (WALE, which measures the average expiry period of all the leases) is 15.7 years. Only 12 per cent of leases will be renewed in the next five years. But some early renewals are already in progress. Early renewals mean higher property revaluations as the capitalisation rate is tightened for the longer lease term.

Some 73 per cent of leases expire in 2030 or beyond. And the established relationships with tenants including Healius Ltd (The former Primary Healthcare) and Ramsay Health Care also provide access to an expanding future pipeline of new healthcare assets.

NorthWest aren’t offering a penny to me for any of that ‘embedded value’, nor are they offering a premium for the wonderful portfolio that has been assembled. And they’re creating more work for me when I must go out and find another replacement investment.

Most importantly, I might not find another one like it. If I accepted NorthWest’s offer of $2.55 and put the money I receive in a bank term deposit, I’d generate income of just nine-tenths of one cent. That’s equivalent to $892.50 on a $100,000 investment, which is nowhere near the $30,000 I estimate I could receive in FY22 from $100,000 invested in the AUHPT today. And then one might also make another $30,000 the year after, and the year after and the year after that.

So, here’s the thing, I don’t want to be offered a premium by NorthWest. I want to keep the asset, enjoy the returns, enjoy my job and my family. And I want NorthWest to help save the planet by not sending me junk mail.

Postscript: For Australian Unity investors who might want liquidity, AUHPT could structure a partnership with an Aussie player to buy those investors out – at a premium of course – while offering a discounted entry to remaining investors as part of another equity raise. A quick chat with a solid ECM adviser can result in an outcome where everyone’s needs are met.

Roger Montgomery owns Australian Unity Healthcare Property Trust units. This article was prepared 09 June 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to invest in the Australian Unity Healthcare Property Trust you should seek personal professional financial advice.

So, what do you make of the potential SOL / MLT merger ?

Roger thank you for your excellent article. I am in total agreement with you and I still remember NorthWest walking away with Generation Healthcare! It is so wrong to sell off Australian Healthcare infrastructure for short term gains.

As a private investor it is necessary to stand up against the big companies. Every NO counts!

That’s the problem, Roger.

Retail shareholders, regardless of just how many can join together and tender their proxies, will never be able to compete with institutional shareholders – most of whom are just after the short term money and not the long term performance; even more so if it is the average CEO of a company who is there for a few years and then gone just as quickly.

So regardless of whether retail shareholders – like myself, others, the average SMSF etc. – don’t want to sell / re-elect the CEO / approve the increase in pay / accept the takeover etc., they don’t really matter in the bigger scheme of things, let’s be honest here. They will get outgunned. Every. Single. Time.

Too many retail shareholders have the footprints of the institutions on their backs, as a result of being caught in the stampede and direction of the market.

This is the reality.

The 10 yr cagr is 12% not 15%.

Good pick up Paul. Corrected now. yep at 15 it would have doubled twice and be $400,000.