It’s Official: Residential Construction is Crashing before our Eyes

We’ve known for some time that the sharp decline in building approvals would lead to an equally sharp decline in construction activity. It has been our view that because building approvals have already fallen from 280,000 dwellings to 170,000 dwellings, a consequent decline in building activity would start to be seen about now.

Our thesis appears to be playing out. A conversation with one of the owners of the largest residential builders just this week has revealed that the slowdown in construction activity has indeed commenced.

While the story is only anecdotal, it is likely to be repeated more broadly. The particular builder we spoke with was previously constructing between 100 and 120 houses per month. The decline they are seeing in their pipeline is now about 50 per cent.

Unless there is a substantial change to conditions, the decline in their forward book will soon translate to much softer activity for this builder. By Christmas “it falls off a cliff”. This builder is still busy building and completing houses that were ordered 12 and 24 months ago, but by the end of the year the firm will need to start laying off staff.

Remember, the construction industry is the third largest employer in the country, employing 9.6 per cent of the workforce. And residential construction is 37 per cent of that figure. That’s 3.5 per cent of the workforce working in an industry that is about to halve. If half lost their jobs, that would result in a substantial increase in the unemployment rate, which currently sits at 5 per cent.

The slowdown must already be affecting other builders and in turn, contractors and tradies. According to my contact, bricklayers just 12 months ago were impossible to find, and they could name their terms. Today the tables have turned, and my source has been flooded with requests for work by tradies. Just 12 months ago bricklayers were being paid $1.80 per brick but today the price has fallen to $1.40 dollar per brick. This is evidence that the crash goes beyond this one builder’s experience.

The Builder further told me that whether interest rates are at 3.9 per cent or 2.9 per cent won’t make any difference to the level of demand for his product. What matters more is the capacity and ability of the banks to lend and to get borrowers ‘over the line’. That means changing lending criteria and loosening conditions.

To that extent, what APRA, the Reserve Bank of Australia and the Council of Financial Regulators do next will make all the difference. If they do nothing, a full collapse in the housing construction industry is almost assured, with obvious flow-on effects to retail spending and retail property vacancy rates. And remember the retail industry is the second largest employer in Australia.

I suspect it’s one reason the RBA elected not to cut interest rates on Tuesday, 7 May, preferring to keep its powder dry for a much bigger cut later in the year when necessary and when it can have a much bigger impact. Presumably house prices will also be slightly lower then and a cut that spurs housing speculation will push prices of the lower base rather than higher one.

Mortgage Stress already elevated

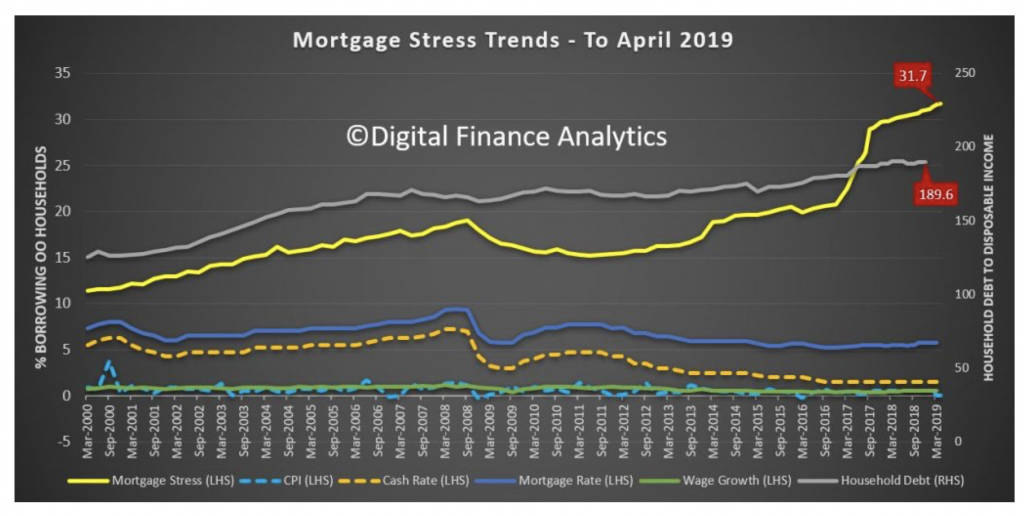

Further, Digital Finance Analytics (DFA) this week released their mortgage stress and default analysis update for April.

A financially ‘stressed’ household cannot cover ongoing costs from net income, but there’s some flexibility in cash flows. Restricting spending, selling assets and refinancing or restructuring debt are all methods by which households might alleviate the stress, however all efforts have second and third order consequences for either property prices or the broader economy.

A household in ‘severe’ stress is unable to meet repayments from current income and are likely to be forced to liquidate assets.

DFA’s data points to continuing, indeed increasing levels of financial stress amid rising living costs (particularly child care, healthcare, education and utilities), elevated levels of debt and a lack of wage growth.

If the aforementioned collapse of the residential construction industry is not mitigated by easing monetary policy and macro-prudential measures, a reasonable assumption would be that financial stress increases further.

According to DFA, a record 1,050,450 Australian households are now estimated to be in mortgage stress, up from 1,044,666 last month. The figure represents almost a third (31.7 per cent) of owner-occupied borrowing households.

It is now the case that more than 30,413 (up from 27,775 in March) of households are in severe stress. This trend was also seen in the recent half year results for Westpac, National Australia Bank and Australia and New Zealand Banking Group, where mortgage arrears (90+ days) rose by 10 basis points to 0.82 per cent, 14 basis points to 0.86 per cent and 14 basis points to 1 per cent respectively.

And finally, it seems the Royal Commission’s spotlight may be unintendedly contributing to the level of household stress.

To help alleviate stress, many households are looking to refinance but our sources confirm that dodgy income and/or expense data, first provided to lenders to secure mortgages in 2014-2017, may prevent many from successfully refinancing now.

While more relaxed lending standards could help new borrowers to put a floor under property prices, the only way out for many existing borrowers may be much lower interest rates or a forced asset sale.

A builder we spoke with was previously constructing between 100 and 120 houses per month. The decline they are seeing in their pipeline is now about 50 per cent. Share on X

David

:

Would you agree with this possible scenario if there’s no material loosening in lending hurdles and/or the property market doesn’t get stimulated by whatever the Govt’s throwing at it?

– less people will be able to buy

– less people will sell or have to sell c/o interest rates

– OTP apartments will get hammered and via media bombardment re: building quality, there won’t be enough takers for new apartments. Instos will buy these apartments in bulk for a hefty discount from cash strapped developers and flood the rental market in the short term. But we are talking about the last batches of supply here because…

– the pipeline of new properties will be down the toilet (already happening now)

– reduction in cash rate/interest rates will facilitate a floor in the property prices…but alone will not lead to price increases. However, if the stockmarket implodes, that might trigger a flight to perceived safety/quality ie property and we’ll have a spike in house prices

– reduction in cash rate will stave off a deep recession, but there will be some pain particularly in the construction industry as you’ve mentioned and the knock-on effects on the broader economy The cash rate may even fall below 0.50 if the banks don’t play ball.

– migrant intake will be ramped up again

– in the medium term ie 2-4 years, rents in the major cities (Sydney included) will increase significantly

Eventually, rising rents and (consequently, house prices) will feed into CPI numbers and the RBA will be forced to get the cash rate off its historical lows.

Roger Montgomery

:

Thanks David. You have described what amounts to a typical cycle. I tend to agree.

Petyer

:

Carlos, We are in this financial mess because for 6-years we have had a particular brand of politics stuffing up the economy. Should we be pleased with the result? The Liberal Communists who want thought control, have not a clue on financial matters and if it was not for Bob Hawke, Australia would be a back-water today. It is not because of the dumb and dumber slogan-carriers without a single positive meaningful thought that the Aus economy is actually breathing. You know the slogan “If Labour offers a good idea – oppose it and claim the credit later in the cycle.” Interestingly, the wealthier voter voted for the proposed tax changes. Only the very poor who will never have anything without government handouts voted en mass for ” don’t change I might be affected”.

Roger Montgomery

:

Thanks Petyer, Fortunately, we live in an autonomous society that allows everyone to have their opinions heard and respected. I am not sure I can agree with your conclusion about who did and didn’t vote for the tax changes. There were plenty of millennials voting to protect their grandparents incomes and their own inheritances.

Christian

:

I love the anecdotal evidence, human aspect is always more interesting than the stats. I personally think we should let interest rates be set by the market, just like we have a floating currency. But I guess that’s far too radical a policy to hope for.

Roger Montgomery

:

what, asking regulators to stop regulating? yes that is quite radical.

ben lebsanft

:

Rodger.

A plumber and drainage contractor,nearby our business was doing 5 homes a day [ new homes for foundation/ drainage work .]

Now doing. 1

Roger Montgomery

:

Thanks for sharing that information Ben.

peter s

:

On a rough estimate from what I can see construction as a proportion of GDP in most developed countries is half of what it is in Australia. You might say we have a much faster growing population but look at where we stand now economically with this ‘turbo charged’ population growth. It is safe to say it is not working ie the result is not a robust economy. The builder in this article says “The decline they are seeing in their pipeline is now about 50 per cent.” That’s about where we should be compared to other developed economies so I would imagine we should stay there. All that is mentioned here is residential construction. What about the other large employers in Australia that rely on construction. Our banks have a ridiculous weighting of 60% mortgages to commercial. How much employment is tied up in that imbalance? It appears to me our economy needs a massive rebalancing and it is hard to see a way to do this without a massive recession. Yet the likes of Monti and Martin North himself do not have this as a base case scenario. I would love to hear how we get out of this given it is not a base case. What would the transition look like without a ‘kick the can down the road’ intervention?

Roger Montgomery

:

It seems what we have learned since 2009 is never underestimate what humans will do to avoid pain Peter.

peter s

:

This is why ultimately I think our currency will have to be the valve to release the pressure. It’s taking a lot longer than I thought though.

Carlos Cobelas

:

and things will only worsen when Bill tax-a-lot Shorten gets voted in and implements his BS policies.

John

:

I need to do some more anecdotal data gathering but I am hearing similar things about a contraction.

‘3.5 per cent of the workforce’ is working in residential construction. This is lower than I would have expected – I wonder how big the ancillary services are?

I wonder if the government of the day might do a building stimulus like Rudd did to provide some work for these builders?

RBA – “preferring to keep its powder dry for a much bigger cut later in the year when necessary and when it can have a much bigger impact.”

If this is the RBA’s strategy they are doing little more than hocus pocus and these tricks only work when you have an attentive audience who are willing to enjoy the show.

Ben Wortley

:

I’m a resedintial building supervisor for large loss insurance repairs. In the past three months I have been flooded with tradesmen desperate for work. I can confirm that brick layers will lay bricks for $1.40. Astonishing when compared to last year when it was difficult to even get a brick layer to a job.

jimbo james

:

A good friend is a gun chippy who has never advertised in his life. Suddenly he’s telling me he’s bought the materials for my next project, despite me telling him I’m at least 12 months away! Hint Hint Jimbo! Earthmovers working Melbourne’s northern fringes have practically ground to a halt, but suggest the outer south west still has a pulse. This conflicts with the chippy’s experiences.

Always appreciate a good anecdote, thanks for the forum Roger and well done again for being so far in front of the econo-sheeple. Afraid to say but if APRA loosens the purse strings it’s effectively just kicking the can.

Roger Montgomery

:

Thanks for sharing that Jimbo!