Is Woolies trading at a discount?

In our continued search for places to deploy capital, we recently reviewed the listed supermarkets and asked: ‘Are supermarkets trading at a discount to intrinsic value?’ After all, since mid-2014, the Wesfarmers (ASX:WES) share price has barely moved, while Woolworths’ (ASX: WOW) has fallen sharply. Our analysis threw up some interesting findings.

Of course, simply looking at share prices (or price to earnings ratios for that matter) is hardly a rigorous analysis. We need to go a little deeper; to do so, let’s review the major trends of each business over the last few years.

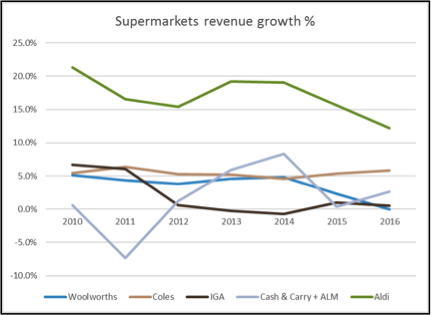

Most of the value for Woolworths Limited is tied up in the supermarket itself (Dan Murphy’s does add some value but we’ll leave that for now). So firstly, we break down revenue growth achieved by each supermarket.

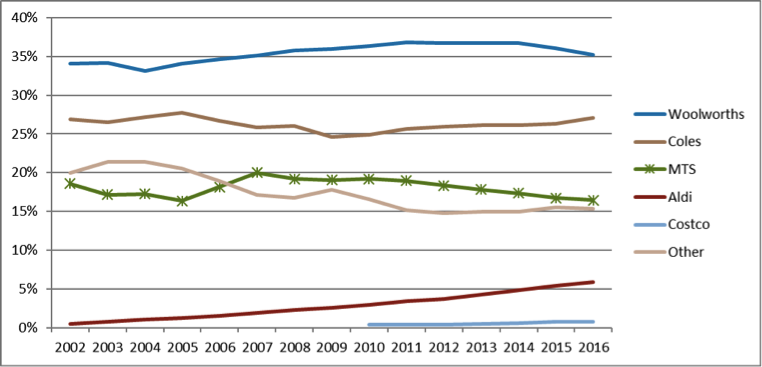

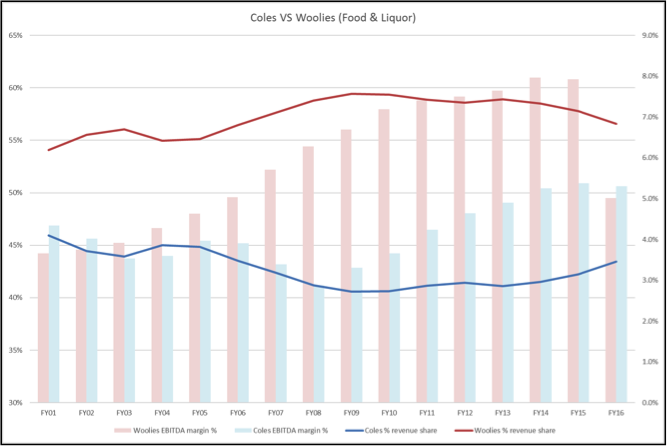

Clearly Aldi and Coles have been growing at a good clip. We also note Woolworths beginning to cede supermarket share since about FY12. Market share statistics compiled by UBS are shown in the chart below.

Supermarkets market share 2002-2016

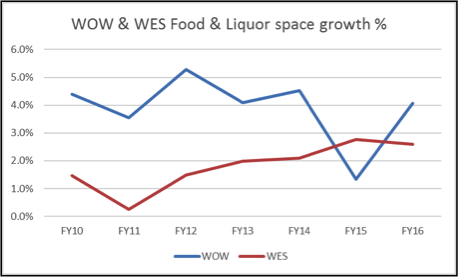

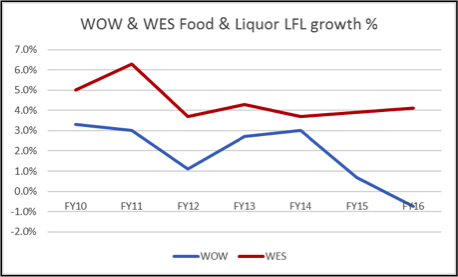

Why was this? Well, over the period of FY12-16, Woolworths had been growing new store space at a high rate (circa 4% p.a), higher than Coles (circa 2% p.a). Hence the driver of this market share loss was low like-for-like (LFL) revenue growth. These trends are shown in the charts below.

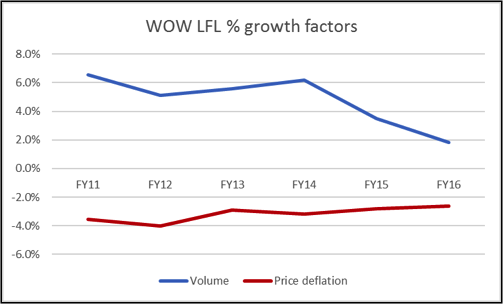

LFL revenue growth is naturally a function of price inflation/deflation and volume growth. A chart showing historical deflation is provided below.

Woolworths price deflation has been abnormally high when compared to Coles since it was trying to close their relative price gaps. Offsetting the price declines in order to achieve LFL revenue growth was growing sales volumes. But, evidently, the volume growth was not sufficient to maintain market share.

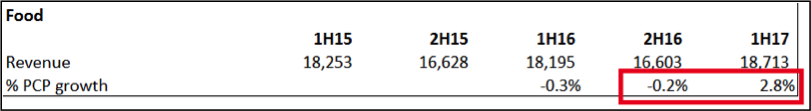

So that was the history up until FY16. If we begin to look at FY17, these negative trends seem to be slowing.

So why is this? Firstly, ‘price investment’ (i.e. discounting) over the past several years is finally having an effect. Coles and Woolworths prices are now roughly similar.

Secondly, market share gains and losses between Woolworths and Coles are cyclical in nature and are based largely on the refurbishment cycle of stores/inventory and price competitiveness (all variables that Woolies has recently been improving). These market share swings can last for several years. This is easily observable in the below chart.

Further, this trend seems to have followed through into 3Q17 with Woolies reporting 5.6% sales growth (comparable sales growth of 4.5%) despite average prices falling 2.5%.

Given all this, we hence expect Woolworths’ revenue growth to be above average for some time as it regains its natural level of market share – benefitting from better prices and a store refurbishment cycle.

We’ll continue our analysis on Woolworths – stay tuned.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Scott, while Woolies is gaining back market share, through over $1billion in price reductions, it’s supermarket margins will never get back to what they were and will track Coles lower margin.

The price war continues and the full effect on higher margin fresh food reductions, is yet to be seen. Increased customer count and average spend in Woolies is currently supported by heavy deep discount 1/2 price promotions, paid for by suppliers, not sustainable longer term. 50% of shoppers chasing deep discount promotions, have no brand loyalty or Supermarket Banner loyalty.

Aldi will soon have full national footprint coverage and will expand & improve it’s fresh foods offer, while Woolies and Coles in particular, move to head off Aldi with Everyday Low Price ranges bigger than Aldi’s range.

Woolies has focused on reducing grocery packaged product prices, but it’s fresh foods offer (quality, presentation, price, out of stocks) has been in decline for years. The Fresh Food People, in my opinion, is certainly not trading at a discount and is simply the beneficiary of many perplexed investors in a low yield/over-valued market.

Hi Rob,

You are very generous to have shared your insights with us. I am pleased we are on the same page by the way.

Anecdotal discussions I have had suggest the marvel super hero disc promotion has been very popular. If this is true it will produce a jump in sales and increased market share over the short term. The danger for investors is reading the change as a trend rather than unique to the promotion.