Murray Goulburn shows what can happen if management is not shareholder oriented

When we assess whether or not to invest in a company, we ask: is it an extraordinary business, is management shareholder oriented, and is it trading at an attractive price. The recent announcement by Murray Goulburn (ASX:MGC) shows the downside when management is not shareholder oriented.

In a post we wrote on Murray Goulburn in June 2016, we looked at the quality of a company in the context of the profit warning the company had released earlier in that month. In the post, we focused on whether Murray Goulburn’s management is shareholder oriented.

Management being shareholder oriented refers to the way they are remunerated as well as their focus on reinvesting capital, either organically or through acquisitions, to add shareholder value. A shareholder oriented management and board are very important in ensuring that shareholders are rewarded for the risk capital invested in the business.

In the case of Murray Goulburn, the shareholding is split between supplier shareholders and the listed unit holders. While a share of either class is entitled to an equal proportion of the economic benefits generated by the company, only the supplier shareholders have voting rights. Additionally, supplier shareholders receive the bulk of their return from the milk supply payments rather than dividends from the company, the value of which is determined by the profitability of the company in that it determines the farm gate milk price.

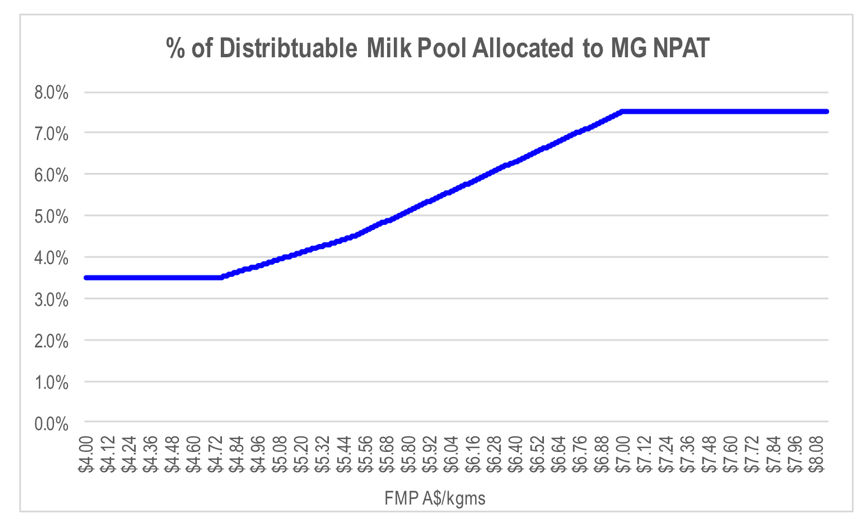

The proportion of the operating profit that goes to unit holders and shareholders depends on the operating profit generated by the company before supplier payments per unit of volume supplied (kilograms of milk solids). The chart below sets out the share of operating profit that goes to unit holders and shareholders as a function of the unit milk price received by the suppliers for their milk. On the surface this seems to be a good deal for unit holders as suppliers share in the profit upside as milk prices increase as well as the downside as they fall. In theory, the company’s net profit cannot fall below zero given it is extremely unlikely that the value of the distributable milk pool will be below zero.

On the surface this seems to be a good deal for unit holders as suppliers share in the profit upside as milk prices increase as well as the downside as they fall. In theory, the company’s net profit cannot fall below zero given it is extremely unlikely that the value of the distributable milk pool will be below zero.

However, supplier shareholders receive a disproportionally large share of any return generated on investment by the company because the increase in profitability generated by the investment also leads to higher supplier payments. This is despite supplier shareholders only contributing capital in line with their proportional shareholding.

The protection of unit holders from losses through the distributable milk pool allocation formula provides an offsetting reduction in risk for unit holders, offsetting the disproportional share of any upside that went to supplier shareholders.

However, this all changed in the middle of last year when Murray Goulburn decided that it would provide loans to top up supplier payments due to the fall in the estimated milk farmgate milk price late in the financial year. These payments were capitalised on the balance sheet as a receivable and did not impact the reported FY16 net profit as Murray Goulburn expected to recoup the payments over the following 3 years through lower supplier prices.

While this sounded reasonable, the loan repayments could be avoided by a supplier if it stopped supplying MG from FY17 and instead sold its milk to another dairy. We highlighted this as a likely outcome in our post last June.

Rolling forward almost a year and Murray Goulburn has announced a complete review of its asset footprint and restructuring. MG was losing a material amount of its milk supply. As a result, it has decided to forgive the debts it was owed by suppliers, writing off A$148m of receivables on its balance sheet. Additionally, the company has determined that it also needs to pay suppliers a higher price for their milk in FY17 than what would have been determined by the profitability of the company. This transfers up to a further A$30m from unit and shareholders to suppliers. But because shareholders are the suppliers, effectively this money comes from the unit holders.

Additionally, MG intends to close three of its dairies to reduce costs. These closures will cost shareholders A$60m to implement. It will also write off A$62m of capital investment from previous periods. These costs are all worn by share and unit holders. However the estimated A$40-50m a year of savings from the closures and restructuring will be shared by shareholders, unit holders and suppliers through a higher farmgate milk price.

Not surprisingly, the board is unanimously in favour given that only milk suppliers can vote for them, and 8 of the 12 directors are dairy farmers.

Ensuring that the interests and incentivisation of management and board decision making are aligned with the interests of your investment is critical in order to have confidence in your investment. When this is not the case, the risk attached to any investment is made significantly higher.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Scott W

:

Murray Goulburn should never have become a part listed entity. The business as a co op was a bedrock of many rural communities and made a potentially fatal mistake of appointing a man with no understanding or regard for the Dairy Farmers as the CEO, and he turned that business into a typical corporate animal with the commensurate waste, such as moving from a humble complex in Brunswick to a super expensive headquarters at Freshwater Place to satisfy his ego etc. In China the Devondale brand was formerly a stunning example of premium being paid for Australian Quality and the arrival of the Ego brigade has reduced the brand’s premium and allowed it to become a traders favourite without full control of their supply chain. Desperate moves made to satisfy the promises made to the market lead to disaster and that being the destruction of a great business that has supported generations of Aussies in rural communities and I dare not think of the number of farmers who might have taken their own lives because of the chain of event create by appointing the wrong CEO. It’s a disgrace. But also a warning of letting the finance sector near your business, and the risk of letting in the global market. The upside of Global markets run at odds with the companies selling into them more often than not and although Aussies enjoy cheap white milk due to our foreign managed supermarkets holding a gun to the heads of the Dairy Farmers, the price of Gas is a stark contrast to the supposed benefit of free market pricing. Aussies are generally the small naive player being eaten alive by Global Finance Players rent seeking against our national interest.

Alan Hartstein

:

Roger, did you even look at the clip?

You expect me to feel sorry for shareholders trying to make money off this disgusting industry and company?

The world will have to wake up one day to the whole profiting from misery and suffering thing, one day. Watch the clip and then comment. Oh, and %*#k the shareholders too!!!

Roger Montgomery

:

Thanks Alan for sharing your outrage. I have friends who are dairy farmers and I can assure their treatment of animals looks nothing like another clip Patrick submitted which I deleted and which was of one single farmer in the US that PETA quite rightly exposed. To extrapolate that one farmer’s behaviour and tar all dairy farmers with the same brush is common and frequent but unfair. The concern should be about the impact of the move from small family enterprises (many if not most of those operators genuinely love their animals) to large commercial operations owned by absent city investors. Please refrain from the use of expletives. Young investors read this blog too.

Alan Hartstein

:

Wow Patrick – I was literally in the process of posting the same clip! I could not possibly agree more, which is exactly why I’d never ‘invest’ in a disgusting company like the one in this article.

Roger Montgomery

:

As the article explains we are equally disgusted when shareholders are not treated as owners.

Patrick Murphy

:

The dairy industry is a disgrace.

Dairy needs to be more closely scrutinised.

Start your investigations here:

DAIRY IS SCARY! The industry explained in 5 minutes

https://youtu.be/UcN7SGGoCNI