Is Vocus worth $6.10?

Vocus worth $6.10?

On Tuesday, we reported on the exciting future for Vocus Communications (ASX: VOC) after their AU$107.7m acquisition of New Zealand’s largest ducted inter-city fibre optic network operator, FX Networks.

We’d like to take that note further and put some numbers around the deal in combination with Vocus’ existing business, to derive a rough estimate of what we think the business could be worth today.

As a starting point, are our base expectations for Vocus before FX Networks. To this we must add the financials and forecasts of FX Networks.

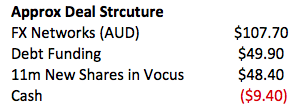

FX Networks will cost Vocus AU$107.7m, of which approximately $50m will be funded by debt, with the balance coming from ~$50 new equity and ~$10m cash.

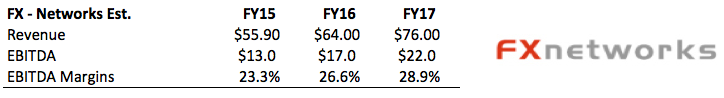

For this consideration, FX Networks will immediately deliver AU$55.9m in revenue, and $13m EBITDA, annualised on top of which we estimate there to be $2-3m in integration benefits. These will come from things like more efficient resource allocation and interest expense savings as Vocus’ balance sheet and scale provides access to lower funding costs.

Longer-term, the command and control structure that has worked brilliantly for Vocus will be implemented; the fibre network will be worked much harder and leveraged right across the board. This will include cross-selling additional products such as cloud services, significantly improving existing margins. We therefore estimate the below revenue:

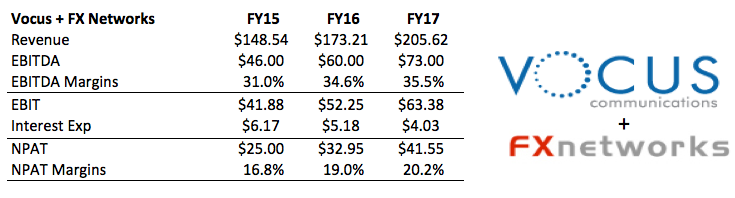

If we combine the two businesses, assuming they were operating together for the full 2014 financial year (thus experiencing lower funding costs), we expect the next few years to develop similar to our workings below. Note: we have not included any additional data-centre acquisitions.

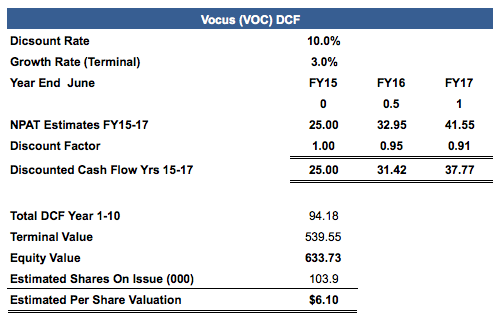

In order to compare our estimate of valuation to that of the prevailing market price, the question now becomes: what is the combined group worth today? For simplicity, a discounted cash flow of the period FY15 through to FY17 produces $6.10.

The Montgomery [Private] Fund owns shares in Vocus Communications Limited.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

On the 11th July after market close, Vocus disclosed the following:

Vocus Communications Limited (ASX: VOC) is pleased to announce the renewal of the contract with its largest IP Transit customer Vodafone New Zealand Limited. The contract renewal is for a period of 24 months at a fixed price in line with the market. Under the contract, Vocus supplies international Internet capacity to Vodafone New Zealand. The difference between the Vodafone contract in FY14 vs FY15 is an estimated reduction of A$4.5m

in EBITDA for FY15.

Despite the reduced contribution from Vodafone, Vocus continues to expect very strong EBITDA growth for FY15.

From FY15 no customer will account for more than 5% of the company’s revenue.

The following monday Vocus shares were marked down by almost 10% and have not recovered since. The question is: Does the reduced contribution from Vodafone NZ point to a sign of things to come for Vocus? Is the market completely wrong?