Is there hidden upside in Carsales?

Carsales.com (ASX:CAR) has enjoyed a strong run since floating in 2009 at $3.50 per share and it’s a business we’ve held in high regard for some time.

CAR’s dominant position in the capital-light domestic automotive classifieds business has considerable appeal, and the company has leveraged this position into the development of adjacent businesses which are showing good growth.

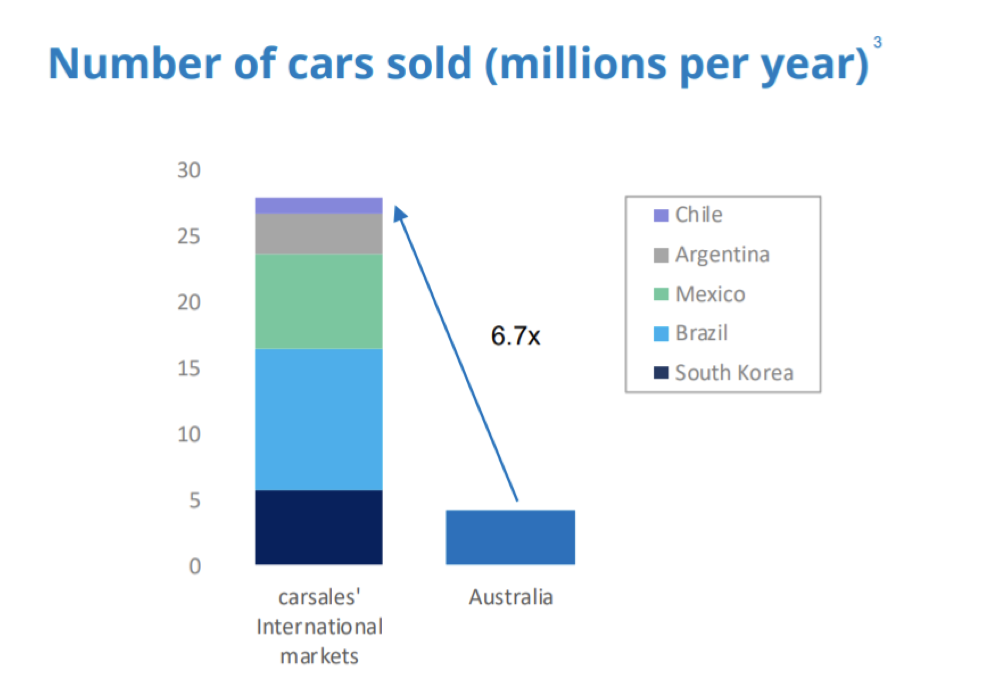

Another interesting dimension to CAR is its international portfolio. Over the years CAR has acquired leading positions in a number of automotive classifieds businesses in Asia and Latin America. These assets currently generate a tiny percentage of CAR’s earnings, but their medium-term potential is interesting. In its recent annual results presentation, CAR made the point that these businesses provide exposure to a far larger pool of GDP and total car sales than its Australian business, as shown below.

This observation stands in contrast to the modest earnings currently generated by these businesses, and the relatively modest future earnings and value that appears to be factored into many analyst reports. So, is CAR drawing an unduly long bow in making the above comparison?

A closer look at CAR’s Korean business, SK Encar, can perhaps shed some light on this. CAR bought its 49.9% shareholding in the online assets of SK Encar, South Korea’s leading automotive trading business in 2014, and the first obvious point to make is that CAR is entitled to only around 50% of the value, and doesn’t have control. And any comparison with the Australian business needs to take this into account; nonetheless, total revenue for the entire SK Encar online business is a small fraction of that of CAR’s domestic business. The obvious question is why that should be.

South Korea is no slouch in terms of internet penetration and speed, nor is it off the pace in terms of adoption of mobile technology or the development of online retail markets. There is nothing to suggest that the country is “behind” Australia in terms of the development of internet things generally, so why is SK Encar so light in terms of revenues?

The answer seems to lie partly in adoption by car dealers, and partly in its pricing model. Whereas CAR has developed a sophisticated pricing model that charges by listing or lead in Australia, the Korean business appears to have developed very much as a subscription model. Because of this, one suspects that the Korean business is currently able to capture only a relatively small proportion of the value it generates for users.

The solution to this seems like it ought to be very achievable. To summarise CAR’s position in South Korea, most of the critical bits of the puzzle are nicely in place:

- #1 market position: check

- Large existing market: check

- Technology savvy audience: check

- Pricing model and dealer uptake: work in progress

On the face of it there doesn’t seem to be much standing in the way of SK Encar becoming a much larger and more profitable business over time. However, that question of time is probably an important one. For one thing, recall that CAR doesn’t have control over the business, but rather its partner, SK C&C does.

Importantly, we should also note that SK C&C has other business interests, including car dealerships. It is effectively a customer of the SK Encar online business, and one can imagine that unduly rapid price changes might be difficult to implement.

Given time, however, it seems reasonable to think that this business should move closer to the Australian model in terms of capturing the value it delivers, and this appears to already be happening. SK Encar earnings are growing rapidly, albeit off a low base.

As they say in the classics, it won’t happen overnight, but if the success of CAR’s Australian business can be partially replicated in Asia and Latin America, the company may well have an impressive growth runway ahead of it.

The Montgomery Fund owns shares in Carsales.com