Is the US too expensive?

With headlines booming across the newswires such as “U.S. Retakes Helm of Global Economy” citing the US economy is on the up, the US market has soared as share prices – on average – have baked-in a clear road ahead for listed businesses and their earnings prospects.

But just to what extent?

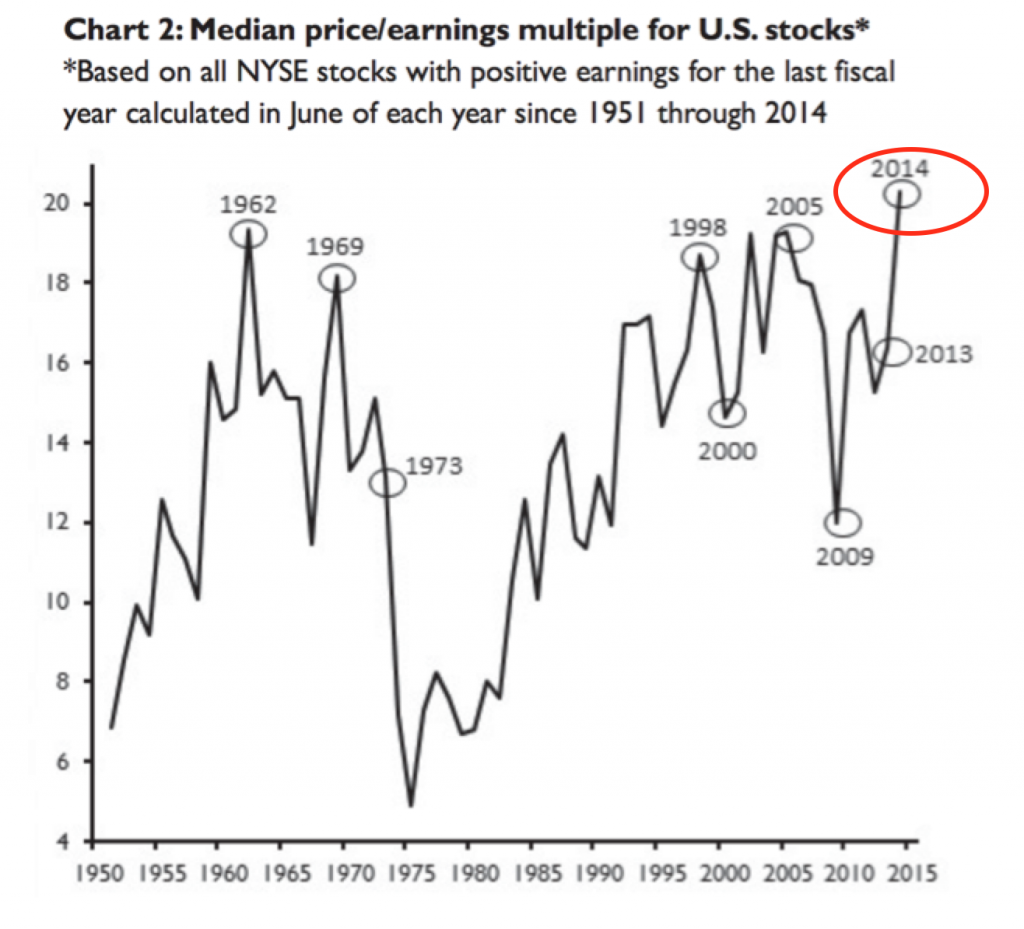

Well, according to a report just published by Wells Capital, based on all NYSE stocks with positive earnings for the last fiscal year calculated in June of each year since 1951 through 2014, using the median price-to-earnings ratio, the US stock market has never been this expensive.

As shown below, over 64 years of history, at the current 20x earnings the US market has eclipsed 1962, 1969, 1998 and 2005 prior peaks to represent the most expensive it has ever been.

A similar story evolves when earnings are substituted for cash flow, arguably a better measure of profitability than earnings.

What we find interesting is that previous valuation extremes, have generally coincided with turning points in the market, with many periods followed by significant declines as highlighted in the charts above.

What we find interesting is that previous valuation extremes, have generally coincided with turning points in the market, with many periods followed by significant declines as highlighted in the charts above.

But rather than suggesting that a correction is coming – we have no ability to be able to predict share price movement’s en-masse – what investors in the US may find is that generally the market may struggle from here to match the returns from previous years.

Instead, what we read from this is that unless the US economy faces a left field event and a shock to its economy, then a period of consolidation and a lower return environment may be forthcoming as investors simply will have to now wait for earnings to catch up until those generally excessive prices again look more attractive.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, found out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Cannot agree more. I was going through Skaffold yesterday and noticed a few companies that satisfied all ‘BUY’ parameters. Unfortunately, they are too expensive.

I need to leave a reasonable amount in cash in my SMSF account, so can’t buy any US stocks at the moment.

If history repeats, I will be going on a shopping trip.