Is the housing market causing trouble for realestate.com?

Investors could be forgiven for feeling slightly anxious on the back of the news coming out of Australia’s real estate market.

First the revelations on dubious real estate financing based on research by Bronte Capital, then reports of large falls in apartment prices in Melbourne and to top it off, reports from McGrath Limited (ASX: MEA) of listing volumes declining by circa 25 per cent in certain areas of Sydney. Montgomery’s portfolios have no direct exposure to any of these particular events however it does raise questions about the prospects for REA Group Limited (ASX: REA).

To analyse this, let’s return to first principles. REA’s revenues are primarily driven by the sales of premiere/highlight listings on the realestate.com.au website; we can hence use data which records listing volumes as a proxy for where said revenues are headed.

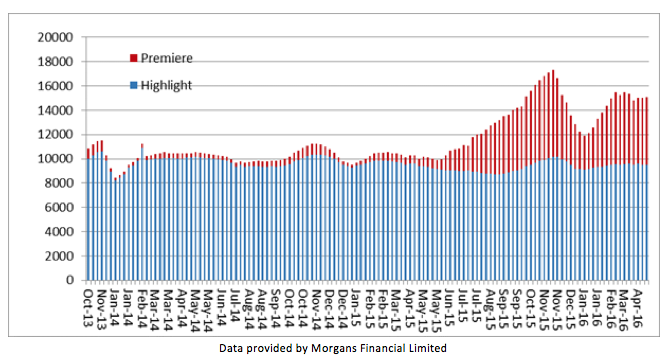

So let’s look at the data, nationwide listings are down since the end of December as per the seasonal trend. However on a year-on-year basis, considerable growth is easily observed.

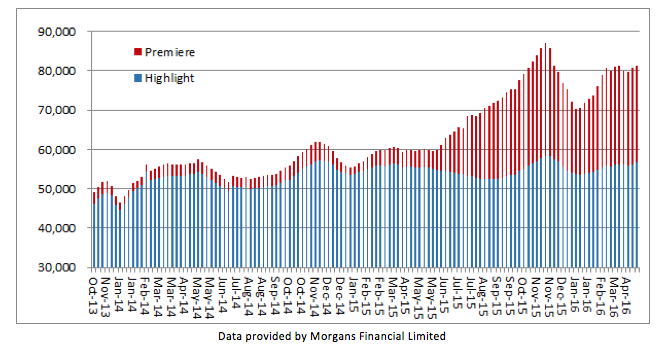

Now the above events were largely concerning NSW, so let’s segment the data down to focus on NSW.

Overall the seasonal trend, evident by year-on-year growth, is considerable.

Both of these studies are of course high level and don’t take into account more specific geographies. However since REA’s revenues are a function of the aggregate of listing volumes as opposed to specific postcodes, the studies are largely adequate. We can conclude that there appears to be no issue (at least for the moment).

It’s further worth consideration that in a market where listings volumes in the market have been under pressure, REA’s revenues have grown more than 50 per cent on the back of price increases and changes in the volume of premier ads (i.e. mix shift). This resilience as a function of pricing power is notably an attractive quality to us as investors.

The Montgomery Private Fund, The Montgomery Fund, the Montgomery Global Fund and Montaka each hold a position in REA Group Limited.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY