Is the early release of superannuation a good idea?

One of the actions announced by the government to stimulate the economy as a response to the current crisis is that individuals can apply for an early release of superannuation savings. The rules are that an individual can apply to withdraw $10,000 before the 30 June and another $10,000 between the beginning of July and the end of September.

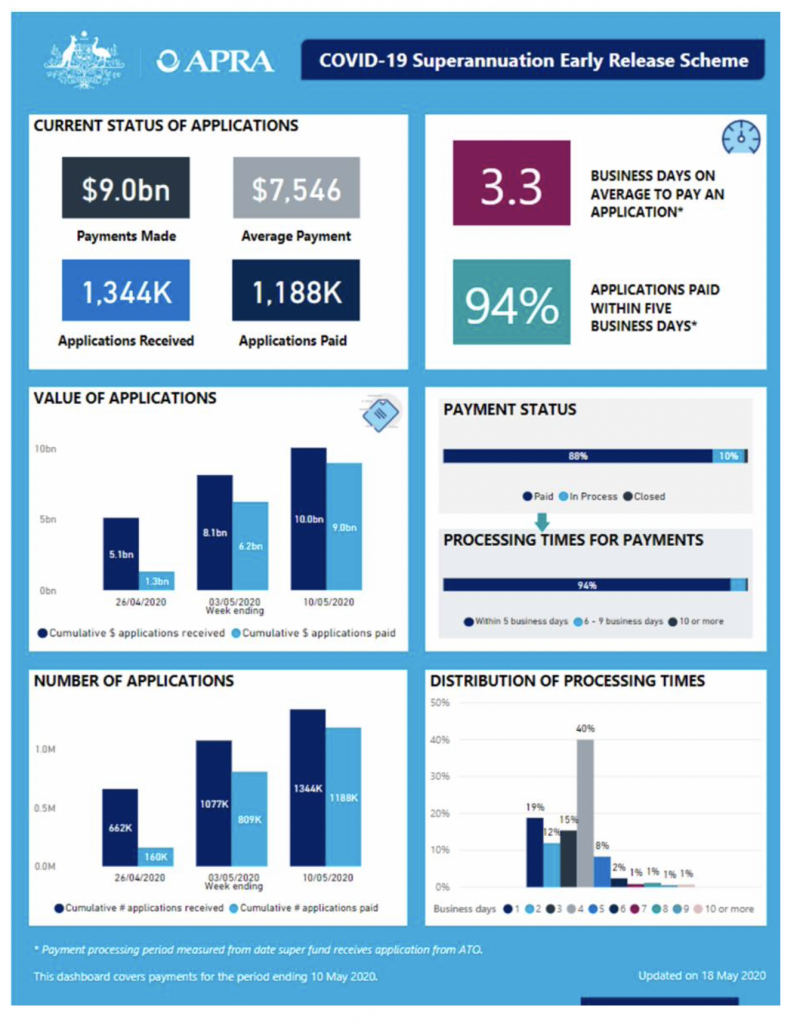

On 18 May, APRA released updated stats on the current state of withdrawals (up until 10 May), and I thought it would be interesting to have a look at the data.

In total, $9.0 billion has been withdrawn spread across 1.19 million applications. There is a slight lag (not very long at 3.3 days on average) between the payments being made and applications being received, and the total amount of applications is for $10.0 billion spread across 1.34 million applicants meaning that the average withdrawal application is just under $7500.

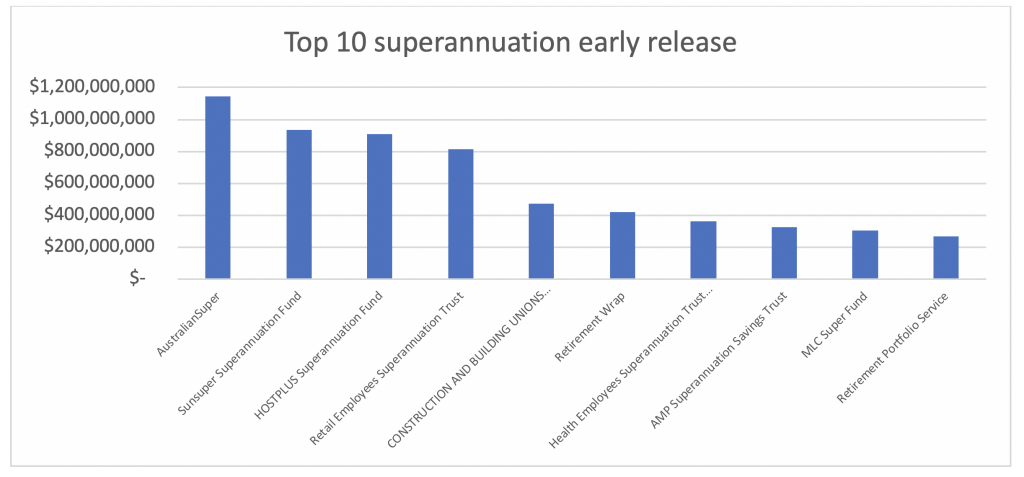

If we look at which funds had the largest withdrawals, it should probably come as no surprise that it is primarily the industry funds that are top of the list as their members working in retail, food and accommodation are the ones hit the hardest by the lockdowns, but it is also interesting to see that there are significant outflows from the Health Employees Superannuation Trust which I would not have expected:

Given that we are still 1.5 months away from 30 June and people will be able to withdraw another $10,000 in the following quarter, we should expect the current figure of $10 billion to increase quite substantially. In the December quarter of 2019, the inflow to superfunds in total was around $30 billion and the total superannuation system balance is around $3 trillion, this might not seem like much to worry over as the total withdrawals is probably likely to amount to around one quarter of inflows. This might be an overly simplistic way to look at it as the withdrawals over time will have both short and long-term consequences, both for the people withdrawing and for the people who are not. These consequences can be quite substantial and unequitable. Some of the ones I can think of are:

- The people applying to withdraw super are generally of lower incomes and have hence not benefited as much from the superannuation tax breaks as people on higher incomes. Withdrawing early for consumption before time accumulation has enabled higher wealth creation is therefore in effect quite a regressive tax on low income people.

- Allowing primarily lower income people to withdraw super early will make it less likely that those people will be able to build up a big enough superannuation balance to not have to rely on the public pension in retirement and this is therefore a kind of tax increase on our children rather than a tax increase on the current working population.

- A lot of superfunds invest in illiquid unlisted assets as well as in publicly listed assets where there is a clear market price. As we all know, we have seen a sharp selloff of publicly listed assets but there is always a lag between the valuation of publicly listed assets and unlisted assets as the funds have to go through a valuation exercise for the unlisted assets which takes time and also leaves significant leeway to arrive at a valuation that the managers of the fund prefers rather than what the reality might be. People withdrawing currently might therefore be doing so at an inflated valuation of the fund that does not reflect the true underlying value of the assets held and when the valuation of illiquid assets catches up to reality, the adjustment will have to be taken by the remaining investors in the funds. Allowing people to withdraw early just after a major fall in asset prices is therefore in effect a value transfer to the people withdrawing from the remaining investors.

These are all complicated issues and I do not profess to have the exact answer for what is the most equitable way to provide people with needed financial resources in the current situation. I can only hope that not too much of the withdrawn super is spent like an acquaintances brother who withdrew $10,000 and spent it on modifying his Subaru WRX while at the same time being on Jobseeker payments…..

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thanks Matthew, the lost compounding was what I was hinting at in my second point.

Unfortunately, there is generally an inverse correlation between age and the understanding of time value of money… One of my pet peeves with educations systems is that you have to take specialised economics courses before anyone really teaches you about compounding (I actually learnt it in an advanced math class as a applied example before I was taught it in any other subject). Forcing schools to teach a subject on general financial literacy (compounding of returns, effective interest rates on credit cards, some basic Bayesian probability theory etc.) in high school would in my mind be one of the highest ROI reforms in education.

ah yes indeed, as Buffet has said, ‘compounding is either working for you or against you’. There would indeed be great value teaching these concepts in schools, however, you might have just changed careers to politician or political campaigner ;)

I would unfortunately not survive long at all as a politician in Australia without punching someone I think given the level the political discussions are generally held at…

A good article, Andreas.

A further add is the lost compounding too.

A $10,000 withdrawal (assume a slightly higher average when the dust settles) by a 30 year old which has now lost 40 years of compounding (assuming withdrawal at 70, very likely for the future) at 8% is c$207,000 of super (simple calculation without taking account of inflation etc.). That is shaping up to be one expensive WRX….

Complete agreement on stamp duty as a regressive tax. Might be better to have a decent land tax (to cover amenity improvements) which can, if the owner wants, be offset with a reverse mortgage. I have not thought through what the implications might be on fueling land bubbles/affordability issues, though land tax would likely help keep prices down (which is economically sensible though not in line with government policy).

Andreas this is an interesting development – I wonder what your thoughts are about ‘reverse mortgage’ and ‘home reversion’ interventions

There might be downsides to this but I would have thought it solves a great many problems with people who need to able to access well paid long term revenues. I am always surprised that governments don’t push it more and that it is not opened up (in a limited way) to people of younger ages. Am I missing something here?

Hi John,

I am not an expert in these kind of products but they do make intuitive sense to me as the structure of wealth in Australia is so heavily tilted towards home ownership and it makes sense to let people access that wealth in retirement.

What I think would be even more helpful is to remove transaction costs in real estate which would enable people retiring to downsize easier without leakage. Stamp duty in particular is an extremely inefficient tax that should be switched to a land tax instead. This would encourage people to release equity and lead to a better functioning real estate market.