Is Myer’s Equity Raising Throwing Good Money After Bad?

Myer (ASX: MYR) recently surprised the market by pre-announcing its financial year 2015 (FY15) results and launching a deeply discounted 2 for 5 entitlement issue. While the FY15 results were roughly in line with market expectations, the greatest focus was on the company’s new strategy announcement.

The new strategy calls for a $600 million investment in the business over 5 years to refit stores and invest in the company’s omni-channel capability. The omni-channel refers to Myer’s ability to engage and transact with customers irrespective of their preference for in-store or online shopping, as well as in-store collection or delivery of goods. The company will increase its focus on the company’s best stores and most valuable customers. The company will also look to reduce its store footprint by up to 20 per cent.

The company released the following medium to long term targets:

- Sales growth greater than 3 per cent between FY16 and FY20,

- Greater than 20 per cent improvement in sales per square metre by 2020,

- EBITDA growth greater than sales growth by FY17, and

- Return on funds employed greater than 15 per cent by FY20.

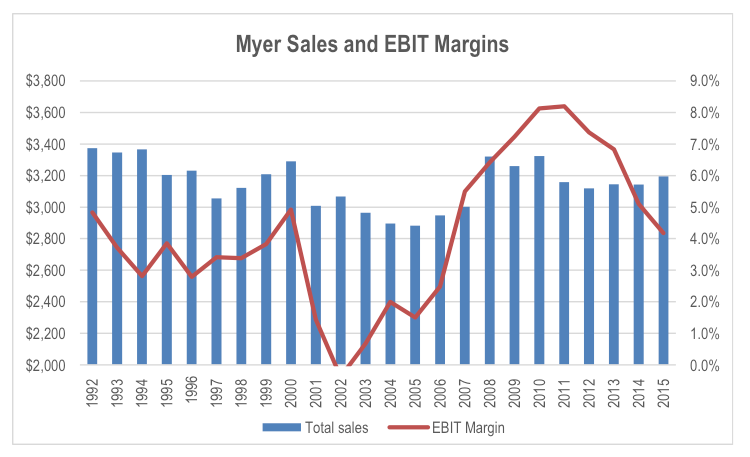

Looking at sales growth, the company has struggled to deliver any growth in sales in the last 20 years. The headwinds facing Myer and the department store segment in general are many. The department store format was established many decades ago as a means of offering the consumer a one-stop destination for their shopping needs across multiple product categories. The rise of the shopping mall largely replaced this need by providing the same function in a far more flexible and competitive manner. More recently, internet shopping has changed the nature of the market, making the fixed cost investment in floor space even more difficult to adequately leverage. This inflexibility of the format is demonstrated by the regular write downs and restructuring costs incurred by Myer and David Jones to refocus product offerings in stores.

Myer has also suffered from having a store portfolio that covered the full spread of demographics in Australia, making it almost impossible to focus the business on the more attractive high end consumer segment. Back in FY06 when Coles sold Myer to private equity, it recognised that it had around 20 stores too many in its portfolio of 61 stores. However, it was unable to close surplus stores to refocus the business due to the cost of exiting long dated leases. Interestingly, the company stated that it will look to reduce floor space by up to 20 per cent. Payments to landlords are likely to consume a large proportion of the A$200 million total A$600 million investment allocated to shrinking the store footprint.

Myer has also suffered from having a store portfolio that covered the full spread of demographics in Australia, making it almost impossible to focus the business on the more attractive high end consumer segment. Back in FY06 when Coles sold Myer to private equity, it recognised that it had around 20 stores too many in its portfolio of 61 stores. However, it was unable to close surplus stores to refocus the business due to the cost of exiting long dated leases. Interestingly, the company stated that it will look to reduce floor space by up to 20 per cent. Payments to landlords are likely to consume a large proportion of the A$200 million total A$600 million investment allocated to shrinking the store footprint.

At the same time Myer is targeting an increase in sales per square metre of over 20 per cent by 2020. This would suggest sales will be roughly flat on current levels if both these targets are met. This is inconsistent with the sales growth target of over 3 per cent a year.

Of greatest interest is the 15 per cent ROFE target in FY20, as this drives the valuation outcome. In FY15, MYR generated a ROFE of 10.7 per cent on A$1.25 billion of funds employed. Myer will invest A$600 million over the next 5 years. However, of this, A$120 million will be restructuring and implementation expenses, and a further A$200 million will be involved in rightsizing the store portfolio. As a result, these investments won’t add to capital employed by FY20. If we assume the residual A$280 million of investment is incremental to the current funds employed, total funds employed in FY20 would be around A$1.5 billion. The actual figure is likely to be lower than this due to the write off of assets in rationalising the store network, as well as depreciation expenses between now and FY20.

A 15 per cent ROFE would suggest EBIT in FY20 of around A$225 million. This would also imply an EBIT margin of around 7 per cent.

A pre-tax cost of capital of 12.1 per cent (8.5 per cent post tax) would value the company at around A$2.09 billion at the end of FY20, assuming the company can continue to generate 3 per cent growth each year from FY20. Given the spend, net debt is likely to increase by around A$300 million by FY20, even after the company raises A$221 through the current entitlement offer and retains some of its earnings, from the current net debt of A$388 million. This means the value of the equity in FY20 would be around A$1.4 billion in FY20 even if the company achieves its targets.

This equates to A$1.70 per share, and a 12.6 per cent a year increase from the A$0.94 entitlement offer price. This might look attractive, but this assumes everything goes right for Myer. The market position of Myer, the inflexibility of the department store format, and the increasing competition for the high end consumer suggests that the end result is more likely to be weaker than management’s target. Companies tend to assume investment returns will be incremental, but this implies the competition stands still. This is rarely the case, and as such, a proportion of the benefits from reinvestment are usually competed away. As a result, the risk outweighs the return upside in our opinion.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Market voted quite resoundingly no.

Do you know who was underwriting the deal? I cannot seem to find it

Hi Lucas, the retail investor base certainly gave it a big thumbs down with just A$3.7m of the A$121m being taken up. The original underwriter was Goldman Sachs, however the release from Myer indicated that the shortfall would be taken up by sub-underwriters. It will be interesting to see if the sub-underwriters intend to hold the additional stock on the long term basis.