Is Link’s acquisition of Capita Asset Services as good as it seems?

On 26 June, Link Group announced the £888m acquisition of UK-based Capita Asset Services. This was heralded as a transformational acquisition. After all, it will increase Link’s enterprise value by a whopping 50%. But is the deal a plus for shareholders?

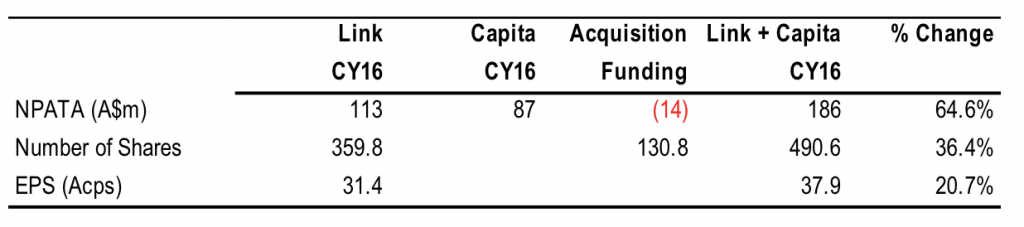

Using the figures provided by the company, if the acquisition of Capita Asset Services had happened prior to the start of calendar 2016, it would have increased CY16 group net profit before amortisation of acquired intangibles from A$113m to A$186m. This represents a 65% increase. This is calculated by adding the net profit of Capita in CY16 of A$87m to Link’s net profit before amortisation of A$113m and deducting an estimate of the after tax interest expense that would have been incurred on the additional debt raised to fund the acquisition of A$14m.

Of course, a shareholder’s share of the net profit is calculated on a per share basis. The 4-for-11 entitlement issue by Link that funds part of the acquisition dilutes the proportion of net profit to which each individual share is entitled. Factoring in the impact from the increased number of shares results in a 20.7% increase in EPS as shown below.

A 20.7% increase in EPS looks like a great outcome for shareholders.

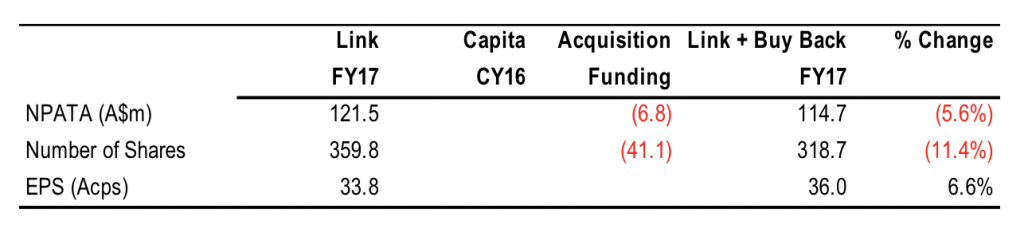

However, let’s look at a different scenario. Let’s assume that, instead of acquiring Capita Asset Services, Link raised an amount of debt that takes the gearing of the balance sheet to the same level as is expected to occur following the Capita transaction (ie increasing net debt to EBITDA from 1.35x to 2.80x). This would see the company raise A$321m of new debt based on FY17 EBITDA guidance of A$217–219m and net debt of A$300m. Link then uses the proceeds to return capital to shareholders through a buyback at the share price prior to the announcement of the Capita acquisition (A$7.83).

As shown in the table below, this simple alternative increases EPS by 6.6%.

This says that around a third of the EPS accretion presented by the company is the direct result of increased gearing of Link’s balance sheet.

Link is currently trading on a premium earnings multiple to reflect the A$45m of integration synergies from the Super Partners acquisition that will be realised over the next 3 years. The trading update provided in the company’s presentation noted that FY17 revenue will be flat on the prior year. Revenue growth is being negatively impacted by contracted price cuts to Super Partners clients, as well as account consolidation. Looking forward, organic revenue growth is likely to remain challenged.

Consequently, the earnings growth forecast by the market is expected to be generated by the estimated A$45m Super Partners integration synergy benefits that are expected to be realised between FY17 and FY20. This accounts for the bulk of consensus forecast growth in EBITDA by FY20.

This step-up in margins means that the actual EPS accretion from the Capita acquisition will fall over time. If we add the after tax synergies that are yet to be realised by Link from the Super Partners acquisition (A$45m * 0.7 = A$31.5m) to the FY17 NPATA guidance provided by management of A$121.5m, the EPS accretion falls to 8.3%, with all of this accretion stemming from the increased level of gearing in Link’s balance sheet.

Essentially, what appears to be an impressive level of EPS accretion from the Capita acquisition is really a function of gearing up Link’s balance with debt, applying low short term interest rates to determine the incremental interest expense, and using a low base of earnings relative to the longer term earnings expectations the market uses to value the company.

EPS accretion is over emphasised by the market when assessing the quality of an acquisition. This is particularly so when interest rates are as low as they are at present. The 2.75% pre tax cost of debt and 4% after tax equity earnings yield used in the calculation of EPS accretion from Capita represent a very low hurdle rate of return when measuring the merits of the acquisition.

We also note that increased balance sheet gearing adds financial leverage to the earnings, adding risk to the investment. As a result, a shareholder should demand a higher rate of return on their equity to compensate for this added risk.

A better way to assess the value of an acquisition is by looking at the return it will deliver based on the acquisition price. Link is purchasing Capita for A$1,547m. Deducing the A$18m of cash that comes with the acquisition yields a price of A$1,529m for the business itself.

According to the company presentation, Capita generated A$101m of EBIT in CY16. This implies a pre tax return on the acquisition of just 6.6%. Deducting corporate tax at the UK’s 20% tax rate generates an after tax rate of return of 5.3%. This is well below Link’s cost of capital, which we believe is well above 8%.

Even if we give Link the benefit of doubt on its ability to realise, and more importantly, retain the target £15m of synergy benefits, the return on investment increases to just 6.6%, still well short of the cost of capital hurdle that would generate a neutral outcome for shareholders.

On top of the low rate of return on the funds invested, the acquisition also introduces shareholders to a range of new risks.

While the acquisition is exposed to Link’s core Funds Administration and Shareholder Registry businesses, providing the company with the opportunity to grow in a developed market from a beachhead acquisition to the number 3 player in the market, it comes with a number of new risks from an operating perspective. Link is now significantly more exposed to regulatory risks in the UK and EU, including the uncertainty of Brexit. Around half of the revenue in the acquired business comes from Banking & Debt Solutions and Corporate & Private Client Solutions. These are at best adjacencies for Link rather than businesses that will leverage its existing capabilities.

The acquisition is very large in the context of Link, with the acquisition price increasing the company’s enterprise value (the market value of its equity plus the value of its debt) by around 50%. Management stretch and risks around cultural integration cannot be ignored.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY