Is it time to invest in travel stocks?

As far as listed companies go, travel stocks are probably ground zero for COVID-19. They have been among the hardest hit in terms of business and share price impacts, and share prices generally remain well below their pre-COVID-levels.

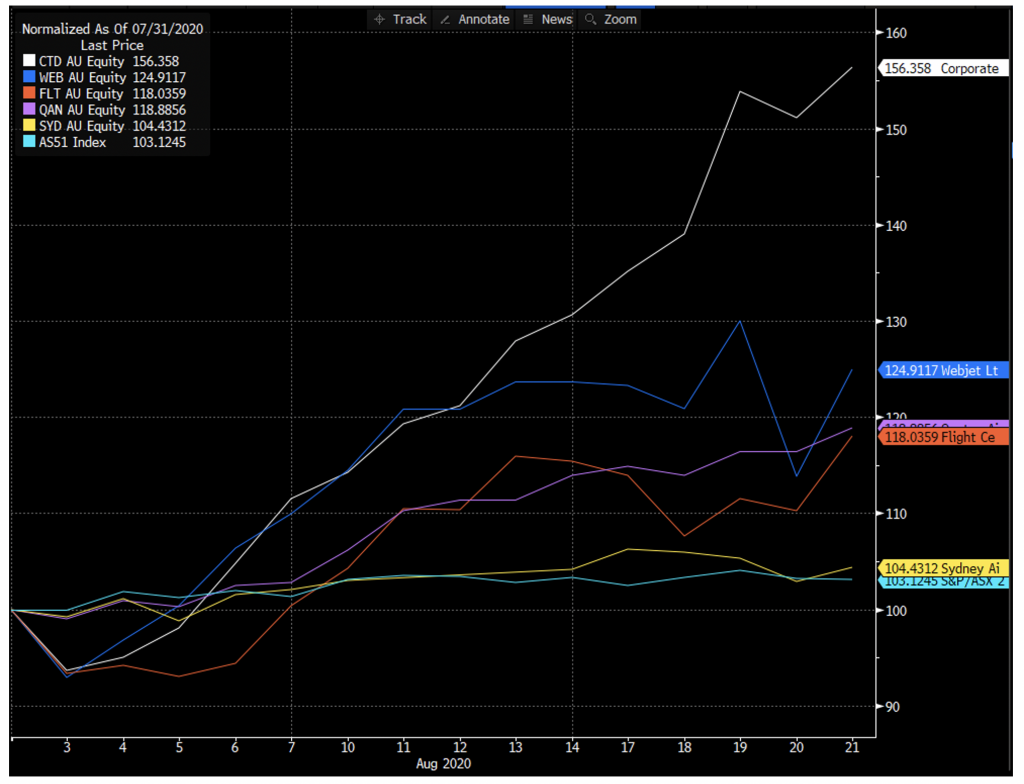

Since the start of August, however, we have seen some strong performances from many of these names, despite a string of reasonably grim full-year results announcements, which have offered little by way of forward guidance.

During this time, while the ASX200 index has risen by around 3 per cent, most travel stocks have recorded double digit advances, with Corporate Travel Management a stand-out returning more than 50 per cent in the space of a few weeks. At the other end of the spectrum, Sydney Airport, which is leveraged in particular to international travel, has not yet seen much share price movement.

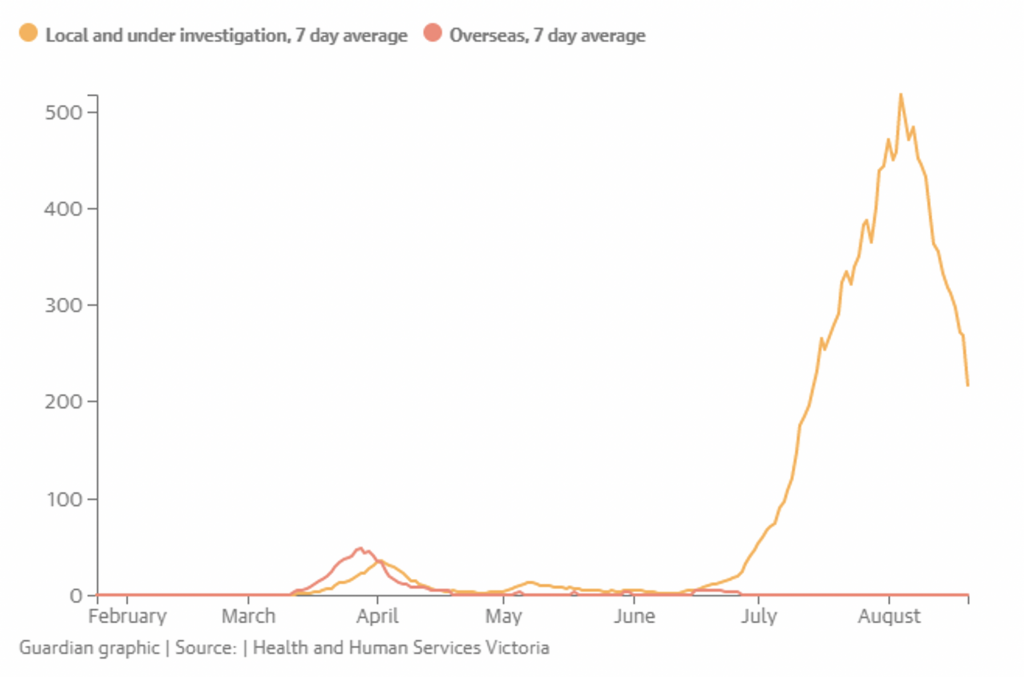

It is probably no coincidence that the peak of Victoria’s second wave of COVID-19 arrived around the start of August, with case number moving averages showing an encouraging decline since then. A resolution to the issues in Victoria raises the prospect of some re-opening, at least of domestic borders, directly benefitting those companies with exposure to domestic travel. Further, if domestic travel is able to resume, it does not take a lot of imagination to think that international travel may follow at some point.

Victoria 7-day moving average case numbers

Notwithstanding the recent rallies, travel stocks generally remain well below their pre-COVID levels, and if they are to return to historical levels of profitability in the coming years, this may imply some significant share price appreciation as the market factors this in.

While risks are elevated and the sector will remain volatile, investors who are able to judge the possible timing and rate of a recovery in travel stand to do very well by positioning themselves appropriately.

Over the coming weeks we will aim to provide some insights into individual names and whether they may represent good value at current trading levels.