Is it time to hit the ‘buy’ button?

If there’s one investing axiom to hang your hat on, it’s this: the lower the price you pay, the better your returns over the longer term. With the price-to-earnings (P/E) ratios of many high quality businesses compressing, I therefore think it’s time for long-term investors to buy while so many others are fearful.

P/E ratios have compressed materially and quickly. Most of the compression is due of course to rising bond yields, which in turn are a response to inflation concerns. But in some cases, some of the P/E compression can be attributable to rising earnings. Keep the latter point in mind.

Let’s talk about a bear market

A bear market is a 20 per cent slide from its peak but at the point of a bear market, investors make a 25 per cent return just from the market returning to its previous high. If the market falls 50 per cent, investors who buy at the trough make 100 per cent just from the market recouping its losses and returning to previous highs. The lower the price one pays, the higher the return.

Looking at every bear market (fall of 20 per cent or more) since WWII, the average length of time it takes for the S&P500 to reach its nadir is 12 months and the average decline is 32.7 per cent. Finally, the average length of time it has taken for the S&P500 to return to its previous high, is a further 21 months. At the time of writing, the S&P500 is at 3900 points, down 19 per cent from its high of 4818.63 recorded on 4 January 2022. The index has been as low as 24 per cent below its all-time high. If the market played to the historical averages (unlikely) the S&P500 would fall to 3242 points (down 32.7 per cent from its high, and another 11.5 per cent from its recent low) on 4 January 2023. It would then reacquire its previous high of 4818.62 on 6 October 2024.

While the averages are unlikely to be repeated (the events create the averages not the other way around) what is interesting is an investor who buys the S&P500 index today at 3900 would generate a return of 23.5 per cent over the next two years, three months and eight days. That’s equivalent to 9.75 per cent per annum if the market were to follow the averages. And it is also only applicable to the index.

As we aren’t in the business of buying indices, rather we seek to own individual companies, the above ‘analysis’ is only useful in that history offers encouragement the market will reacquire its previous highs, eventually.

Investing in individual companies

Encouraged by the prospect of an eventual broader market recovery we can now examine the arithmetic of investing in individual companies.

First, if I buy a share on 10 times the earnings per share (EPS) of the company – a Price to Earnings (P/E) ratio of 10 times – and sell the shares on the same P/E ratio in a future year, and EPS grow at 15 per cent, then my annual return will be 15 per cent, the same as the earnings per share growth rate.

It matters not what the P/E ratio is, if they are the same at the time of acquisition and disposal, my return will equal the EPS growth rate achieved by the company.

Second, as Figure 1 illustrates, the P/E ratio reflects the bipolar nature of markets. Frequently market sentiment swings to reflect popularity for equities, and equally frequently sentiment reverts to being depressed and despondent with P/E ratios correspondingly slumping.

Figure 1. PEs reflect bipolar nature of market sentiment

Source: Yardeni Research Inc.

P/E ratios are a measure of popularity. The more popular equities are, the higher the multiple of earnings investors are willing to pay and therefore, the higher the P/E ratio. When equities are unpopular, the lower the multiple of earnings investors are willing to pay.

We can take advantage of this bipolar behaviour by focusing buying activity around periods when sentiment, as reflected by P/E ratios, is depressed.

We can also take encouragement, from the reliable bipolar market behaviour, that P/Es will eventually reflect buoyant optimism again.

And further encouragement comes again from the arithmetic of EPS growth and P/E compression and expansion.

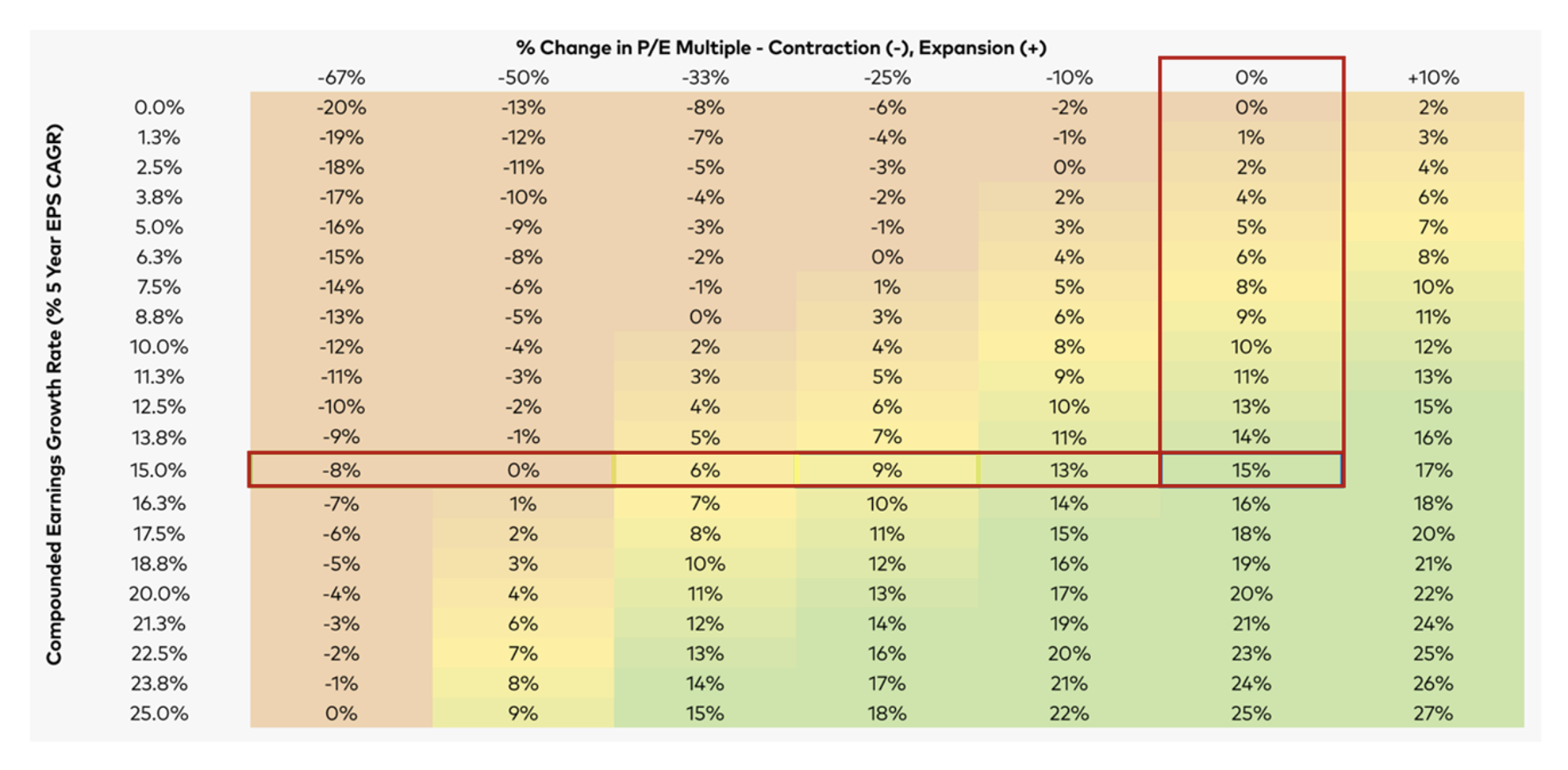

I have published Table 1. previously but it is worth dwelling upon again.

Table 1. PE compression v. PE expansion

The vertical axis represents various levels of earnings per share growth. The 15 per cent row assumes the purchase of shares in a company whose earnings per share grows at 15 per cent per annum for five years.

The column headings across the top represent the change in the P/E ratio at the end of the five-year period.

The 15 per cent row and the zero percent column interest at 15 per cent. Purchasing shares in a company whose earnings per share grows at 15 per cent per annum, will return 15 per cent per year to the investor if the P/E ratio does not change.

The intersection of the 15 per cent row and the -25 per cent column is 9 per cent. Nine per cent is the annual return to the investor, over five years, from buying shares in a company whose earnings per share grow at 15 per cent per annum and the P/E ratio declines by a quarter and fails to recover over the five years.

You will see a zero per cent return is received where the 15 per cent row intersects with the column representing a P/E contraction of 50 per cent. Buying a share of a company growing its EPS by 15 per cent per annum over five years, produces a nil return when the P/E ratio falls by half and stays there. The investor would also have to hold the shares for the five years to break even.

But a nine per cent return is received, even if the P/E ratio halves when shares are purchased in a company able to grow earnings by 25 per cent per year.

The best chance of attractive returns

It should be apparent by now buying shares in companies able to compound earnings at high rates over a long period, offers the best chance of attractive returns even if the popularity of shares were to collapse and remain in the doldrums.

But as we have previously noted, this is unlikely. PE ratios reflect popularity which swings frequently and reliably.

Figure 2. ASX Cyclically adjusted PE (CAPE) five year forward return (dot plots)

Finally, stockbroker MST have conducted historical analysis of returns from Australian shares based on the P/E at which the investment was made. It is clear from the data, the axiom referred to earlier – the higher the price one pays, the lower the return and vice versa – holds true. A higher starting P/E produces a lower return.

Regression analysis of historical returns (note my comments about averages) reveals paying today’s P/E ratio should result in a return over the subsequent five years of approximately 15 per cent per annum. The range of historical returns at the current P/E however is five per cent to 25 per cent per annum.

In any case, history and math is on the side of the long-term investor brave enough to invest when others are fearful, as they are today.

Excellent article Roger, thanks for sharing your knowledge. I have become a big fan value investing after reading your book Value.able and taken up as my mantra for buliding wealth in long term. Please keep on sharing your thoughts and experiences.

Regards,

Akshay