Is China exporting inflation now? Did the RBA know? What’s going on at RIO?

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.

First the RBA held off cutting rates. Did they know that China would soon be exporting inflation (cost pressures there)? Then the next day China reported…guess what….the biggest jump in inflation…so forget about rate cuts there to help out US and Euro exports?

And now we are hearing that over at RIO a freeze has been placed on contractors and recruitment. Read; “massive overspend / cost inflation”.

Today Bloomberg quoted an analyst on China: “Domestic demand was genuinely weak in January, while exports remained on a gradual downward trend,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. And “Tom Albanese, chief executive officer of Rio Tinto Group, said yesterday he remains confident of a so-called soft landing in China… Inflation (CNCPIYOY) accelerated last month for the first time since July as food prices climbed before the holiday that started Jan. 22, a statistics bureau report showed yesterday. An index of export orders in the agency’s survey of manufacturing purchasing managers released last week showed a contraction for the fourth straight month. The IMF said in a Feb. 6 report that China’s economic expansion may be cut almost in half from its 8.2 percent estimate this year if Europe’s debt crisis worsens, a scenario that would warrant “significant” fiscal stimulus from the government.(See my postscript).

17/2/2012 PostScript: An analyst we regard highly wrote this to us today:

“On this recent visit, our wise counselor forecast China’s growth rate will be in therange of 8 to 9% in 2012—assuming no major external shocks. Inflationary pressurewill be lower this year than last, especially in the first half of the year. The inflation ratein China for the entire year will be lower than 4%. Low inflation will allow thegovernment to deregulate prices—water, natural gas, and power.Our trusted counselor believes that export markets cannot be counted on to deliver thegrowth that China needs in 2012. Likewise, domestic consumption, while on the rise as apercentage of GDP, is hard to stimulate quickly. Therefore, the only remaining option to preventChinese economic growth from slowing is for the government to use investment as a stimulus.”

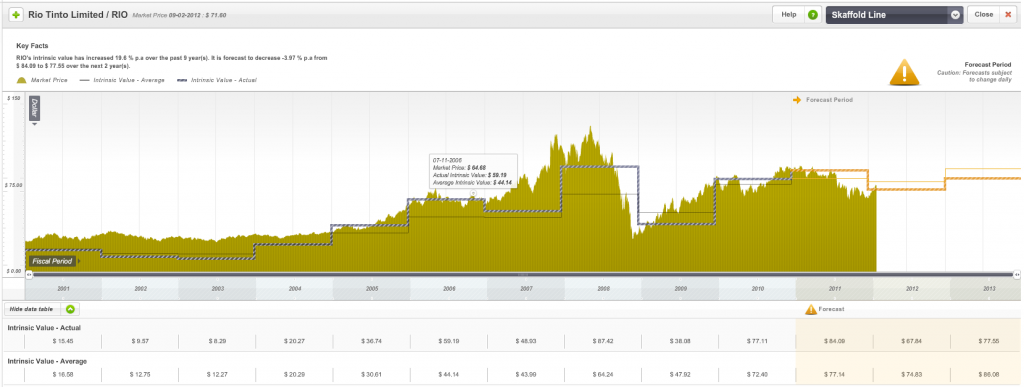

Here’s a quick view from Skaffold of RIO. To become a Skaffold member and enjoy having every stock in the Australian market quality rated and valued and all valuations and data automatically updated for every company every day CLICK HERE

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 10 February 2012.

Is anyone else concerned with the huge EBA agreements being negotiated around Australia? Holden workers just received 18.5% wage increase over 2 financial years with no productivity trade offs?!? Manufacturing in Australia is already extremely uncompetitive and now Labour cost for Holden at least will increase by 18.5%. These sorts of unsustainable wage demands will kill our industries. Espcially when global growth is going nowhere possibly backwards.

Im interested in everyone elses opinions.

yes Terry, and before some workers get to see the wage increase, they will be laid off because of the extra costs to the business in funding the increase.

Its the same for our tourist industry..I just spent some time at the barrier reef and all I heard was complaints from overseas tourist, complaining about the extravagant costs and the lack of service and value they received for it.

Most expressed they would never return. And now islands are uneconomical and are starting to close down.

And what a shame when we have arguably the most marketable country in the world.

Regarding the car industry, the other day I read in The Australian…

“The budgetary assistance is currently running at $160,000 per worker per year, with total protection amounting to an average of $7000 per car.”

China exporting inflation? I don’t think so. The real source of China’s inflation is US Fed. For years Americans have been paying for imports by printing IOUs. This has resulted in trillions of US dollars sitting in foreign back accounts with nowhere to go. Much of the Chinese manufacturing boom was financed by the US IOUs. Money that Americans didn’t earn to pay for stuff they didn’t make.

US is in the privileged position. Because $US is the World reserve currency there is very little inflation in the US as long as foreign suckers take their IOU’s. Unlike the US, Chinese have nowhere to export their currency. Because of this, the growing quantity of domestic currency resulting from the Fed-induced artificial export boom leads to domestic inflation.

The only way Chinese can prevent domestic inflation is to de-peg Yuan from the dollar, let their currency to appreciate and let Americans eat their own inflation.

I may be putting too much on this statement but the below from the RBA was an eyebrow raise for me

The exchange rate has risen further, even though the terms of trade have started to decline. This is largely a reflection of a decline in the euro against all currencies. Nonetheless, the Australian dollar in trade-weighted terms is somewhat higher than the Bank had previously assumed.

From a bushie in Qld this means ……………Crap they have printed alot of money in Euro and USA…………….we better print as well because our dollar is too high………..If we print we can’t drop rates………..We have to keep a lid on inflation.

Just my take.

Actually its our relative high 4.25% cash rate AUD Vs other commodity currencies e.g Canada and N.Z that have resulted in carry trades out of cheap 1% Euros (via ECB 3 year 1%p.a policy) into AUD and keeping the 3.5% margin as profit. This has caught the RBA with its pants down. Lifting the Aussie exchange rate further

Albanese and Elliott should be strung up over the Alcan purchase. The cost to shareholders of that overpriced and value-robbing acquisition is not over yet, resulting, I fear, in further write-downs. Until the Alcan purchase, Rio was one of the most conservative miners. Had it remained that way, it would have been a vastly more valuable company than it is today. Having said that, I think long term it remains undervalued even at $70.

Justin,

I totally agree with you but it was Paul Skinner that did the deal and it was basically doen by the time Tom A came on board. RIO will be paying for this for years to come. RIO are sinking so much capital that their EPS look fairly flat over the coming years and that assumes that China doesnt have a flat spot. That is why I staying on the sidelines.

Steve

Just on another topic, the problems our banks are having with refinancing costs..

Can someone help and explain, why our banks are unable to profit in an interest rate environment, that is double most offshore nations.???…

Surely their rating and strength enables them to borrow money at lower rates than offshore banks. Yet their complaining their margins are still so lean..

Why is it that offshore banks can manage, surely their raising money in the same market, but lending it out at sometimes half the rate as here??

Thanks in advance.

Interesting question Garry

The answer is a huge essay

The short answer is our interest rates are high but so our our funding costs…………Funding for out banks comes in many forms,

The ideal is that they are all funded locally from term deposits……….But this is not the case for out banks………..They have a high reliance on overseas funding…………………Last time I looked they(the overseas funders) were all broke……………So to get funding they have to payup

Cheers

I cringe every time I see Swanny bashing banks.

I imagine a very large percentage of the banks is owned by superfunds, ie all the mums and dads. The average Ozzie has a sizable amount of there super invested in banks, surely they must be doing back flips over the banks making profits and there super funds growing, if only they knew.

Interesting Roger, with their rapidly emerging monopoly situation, where no country will have voable manufacturing left, this is a major concern, let alone a National Security Concern.

I wonder is the politicians are thinking of this?

Whats going on at RIO? The recruitment freeze is not to do with operational personnel but more to do with services. There is significant duplication of resources in areas such as IT, admin, shared services etc. They want to get this under control because costs have been spiralling and if they didn’t act would blow out significantly again in 2012.

The other thing about this is that while it was a global announcement the feeling is that the Iron Ore business is almost exempt because they just make so much money. No doubt there will be some review and some movement there but it won’t be significant.

The contractor freeze isn’t to do with construction simply related to the above. That is, you can’t sidestep recruiting full time staff by recruiting contractors.

Steve

Thanks Stevek. Excellent.