Is Australian manufacturing dead, or just in need of a cuddle?

With high salaries, higher rents, a strong Aussie dollar and ‘level-playing-field’ policies, are Australian manufacturers being unwillingly and inexorably dragged to doormat status?

We are in a race to the bottom and run the risk of ultimately being chewed up and spat out when our commodities are no longer required with such urgency.

Driven by a belief that economists are right and the way to measure happiness is by the consumption of “stuff”, government policy in Australia is set to keep the masses happy by making that “stuff” as cheap as possible.

Our way of life, and the quality of that life for our kids, is at risk if we continue to be apathetic. Driving around Sydney’s Eastern Suburbs and Lower North Shore, its apparent there isn’t a communal approach to the solution. Instead there is an individual race to accumulate more “stuff” to protect oneself. “Forget about the neighbours”. “Look after number one”. “If I have plenty in the bank, the kids and grandkids will be set up. What do I care if the rest of Australia goes to pot?”

It’s like watching seagulls fighting over a Twistie.

When competing against a country with an ethos that puts ‘the people’ first, what hope does a country whose constituents are clambering over each other for the next short-term dollar have?

Manufacturing in Australia needs help. I am not suggesting protection or a hand out. I am suggesting a leg-up.

Singapore rolls out the red carpet for new businesses with tax-free holidays for the first few hundred thousand in profits. What does the Australian government do for new businesses in Australia? A TAFE course? R&D tax breaks are a start, but helping big business roll out classrooms at $5000 per square metre helped who exactly?

Unemployment in Australia’s wealthiest suburbs is creeping up because we don’t need so many bankers and Merger & Acquisition experts when there aren’t any businesses left to merge and acquire.

Can our current way of life survive without manufacturing? It seems we may just find out. What will we do without manufacturing?

The commodity boom will end one day and we are selling large tracts of arable land to foreign investors. Without manufacturing, will we be running around serving each other lattes? Is that it?

Australia is still the home of ingenuity. Just look at programs like the ABC’s New Inventors. The best and brightest should be receiving generous awards and access to incubator programs that ensure the international success and that the commercial benefits flow back to Australia.

One American recently lamented “10 years ago we had Steve Jobs, Bob Hope and Johnny Cash. Now we have no jobs, no hope and no cash”. If we don’t want to end up in the same place, Australia needs to do more to help incubate, nurture, commercialise and protect our best ideas.

And what are we doing bringing the brightest foreign students into Australia, giving them some of the world’s best education and sharing our IP and then, when they graduate, telling them they cannot work here and sending them home to compete with us?

“Go Australia”? Or “Go, Get Out of Australia”?

We also have some amazing established manufacturing businesses – paint, water heaters, bull bars, truck tippers, caravans, mattresses, wine, beer, pharmaceuticals, chemicals, anoraks, toilets.

The list of those producing attractive products and results is nothing short of A1.

A company that…

1) Has built a brand and or reputation for quality, value or innovation;

2) Is vertically integrated – owning the distribution channel;

3) Is manufacturing a highly specialised or customised product and not competing solely on price;

…has a chance to succeed in manufacturing in Australia. And while it’s a shame our government has gradually allowed manufacturing to ‘die’, there are pockets within which Value.able Gradutes can find extraordinary businesses, especially when the market’s manic phase turns to depression.

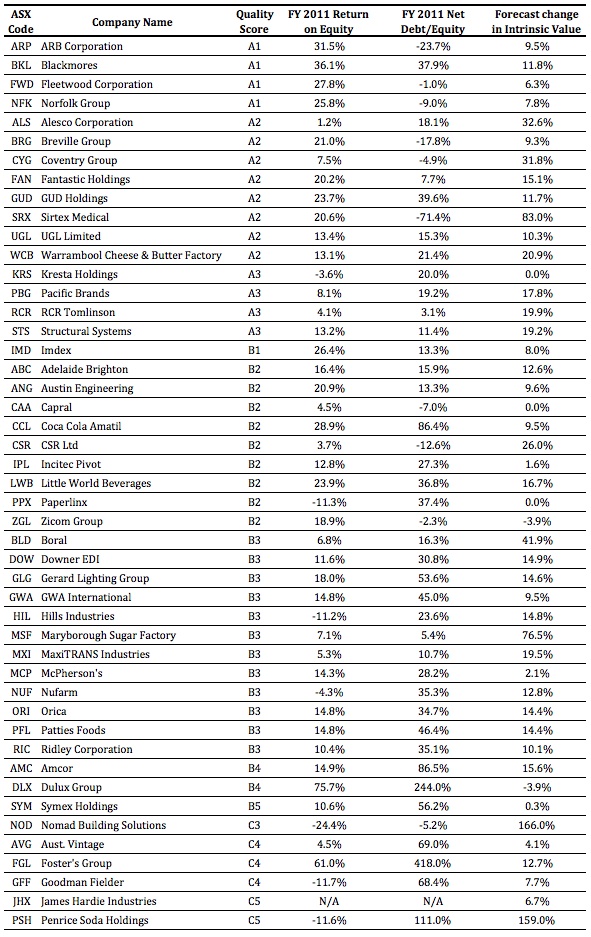

Many of the manufacturers listed in the following table have a long history of operating through a variety of economic conditions. They are ranked from A1 down to C5 – you can immediately see the broad spread of quality. I find looking at the ‘tails’ to be particularly insightful.

While declining in volume, manufacturing in Australia is not dead. Indeed some businesses are positively ‘raking it in’.

Manufacturing is tough and because inflation is always running against a business with a high proportion of fixed assets, smart managerial decisions are constantly required.

Ironically, with so many winds against manufacturers, those that have little or no debt, high rates of return on equity, bright prospects for future growth in intrinsic value and are trading at substantial discounts to current intrinsic value, may just prove to be Value.ablely positioned to leverage a broader economic recovery, locally and globally.

Who’s your top pick for Australia’s best manufacturer? I also want to hear your stories about manufacturing here. Are you a business owner that makes something we should be proud of? How is government policy or a monopoly customer affecting you? What changes need to be made to give Australia a fighting chance?

The universe of great businesses to invest in will inevitably decline unless something is done.

I look forward to your stories. They will be read by the who’s who in banking, management and government, so jot down your thoughts and share your Value.able experiences.

Posted by Roger Montgomery and his A1 team (courtesy of Vocus Communications), fund managers and creators of the next-generation A1 stock market service, 13 October 2011.

Roger

This was a great post. I’m sure you’re aware that the Federal Government has just set up a manufacturing taskforce (http://minister.innovation.gov.au/Carr/MediaReleases/Pages/PRIMEMINISTERSTASKFORCEONMANUFACTURING.aspx).

In your post you argue that Australia needs to do more to help incubate, nurture, commercialise and protect our best ideas.

Further, I infer that that our legislative, business and regulatory environments should induce companies:

1) To build brands and a reputation for quality, value or innovation;

2) Are vertically integrated – own the distribution channel;

3) Manufacturie highly specialised or customised products and do not compete solely on price.

Such companies have a chance to succeed in manufacturing in Australia.

So what submissions would you make to the Federal Government’s manufacturing taskforce?

Hi Robert,

Thanks Robert, i did receive a call and attended a meeting at which it was discussed. Sitting on the task force is a strong contingent of union reps. Do you believe the balance is right, to effect the kinds of changes you and I are referring to?

Any views on the options provided to Sally McDonald from Oroton? There is quite a substantial amount, and a zero price.

Well Michael you’ll be rapidly running out of A1’s to invest in if you keep digging up these Option disclosures with your distaste of these grants.

But in this case, Mrs. MacDonald does indeed seem to have landed on her feet with ORL. With her BCG background and her experience at GAP, little ‘ol ORL probably had to pay up for such a supposed high fly’n catch from the US Big-End-Of-Town.

Resolution 5 was passed by the shareholders for the FY11 grant, but as hard as I dug you just don’t seem to be able to find the specific EPS hurdles that vest the options – and based on the vesting so far they don’t seem that high. Mrs. MacDonald is effectively granted ~1.8% of the company over FY10/FY11 for absolutely $0 cash down and no disclosed (that I can find) benchmark/hurdle. Now that’s on top of the ~780k cash base+bonus salary.

LL

I have no problem with rewards for performance. Have a look at the growth in return on equity, the decline in debt and the growth in intrinsic value since she began.

But I thought you said when shares are provided for free, there is no downside. Aligning the upside only, is not aligning at all?

And it seems that ORL are not willing to disclose exactly what the performance hurdle is – so we can’t even conclude that the options were able to be exercised based on performance.

FWD requires 15% shareholder return, and also require an exercise price to be paid, but for some reason this is not acceptable to many on the blog. I can’t follow the logic here.

I don’t actually have much of a problem with what ORL are doing either, but I don’t get why FWD have been criticised, given they have higher hurdles, as well as more transparent disclosure than many companies.

I agree with pay for performance and usually don’t have an issue with option grants to snr execs; Fleetwood for example as we discussed earlier.

Sally has done excellently for ORL and shareholders since starting in 2006. She was compensated for that turnaround though. The question is do you give away 1.8% of the shareholder equity for FY10/FY11 with undisclosed hurdles?

I find it interesting that you would defend a CEO being granted 1.8% of a company for $0 while arguing that its suitable rewards for performance (and note the hurdles aren’t disclosed) and at the same time argue that options grants in in Fleetwood are not aligned with shareholders when there is a) a clear hurdle for the execs and b) demonstrated value creation for the shareholder base:

“When shares are provided for free, there is no downside. Aligning the upside only, is not aligning at all. And when shares are cream on top of a generous salary one cannot claim that remuneration is “at risk” either.”

@1.8% of the company for $0; Little ol’ Lindy Lu is struggling with your shareholder alignment argument here.

Sally is smart cookie and disciplined. But gifting 1.8% of the company post turnaround?

Kisses, LL

C’mon Lindy. I haven’t defended Orl. I mentioned that I don’t have a problem when intrinsic value is increased dramatically over the tenure of the exec. Orotons iv has increased much more dramatically than fwds.

Lindy, smart and concise commentary from you as always. I am not a shareholder in ORL although would have sold my stock on this announcement had I been. It’s behavior like this which turns people off investing in public companies. Roger, I fear your defense of Sally and this absurd granting of free options may have been clouded by your personal feelings for the lady. Best Wishes to all.

Ok

Total pay and bonus for 2011 down $800,000. Cash bonus cut from $442k to $250k. Options payments significantly lower too. Total remunerations was $1.1mln down from $1.9 in 2010.

And a thoroughly predictable response from Ms McDonald’s cheerleader.

Peter

That’s precisely my justification for the directors of FWD being rewarded with options, a rising ROE, rising dividends and a clear and clever growth strategy. We’re all in the winners’ circle!

just my views, but i wouldn’t make a big deal out of this if the company has delivered shareholder value!

looking at ORL share price and performance, what are you complaining about??

you made money! be happy!

on the other hand, MCE deserves more scrutiny….

cheers.

I agree with you here Ron, I for one would prefer the option price wasn’t $0.00, but i think you could definitley argue that it has come with a benefit for shareholders looking at the results.

The performance of the company has been great in the past 3-4 yrs and there have been some rocky rides for retail companies over this period. I may be a very obliging investor in regards to this particular instance perhaps, however looking at the results that are being achieved i would worry more about other companys option plans rather than ORL as the management don’t seem to be doing a job that should see them get any.

Hi Roger,

The iconic Akubra hat is still made in Australia and is still owned by an Australian family. They have been decimating the rabbit population for their hats for over 100 years.

They are not a listed company.

Maybe this, along with continuous family involvement in the business,is why they are still Australian owned.

The Dymocks booksellers group, whilst not a manufacturer, is also a long held Australian family business not listed on the ASX.

Both business owners have made direct decisions not to be left open to being taken over or have outside interests stuff things up.

ASX listing for many companies is a pathway to greater wealth but also runs the risk of an aggressive takeover by another company and sent offshore.

Perhaps the mechanisms of the market and the merger and acquistions process is also a contributing factor to the decline of Australian manufacturing. Just a thought.

Also, I liked the photos from the harbour tunnel. I would like to see more of the processes that these companies go through in the day to day running of their businesses. Too often they are just slick websites and codes on this blog or in the paper.

And what on earth is the ASXs business allowing $1.2 mln market cap companies remaining listed?

Hi Rodger, thank you for your ratings list. I noticed MCE is not on it. Their AGM is Tuesday 26th . I voted against the election of Mr. Hood although he is very well qualified and the President of the Chamber of Commerce and Industry of WA, he has directorships etc. in five more companies including MCE. If he has Sunday off he can spent 16% per week on his entities. As share holder, would you employ him? Shame on the board of MCE, he was only appointed 15/09/11 and in the AR, it was mentioned he was Director of a “number” of listed companies. Well it adds up to six entities and they don’ seem to be worried about it. I do not have a handle on their financial report and find it difficult to comprehend there cash flow, which is only just positive [ a little hiccup and it is negative]. Although explained, is this A1 management?

ROE if using Rodgers Beginning Equity is 56%. However, the AR and or using ending Equity gives 26.5% . Does this mean that if the Coy manage the same profit next year the ROE is about 26%. The share price has fallen to 3.68, which is nearly half of what I paid for them. Is any of the above the reason they are not on your list anymore?

What a changing world, KRS, I pissed off years ago and PBG I sold after reading your book as I analysed them to be poor performing companies of mediocre outcomes and please note, I do not want to reflect here any criticism on your book which is great.

I noticed Roger’s article used the words “monopoly customer “, which is an oxymoron. A monopsony is the situation where there is a single customer, the monopsonist. If there are only two customers, then “duopsony” is the word, and “oligopsony” if there are a few of them. Monopoly, duopoly and oligopoly are the words that relate to one, two or a few sellers, respectively. That’s the vocabulary lesson for the day.

When I entered the stock market in 2007, I foolishly assumed that listed companies were well run, and hence I would back themes – an investing approach that sometimes worked, but often delivered disastrous results. On the equipment-hire-outsourcing theme, Coats Hire was good, Emeco (EHL) was bad (lost nearly $3K on a $12.5K investment) and Boom Logistics (BOL) was disastrous ($50K invested now worth $5K). On the accommodation-in-the-sticks-and-China theme, Fleetwood was good (made a quick $3K profit on an $8.5K investment), and Nomad (NOD) was disastrous ($25K investment now worth $10.5K). A huge investment built up over time in Thorn Group (TGA) has cushioned the losses.

I still hold NOD, so I was interested to see that Roger’s table mooted that NOD’s SP could recover by a fairly healthy percentage. NOD’s SP is currently so poor, that selling it is hardly worthwhile, so I simply ignore it, and pray for something good to fall from the sky. My average buy price is 24 cents, so it is not inconceivable for it to recover if the new management’s turn-around program works. Hoping for a turn-around is gambling, not investing.

On the topic of gambling, FFI is a WA-based manufacturer of food-related items that I like, and I hold 10,734 shares that now show a paper loss. About half the value of an FFI share resides in industrial land, so I split the performance into two, and I subjected the food processing business to Montgomery-style analysis, and it looks good. A patient investor (FFI is an illiquid stock, and hence difficult to exit) can have a flutter on FFI without the down-side risk that a mineral explorer, or would-be biotech, carries. If FFI sells the investment land it owns, then it could return that money to its shareholders, or find a home for the money at the ROE that FFI generates from its food-processing operations, which would even be a better outcome. Obviously, there are other ways that could unlock the money-generating value of that land. If nothing happens on this front, I’ll still have an investment in a well-run company (albeit an illiquid one, and hence unsuitable for many investors), so my gamble is a Clayton’s flutter with no real downside risk.

Christopher Langdon is retiring from the FFI directorate, to be replaced by Robert Fraser who has corporate and financial advisory experience with a background in investment banking, including M&A. This bodes well for the “gamble” side of my investment. I am gambling that something will happen with the industrial land, plus some M&A activity. As an aside, Robert Fraser is on the board of ARB Corporation – a listed company (ARP) much loved by value investors.

On the matter of investing, rather than gambling, FFI’s management seem to be honest and pragmatic, with the MD having a fair investment in the company (about 25%, from memory) to have an interest in growing the business. The annual reports I have read are the most lucid and pragmatic that I have seen from an ASX-listed company – substantially devoid of value statements, professed love for dolphins, employees, community and boardroom diversity – puffery that clutters so many annual reports these days. My major gripe about FFI is that the company is so well run, that it’s a shame that the obvious talent of its managers is underutilised – they should be running a business twice the size.

FFI is probably too small to be of much interest to a forum like this, because there are just not enough shares for sale to go around. Howard Coleman of Team Invest made favourable comment on FFI many months ago, but he also said that it was too illiquid for Team Invest members to even sniff without distorting the SP. I do not mind illiquid investments that I like, because if I need cash, I can sell something else that is liquid. Also, yesteryear’s illiquid stock can in time become much more liquid, as has happened in TGA’s case.

Thank you Michael. I’ve certainly had a good look at FFI after reading what you wrote. My main concerns are declining ROE (last 2 years), down to c. 10% most recently, and lack of liquidity as you pointed out – which could be a problem getting in (no low priced sellers), and certainly a problem if they turn pear shaped and there are no buyers. Having said that, as you also pointed out, they have substantial land assets which if sold (or developed) could see a rapid change in their fortunes. On the plus side, I like the 7% fully franked dividend yield and the management seems to be top rate. I’ve put them on my watchlist.

I don’t mind these micro-caps either. It’s the ones that are too small for the brokers and insto’s to worry about that are often the unpolished gems of tomorrow. Another one I like is WLL – Wellcom Group. I read about them here on the insights blog about a month ago, and have been trying to buy some recently, but lack of liquidity is an issue there also. Most days, they don’t trade at all. There’s usually a massive gap between the top buy price and the lowest sell price. Patience is the key.

WLL have a similar yield (at 7.5%) to FFI, but higher ROE (at 18%) and rising. They are also in a completely different space, managing major companies’ brands (creation and marketing), they do most of their work on-line, and are expanding into overseas markets. The main similarity is probably that they are both so small that most investors won’t currently consider them (so they may both be currently undervalued) – except for some of the people who read this blog…

Hi John,

There’s plenty of merit in researching under-researched stocks. The idea that small companies have higher growth rates and when successful become popular because of the tracking error biases of the larger fund managers, is also one that quantitative research would show as being worth pursuing.

The huge percentage of FFI’s equity invested in investment land distorts metrics like ROE, which is why one should split the company into two, and work out the investment metrics for the operational arm. A generous revaluation of the land flows directly to FFI’s profit line, so revaluations, or the lack of them, can distort the perception of FFI’s management. If FFI sold the land, and returned the proceeds to shareholders, each share would get about $1.70 from that realisation.

When I looked at the operational performance some time ago, I got a rough value of $3.20 a share without the investment land, and hence I valued the stock at about $4.90. When FFI disappointed recently, it was for a good reason – a huge spike in sugar and cocoa prices, which quickly went away. Anyhow, I liked the management style, the lucidness of the Annual Report and the reasonable dividend, so I bought FFI shares as a Clayton’s gamble (if nothing happens on the industrial-land front, then life goes on as we know it). That FFI is so financially liquid, and it holds so much investment land is impressive – perhaps not wise.

FFI, it is not a share that I would recommend to others, because it is so illiquid, and not exactly an ROE star when you look at it in its totality. In my case, investing in FFI was a playpen investment (a Clayton’s gamble, as I wrote above). I mentioned FFI in this thread because Roger wrote about Australian manufacturers, and although I am fearsome of investing in Australian manufacturers, FFI appealed to me.

I think that some investors could find watching FFI interesting, particularly now that Robert Fraser has joined the board, and they should read its Annual Report for the sheer joy of reading one that is not turgid. I’ll invest some time analysing FFI again when the next Annual Report is published.

Massive roc in mining causes capital to deployed to mining: Adam Smiths invisible hand at work.

Robin Hood style taking the rich to give to the poor and inefficient sounds utopian but doesn’t work.

Korea, Brazil and heaps of others tried it and failed. They finally gave people freedom and their economies boomed.

Maybe emigrate to North Korea, the “workers paradise”

While blessed with many natural resources (albeit finite) Australian business has consistently failed to innovate and build a broad based globally competitive economy. The relatively small size of the domestic market is a major constraint on the development of a robust manufacturing sector and we need more than the Closer Economic Agreement with NZ to compensate for this.

When I was a student of industrial economics in the 1980’s, only Canada out of OECD countries had fewer patents issued per head of population than Australia and I suspect that with the exception of the healthcare sector little has changed over the ensuing decade.

Given Australia’s small domestic economy coupled with a low propensity to innovate it should be no surprise that the Australian bourse is bereft of Australian domiciled globally significant technology stocks of the likes of Apple, IBM, Samsung, Taiwan Semiconductor Manufacturing Co (TSMC) etc.

I worked in the investment management industry for 20 years and I recall one sell side analyst commenting that he only put buy ratings on Australian companies that don’t actually manufacture any products in-house. When I left Australia to work in Hong Kong in 2000, I had to quickly become familiar with a wide range of technology stocks that simply did not exist in Australia.

After being on the wrong side of a couple of consolidations in the investment management industry in the past 10 years, I decided to become a business teacher and I quickly learnt that “what is honoured in a country is cultivated in a country” – hence Australia is a very successful sporting nation.

When it comes to portfolio investing I tend to gain my manufacturing exposure offshore and for anyone who invests in Australian domiciled manufacturing companies a well diversified holding of high ROE stocks like ARP is important given the bad experience that many of us have recently had with MCE.

We cultivate what we honour! Brilliant. I was always told that without exception, we make time for what is important to us.

on MCE but I have some questions directed to any bloggers who would care to respond:

1. cash flow: is the company’s explaination unacceptable? If so, how?

2. orders: were more orders expected? If so how did you form that view?

Hey Brad 2010 figures are higher than I thought.Cashflow & profits will be very lumpy………… orders are below my expectations and they will be like profits and cashflow……very lumpy

Hi Ash, what did you think the orders would be ?

Another example of how we don’t cultivate technology in Australia. The recent economic stimulus package provided a 50% rebate to businesses buying stuff. A doctor friend of mine with a perfectly good car bought a new BMW with the aid of this rebate. Why shouldn’t he ? On the other hand, I work for a small private Australian owned software company which employs Australians and sells software. There was no rebate for buying our software made by Australians in Australia. There were rebates for all sorts of imported goods, including luxury items people probably didn’t really need.

Perpahs the package wasn’t entirely aimed at stimulus, certainly not long term stimulus.

Great point Bruce. There was also a 150% IT rebate but contrary to your example, you had to spend the funds with Australian developers, IT companies to qualify.

Roger like your blog, analyzing companies and valuing them.

about this article:

this article assume that we live in freedom, capitalism, and that we are educated.

people living in australia or USA or any western countries are not free people. there is big difference between slavery and freedom.

western societies living in systems which some people calling crony capitalism. for me it is close to socialism.

“education system” is not need of overhaul, it deliver what suppose to deliver.

purpose of “education system” is to train,brainwashed and indoctrinate kids. not all person can be educated, all can be trained.

some educated people have read 3000 books and those books are not one that kids are reading in school.

any person asking help from government ( bunch of bureaucrats ) will have nose around his/her neck eventually.

and any person who think that bureaucrats at RBA knows more than market will end up in poverty.

and i was born in SFRY and i can tell you socialism is not good.

thanks ned.

I’m curious, I’d have thought that MCE would be on that list,

did you forget it, or is there a reason.

Cheers

Hi Roger,

you didn’t answer the question,

was there a reason for it not being on the list

Cheers

Nigel, MCE is the current red headed b&@$)(d step child of this excellent blog because no one really wants talk about it unless to say that they had previously raised concerns about their cash flow etc…

Roger had previously given his IV for MCE assuming that they met forecasts of 20% revenue growth although if you read the AGM presentation by Aaron Begley this has been revised downwards to between 0-10% revenue growth and they have also said that margins will be impacted. Given that revenue has been revised downwards Roger’s IV which is based partly on forecasts will also have to be revised downwards.

I am predicting that this years results will be extremely underwhelming and will disappoint many people (myself included.) I also predict that over the next 10 years there will be few finer companies in Australia than Matrix. I hold.

I wrote a no holds barred report here and in a popular newsletter immediately following the full year results and my meeting with the company. Vluations are subject to numbers. Numbers for matrix are subject to company guidance. Remember that I said that revenue growth will be dependent on an announcement about contracts wins. There haven’t been any. I now suspect there could be a very large loss for 2012. If revenue grows by 0% and margins are squeezed, whT happens to profit. You need to think about the costs that are fixed and variable. Think about the level of operating leverage. But no amount of warning by me either after the 2011 half year or the 2011 full year result or this post now will convince investors to do the analysis to work out their own conclusions of what is possible.

Thanks for that Roger,

Revenue and profits have been described somewhere as “lumpy”,

how true. The AGM presentation today was illuminating. I guess long term it’s an excellent prospect, so I guess you keep your powder dry and invest elsewhere but keep this one on the watchlist, and jump in when things look rosy again, I imagine a good contract announcement would make it really jump. And if you own them, as I do, sit tight and be patient. As the largest and most efficient producer of their products for which there is a demand, I believe they will stay in business and ultimately do very well.

The key for investors is to look at the level of fixed versus variable costs. If new contract wins don’t emerge, what is the proportion of the cost base that is fixed and therefore unable to be mitigated? Operating leverage is a very important part of understanding if a companies profits rise and fall gradually and in an orderly fashion or swing from big profits in one year to equally large losses the next.

Obviously as share market investors a good way to help Australian manufactures is to buy shares in those companies.Also to buy shares in small type manufacturing companies just starting out say with market caps under $20 million.However many of the small start up manufacturing companies require debt to get off the ground and may not fall into our investment criteria.

I noticed that you had PPX on the list a fallen company trading at 8c market cap $51million.PPX has sales of over $4 billion and is being re structured.Do we buy shares in this type of company and support it?

Buying shares in the secondary market may just support the seller, not the company

Thank you for a very topical article. With these good manufacturers, we see a regular queue of suitors coming to buy not just our farms but companies as well, as the have done for aeons. My question is about comments by Boards of Directors who say, “… therefore, in the absence of a higher offer, we recommend you sell.” Why do we have to sell? Why cannot the board say that the business is good and will continue to be, etc? Why are Boards so willing to let go?

That’s an excellent question. The current requirement of the directors is to act in the best interest of shareholders. That requirement does not specify long term or short term interests. In the absence of a definition, they appear to go for short term – with the obvious exception of those companies for whom bids are received that are way above any worth they could ever hopento achieve. Even in that latter case the asset may not be producing an economic return but may be important to national interests such as food or water security.

Those “amazing established manufacturing businesses” all produce low tech, run of the mill products. Nothing that would put Australia on the map in a global sense. Good, profitable businesses in Australia, but on the world stage they are irrelevant, as is most of what happens in Australia.

Peter

True. But many of the businesses that made Buffett the third wealthiest are equally boring.

I like boring, boring is good. I have always said to people that “if the share market is an exciting place, then your probably doing it wrong”.

Hi Roger,

Regarding Sirtex, which analysts estimates are you using to estimate that their intrinsic value is going up 80 odd percent?

If this is a consensus view, it’s well worth a good hard look.

Cheers,

Andrew

Hi Andy, I suspect it’s a typo. Thanks for the heads up.

Hi Andy, I suspect it’s a typo. Thanks for the heads up.

Hi Roger – was it a typo? You’ve still got the IV for SRX expected to rise 83% in the chart above (as at Monday 24th October). If a typo, what is the correct figure? If not, that’s pretty good news for us SRX shareholders!

A good post Roger. I am glad that the public spotlight is beginning to shift to the downside of being the Lucky Country. I tend to agree – we shouldn’t necessarily be propping up poor business models (although I believe some capital controls may be warranted), but instead encouraging entrepreneurship and innovation. A good post all up.

However, I think you have overlooked one of the biggest issues that has prevented innovation in this country. That is the role of the big 4 banks, and the politico-housing complex.

For too long it has simply been too easy for Australians to invest in property (making a loss through negative gearing). The banks were complicit in this as it was always easier to lend money into a rising asset market than to do the required due diligence and take on the credit risk of lending to entrepreneurs. State governments are dependent on the housing market for revenues and also have a vested interest in keeping the property market buoyant. The print media relies on real estate for advertising income and is heavily biased towards supporting the housing market too. As long as credit is expanding, retailers are very happy too – houses need to be filled with new shinies.

We have created a rentier mentality where Australians are rewarded more for using their intelligence to exploit tax loopholes and leverage up to speculate in rising asset markets than they are for attempting to create something new.

Despite all best intentions to encourage innovation, we will not succeed until we break down this cultural and economic reliance on housing, credit, and consumption.

Thank you Rob. Not overlooked just short of space. Was talking about just the same thing today over lunch. The deposit guarantee made it even worse.

Hi Rob,

Very articulate post! I agree with your comments. What would you suggest we do about the negative gearing situation? We can’t just retrospectively turn it off overnight – there would be chaos and many Australian’s paper wealth would be massively reduced overnight. Not to mention, the current political party at the time would be out as fast as we could have an election.

Would it be possible to scale it back slowly? Or perhaps put a limit on the total losses that can be claimed? Or put a single property limit (how would we count negative gearing of shares then?) Sorry, I don’t have the answers but I would like to hear other people’s thoughts.

Cheers,

Luke

Thanks Roger and Luke,

Yes, it is a big and complex problem (so I can understand the lack of space issue for the post Roger), and one that will not be easy to solve. Regarding negative gearing (which is only one cog in the machine I might add), I have heard some of the ideas Luke suggests – the suggestion of a single property limit, or scaling in a limit from 3 properties to 1 over a number of years is a good one. Perhaps my favourite is the suggestion that future negative gearing should be restricted to investment in new housing only. This would keep the incentive for increased housing supply (which was the original intention of the policy), but reduce the leveraged speculation in the established dwellings market (which is where +90% of investors have invested).

As for shares, I’m not sure if the same rule would help – negative gearing for new issues only could lead to an unscrupulous IPO boom and would only serve to shift leverage from the business onto the mum and dad investors. Personally, I think negative gearing in the stock market is an absurd idea and I can’t see any systemic benefit to this policy at all.

I don’t think one policy change will solve the problem though. You still need to tackle capital gain tax discounts and exemptions, the power of the big four banks, and the cultural negativity towards investment in innovation this country has. I can see no solution that doesn’t involve pain and a lot of hard work. Because I can see no politicians willing to accept the pain anytime soon, I think new policies will only come once the problem has materialized and the rest of us have suffered enough to get angry. Even then the power of vested interests, lobby groups and marketeers might be too great…

I’m of the view that capital should be directed to businesses with high returns on capital. Generally this ROE outperformance, relative to competitors and the cost of capital, is due to a sustainable advantage that a business has over its competition.

If I apply this cold-blooded rationalist view to Australian industries as opposed to businesses, personally, I find it difficult to suggest that we should be sinking capital into manufacturing as the advantages possessed by the Australian manufacturing sector are unclear;

i.e. expensive labour and land, skill shortages, the tyranny of distance, lack of a large domestic market, high A$ at present etc.

Yes we have lots of smart people who are good at developing products, but I see the advantage being at this higher value adding section of the manufacturing chain with the actual manufacturing occurring offshore, e.g. ORL and ARB. I noticed that you have left ORL off your list Roger. I imagine this is due to being unofficially wall crossed by Sally. I think Oroton and ARB are some of the best Australian “manufacturers,” and yet, the majority of their manufacturing occurs offshore or will be in the short-term (in the case of ARB).

If we want to focus on ARB further, ARB is moving their production towards Thailand because they get cheaper, high quality products out of Thailand. Higher quality, because the best welders work in the Pilbara or in Coal country where they earn the most.

This makes more sense to me than advocating a protectionist approach towards any industry without an advantage. I think we should be playing to our “strengths”, our sustainable competitive advantages.

Taxing revenue incentivises high ROE. Your point is fundamentally correct.

How does that not hurt high-volume, low-margin businesses that do have high ROE (JBH, DTL etc)?

Very nicely written post Roger, and i particularly liked the “seagulls fighting over a twistie” line.

My opinion is for the most part, Australia tends to be a bit lazy and too often want to wait until others do something than we will follow. We are relying on the mining boom but as you say we are doing nothing to really set the foundations for future growth and success when people stop wanting our metallic rocks.

I remember reading about a businessman from Australia (can’t remember his name) who was helped by a university i believe to build the next gen of solar panels, he had to go to China to get the capital needed and now they appear to be getting the benefits.

We need to encourage creativity and innovation but rely on people punding bits of metal into earth and hope more valuable bits of metal come out.

I think more needs to be done in the way of grants and assistance for manufacturers and R&D which rewards innovation. We have the brains and the know how to make the next Apple etc, but i just don’t think there is an environment that promotes such risk taking and innovation “because we don’t need to, China can’t get enough of our iron ore”.

I would class Oroton as a manufacturer as well, but i agree with others that ARB and Cochlear would stand out as two of our best manufacturing success stories.

Perhaps the role of government should be to build the broad infrastructure, which is outside the scope of commercial enterprise, enabling smaller manufacturing opportunities. For example, building the NBN to enable new IT and commercial business and creating an energy grid that is capable of handling ‘green’ energy solutions.

http://www.theaustralian.com.au/national-affairs/carbon-plan/rooftop-solar-panels-overloading-electricity-grid/story-fn99tjf2-1226165360822

This capital intensive infrastructure will likely become profitable over time, allowing it to be privatised (like most government projects) and the funds used to build new projects – like a high-speed rail link between Sydney and Melbourne – continuing the cycle of innovation.

A very relevant interview with the head of Manufacturing Australia:

http://www.businessspectator.com.au/bs.nsf/Article/KGB-Dick-Warburton-Kohler-Gottliebsen-carbon-tax-m-pd20111013-ML52L?OpenDocument&src=sph

Hi Roger.

Any thoughts on publishing the Montgomery Margin of Safety for the above companies?

As an interesting aside to the topic of manufacturing, I’d like to point fellow readers to a rapidly developing technology that is revolutionising the way in which manufacturers/developers/entrepreneurs approach the task at hand: 3D printing.

Also known as “additive manufacturing”, 3D printing involves laying successive layers of material around 0.1mm thick (though high-end printers can go as low as 0.016mm!) repeatedly until a 3-dimensional form is built up.

Common printing materials used include various metals, plastics and resins. Although certain food companies (and the odd restaurant) are “printing” out food, whilst medical labs are using layers of living cells to “print out” early-stage human organs.

Though I’ve only known of this technology for about a year, it has been around since the 1990’s (to my knowledge) and is advanced enough that moving parts are routinely printed for use in aerospace (Airbus A380, military aircraft) and medicine (hip replacements, artificial limbs, heart valves etc).

Arguably, the greatest benefit to manufacturing is that 3D printing can greatly reduce (in some cases eliminate) the hurdle of economies of scale (factories don’t need to be built and re-tooled as any product design is printed out on the spot). Products and prototypes can be tweaked and altered very quickly, very accurately and very cheaply. It can also reduce material costs as there is no wastage (some products now require 90% less material to be manufactured). I won’t go through the list of other benefits, but it is long.

In terms of cost accessibility, 3D printing is said to be roughly where laserjet printing was in the 1980’s. Though personal 3D printers can now be picked up for under $1k, medium quality industrials are around $10k and the world’s best (think aerospace/medicine) are well above $100k.

Ultimately, I would envisage this technology to assist those economies centred around more complex/high-tech manufacturing through shorter lead times, shorter product cycles, less wastage of particularly expensive materials (certain metals, composites), greater customisation and lower cost/barriers to innovation/prototype development.

Ex-resources, this is where Australia should push for its future – we’re not going to beat anyone (Asia) in the manufacturing of simple products such as clothing or tyres.

Roger’s point about Australia’s lack of niche (again, ex-resources) is a very valid and very serious one. The US has a strong culture of entrepreneurialism and innovation, it is the land of opportunity. Asia has a huge, low-cost workforce (though China is said to be showing signs of a struggle with change just as Japan did in the 1960/70’s when it had to up the technological complexity of its manufacturing due to labour inflation).

Though it has been suggested that Australia become a hub for financial services due to our (by global standards) stable and honest political system alongside Anglo-Saxon law and an educated workforce, I personally don’t see this happening. But that is not the point, because even if it were to happen, Iceland and the US have demonstrated what occurs when financial services makes up too larger part of an economy – disaster. Yes, banking and finance is incredibly important, but essentially its role is to assist the proper functioning of an economy, not become the economy.

I believe that the solution lies in:

_ A government that is pro-business/pro-innovation (we need more Cochlears, more Matrixes). What would happen if we were to scrap the NBN and use that money to create the country’s largest VC Fund to give these New Inventors a go? We could select a handful of our best Private Equity managers to run it, give them a slice of equity of any investment approved, you could set the criteria for all sectors ex-resources/banking if you wanted. Surely this would get the creative juices flowing for a lot of businesses/innovators/entrepreneurs..

_ An overhaul of the education system. It has barely changed since the industrial revolution (Australia is not alone here) and we continue to push our youngsters along a production line in which basic financial education is not even attempted (though every single student will live in a modern-day economy) and evidence of talent is rarely rewarded (RSA Animate has a terrific mini-lecture called “Changing Education Paradigms”). Our national literacy/numeracy scores are now frankly embarrassing (as is the case in the US) and there are third world countries whose high-school standards leave us for dead (that was my experience, anyway). To have students feel that it’s ok to drop out of high school because you can be a sparky at a mine site on $150k is ridiculous and, as Roger pointed out, we also have a significant brain drain.

So, for Australia’s largest government-funded, privately managed VC fund to give real world businesses a boost – yay or nay?

What a terrific idea. Recently Mark Carnegie spoke about a higher tax responsibility for the wealthiest 15% of the population, with proceeds goingbto a Sovereign wealth. Putting aside the possibility of a fee for managingn it, I am sure he’d be open to an allocation to VC.

There was a worthwhile article in The Australian (Dec 2010) about Mark Carnegie – I think you may have found the man for the job!

Norway’s sovereign fund is often pointed to as an example of what Australia might pursue (though it has been rejected by the current government), however the majority of its investments are international and, of those that are local, they are primarily in the secondary market.

Questions for Roger et al.:

Do we have examples of “large, government-funded VC funds” that have been successfully run elsewhere?

What do you think is the best approach for getting this idea off the ground?

And would it necessarily require a change of government?

As for funding, this will no doubt come from Australia’s wealthy in one way or another. Although I think our situation is different to that of the US (Buffett paying lower rates than his secretary etc) and I’d be hesitant about any generalist “robbing Peter to pay Paul” policies (our top marginal income tax rates are already amongst the highest in the world) that might encourage the truly wealthy (and their related corporates) to shift overseas. Certainly Mark’s example of “trustafarians paying less tax on inheritance than an entrepreneur would on their business sale” should be addressed. I would also throw in other useless tax subsidies such as negative gearing allowances for secondary market securities – it may be politically popular but ultimately it doesn’t help our real economy.

By the way, I forgot to mention in the first post that PTM’s annual report has a few pages on 3D printing for those who are interested. I find PTM’s reports to be one of the more enjoyable reads, so take a look.

I agree with your last two ideas, in my view, the most successful economies currently have high levels of savings at the government level which are re-invested into businesses.

Furthermore, my rating of the Australian education system was first re-assessed three or four years ago when I started having long conversations (in perfect english) with German, Dutch and Scandanavian kids on backpacker’s pubcrawls. I’m not sure why you are begrudging high school drop-outs their $150k salary though.

I disagree, however, with your examples of the US and Iceland as the results of having a significant financial industry. The US has a large manufacturing sector also. I think these are perhaps better examples of unbridled fundementalist capitalism without a suitable level of regulation.

Other pertinent examples of economies with large financial sectors might include Hong Kong, Singapore and Germany.

Great observations Dan. Thank you.

Dan,

My wording re “high school drop-outs” was perhaps a little ambiguous. I wasn’t having a go at the drop-outs themselves, they are merely choosing to take advantage of what is an unusual situation (being paid more than a lot of GP’s, lawyers etc), so good luck to them. My point was that it is clearly an unusual (unsustainable) environment in which the disincentives for academic failure appear to be at all time lows.

Increasingly, the youth of today will say: “why bother studying day and night for years (and paying for it) to become a GP or a lawyer, when I can skip class and make just as much or more as a labourer or tradie”? In addition, greater percentages of our best and brightest have been lured into IB’s/Hedge Funds as they can make far greater $$$ than as an engineer/doctor/lawyer/scientist. Surely this will do us no favours in 20 years’ time. Would you agree?

I agree with your point on “unbridled fundementalist capitalism without a suitable level of regulation”. Though I never claimed that the US didn’t have a large manufacturing sector, indeed it’s huge, my point was that when purely domestic financial activity becomes **too large a portion of GDP** then you’re playing with fire. Both Iceland’s meteoric rise, and spectacular fall, and the US sub-prime markets fit the bill here. Germany is well renowned for its industrial strength, while Hong Kong and Singapore are centres for world trade (and I’m not talking financial securities here) due to their geography among other things.

It can be useful to relate this back to the global economy. We agree that real increases in standards of living stem from the development and production of real goods and services. In the same way that we can’t all be manufacturers on this planet, we can’t all just provide financial services and we can’t all just bid up securities to create the illusion of endless wealth (Iceland, US sub-prime). Financial services merely allow for the efficient functioning of the real economy (made up of goods and non-financial services), but it shouldn’t dominate/become the economy. Globally, there is a limit to how much “financial servicing” we really need

So, with the existence of such financial powerhouses as NYC, London, HK, Singapore, and let’s throw in Sydney for kicks, exactly what are we going to achieve (from both an Australian and global viewpoint) by artificially boosting our financial services sector unless there is real-world economic growth to warrant it?

PS: Has anyone come up with any thoughts on the VC fund questions in the posts above?

Great ideas there Aaryn. For anybody wanting to read a little more about 3D printing, Platinum Asset Management (PTM) has a very interesting article included in their annual report, titled “Print Me a Stradivarius” (subtitled “How a new manufacturing technology will change the world.”). If you’ve received the PTM AR, flip it over, and it’s the first article (reading from the back page forward). Otherwise, access it by downloading the 112 page AR (posted on the ASX website on 29/09/11), and skip to page 77. The article following that one, titled “The Printed World” is on the same topic, and it’s future applications. Very interesting read.

Hi Roger,

Does Codan (CDA) fit this criteria? My brother is a structural engineer that designed their factory footings and described the footings as one of the most stringent that he has worked on due to their requirement for absolute minimal vibrations of the manufacturing equipment. Admittedly some manufacturing is done in Malaysia and some in the USA. In 2009 Codan acquired US based Locus Microwave, Inc. Locus Microwave is a preferred supplier of RF subsystems for the expanding US government requirement of satellite communications at the X-Band frequency.

A great Aussie manufacturer previously list as – A1 and 31% ROE average over the last 8 yrs.

Disclosure: I own part of Codan

Great sharing and insights Will. Thanks on behalf of everyone.

Hi Will,

Codan’s reasonable consistent history of impairments and restructuring charges put me off them.

Restructuring charges can manipulate statutory profits and can bring expenses forward into one year to make it appear as profits are growing each and ever year.

Impairment charges for Codan like most show that management have paid too much for various assets/businesses in the past.

Excellent detective work! A great demonstration of what everyone should be looking for.

Roger

GREAT article well written too.

Maybe it needs someone outside of the manufacturing sector like yourself (and other Value-able graduates with clout) to pressure governments. Perhaps you have already started that process with this article.

Just a thought from me.

Thanks for the feedback Michael.

This is a very timely blog as I have just been doing research on a tiny manufacturer located in South Australia. The company is Korvest. (KOV) and these are my views.

From the Morningstar data feed Korvest Limited (KOV) is a South Australia- base manufacturing company with principal activities comprising of hot dip galvanizing, sheet metal fabrication, walkway fabrication, manufacture of cable and pipe support systems and fittings. The Company consists of the Industrial Products Group which includes the EzyStrut and Indax businesses, and the Production Group which includes the Korvest Galvanisers and Korvest Manufacturing businesses.

It is tiny….Market cap at the time of writing is $37M

My interest was sparked when management recently announced that first half profits will be 65 to 75% higher than last year.

Some digging is required when that happens but first we have to see check if we really should be digging. Virtually no debt is a good start and 10 years ago the company had a book value per share of $1.19 which had grow to $3.81 per share at 30 June 2011. This is a 12% compound return. Yes that makes me want to go further.

Shareholders equity has gone from $9.2M to 33.2M……Yep we are still going.

Shares on issue have gone from $7.8M to $8.7M over 10 years..That’s good they have not increased shareholders equity by issuing many new shares.

Profits have grown from 1.5M to 4.2M over 10 years……….that’s 11% compound……Yes still going.

What we have found is a near perfect Ben Graham view that price is tracking value with the share price going from $1.20 ten years ago to $4 today.

All of these numbers are just numbers but it does tell me management have done a good job over the last 10 years.

So this business is ticking a lot of boxes atm. But the question marks and stumbling blocks are just starting.

Profit may have gone from 1.5M to 4.2 M in 10 years but it did peak in 2009 at $5.7M. In fact profits have been flat or volatile since 2006. This is probably a reflection of manufacturing in Australia during that time.

Until Skaffold is available I do not have the ability the check the 10 year IV for the stock at the push of a button but roughly in my head it would be flat to negative since 2006.

My biggest light bulb moment was thinking about Rogers comments. “I like buying businesses at big discounts to IV and IV rising at a nice clip”. The penny dropped for me with this. So KOV fails to tick the very last box for me.

All this is looking in the rear view mirror and the value is what will happen in the future and the recent upgrade to profits are very very interesting……..Are they sustainable? and has this business taken a leg up?………………I am still digging on this one,

Cheers

Ash

Great stuff Ash. Thanks for sharing.

Roger & Ash

re KOV

(1) market capitalization is a poor measure of a company. It can vary 100% but the company is the same yesterday as it is today. It probably is better described as small.( micro )

(2) Untill the profit upgrade the other day KOV share price was less than the current BV & by my calc IV. The coy is debt free and trading profitably. Its current ROE(13%) is below its long term average and may be a reflection of delayed effect of the world economic crisis on purchasing decisions(my interperation).

(3) If you read Value.able on BV vs IV , BV is a rough proxy for the way IV is moving.For KOV BV has been rising continuously for the last 10 years and with ROE> RR (for me RR=12) then IV should have been rising at a higher rate. This year BV approx = IV (ROE approx = RR) It will be interesting to see if Skaffold confirms this.

(4) Negatives for KOV: It is a commodity business with a franchise that is weak / medium (my gut feel). Margin has been under pressure the last 12 months.It has some protection from the type of business it is in-galvanizing is not exactly flavour of the month enviromently- it has dirty waste both gas and liquid . However to set up an opposition business you have a few regulatory loops to go through and considerable capital expenditure & and you would be entering a mature market (constrained growth)

(5) On the positave it has been & is a well managed business. It is debt free, good cash flow, Since 1996 has not made a loss,and on annual returns all bar 2 years (2005, 2010) have been earnings + For a SMSF in pension phase (me) it has one year with reduced dividends (2010). I need some dividends.

(6) For the future – near future (2-3 years)The mining boom should provide good prospects for the earnings to allow a return to its average ROE (approx 18%). After that who really knows the future of any coy -it becomes speculation.

When I first started accumulating KOV ,it had a ROE of > 15% no debt and a div/yield > 5% -5% was my min.I paid too much for them (before Value.able) but am still happy to continue owning my little piece of the coy. They are approx 5% of my portfolio .

Would I choose them today (post Value.able)?Maybe not. Today I am looking for those elusive coys with strong franchises but are cheap enough to buy.

Would I sell them in the future? Yes if the market price rises well above their intrinsic value and I had a replacement in mind.

Regards

Tony

Thanks Tony. Really like the way you articulated the relationship in point 3.

Great analysis, Ash. I had a look Korvest a few months ago but put it to one side as Hills Industries have effective control with a 48% shareholding, removing any possible take over premium and making the shares even more illiquid.

Ash,

You could have just asked yourself what the market is like in the hot dip galvanising business.(It’s going down the toilet.)

Peter

Hi Ash – I worked for Korvest on Prospect Rd (Kilburn, Adelaide) for about 3 months about 7 years ago, so that would be 2004. I worked in their robotics division. Sounds nice, but it was mostly labouring and making program touch-ups to a mig welding robot that welded rungs onto cable ladders. That division had 4 employees (2 day shift, and 2 arvo shift – they didn’t work a night shift). They churned out a LOT of cable ladders, which were then galvanised by their much larger galvanising division out the back. They are basically a welding, metal fabrication and galvanising company, and they have high volume at low cost, because they pay their employees very little (which is why I left).

Their largest shareholder at the time was Hills Industries, and the management of Hills had a very big say in what went on at Korvest. I was briefly involved in some EA negotiations there, and soon realised that their future profitability depended on them keeping wages as low as possible. With the much-talked-about trade skills shortage either just around the corner, or here already, depending on who you talk to, it is possible that Korvest may struggle to retain skilled workers, unless they are prepared to pay competitive rates. If they increase rates to retain workers, that may pressure their margins. It is one of the many pressures facing Australian manufacturers and their future profitability.

By way of some comparrision, the company I work for now pays around twice the hourly rate that Korvest does, plus many other benefits, but my current job is basically unskilled (just requires industry specific experience, which I gained since moving to this company). The company that I work for now has a sustainable competitive advantage and can continue to raise prices (in an FMCG environment), without worrying about losing significant market share. The company that I work for now is a B2 and it’s in Roger’s list above – it’s CCL.

Korvest’s galvanising business doesn’t require skilled workers, just workers who are willing to work hard, get very dirty, get occasional acid burns, and not get paid very much, but the rest of Korvest’s business will be under some cost pressures soon I would imagine as the cost of employing semi-skilled and skilled workers rises.

Hi John,

Thanks for the info

“The company that I work for now has a sustainable competitive advantage and can continue to raise prices ”

Good for you John –

In “Quest for Value” EVA speak – you moved your employment from a X (or perhaps X- if ROIC is continually < WACC) to a Y company. If you wan't a happy contented employment life then a great start is working for a Y company. With 20% EBIT margins and 17%+ ROIC CCL won't pressure wages.

Another recent example in the media is Fosters in the Abbotsford brewery, where a bottler said he'd been there 20 years and would never find another job that looked after him as well. Y company. Ability to raise prices at or above inflation (over time) is the key giveaway.

LL

Interesting post, what happens if there are cheaper labour substitutes available? E.g. ARB.

I noticed that Porsche is expanding to the lower labour cost eastern extremity of Germany, with Mercedes doing likewise.

What else is worth reading LL, EVA related or not?

Can we safely tar you with the consultant brush?

Kisses?

Hello Dan S –

In general any cheaper labour advantage would be eroded as competition follows a similar strategy which is why the competitive advantage/CAP is critical to understand to ensure if inflation or above pricing can be maintained over time. I don’t follow ARP so can’t make an informed comment in their case, however I would surmise that if the 4×4 product line is subject to cheaper imports then any offshore manufacturing shift was an imperative to protect margins. One check is by tracking EBIT margins over time. If EBIT margin increases then the productavity labour advantage is captured by ARP vs the consumer from competative forces.

As to reading ideas, not sure what area interests so here is a selection. For frameworks then ‘The Quest for Value’/McKinsey’s ‘Valuation’ cover similar RIOC/WACC growth tradeoffs. For Competition, people like to point to Porter’s ‘Competitive Advantage’ for the five forces framework however one of the five forces is more critical to understand than the others and that’s ‘Barriers to entry’ and as such you may be interested in ‘Competition Demystified’ which focues entirley on that force. To understand issues in accounts see ‘Financial Shenanigans’

“Kisses?” Sometimes Dan, the moderating filter is feeling a lttle less generous to Lindy’s ‘Kisses’, but remember they are always there.

Kisses, LL

Hi Dan S, there are always cheaper labour alternatives, but in FMCG (fast moving consumer goods) businesses, overseas manufacturing isn’t always a viable option. With ARP (ARB), it makes sense to get stuff made in Thailand, especially when you market your stuff all over the world. It even makes sense to make bull bars in Thailand and ship them back to Australia to sell to Australians when the labour costs are so much cheaper over there (and the quality is still high).

However, making soft drinks and beer overseas and shipping it back to Australia is not so easy, or cost effective. For example, dietary soft drinks (diet coke, coke zero) have a 120 day shelf life (expiry date) from the day of bottling in PET. That’s only 4 months. This is mainly due to the porosity of PET that allows CSDs to go flat quicker in PET than in glass or coated aluminium (cans). This is exacerbated in hot weather, so shipping full PET bottles in Sea Containers that are exposed to weather extremes could be especially problematic. After that, it’s virtually unsellable. Cans and glass bottles vary from 6 months to 18 months, but the main issue is transportation costs. Beer & Soft Drinks = high volume & low margins, so it’s cheaper to manufacture them locally (from local and imported ingredients), even when labour costs are a lot higher here.

That’s why most “imported” beer is not imported at all. It’s made right here in Australia under licence. One of the things that could have torpedoed SAB Miller’s bid for Fosters (early on), was the deal that sees Fosters manufacturer all Corona beer for the Australian market right here in Australia (under licence). There was a clause in that contract that would have allowed Cerveceria Modelo to back out of that arrangement with Fosters in the event of a takeover of Fosters by another large overseas beverage company (such as SAB Miller). SAB have sorted all that out with Modelo now, and it’s all sweet, and we can keep drinking our imported “mexican” beer that’s still going to be made right here in Australia (by a London listed company soon).

Hi Roger

Have read the ARP Chairman’s presentation today. Plenty to look forward to if it all comes together and the company’s history suggest it will. A great company rightly at the top of your list- keen to get more at a bigger discount to IV that it is now

Cheers

Jim

Hi Roger,

You left a couple of the major steel manufacturers off that list – namely BlueScope and OneSteel.

The exchange rate is one of the biggest things killing manufacturing at the moment. Not only does it make it very difficult to sell product overseas, it makes our domestic markets more attractive to overseas competitors who can compete on price.

One of the greatest competitive advantages local manufacturers have is the isolation of Australia and the ability of local manufacturers to be much more responsive to local customers than our distant opposition. However, with the Aussie dollar so high, distributors will take the lower price from offshore, hold more inventory to compensate for the longer supply chain and still be ahead.

I work for a large manufacturer, which is purely in survival mode (not the nicest environment). My neighbour runs a tiny company with a niche product (locks). They off-shored the manufacturing process a few years ago, and now just do R&D here (plus obviously sales).

If the exchange rate continues to be high for a prolonged period, the risk is that only the very top echelon of local manufacturers will survive. Once the critical mass go, it will be very difficult to ever get them back.

Latte, anyone?

Thanks Peter. For a long time, the Aussie Peso was a lot lower, and manufacturing was gasping. But you are right. It’s the straw that breaks the camel’s back.

Roger,

Vocus must be paying you for advertising – the post says courtesy of Vocus Communications?

ARP has no peer among Australian manufacturers.

The pics are courtesy of Vocus. No ‘cash for photos’ going on here.

Its in need of help, its a national security issue and needs to be treated as such.

Fleetwood Corporation shows great operating ratios.

As a suggestion people may like to look at what % of the current 58.6m shares on issue have been issued as options to execs & staff.

Turned me off straight away….

Have fun everyone

Something that has not gone unnoticed by us and you don’t want to know what the share price would be now, without those options…

Mathew and Roger –

Time for you both to spend more time in footnote 21 of FWD.

For the last 6 years share count increased from 46.3MM Beginning FY06 to 57.8MM end FY11 or a 25%/11.5MM share count increase over the 6 year period. However options have very little to do with it.

11.8%/6.8MM of the increased sharecount was from DRP, 4.3%/2.5MM from acquisitions leaving 3.9%/2.3MM from options or ~0.66% per year. Bigger fish to fry than trying to mistakenly tar these guys as option abusers!

And remember….over those 6 years FWD has paid out 150MM in dividends plus increased shareholder equity by 86% and still earns a respectable ROE of ~25% ….. and you guys are seriously worried about 0.66% dilution from options each year??

Don’t major on the minors!

Kisses, LL

Sorry Lindy, I think I should ask you to tot up all the 3Ys and 3bs before we agree because I suspect you are unwittingly understating it. Go back further and measure the percentage increase of each directors holding and then ask if it lines up with your return as a passive shareholder over the same period. I like the fact that you tend to respond where there is an opportunity to contradict. What we must consider Is whether the remuneration policy of directors is aligned with shareholders. Share price would be higher. And don’t forget the more options you exercise, the more dividends you keep for yourself.

3Y/3B filings must foot to issued capital in the FY AR filings – to FY report date. The numbers are right for the 6 year period I outlined. Sharecount increased a mere 2.3MM over the 6 years or 0.66% per year from issued options. If you believe the growth and ROE will continue and you can get at a good discount to IV then thinking these guys are options abusers is off base.

” Go back further and measure the percentage increase of each directors holding and then ask if it lines up with your return as a passive shareholder over the same period. ”

It will never line up Roger – you know that. When you are granted a $0 cost option the return on Invested capital is infinite compared to a passive shareholder who has to invest initial capital at the current share price.

Kisses, LL

…and that’s the point. So more is less.

Hi Lindy,

I appreciate your reply very much thank you.

I take it that you are an American perhaps…and maybe use to American businesses whose management quite often have issued more than 3-5% of outstanding shares as options to staff.

Whilst Fleetwood execs have not gone as far as re-pricing the options which in my opinion is worse than having 4.5% of total shares issued as options. Re-pricing occurs more than people care to realise.

Lindy imagine if you owned all 58.6m shares or 100% of the business and then all of a sudden you only own 96% and not a single cent has been paid for those shares…wouldn’t you be quite cranky??

Hi Roger,

Maybe a blog on what constitutes bad corporate governance and what to look for could be great for other members??

Matthew,

The current options on issue have an exercise price of $8.02 – why do you say not a single cent has been paid?

Secondly, the options are only exercisable if shareholder returns exceed 15% and the ASX 300 index return is exceeded. This is a high hurdle compared to many companies.

Further, share based payments are expensed through the profit and loss. If they are used excessively, then profits suffer. This has not occurred. Staff need to be remunerated. If this is not done by share options, then it is cash – either way it is an outflow that is part of the cost of doing business.

Finally, if you look at the remuneration paid to directors and executives in the remuneration report, amounts are relatively modest compared to many other listed companies.

Sorry, no bad corporate governance going on here.

Michael,

Suggest you read the notes to the Annual Report, where it states;

“In accordance with the provisions of the plan, employees with more than 2 years service with the consolidated entity are granted options to purchase ordinary shares in Fleetwood Corporation Limited. No amounts are payable for the options.”

Shares issued under the option plan last year were at an average price of $6.89, which is a substantial discount to the share price.

You say the current options on issue are at $8.02, but in fact the following is the case;

243,150 @ $6.38

324,386 @ $8.30

217,825 @ $4.20

203,217 @ $6.00

665,280 @ $8.02

All destructive of shareholder value and I would suggest that simply working for 2 years is a ridiculously low hurdle.

Peter

Hi All – re-Fleetwood’s share options. While unarguably destructive of shareholder value, there is also some merit in “aligning the interests of employees with those of other stakeholders in the company, such as shareholders”, as some companies choose to put it. In other words, if more employees are also shareholders, the value of their work may tend to improve.

This is common practise in many companies in many industries. For instance, Coca-Cola give all permanent employees (not just executives) matched shares ($ for $ up to 3% of base salary) for shares bought through their salary sacrifice ESP (Employee Share Plan).

F.H. Faulding used to give all permanent employees $1,000 worth of shares every year (before Mayne bought them).

I’m not saying that it’s necessarily in share-holders best interests, but issuing shares to employees at a discount is very common practise and is often seen as more useful than cash for aligning employees interests with those of the company and shareholders.

If most of the workforce are shareholders, their attitude changes somewhat, and this does (hopefully) affect their work – in a positively way.

It always has to be viewed in the context of overall remuneration. If you remove any share-related benefits, you arguably have to pay more cash to retain or attract the workers you are after.

When shares are provided for free, there is no downside. Aligning the upside only, is not aligning at all. And when shares are cream on top of a generous salary one cannot claim that remuneration is “at risk” either.

Hi RM – to clarify – my comment was actually not in relation to shares given to executives for free, but was in relation to Peter’s comment about employees with more than 2 years service being granted options (at no cost) to purchase shares in the company. My understanding is that this relates to everyday salary and wage employees of the company, and that the shares are not free, as the options have an exercise price that ranges from $4.20 to $8.30 per share, depending on when the options were granted.

Granting share options to executives on top of generous salaries is a different matter, but considering the performance hurdles that the FWD board has put in place, I don’t consider them to be unreasonable either.

Agreed.

Peter,

The post I was replying to said not a single cent was paid for the shares. You say it is $6.89. That is not zero?

Hi Michael,

You are correct as the staff pay the strike price.

Sorry I made a mistake with my wording but regardless I would still be quite unhappy…Peter is also correct as the staff have not paid anything for the option to buy at prices far below both the market price and the intrinsic value.

To redeem myself somewhat I must have been confused with yet another ASX listed business the scores a very high quality rating I was looking at where the shares simply vest to the employees and no consideration is payable for either the options or the shares themselves.

If a CEO is “only” getting paid $100m in today’s dollars and all other CEO’s are getting paid $500m…that does not justify the $100m pay packet…plus if the CEO does not hold a big lick of the business whose interests is he really aligned with.

A CEOs pay packet can also give you an insight into what they are interested in i.e. shiny new cars, houses, boats etc

As for your comments on the accounting front the actual economic impacts are vastly different.

I am a huge fan of employees sharing in earning increases and leaving the increase in value to the owners. Pay a cash bonus any day over issuing options.

Fleetwoods management are selling parts of the business at a discount to what its worth…how is that great for existing shareholders??

In my own experience my biggest strength has been an ability to be able to say no to an investment….