Investments like Resmed help us sleep better at night

Resmed (ASX: RMD) – the Aussie sleep apnea treatment business – is a company we really like. It’s the largest position in the Montgomery [Private] Fund and second largest in The Montgomery Fund. And its 1Q results were again impressive, propelling the stock price to all-time highs.

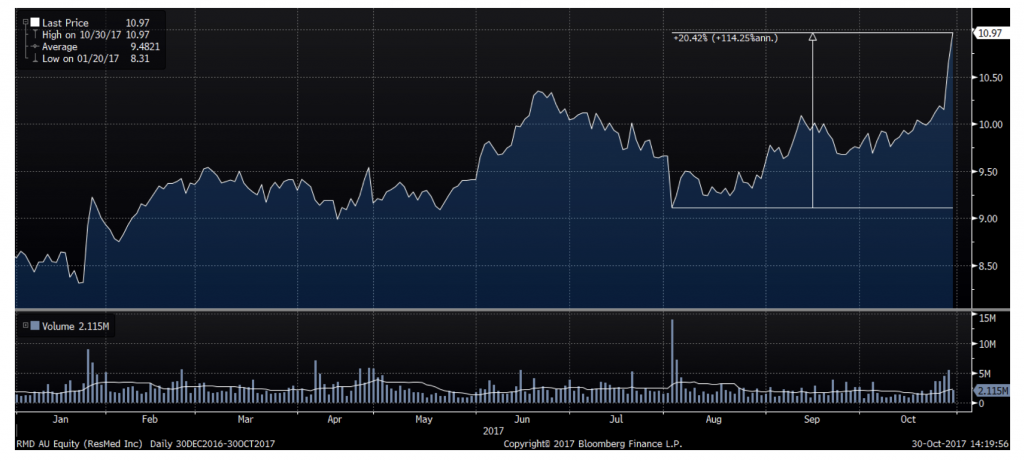

We have repeatedly reaffirmed our liking for Resmed (see our June post and August video). As mentioned in the video, we strongly believed at the time of the full year results that management’s guidance was very conservative, so we took advantage of the weakness in the share price to increase our position in the company.

With the recent release of its 1Q results, it is now becoming even more obvious that the market misinterpreted the guidance given in connection with the full year results. What the market took as disappointing in the guidance was that the management team was not guiding for a significant uplift in gross margin which would be expected if high margin masks shipments were to recover after a supply constraint associated with the introduction of a new model.

The 1Q results were very encouraging in that, even though gross margin did increase a bit, the reason it is not increasing more and why management is not guiding for a strong increase in margins is becoming clear to investors. The reason being that the sales of devices (the pumps you attach the masks to) are very strong which is indeed a positive development as it:

- increases the installed base and sets the company up for the long term with recurring replacement mask sales and software revenues and

- Is in itself a very profitable business even if not at the same absolute margin level as masks.

The result is that the share price was up 3 per cent yesterday and is now more than 20 per cent above the level it fell to after the full year results and where we increased our position to take advantage of the misinterpretation of the guidance.

This is therefore a good time to again reiterate the point how investors can take advantage of misinterpretations by doing the work and really understanding what the underlying drivers are.

Please note that this is not a recommendation to invest in Resmed. We may change our view or position in a stock at any time for a number of reasons including movements in share price.

The Montgomery Funds own shares in Resmed

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Darren,

Thanks for the insight. It is correct that parts are expensive, especially in Australia which is a high margin market (US prices are much cheaper as that market is a insurance reimbursed market and the distributors negotiate harder with the suppliers).

It is quite common for a lot of industries to make their highest margins on spare parts, the auto industry is quite famous for that and there you see a big difference in pricing between the OEM parts and non-OEM parts. The CPAP industry has not got the same scale as the auto industry so we have not seen companies starting to make spare parts that fits other companies equipment.

I was told by a client that there accessories are very expensive. He paid $100 just to replace the strap on the mask and complained about it and so had alot of other clients..just a tit bit of insi g t.