If you don’t already own Nvidia, should you buy it?

After the disaster for equity markets in 2022, calendar 2023 saw investors return to rewarding robust fundamentals, but only for a very narrow band of companies. Perhaps it was the fear of further rate rises or the fear of recession, but investors concentrated their bets on only the most liquid securities, those of mega cap companies.

And since the 1970s, whenever disinflation has been accompanied by positive economic growth, the equities of innovative companies with pricing power have done well. Calendar 2023 was no exception. Artificial intelligence (AI) was the innovation investors latched onto this time.

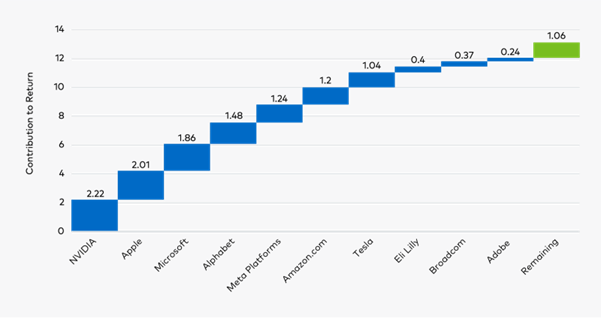

Those two themes converged to produce a distortion in equity market returns. Through the third quarter of 2023, the top ten stocks accounted for approximately 92 per cent of the S&P 500 Index’s market return, as shown in Figure 1.

Figure 1: 92 per cent of the S&P 500 Index return from ten stocks

Source: Polen Capital, Bloomberg. Bloomberg. Top ten contributors to the S&P 500 Index return 12-31-2022 to 09-30-2023.

The factors behind this unusual phenomenon are up for debate, and I have made an attempt at a reasonable explanation in my introductory paragraphs. Generally speaking, the low interest rate environment over the past decade, breakthrough innovations like generative AI, the emergence of platform businesses, and winner-take-all (or most) market dynamics can also be argued to be contributing factors.

Perhaps even more surprising, however, is that the index concentration is also visible globally. The same ten stocks account for 65 per cent of the MSCI ACWI Index return over the same period.

And the biggest single contributor is Nvidia (NASDAQ:NVDA). The decision has been a detractor to performance for fund managers and investors who haven’t owned Nvidia.

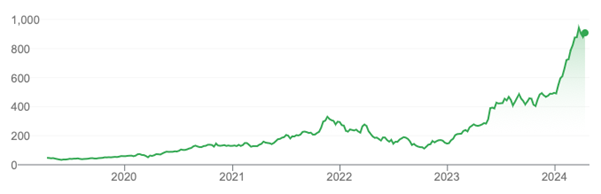

Figure 2. Nvidia share price

You would have done much better in absolute terms and much better relative to a benchmark (although most private investors don’t benchmark their returns against a fund or against an index) if you had owned Nvidia.

In Q1 this year, as Nvidia’s share price continued its ascent, its shares appreciated by 82 per cent, following a 239 per cent gain in 2023. And the relative effect has become more pronounced as Nvidia has become a bigger part, for example, (now 8.5 per cent) of the Russell 1000 Growth Index.

As we all know by now, Nvidia provides the foundational “building materials” for AI-driven technologies. It sells processors to hyperscale cloud companies (e.g., Alphabet (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT)) that, in turn, rent this capacity to businesses, which translates into recurring revenue for them.

Importantly, however, as Polen Capital recently pointed out to me, Nvidia’s business model does not produce recurring revenue, meaning that every year, it will have to sell an ever-increasing volume of graphics processing units (GPUs) to ‘lap’ such elevated comps and maintain its massive growth.

Triple-digit earnings per share growth, however, is extremely difficult, if not impossible, to maintain, lest the company eventually become ‘Earth’.

Meanwhile, the long-term demand for Nvidia’s processors is by no means certain. It’s reasonable to ask whether exponential growth is sustainable or, instead, whether we have witnessed a one-off acquisition phase of the technology to power AI.

Another question to ask is whether companies might have acquired too much capacity relative to their future business needs.

For example, certain AI-powered services may become less computationally intensive over time, reducing the demand for new processors. That might very well be the case if tech companies employ AI to solve the problem of becoming more efficient!

Generally, investors will do well investing in businesses with steady, consistent growth. Nvidia is the current flavour of the month, but historically, it has not demonstrated steady, consistent growth, nor does it enjoy a recurring revenue stream the way a SaaS or platform business does.

As you know, at Montgomery Investment Management, Polen Capital, Australian Eagle Asset Management, and Aura Credit Holdings, we are all long-term investors, not traders or market timers.

You will do just fine financially, building a portfolio of businesses that can steadily and with some degree of certainty, grow earnings in aggregate at a mid-teens rate.

I am not willing to dispute Nvidia’s transformational power for business, consumers, and the world, but I note there have been plenty of transformational technologies, which I have written about in the past – such as commercial air travel, the motor car and the television – that rewarded all consumers with a better quality of life but did not equally reward all investors.

The popularity of Nvidia displays parallels to the internet boom of the late 1990s, whereby the infrastructure had to be laid down only once. Companies like Cisco (NASDAQ:CSCO) (internet routers) and Corning (NYSE:GLW) (fibre optic cables) achieved elevated valuations in a very short time but subsequently failed to reach those previous highs.

Nvidia may yet prove to be very different. This time might indeed be different. Nvidia was recommended to me at a pitch for an investment in a startup called Zoox in February 2018 because it was then seen as THE chip maker of the autonomous vehicle boom. So, there are now many investors who own Nvidia, and there are many more who feel they have missed out. If you don’t own Nvidia already, I reckon it might be very dangerous to do so. And, of course, if it’s dangerous to buy it today, it may be equally dangerous to continue holding it.

In any case, you will still do very well following, with discipline, a path of focused investing amid a veritable sea of quality growth companies listed here in Australia and globally that aren’t Nvidia.