If you are going to forecast, forecast often

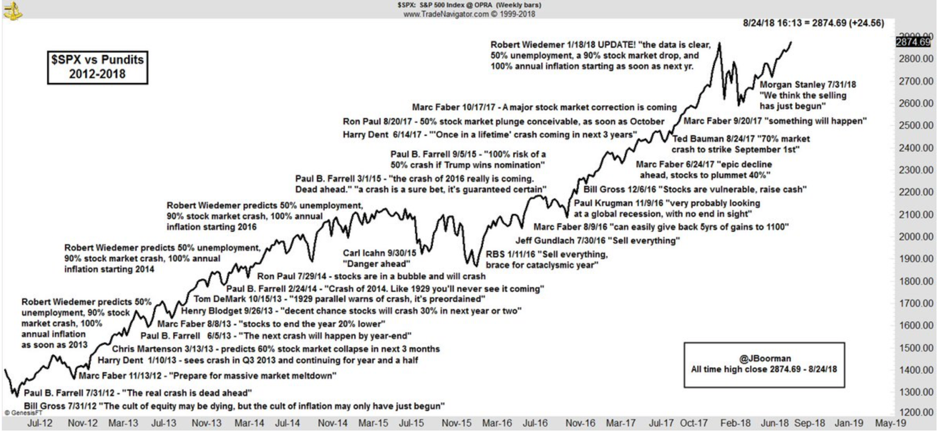

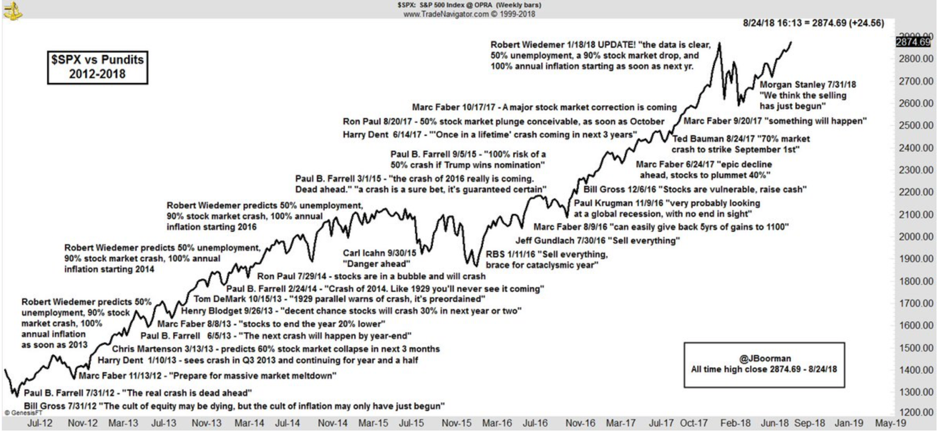

My very good friend Graham Hand at Cuffelinks recently published a chart by Jon Boorman from Broadsword Capital (a US-based hedge fund) who “has been tracking the comments made by famous bears…”

The chart demonstrates that 6th Century BC Chinese Poet, Lao Tzu, was on the money when he said; “Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.”

Much later, the American humorist, Evan Esar, observed; “An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”

Winston Churchill might have heard of Esar’s work, and once wryly observed himself; “I always avoid prophesying beforehand because it is much better to prophesy after the event has already taken place.”

But the forecaster’s life is perhaps best eulogised by Edgar R. Fiedler in his 1977 book, The Three Rs of Economic Forecasting-Irrational, Irrelevant and Irreverent; “He who lives by the crystal ball soon learns to eat ground glass.”

Click on the image to open a bigger version.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Even a stopped clock is right twice a day though.

Those who predict dont have knowledge. We need to add a qualification to this. It should go

Those who make predictions dont have knowledge or do have knowledge but work for large financial institutions from which the public expect learned sounding one sentence forecasts

Most of these investors have kept investing despite their bullish comments. reminds me of a comment I heard on Bloomberg one night “we have never had so many fully invested bears! Carl Icahn has had enrormous success during this period despite his negative predictions.

I’m waiting for Marc Faber to say something bullish, then I know it’s time to sell everything!

yes, and he certainly seems to forecast often!

Here’s a forecast for you, I bet Marc Faber will still be many times more wealthy than both of you on his death bed, he has obviously been right more times than he has been wrong, investing is all about predicting the future as you have done many times on this site Roger, and been correct with most of them. I find listening to insights from these big hitters fascinating.