IDP Education continues to be a high-class business

International education is big business in Australia, and one of the firms benefitting from the student boom is IDP Education (ASX:IEL). In the half year to December 2018, IDP maintained its record of producing very strong, high quality results.

In its core value driving IELTS (International English Language Testing System) business, volume growth of 18 per cent in the 6 months to December almost matched the 23 per cent growth recorded in the second half of the 2018 financial year, despite 2H18 volumes being boosted by the reduction in test volumes in India.

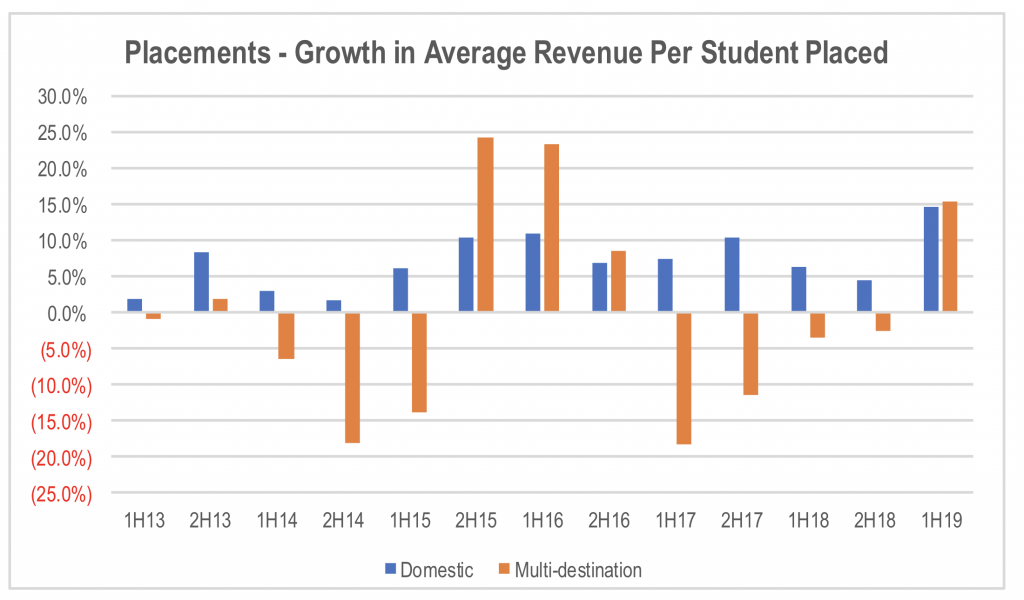

But it was the international student placements business that stole the show in the period, growing revenue by 40 per cent relative to the same period the year before. Volume growth was strong for both Australian university bound students (+9 per cent) as well as for IDP’s multi-destination (+40 per cent), but the biggest surprise came from the strong growth in the average revenue per student placed at an increase of 16 per cent in constant currency.

This strong uplift in average revenue per student placed was driven by a number of factors including positive mix shift to higher fee paying undergraduate and post graduate courses, tuition fee inflation, improved contracting terms as well as the initial benefits of the Student Essentials initiative. The chart below shows the acceleration in average revenue per student placed in recent periods.

Source: IEL

Of particular interest is the Student Essential offer. In the period, IDP offered students placed into Australian institutions a health insurance package under a pilot programme. The company commented that 42 per cent of the students placed took up the offer, for which IDP earned a commission from the health insurance provider of around A$150. Given that private health insurance is a requirement for an international student in Australia, it is not surprising that the take up was high even in the first year it was offered. This contributed approximately A$0.8 million of incremental revenue for little incremental effort from counsellors and at very high incremental margins.

IDP is looking to launch a similar service to provide access to accommodation in the current six-month period. There is the potential to source a wide range of services for students over time, as well as the potential to extend the products into the multi-destination placements. This will significantly enhance average revenue per student place and gross margins in the Student Placement business over the next few years.

Growth runway

There remains enormous growth potential for the Student Placement business given the fragmented nature of the industry, combined with the rapidly growing and increasingly aspirational middle-class population in Asia. Additionally, IDP is yet to roll out its full multi-destination product suite in most countries. At present, India is the only country in which IDP offers access to all of its international institutional partners.

The acceleration in revenue growth in 1H19 occurred while the company continued to lift its investment in the business, with the company rolling out computerised testing to 23 countries so far, as well as investment in the company’s core technology platforms and capabilities.

By the end of FY19, IDP will have largely rolled out its global platform across its network, the number of its markets operating a global contact centre will increase from 11 to 18, allowing for greater data capture, and more efficient marketing and follow up to leads generated by the company’s websites and mobile applications.

In its 1H19 result, the company noted that student placement leads had increased 35 per cent relative to the same period in the prior year. Lead generation is the primary bottleneck to volume growth in the business and the company’s digital platforms are driving an acceleration in this key growth indicator.

However, there is a lag in leads turning into actual billable volumes. This can be as long as 2 years. Consequently, the company’s earnings results are yet to benefit from the acceleration in lead generation from its digital capabilities. This is likely to start to flow through in FY2020 and FY2021.

At the same time, the roll out of computer based IELTS testing is likely to be completed, allowing the company to reduce the number of test centres offering the paper based product. This will deliver an uplift in product quality and flexibility as well as a reduction in operating costs for IDP.

With the period of heavy investment to upgrade the company’s capabilities, competitive advantages, and product quality reaching completion at the same time as the benefits of the investment starting to migrate from accelerating lead generation to actual placement volume growth and reduced costs, FY2020 and FY2021 could prove to be very big years for IDP shareholders.

The Montgomery Funds own shares in IDP Education. This article was prepared 18 February with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade IDP Education you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Don’t know about this company but it I have had concerns about ESL operations in Australia for some time.

It is fairly well acknowledged that the tertiary sector has been passing students that have a poor grasp of English. My view is that these degrees have been more about status and access rather than reflecting efficient learning. With new information technologies instruction in business and English is likely to be much improved.

” combined with the rapidly growing and increasingly aspirational middle-class population in Asia.”

I would suggest to steer clear of this sector especially in an environment when China and surrounding area are shaky.

Hello Stuart, thank you for the update on IEL. I hold IEL and agree it is a quality company with bright prospect, however by my estimate it’s valuation is getting a bit stretched. Could you comment on this?