IDP capitalises on global demand for a good education

IDP Education (ASX:IEL) is a provider of international student placement and English language testing services. It also owns English language schools in South East Asia and organises educational events and conferences. IDP’s strong result for the six months to December 2016 saw a spike in its share price, and confirmed our faith in this high quality business.

We hold IDP in the portfolios and consider it well placed strategically to benefit from rapidly increasing global demand for high quality tertiary education. Accelerating technological change and advancing levels of commoditisation of traditional forms of labour means that tomorrow’s workforce needs to develop new skills on an ongoing basis in order to adapt and evolve with the changing landscape and greater skill redundancy. Tertiary education is a key pillar in being able to differentiate an individual’s skills.

The company has four business units. The English Language Testing and Student Placement divisions account for more 90% of the company’s revenue and gross profit. The English Language Teaching and Event Management divisions deliver the balance.

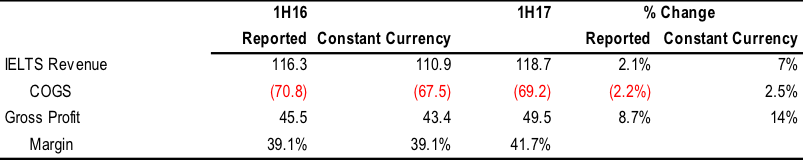

The core English Language Testing business grew volumes by 3.2% during the period. While this doesn’t appear to be too exciting, the underlying rate of growth was stronger than this given IDP was negatively impacted by the temporary disruption caused by the Indian Government’s change in currency denominations in November and December. Management estimates that excluding this, volume growth was around 6%, with a strong contribution from the new Nepalese and Canadian testing centres, as well as growth in the Middle East. With Indian volumes returning to their pre-disruption growth pattern, overall volume growth is expected to reaccelerate back toward this level.

Average unit pricing increased around 4% in constant currency, highlighting the pricing power in the business. This, along with cost reductions, delivered higher gross margins in the business, resulting in 14% growth in gross profit on a constant currency basis.

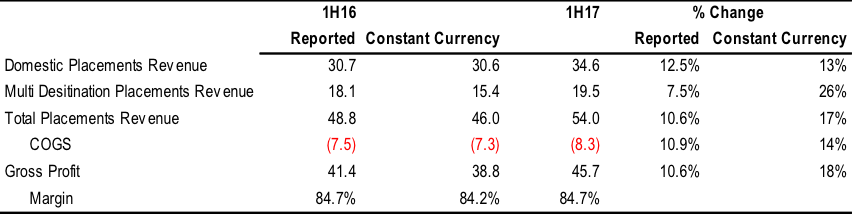

We continue to see the benefits of the lower AUD and proactive government initiatives driving export opportunities for Australian tertiary education institutions. Volumes of international students placed into Australian education by IDP through its overseas offices grew 10% relative to the prior year.

Equally heartening was the 7% increase in average commission received per student placed. While this was partially due to timing, IDP has been able to renegotiate its commission rates with a number of the Australian institutions to better reflect the volume and value of students it provides. This is expected to deliver incremental revenue and margin benefits over the next 18 months.

Student placements into non-Australian institutions grew by 32%, primarily as a result of strong growth in placements into Canadian (up 105%) and UK (+36%) universities. This offset a reduction in volumes placed into US colleges. This shows that demand remains strong irrespective of changes in the policies of individual governments toward overseas students. Growing overall global demand tends to merely flow to other more receptive destination markets.

Overall company EBIT grew 29% year-over-year in constant currency, while net profit after tax increased 33% on the same basis. Reported earnings growth was impacted by exchange rate movements, most notably the impact of the higher average AUD on foreign currency revenues. Reported results were also reduced on a one-off basis by around A$2m at the EBIT line due to FX hedging of the GBP at unfavourable rates. This will drop out of results progressively over the next couple of years.

In its result presentation, management provided greater detail around its strategy following the acquisition of Hot Courses in January. While Hot Courses gives IDP access to revenues further up the student education value chain, it will also provide invaluable prospective student leads for its Placements business. Hot Courses’ newly launched digital placement agency in India will enable IDP to develop a dual channel strategy on an accelerated basis.

The company also detailed opportunities to launch a range of value added student services to augment its core placements offering, with the pilot programme in China showing promising results.

This provides a long runway for growth that complements the strong core franchise of the company.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Stuart,

At current prices around 4.60, is there still value present?

Thanks,

Aaron

Hi Stuart,

Can you share your thoughts on the risks associated with the short term nature of the deal with Cambridge on English Language Testing?

Thanks,

Steve

Hi Steve, The IELTS test is co-owned by Cambridge Assessment, British Council and IDP. This structure was established in 1989 and was formalised with the IELTS Deed in 1999. The agreement is into perpetuity. The IELTS agreement can be terminated on 12 months notice by any of these parties. If any of the parties executes this option, then it dissolves the intellectual property of IELTS. As such, the IELTS brand and products would cease to exist and cannot be used by any of the co-owners. Given that this would ensure mutual destruction for all three parties, it doesn’t make sense for any of the parties to terminate the agreement. Consequently, we see little risk to IDP shareholders in the agreement.