How valuable is Iluka Resources’ MAC royalty?

One mining company that does not get frequently mentioned despite being in the ASX 100 Index is Iluka Resources (ASX:ILU). The company owns a significant asset known as the “MAC royalty” receiving an extremely lucrative royalty rate on iron ore revenue generated from BHP’s Mining Area C mine.

Iluka is involved in “mining” and processing mineral sands deposits, producing titanium dioxide products such as rutile, synthetic rutile and ilmenite that are primarily used in pigments and paints.

Iluka also produces zircon which is primarily used in tiles and ceramics. In terms of global significance, it is a top three producer in both titanium dioxide and zircon production.

Now to the “MAC royalty.” The royalty – entered into in 1994 – entitles Iluka to receive a royalty rate of 1.232 per cent of iron ore revenue generated from BHP’s Mining Area C mine, as well as a step up in payments for an increase in production capacity from the mine. The royalty is extremely lucrative for Iluka given the long reserve life of the Mining Area C mine, and no exposure to operating costs (being a royalty on revenue – not profitability).

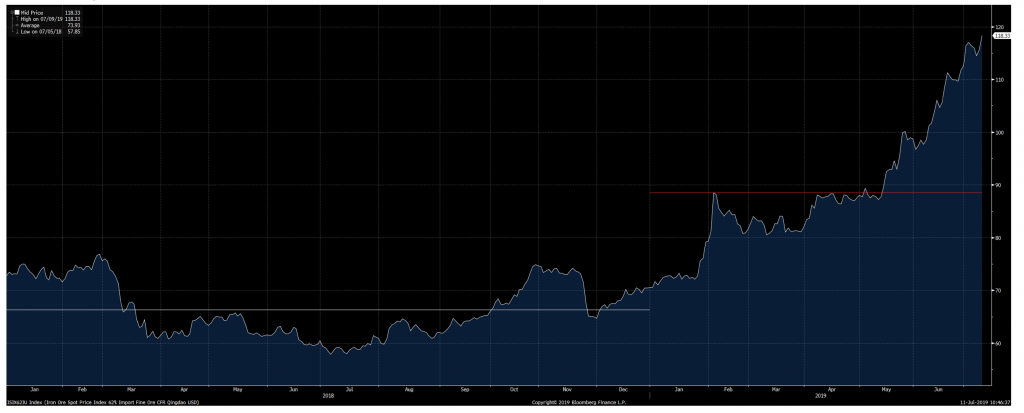

Iron ore prices boost MAC revenues

For those who follow ASX mining companies, you would already be aware of the recent spike in iron ore price caused as a result of the tragic tailings dam spill at the Córrego do Feijão mine in Brazil. For Brazil – and mine owner Vale – it is the second incident of its kind in just 4 years, given the previous tailings dam spill at Samarco, the 50-50 JV with BHP Billiton. Given Vale’s status as the world’s largest iron ore producer, the incident has unsurprisingly caused significant disruption to their operations and global iron ore supply, leading to higher iron ore prices.

While higher iron ore prices benefit iron ore producers (as well as the Australian government), Iluka also stands to benefit through its MAC royalty. In 2018, Iluka received $56 million cash from BHP from the MAC royalty when the iron ore price averaged US$66/t – or A$88/t. The amount is likely to step up this year given the move in iron ore prices, with the year to date average being US$88/t, equating to A$124/t. Assuming the averages hold, this would lead to an additional ~$20-25 million of cash flow to Iluka.

Iron ore price from 2018

Source: Bloomberg

How much could a stand-alone MAC be worth?

The MAC royalty gets periodic interest as a spin-out candidate given the view held by some investors that the royalty is undervalued within the ILU company structure. While a sale of the royalty would trigger a significant capital gains tax liability given its book value of just $3.6 million, it is possible the CGT event is not triggered via an in-specie distribution to shareholders of the royalty.

So how much could the MAC royalty be worth? Those who argue in favour for a spin-off of the MAC royalty point to North American Precious Metals royalty companies such as Franco Nevada and Silver Wheaton and the Price Earnings ratios of the companies as a reason why it is undervalued (Franco Nevada and Silver Wheaton trade at PEs of between 50-75x).

Applying this multiple to ILU’s MAC royalty:

- Using the A$56 million generated on MAC’s 2018 royalty equates to a valuation between A$3 billion and A$4 billion

- Using a forward projection of A$80 million for 2019 given the higher iron ore price equates to A$4 billion to $6 billion

Compared to the entire market capitalisation / enterprise valuation of Iluka at $4.5 billion (assuming minimal debt).

There are a few reasons why applying a simple comparison multiple is misleading, including:

- The outlook of the commodity the royalty is derived from – both the Franco Nevada and Silver Wheaton royalties are derived from precious metals prices whereas the MAC royalty is iron ore price related

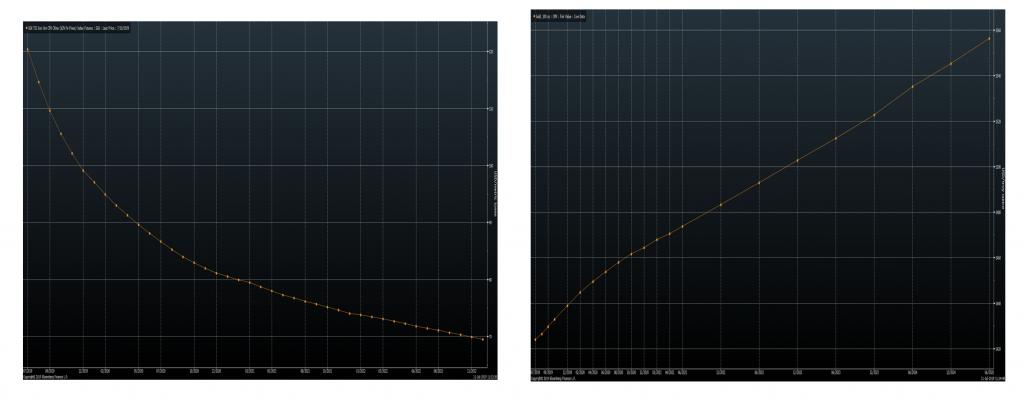

Most investors assume the iron ore price will fall over time given supply and demand dynamics, so assume a level of backwardation i.e. falling future price in their valuation of mining assets compared to precious metals, which usually trade in contango i.e. a higher future price.

Iron ore futures curve vs Gold futures curve

Source: Bloomberg

- The PE does not reflect the future increase in production from their royalty streams – in 2017, the value of the MAC royalty got a significant boost when BHP announced its intentions to expand Mining Area C’s production capacity with the expansion of the “South Flank.” The investment was expected to increase MAC’s production rates from 55 million tonnes per annum to 140 million tonnes per annum over time.

The increase in projected value of the MAC royalty was over 2x after applying a time discount. Now with the higher production rates closer to commencement, the additional benefit should flow to ILU’s shareholders over the next 3-4 years.

Using a discounted cash flow (DCF) approach

The DCF approach will capture both the expected backwardation in iron ore price, as well as the additional capacity expected from the MAC area over time.

Using this approach will yield a valuation of anywhere between A$1.5 billion to A$2.2 billion, depending on your view of the long-term price of iron ore in Aussie dollars as well as the appropriate discount rate. This value of the MAC royalty is more likely underpinning the current ILU market capitalisation of A$4.5 billion.

Regardless of your view on the value of the MAC royalty, there are arguably benefits for ILU in keeping the royalty over the next few years given the projected capital expenditure for greenfield and brownfield developments – for example the cash-flow from the royalty will help to maintain the integrity of the balance sheet and without the need for new equity.

While it could be argued funding development projects should stand on its own merits without the need to rely on the MAC cashflow, the royalty helps to buffer the unpredictable nature of the mineral sands commodity cycle, while still providing a benefit to shareholders longer-term.

Iluka Resources is entitled to receive 1.232% of revenue generated from BHP’s Mining Area C mine. Just how valuable is this? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

If the iron ore is worth $A1.5b to $A2.3b, this a means the mineral sands operations must be worth $A2.2b to $A3.0b to justify the current $A4.5b market cap. even. Have you done the sums on the sands?

Hi Graeme,

Unfortunately I have not done a recent evaluation of the mineral sands business following the production downgrade / deferrals as a result of a change in development plans in Sierra Rutile.

Joseph