How to Track the Omicron Variant in Gauteng

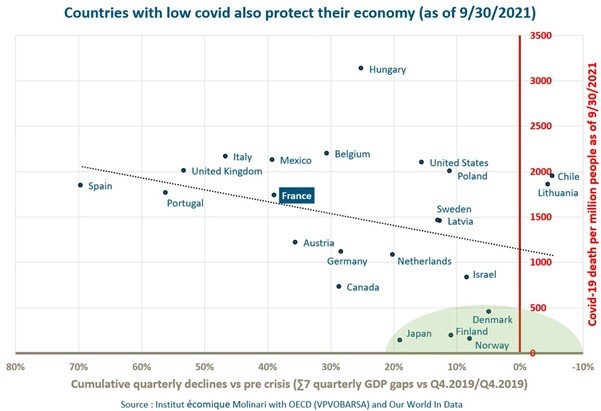

Gauteng, is the region of South Africa with the largest hospitals near to where Omicron was first observed. Before we talk Omicron, note new research from Paris based thinktank Institut économique Molinari (IEM) reveals countries that protect against COVID-19 do better economically.

Figure 1 reveals countries with low COVID-19 do better economically. A thought for NSW Premier ‘Let it Rip’ Perrottet. Free markets can be great, provided they are also free from COVID-19 related set-backs.

Figure 1

Markets reacted negatively (and possibly exacerbated by holiday conditions) at the end of last week to the emergence of a new variant of Coronavirus first labelled B.1.1.529 and now named Omicron.

First spotted in Botswana and first announced early last week by the health department in Pretoria, South Africa, rising infections (a fourfold increase in a week) and a cluster of new COVID-19 cases had emerged among students at Tshwane University of Technology and in the townships of Atteridgeville, Mamelodi and Soshanguve near Pretoria.

With nearly three quarters of genomes sequenced (n =71) from specimens collected as early as November 14 from Gauteng – a region which takes in Jo’burg, Pretoria and the aforementioned towns. The R rate (R is the number of people that one infected person will pass on a virus to, on average) could be as high as two (2) in Gauteng.

In Botswana, 460kms from Pretoria, scientists testing COVID-19 samples taken from three patients dating back to November 11 revealed a brand-new variant, displaying an unprecedented 50 mutations.

The spike protein, the protrusion on the outside of the virus, had 30 mutations. Ten of the mutations are on the receptor-binding domain, which is the specific part of the spike protein that attaches to human cells. For comparison, Delta has only two such mutations. The better it can attach to human cells, the more transmissible the virus is and the faster it can spread, as appears to be the case in Gauteng.

The World Health Organisation’s Technical Advisory Group on SARS-CoV-2 Virus Evolution (TAG-VE) convened on 26 November 2021 to assess the SARS-CoV-2 variant: B.1.1.529 after South Africa reported to the WHO on 24 November. Skipping the ‘Variant of Interest’ labelled, the WHO jumped immediately to Variant of Concern.

According to the WHO, Omicron has a large number of mutations, some of which are concerning. “Preliminary evidence suggests an increased risk of reinfection with this variant, as compared to other VOCs. The number of cases of this variant appears to be increasing in almost all provinces in South Africa. Current SARS-CoV-2 PCR diagnostics continue to detect this variant. Several labs have indicated that for one widely used PCR test, one of the three target genes is not detected (called S gene dropout or S gene target failure) and this test can therefore be used as marker for this variant, pending sequencing confirmation. Using this approach, this variant has been detected at faster rates than previous surges in infection, suggesting that this variant may have a growth advantage.”

Cases have now been confirmed in Belgium, Israel and among passengers from South Africa to Sydney.

While it is safe to conclude the virus is more transmissible, it is still too early to tell if it is more dangerous than Delta or whether it can evade our vaccines. We will not know until scientists have assessed Omicron against antibodies and vaccines. The first antibody lab results are expected to be published this week and Pfizer claims it will be able to publish an assessment of its vaccine performance within two weeks.

For investors, the single most important news will be the efficacy of current vaccines against severe cases of the new variant. Markets will return to optimism if the new variant is more transmissible among vaccinated populations, but not more deadly and current vaccines (or those being worked on – see below) remain highly effective against severe conditions and death. See below link to track Gauteng hospitalisations.

Variants will continue to develop and emerge from third world countries because so few inhabitants are fully vaccinated. Indeed, under newly emerging definitions of “fully vaccinated” that require a third booster shot, only one per cent of the world qualifies.

It is therefore imperative wealthy nations work collaboratively to vaccinate the third world. As one esteemed virologist has pointed out “it’s not just altruism that should drive our effort to immunise people in poor countries, rather it’s a matter of our survival and hence our return to living normally.”

Until then COVID-19 risk remains a live and present risk for markets and uncertainty (and associated volatility) will persist.

According to the Sunday Times in the UK, “On Friday night – just three days after scientists in Botswana published the genetic sequence for the new virus – Moderna announced it was preparing an Omicron-specific booster vaccine. Pfizer is ready to do the same.”

With Europe’s ongoing COVID-19 concerns and reimposition of restrictions, expect markets to remain extremely sensitive to COVID-19 news for the rest of the year.

And investors, and politicians, might like to monitor Gauteng Covid hospitalisation trends