How the rising US 10-year bond yield could affect your portfolio

Macro considerations are not a major driver of investment decisions at Montgomery. But when we assess the potential risks and returns of a business, we still need to be aware of major global developments. Right now, a key development is the rising US 10-year Treasury bond yield – which could have a big impact on a number of stocks.

In recent weeks, there has been significant financial media coverage on the rise of the US 10-year Treasury bond yield and its impact on equities markets. Indeed, as the US unemployment rate hits lows not seen since 1969 at 3.7 per cent, the consensus belief is that rates will continue to rise given the upward pressure on inflation as the demand for labour leads to wages growth.

So why is the US 10-year Treasury yield important? Put simply, the US 10-year note is the market’s preferred instrument in assessing the risk-free rate and provides the barometer for the rate of return required on pretty much every other financial asset class – bonds, equities, property, infrastructure, private equity – even US household loans and mortgages. As the US 10-year bond increases, investors will demand a corresponding increase in return for holding other assets, which drives down the price of other assets. This makes the US 10-year Treasury note (and yield) arguably the single most important financial asset in the world, while its predictive powers are believed to include future expectations on US inflation and economic outlook.

US 10-Year Treasury Yield

Source: Bloomberg

It is now widely accepted the loose monetary policy adopted by the Fed that led to US 10-year yields reaching unprecedented low yields in 2016 has helped drive asset prices up globally. The asset classes that have arguably benefited the most from this phenomenon are those with “long duration”, i.e. those whose cash flows are extended over a long period into the future so investors would need to wait longer time periods to receive these cash flows. Examples of these assets include fixed income securities with low fixed yields and long-dated maturities, infrastructure assets with long-term stable returns and property assets and rental income. As future cash-flows are now discounted to today’s dollars at a higher required rate of return, the value of these future cash-flows declines.

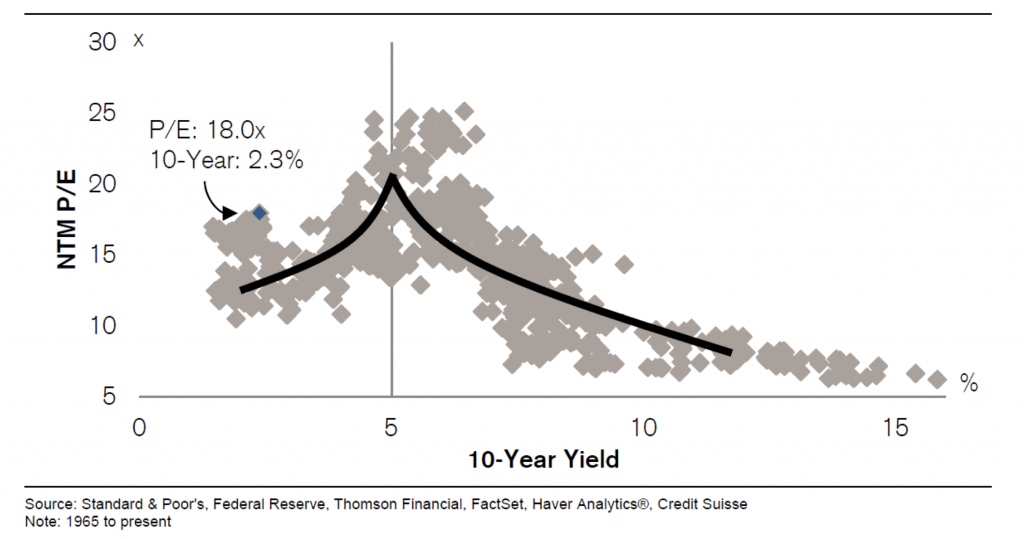

Conventional wisdom suggests equities would also be similarly impacted, as investors discount the value of future cash-flows at higher rates of return and hurdle rates for investment increase. However, research from Credit Suisse suggests the market has historically rewarded equities in a rising rate environment below a certain threshold (5 per cent over the long-term), while valuations start to reverse above this level. Their findings seem to suggest that the market views rising rates as a positive indicator for the trajectory of the economy, and hence corporate earnings – but only up to a point. It is also interesting that Credit Suisse proposes “3.5 per cent is the new 5 per cent”, given the collapse of economic growth and interest rates relative to long-term averages today.

Valuations vs 10-Year Treasury Yield

NB: NTM P/E or Next 12-month Price to Earnings ratio – is used as a simple proxy for valuation in this analysis

As 10-year bonds continue to move up, one of the potential impacts to be aware of as investors is a compression in high earnings multiples that the market has been willing to pay for high-growth companies which has helped drive the strong share price appreciation of these stocks. Another impact may be an increase in the yield investors demand for infrastructure stocks (such as Transurban Group) or property trusts, where the stocks have been valued off a difference in yield expectations and hence demonstrate a high level of correlation with movements in bond rates.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY