How much capital intensity does it take to sell seats?

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.

Capital-intensive businesses, such as airlines, erode shareholder wealth. Inflation ensures their maintenance and replacement is a significant proportion of cash flow, which could otherwise be paid out to shareholders. Parts plus labour, which protect the business assets from wear and tear, actually causes wear and tear on shareholders’ funds.

Raising capital and increasing debt, has hitherto been easy for Qantas, but the market is slowly coming to the realisation that it cannot continue. The market capitalisation of Qantas – the ‘value’ the market ascribes – is less than all the equity that the company has raised – much less.

As a result of the market’s slow migration to understanding the economics of airlines, fresh management have had to respond quickly.

The best measure of economic performance is Return on Equity (ROE). This year QAN achieved a ROE of just over four per cent. Meanwhile, Oroton shareholders have been enjoying eighty per cent returns. Did you know there are 267 companies that earn more than 15 per cent returns on equity?

The business of selling seats is an expensive one for Qantas, and while the business of selling the hope-of-getting-a-seat (the Frequent Flyer program) is extremely profitable, owning planes means the cash is always inhibited – it can’t be distributed to shareholder owners.

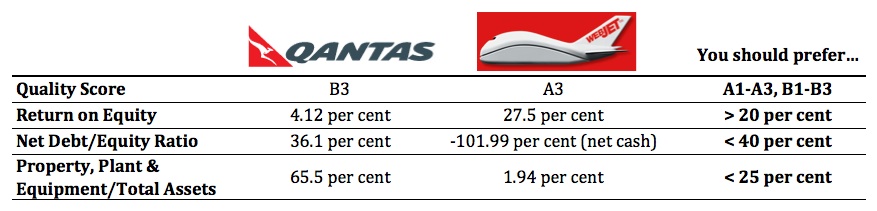

Qantas however isn’t the only seller of seats on planes. Indeed there are businesses that sell seats on planes and they don’t have any planes. Let’s compare two seat-sellers: Qantas and Webjet.

I believe the very best businesses online are lists – lists of jobs, lists of apps, lists of songs, lists of cars, lists of houses, list of flights and lists of seats. What is particularly attractive is that a business with a list of seats doesn’t have any planes. Sure its revenue is going to be lower, but what about its profit?

Let’s compare…

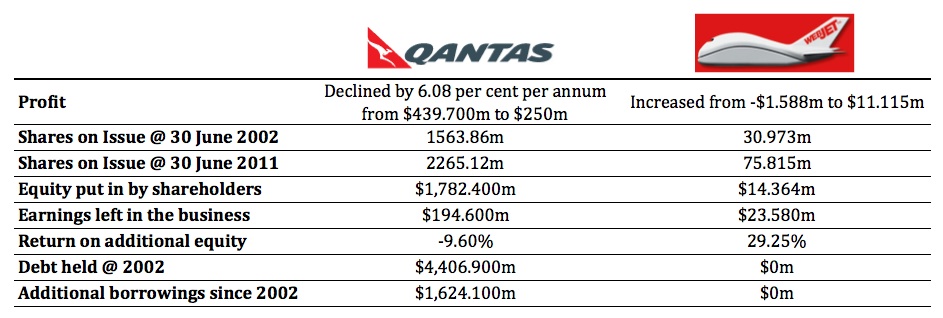

Now, lets take a look the economics of these businesses over the past ten years.

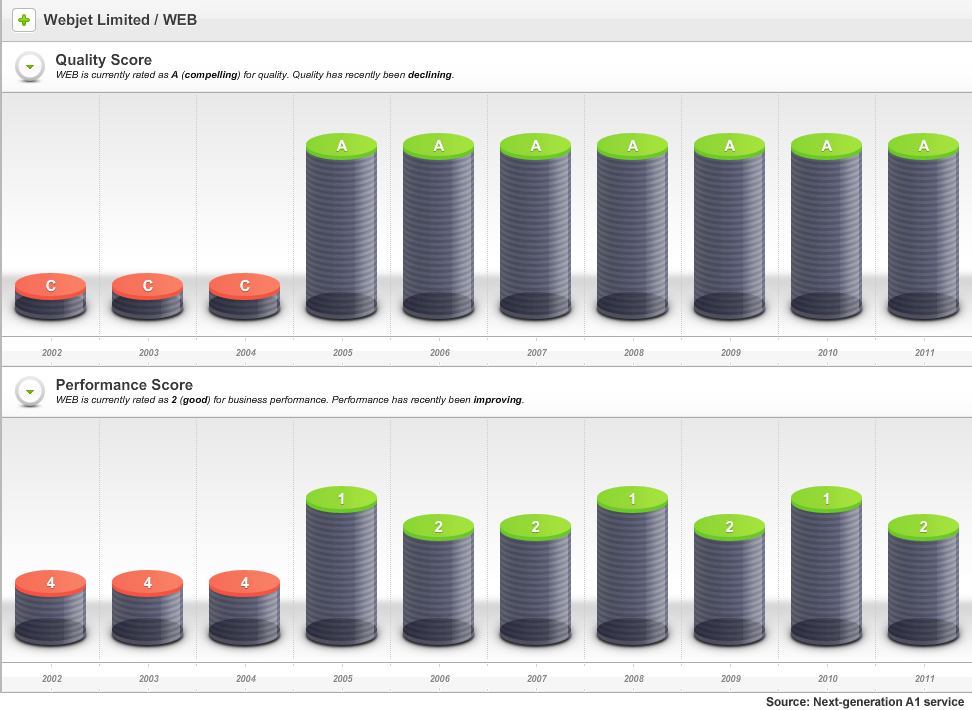

As the following sneek peek charts from our soon-to-be-released next-generation A1 stock market service display, Webjet has scored, on average, an A2 since 2005.

In this example, the Quality Score information tells us that something dramatic happened in the 2004/2005 financial year.

Webjet was once called Roper River Resources Company and in July 1999 the shares, under the ASX code; RRR, were trading at 25 cents. By March 2000 – near the peak of the internet bubble – RRR shares were trading at $1.38.

The reason is now obvious, although at the time it may have been a bit of a mystery.

In January 2000, Roper received a ‘speeding ticket’ from the ASX to which it responded on 14 January with the following statement:

“1. There are no, matters of importance, about to be released to the market.

“2. The Company is not aware of any information to explain the recent trading in the shares.

“3. The Company can offer no other explanation for the price change and increase in volume in the securities of the Company.”

“4. I confirm that the Company is in compliance with the listing rules, in particular, listing rule 3.1.”

On 27 January 2000 however – less than two weeks later – Roper River Resources (ASX:RRR) announced it was issuing 50 million shares to acquire Webjet Pty Ltd.

By June 2004 the shares were still trading at 15 cents, however the company announced the previous October that it was trading in the black for the first time. By November 2004, it was reporting 400 per cent monthly increases in sales. Almost every month to its full year results in June 2005, it continued to report 400 plus percentage increases in monthly sales.

And in that year Webjet’s Quality Score jumped from C4 to A1. As you can see, Webjet has maintained an A1 or A2 quality rating since.

By comparison, Qantas’s Quality Score profile has been more marginal. This should be unsurprising to many, if not most Value.able Graduates, who understand the downside of capital intensity. Lots of property plant and equipment results in more equity for a given profit, and that means lower returns.

So, what do you think?

With reporting season about to end, your mission, if you choose to accept it, is:

Source the latest Annual Report for each business in your portfolio. Go to the Balance Sheet and under ‘Non-Current Assets’ find ‘Property, Plant and Equipment’.

If you have any, how many capital-intensive businesses are hiding in your portfolio?

Making this process simple and easy is something we have been working on for you. We created our next-generation A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. The above graphics are just one

It’s an A1 service that is like nothing you have ever seen before.value

Value.able Graduates – your invitation to pre-register is coming soon.

If you haven’t graduated to guarantee your invitation, click here to order your copy of Value.able immediately. Once you have 1. Read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the ext-generation A1 stock market service, 30 August 2011.

Hi Roger,

I am struggling with the the part that says that Webjets quality score is declining, where its been an A for seven years, and the last time it changed it improved from a B.

Thanks Michael. You should be able to see it.

Hi Roger and others,

Firstly just wanted to say thanks for the book, the blog and your regular musings on various TV shows. I was immediately drawn to your value investing methodology because it struck a chord with how I had thought I should invest, yet hadn’t found so well expressed before. I had also been scared by all the mumbo jumbo that gets talked about shares in the more general media and by other so-called investment experts.

One thing in particular I’ve always nodded my head with you on is the need to invest in a quality business that has great future prospects; and in particular businesses that have created a competitive advantage which in turn create barriers to entry or competition.

In this respect, I’m not sure that having large PP&E is always neccessarily a bad thing as in itself can create a barrier to entry for competitors. When the capital outlay is high and there is a need to have skilled personel to run the business then it makes it a risky proposition for a new entrant. Although I completely understand your point about the depreciation of PP&E and the need for maintenance and replacement. However, if you have few or no competitors you can then charge much higher prices to cover this.

The problem for Qantas is that someone with the British experience and wealth in running a low-cost budget airline company has muscled into the Australian market because of the attractiveness of the previous margins Qantas enjoyed – and their (virgin’s) main approach to taking customers has involved a smashing of air ticket prices. This has been further escalated by Tiger. To put this into context, I was reading an unrelated book that mentioned that in the 1950s a one-way ticket from Melb to Brisbane cost 7 times the average weekly wage! Whereas now you can get a ticket for less than $100 (only a few hours work for most people).

On the other hand, the problem I have with businesses that provide lists is that these can be easily replicated. Sure, if that list provider has established a great reputation as the “go to” organisation, then that can make it hard for a new player to crack the market. But I have seen this easily overcome before if the new player provides better functions and has an effective marketing campaign.

Furthermore, how does a list provider earn money for their services? This is a question I always have of webjet in particular. I’m a user of their services but I never pay them – I just look up the best deals then go book directly with the airline. I can’t say that I’ve looked properly into how webjet makes their money – perhaps its mostly through kickbacks and advertising. But I’ve always thought their business model wasn’t that great – and if they are making a lot of money from listing flight prices then I can’t see it being that difficult for someone to imitate them.

Another example I see of this is in the real estate sector. I think realestate.com has some big problems. It used to be the best and really only place to look for property. However, this has been massively eroded by domain.com and onthehouse.com.au – both of which provide better tools and in the case of domain.com has a better search engine than realestate.com. Essentially their ability to provide a list is much better.

Interested to see what you and others say abotu this.

In the end my personal summary is that I wouldn’t invest in any of these companies!

Cheers

Andrew

Hi Andrew,

Your right, having high PP&E to assets or capital intensive is not neccessarily a bad thing as long as the company is earning high returns on its equity. But i don’t mind it as a rule as to something to watch out for as this means the company is more than likely to get into debt or see cash flowing more into the maintenance and purchasing of equipment instead of dividends, buybacks etc. Woolworths comes to mind as a company which is fairly capital intensive but has good returns on its equity.

i think you have some valid concerns about Webjet, i place them last out of all the online list sites on my watch list as i don’t think their competitive advantage is as strong as the others.

Their cash flow is good, with operating cashflow about 3.8 mill more than reported NPAT which is why i keep it on my radar although not given the same rating as a REA which is my number 1 list company.

As for REA vs Domain, the latest REA presentation which i assume is quite valid shows that REA is still the number 1 place by quite a distance and my observations ahve backed this up with all people visiting REA first and seeing as they usually have all the properties domain would have then there is no point going to domain. It also states that a nielsen online survey has shown that they have increased the gap between themselves and competition from 65% to 66%.

REA as i said is my number 1 list site, followed by WTF, SEK and CRZ as joint third and then Webjet. I couldn’t decide between SEK and CRZ as although they both have a strong competitive advantage there are issues i have with both of them. If i had to choose i would put SEK above CRZ as my problem with SEK is that they are very acquisition hungry, CRZ has a threat to its competitive advantage. Webjet i think doesn’t have all that much of a competitive advantage however and also i can see demand for flights decreasing unless some of the costs of living come down a bit and the australian dollar comes down to encourage people to travel domestically instead of overseas (this will also have an affect on WTF too i will add).

I wrote last year for one of the big newsletters, questioning the sustainability of Webjets competitive advantage and received an excellent retort from Webjets CEO. But time will tell.

I think i remember reading that during my eureka trial. I have to say i agree with you. Of course the CEO will disagree, my barber tells me i need a haircut and real estate agenst have a 24/7 mantra of “now is the best time to buy property”.

My “analysis” which i have done on list websites has shown that whilst people will go to Real Estate.com to look for a house most people i know will go straight to a specific airlines website to book tickets before webjet. In fact at the time i first had a look, i was the only personwho used webjet.

Webjet are a good business as can be seen by their financial results but they don’t have the strength and competitive advantage that would have me put them in my top list of companys in my opinion. As you say Roger, time will tell.

I sold my WEB for 3 reasons. In part, based on user experience. It would help if they had a ‘direct flight only’ filter for domestic flights and ‘most direct flight’ for international. I was also irritated with the barrage of indiscriminate promotional emails re flight and hotel deals. Finally, travel will likely be hit if economic conditions worsen.

The picture is obviously not the inside of a Qantas aircraft. Qantas domestic are yet to learn about new-fangled ideas like seat-back video, comfortable seats, and aesthetic lighting.

My observations of the majority of low return businesses are that frequently they are so focussed on maintaining razor thin profit margins that they lose perspective of the profit generator (ie the customer). This is the case whether or not the low margins are due to high PP&E or otherwise. Qantas is a perfect example though in my opinion. I have consciously avoided flying Qantas for the last 10 years and on the odd occasion that I have had to fly with them I have been reminded of the reasons not to. Sort of like a permanent competitive advantage for their competitors.

While it may not be up there with the most capital intensive (1.7 million), DGX HY report is interesting reading.

Here are some directors that could do with a copy of value.able.

The most disturbing quote in my mind is “A significant focus of the Group over the coming First Half of FY12 will be to return capital into the business to enable the development of other projects within the portfolio”.

A nice way of saying “ouch. We are out of cash. We can’t sell anything for what we hoped for so were off to the banks cap in hand”.

Obviously the bite of the property downturn is deep. Low sales despite a greater than threefold marketing and advertising spend.

This would have to be a nominee for worst report to date?

Roger,

Some business whose PP&E is a large part of their Total Assets are still fantastic are not capital intensive.

I think a better measure of capital intensity to be;

Capital Expenditure / Revenues = Capital Intensity Ratio

I would recommend looking for < 5%.

Have fun.

We all have our favourites. The nice think about PP&E v Capital Expenditure is that no estimating (splitting maintenance and growth) is necessary.

Buffett invests in capital intensive businesses too (see his comments about the Burlington Northern purchase that follows) but in those cases a very low cost of capital helps.

Depreciation is an inexact measure derived from a past transaction. It has none of the apparent science and precision found in estimates of fair value used for financial instruments. But as Buffett says, it is a real economic cost. For manufacturing and trading companies, fixed assets and depreciation are far more significant to measuring economic success or failure than financial instruments.”

and from Buffett

“In earlier days, Charlie and I shunned capital-intensive businesses such as public utilities. Indeed, the best businesses by far for owners continue to be those that have high returns on capital and that require little incremental investment to grow. We are fortunate to own a number of such businesses, and we would love to buy more. Anticipating, however, that Berkshire will generate ever-increasing amounts of cash, we are today quite willing to enter businesses that regularly require large capital expenditures. We expect only that these businesses have reasonable expectations of earning decent returns on the incremental sums they invest. If our expectations are met – and we believe that they will be – Berkshire’s ever-growing collection of good to great businesses should produce above-average, though certainly not spectacular, returns in the decades ahead.

Our BNSF operation, it should be noted, has certain important economic characteristics that resemble those of our electric utilities. In both cases we provide fundamental services that are, and will remain, essential to the economic well-being of our customers, the communities we serve, and indeed the nation. Both will require heavy investment that greatly exceeds depreciation allowances for decades to come. Both must also plan far ahead to satisfy demand that is expected to outstrip the needs of the past. Finally, both require wise regulators who will provide certainty about allowable returns so that we can confidently make the huge investments required to maintain, replace and expand the plant.”

Thanks for that Roger.

I use the spend on PP&E directly from the cash flow statement for that measure.

Independent Franchise Partners put out a fantastic paper with empirical evidence of the correlation between low capital intense businesses and high stock market returns, which I found interesting to read.

Roger,

Does your A1 service also hold Historical Valuations and when the valuations were changed ?

Can you show the changes in valuation for MCE over the last year or two including the dates they were changed at ?

thanks,

Rodney

Stay tuned Rodney.

Hi Roger

I am not as interested in whether a business is A1 or B3 but more what its future prospects are. Analysts forecasts are normally bullish, also in my opinion company guidance is often misleading and we should have quarterly reporting but don’t because the insider traders don’t want it.

The RBA appears to have slowed the economy, unemployment appears to be rising (employment for the Census will cloud things for a few months) and working out which businesses will be impacted the most is the difficult task.

Thanks Pat, Good thoughts. I for one am interested in three things; Quality, Value and Prospects.

Roger,

I posted a while ago, how I was interested to see how the FOFA reforms would affect Count Financial. It seems there is no need to monitor Count Financial anymore! A bid from CBA to buy the business with the board approval. The offer price seems fair and those who got in recently will make a nice profit ( COU share price were down as low as 0.80’s)

“Count said today CBA had offered to acquire the company via a scheme of arrangement at $1.40 a share — a premium of 32.1 per cent to its price of $1.06 yesterday — valuing Count’s equity at $373m. Shareholders can accept cash or CBA scrip.

The Count board, led by founder and chairman Barry Lambert, has unanimously recommend the bid in the absence of a superior proposal and subject to an independent expert concluding its in the best interests of shareholders.

Other Lambert family members who hold about 20 per cent of Count shares have also indicated they will vote in favour of the scheme, subject to no superior proposal being recommended by the board.”

Cheers

Edward

Ten times EBITDA does indeed seem fair!

Edward,

I was personally miffed to see this bid come through…would have rather waited for price to hit my estimate of value down the track and pick up the 10% dividend along the way.

Can not complain too much though I had been buying between $1.10 and $0.90 since May 2011 to just under a 4% portfolio weighting…I just would hate to be the guys who sold down heavily to the $0.80 cent mark only a few weeks ago only to see this offer come through!!

Count was positioning itself with an IDPS license and as an RE going forward to capture an investment margin rather than a volume based rebate from the fund managers…their advisers were predominately accountants whose clients are used to a fee for service structure so one of the best positioned in the financial planning space.

If you are interested check out their Strategic Review presentation to see what they had in mind.

Have fun.

…And Count (ASX:COU) has only ever been an A1 or A2.

Matthew,

Congratulations on the tidy profit. From my research of Count Financial, what impressed me most was the managements proactive response to the FOFA reforms and the large shareholdings by the Lambert family (serious skin in the game). I will have to do some more research into the financial services/wealth managment industry as I really want to get a holding in a well managed small cap business in time for the next boom!

Cheers

Edward

Unfortunately lists, like webjet, wotif, etc are often links to capital intensive companies. Apple has a good ROE, but the companies that actually manufacture are capital intensive. Some software companies may be also high ROE, they rely on the hardware, which is capital intensive ( the cost of chip foundaries). As a different examples consider companies that sell cigarettes. They externalise the real total costs to the health system.

Companies that sell coal get profits, and high wages at the cost of higher insurance costs to us all (papers that show extra carbon dioxide causes increased severe weather,-Perhaps changes in available potential energy and Convective Available potential energy? (Yasi?)) . Similarly companies that pollute. The directors managers, shareholders, that pay themselves well, but who bears the real cost of the pollution?

Other considerations are Infrastructure (roads for transport?) (dams for water?).

Robert

i think u should have compared it to its peers ie flight centre & not Quantas

Thanks for your thoughts Anthony. The point is still made and more dramatic for contrasting purposes.

I guess the point to be made here for Anthony is that every business must be judged on its merits if it is to be considered by us as an investment. It is as fair to compare Webjet with Qantas as it is to compare it with Telstra or DeadDog Funerals Limited, or any one of hundreds of fifth-rate companies. Businesses with good ROE and small capital investments are always likely to be better performers than those with costly, highly depreciating assets at the core of their revenue streams. Like aeroplanes for example. Try operating a new Rolls as a taxi, and you’ll see Qantas in microcosm.

Impressive, not the beautiful plane but the A1 Service demonstration. Can’t wait to be a grad.

In previous post, I admitted that NCM was a mistake before I read Value.Able. I followed the market sentiment and acquired it at a very high price.

Just double check as per Roger’s recommendation, PPE/Total Assets ~

2003 2004 2005 2006 2007 2008 2009 2010 2011

0.995 0.522 0.822 0.656 N/A 0.967 0.930 0.961 0.192

I’ve just learned something again. Most of the money (or assets) are for PP&E. The recent very good figure is because of the jump of Shareholders Equity, 13,9b compare to 5b last year, after all of the issues & buybacks. Record profit but ROE down to 7.7%.

Forecast FY12 Shareholders Equity approx 15b, but ROE still approx 9%.

Is this fundamentally good money making company or a “growth” stock? I think I’ve got the answer.

Thanks Roger. Another great insight and I accept the mission.

Hi Roger,

Looks good! – and I’m patiently waiting to see it. A little while ago I eyeballed the financials of Apple and compared them to Foxconn (who make most of Apples products).. Apple is doing much better to say the least. This post inspired me to do the same with Qantas and Boeing.. The situation here is reversed.. The manufacturer (a capital intensive business) is doing better than the airlines it is selling to, in ROE terms (4% versus 60 – 90 odd %).. Capital intensity shouldn’t mean always avoid.. It really comes down to competition and the price a company can get for its goods… Airlines in particular obviously can’t ask what they need.

RobF

The difference is that there are hundreds of airlines, but only (basically) two airliner producing companies Boeing and AIrbus (both protected by their governments).

And looking at their economics they need every bit of support they can get too.

G’day Roger, could you do something on companies that report in US dollars, and how we work out using the Valuable formula. Is it as easy as converting to aussie dollars on the day of the report with what the aussie was on that day? Also I have a large holding of MCE and I’m not overly concerned at the moment as it makes sense to me that if the world is pausing because of the mess in Europe and the US, then this is the reason behind a lack of orders being placed. If the oil price was rapidly rising and MCE had a poor order book then I would get out ASAP. I keep reminding myself that we are running out of oil and combined with the rapid rise of developing nations who are ditching the old pushy for a car, we will only run out quicker putting upward pressure on the oil price and the need to find more.

We have implemented a lot of processes to do that. Its taken some time to get it just right so I will let the community offer some suggestions Scott.

Scott, my suggestion is calculate everything in US$. when looking at IV you can convert back to AU$ but you may want to demand a bigger MOS just in case the currency goes against you. in addition when forecasting ahead, you may want to assume an even higher AU$ just to be on the safe side. cheers.

Scott,

Keep reassuring yourself about MCE, but I doubt it is going to help them. They are looking more and more like a good company run by sub-standard managers.

David

I’m loving the look of the new A1 service, so clear and simple to read, another quality Montgomery innovation.

I cant wait for the launch Roger.

All the Best

Scott T

Due to financial constraints i don’t have a portfolio at the moment, but based upon which purchases i would have done had i been able to invest i would probably say my most capital intensive is Woolworths at just over 40%.

This is not surprising as supermarkets can be quite capital intensive but luckily the cash flows and hopefully also inventory quickly through the company and they receive the cash pretty much straight away instead of waiting days/weeks for it to be received whilst being able to negotiate favourable terms with suppliers and pay them in around 45-47 odd days. Their return on equity too shows that despite the capital intensity they are able to perform at a decent level consistently.

Nice little peek at the next gen system as well. Having your quality scores will be a good little guide for us to conduct further research on. Stability counts for a lot. I am sure those that purchase this system will be well rewarded if they use it well.

I kind of like at the moment trying to work it all out for myself so that i can spot these things due to my own skill and judgement instead of a system but when i get confident and competent enough that i want a less time consuming way to get the relevant data i need to make a decision you can bet your Next Gen system will be the first place i go too if it still available. Best of luck to you in this venture Roger, i don’t think it will take someone with a crystal ball to see that it will be a success and good tool for investors.

Also with interest i went back to what i consider my first true value orientated investment (well before value.able though) which was Sunlad Group during the GFC where i used price below book value or NTA as a guide to buy. (Share price was around $0.28 and had book value of around $1.20). It worked out well with me doubling or tripling in the time and helped pay for an engagement ring. Although this scenario stills seems to exist I AM NOT interested in this company. Seek adn take your own advice.

As they are a property development company i thought they would have quite a high PP&E to Assets percentage however going by the strict balance sheet record you only get 4.88% which seems quite low. However, puttin gmy detective hat on, i see just above that inventory of $551,001. Looking into the notes this refers to (not surprisingly) property still under development which in my book still should be considered in PP&E (although i am sure accounting wise there is no problem) and this brings it up to 73.6% which sounds a bit more correct.

Would be interested to hear if others think the inventory in this case should be included and i am actually learning something in my post graduate value.able course.