How do we determine the cash weighting for The Montgomery Fund?

We are often asked to explain how we manage the cash weighting, and the most recent market pullback at the end of 2018 provides a useful example to illustrate our approach to managing cash.

Most readers will be familiar with the investment philosophy that drives The Montgomery Fund. The fund philosophy begins with a focus on high-quality businesses, specifically those that have the ability over time to create value for its shareholders. The second important element of the philosophy is value. It is certainly possible to pay too much for a high-quality business, and the higher the price you pay the lower the long-term return you can expect to earn.

There comes a point when value prevents us from buying or owning even the very highest quality businesses, and when we can’t find opportunities to buy quality at a reasonable price the fund will tend to hold cash up to a soft limit of 30 per cent, and it will wait for better opportunities to deploy that cash into the sorts of businesses that we like.

Our view is that valuations have become stretched – in some parts of the market very stretched – so in recent years The Montgomery Fund has held a cash balance averaging around 24 per cent.

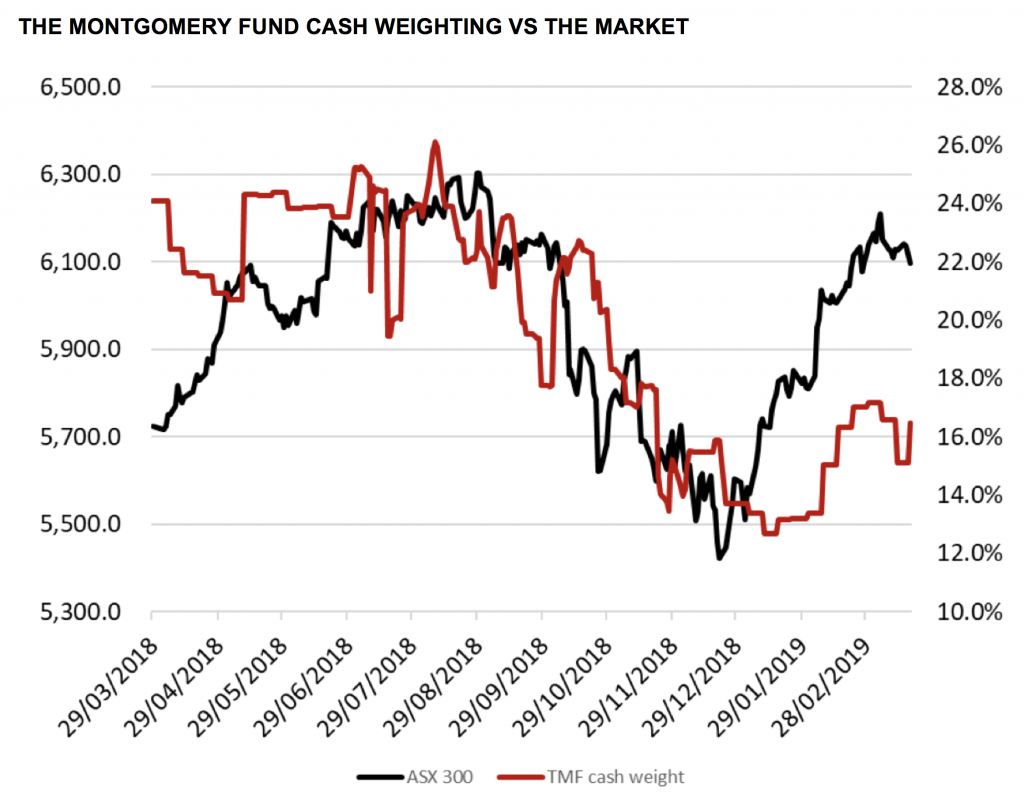

On this chart you can see the level of the overall market in black, and The Montgomery Fund cash weighting in red. As you can see, as the market dropped in October, November and December, we saw valuations improving, and so the fund deployed cash and its cash weighting dropped from around 24 per cent to around 13 per cent.

Source: MIM

As the market recovered at the start of this year, valuations started to become less appealing, and the fund’s cash level started to rise again.

Having the flexibility to hold cash is potentially quite helpful in some circumstances, and it allows the fund to have an upside capture ratio that is higher than its downside capture ratio. With a relatively defensive positioning, The Montgomery Fund outperformed the market by 2.53 per cent in the December quarter, as the market fell by 8.41 per cent. However, this is really only an advantage when the market becomes challenging and downside protection becomes important, which certainly hasn’t been the case in recent years.

Currently, we are concerned – as we have been for some time – about valuations, and the fund is positioned relatively conservatively with a significant cash balance.

Nonetheless, we do think there are some exciting opportunities available in the market and in the event that we see valuations return to more appealing levels we will be very happy to deploy that cash as we started to do at the end of last year.

Thanks Tim,

When you said “valuations started to become less appealing, and the fund’s cash level started to rise again”, does that mean you decided valuations are generally high so you look for the more overvalued stocks in the portfolio and sell, or is it driven the other way around and when analysis of any particular stock is a SELL because it is overvalued, it is sold and the cash weighting rises as a result ?

Ie. Is the 30% soft limit a driver for the sale of overvalued stocks or is it the result of the method of individually valuing the equities in the portfolio ?

Hi Bruce, We keep track of the average valuation of all portfolio holdings and it is that average that drives the cash weight, rather than decisions around individual positions