Have we reached peak stupid on electricity?

Sometimes you have to ask yourself this question when you read ideas put forward by politicians. Take the recent proposal from a group calling themselves the Monash Forum. They want the government to fund, build and operate a new coal fired power station to address rising power prices and the outages that east coast Australia experienced in the summer of 2016/17. There are many reasons why I think this is a BAD idea.

Let’s start with a little background on why power prices are so high in Australia.

- The major reason for the increase in energy costs since 2000 is that the state-owned grid companies, particularly in NSW and QLD, were allowed to significantly overinvest (“gold-plate”) during the period from ~2000 up until ~2011. As they are regulated utilities, they are allowed to make a fixed return on their asset base and hence they were incentivised to build as high an asset base as possible. If you look at your electricity bill, you will see that the majority of it (unless you are a very heavy user) comes from daily charges which are what the grid companies charge to deliver the electricity to your home, and has nothing to do with how expensive the actual electricity is to generate. This is not something that politicians can influence by building more generation, as the only way would be to force a write-down of the asset base and as some of the assets have been privatised, this would create a large sovereign risk factor that I do not think any politician will be prepared to take.

- The second reason energy prices have gone up significantly is mismanagement of the gas resources on the east coast of Australia.

- Australia signing up to the Kyoto and Copenhagen protocols meant that electricity generation over time had to be shifted from being based predominantly on coal to renewable sources. The decision was taken to do this by subsidising renewables through a renewable energy target, creating a secondary income for renewable generation until costs had come down enough for it to be competitive with fossil fuel generation.

- Renewable generation is by its nature intermittent (it is not always windy or sunny) and needs to be “firmed” up to be able to supply continuous power.

- This firming can either be through storing energy when there is plenty generated and then using the stored energy when needed or by burning some fuel (i.e. converting chemical energy to electricity).

- As a lot of the coal generating fleet was starting to get old, and coal power stations are by their nature very slow to start and ramp generation up and down, a decision was collectively taken to use natural gas as a “transition” fuel until energy storage technologies were cheap enough to eventually take over the firming role.

- The east coast of Australia is blessed with a lot of natural gas resources so there should in theory be plenty of gas to use for this firming role.

- The problem is however that three consortia of companies decided to capitalise on high international gas prices by each building their own LNG export facilities on Curtis Island outside of Gladstone in Queensland. And when I say their own facility, I really mean their own! There is no shared infrastructure at all between the facilities even though they are just next to each other. They each have their own pipelines and loading facilities etc., which from an outside observer’s perspective is just mind-blowing as there would be massive scale benefits if they had instead cooperated and built one shared facility. This means that these export facilities are expensive and the companies need to sell their gas at a high price to make a return on their investment. They have long-term contracts at oil-linked prices to sell the gas.

- The biggest problem was that all the companies looking to export had not produced enough gas to fulfil what they had promised their international customers, so they had to go to the domestic gas market and buy up gas to fill their LNG facility.

- At the same time, the state governments in NSW and VIC implemented moratoriums for new gas exploration, resulting in less than expected supply of gas coming to the market.

- The result is that the supply/demand balance in the east coast gas market has shifted significantly since the LNG export facilities came online and gas prices have increased from about $3-4/GJ to $8-10/GJ. This impacts both the generators with no internal gas supply as they have to buy gas at a higher price and the generators with their own supply as they have modified their bidding behaviour as they can alternatively sell their gas to the LNG exporters for a higher price.

- Due to how the electricity wholesale market works, gas generation is the price setter when there is not enough other generation (it is the “marginal generation”). The lack of cheap gas in the domestic market has driven up the wholesale price of electricity from ~$50-60/MWh to the current level of ~$80/MWh.

So why would it be stupid to build more coal generation?

Without involving any arguments about climate change etc., building a new coal fired power station would be stupid for the simple reason that it is just not cheap electricity!

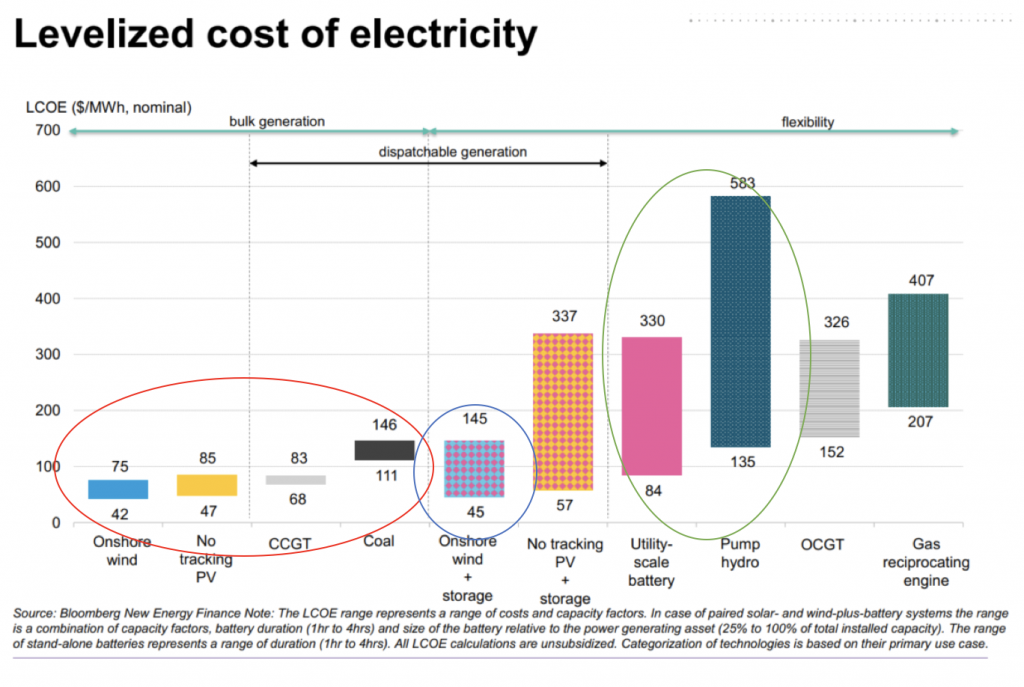

The 1H2018 LCOE report from Bloomberg New Energy Finance, which looks at the Levelised Cost of Energy (i.e. an all-in measure of the cost of energy including capex, opex and financing costs etc.), was released last week. It includes some very interesting charts.

The first chart shows the current LCOE for all types of electricity generation.

The chart shows that:

- Wind and solar are already – even on an unsubsidised basis – significantly cheaper than both gas and coal generation (the red circle).

- Wind + storage is also cheaper than coal generation for small capacity batteries and on par for large capacity batteries (the blue circle).

- Utility scale batteries (i.e. the Tesla battery in South Australia) is very competitive with pumped hydro (Snowy 2 scheme) (the green circle).

In addition, keep in mind that a coal fired power station would probably take at least 5 years to build while wind and solar stations are much quicker to construct, meaning that if we decided we needed extra capacity for, say, 2023, we would have to commit to coal now, but if we were to instead choose wind or solar, we could begin construction in about 2021. Note also that battery storage is very quick to construct as evidenced by Tesla, which famously installed its giant South Australian battery in less than 100 days.

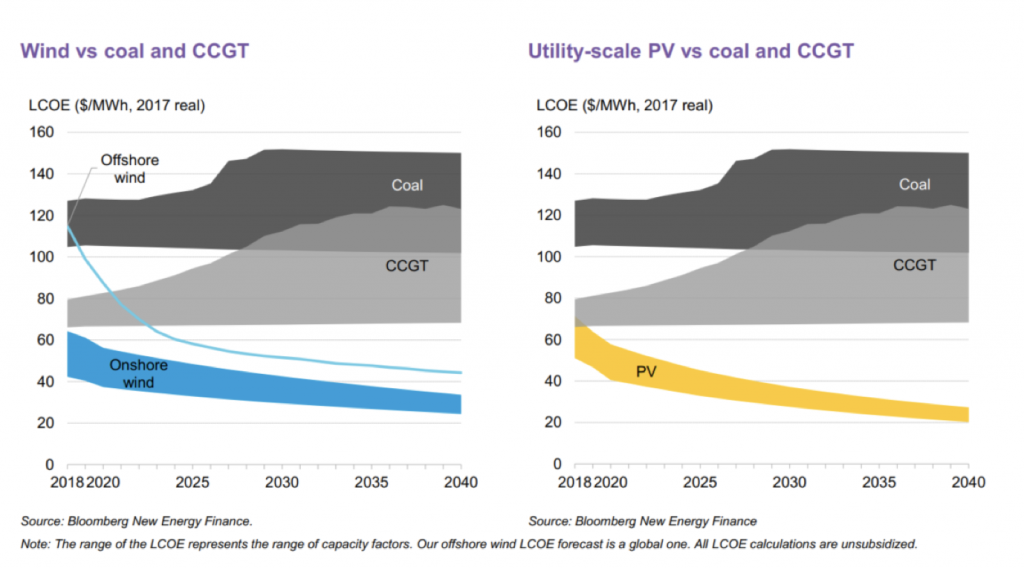

It is therefore interesting to see what is expected to happen over the coming years. Lets first look at the pure generation cost estimates.

- We can see that the price for coal and gas generation is not expected to change in any meaningful way while the costs for both wind and solar are expected to come down significantly, so the gap would be even bigger once the generation is on-line.

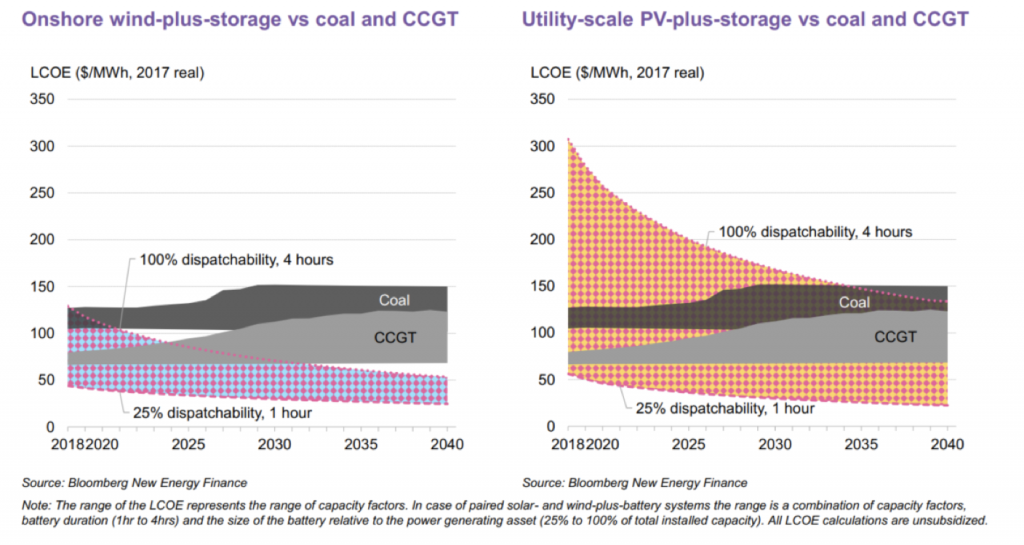

If we then look at dispatchable generation (i.e. adding a battery to a windfarm), we can see that even with a large capacity battery, we are rapidly going well below the cost of coal generation. This is shown in the following chart.

So, in conclusion, building a new coal fired power station does not make financial sense today and will make even less financial sense in the years to come so the message to politicians is please do not waste my tax money on doing something that does not make sense.

The figures also raise questions about the viability of the Snowy 2.0 pumped storage project. This project is projected to come in at the high end of the pumped hydro range at ~$500/MWh and take up to 8 years to construct – during which time battery storage costs should come down even further.

Is building and operating a new coal fired power station to address rising power prices a good idea? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

All you have talked about in your article is the cost.

Renewable energy will never be able to provide baseload power. The sun doesn’t shine for half the day and wind power runs at approximately 30% of nameplate capacity. At this moment coal and gas are providing 72.6% of the country’s electricity requirements.

If renewables are the way to go why is it that SA has amongst the highest electricity prices in the world and could not survive without the interconnector providing coal fired power from Victoria?

The answer to the question which is the title to your article is YES we certainly have. We need new coal fired power generators and we need them now. Stop the subsidies to the renewables and see what happens to electricity prices and future renewables projects.

Hi Philip,

I detect a sense of frustration in your reply to Andreas’ article. Perhaps we are all feeling your frustration, because the answers to our energy issues are extremely complex.

You state in your comment that “renewable energy will never be able to provide baseload power”. Firstly, your statement is wrong. There is a technology called pumped hydro, which has been around for more than 100 years – it is renewable and it can provide 24/7 power (which is what you mean by the term “baseload”). Secondly, “baseload” power is fictional nonsense. Of course we want to have power 24/7, but that isn’t what the electricity market means by baseload. What they are describing is the minimum level that big traditional power generators (coal & gas) can go to before they have to be turned off. It is NOT the baseline of consumer demand.

There are several reasons why South Australia has high electricity prices. Renewables are certainly factor, and the closure of the Northern coal fired station in 2015 and Hazlewood in 2017 have also contributed. A more significant factor (as Andreas rightly pointed out) has been the large increase in the cost of gas, which combined with the loss of old coal (inevitable as aging infrastructure requires replacement – Hazlewood required a $400mn safety upgrade to remain open) has driven marginal prices up in the short term.

You will not get cheaper electricity by building new coal fired power stations, as they are more expensive (on an LCOE basis) than wind, solar and hydro. Please actually look at Andreas’ graphs in his article, for the facts. Renewable sources are cheaper than new coal or gas without any subsidies. The fact that we have chosen to subsidise the introduction of renewables simply reflects a desire to encourage investment from the private sector to grow the industry faster than would otherwise be the case. Investment in renewables won’t stop without subsidies, although the private sector always likes to have incentives for investment and the political uncertainty around this is naturally causing investors to sit on their hands.

Can I suggest you read the following articles to improve your understanding of some of the issues?

http://www.abc.net.au/news/2018-03-14/the-conversation-fact-check-does-sa-have-highest-energy-prices/9546506

http://www.abc.net.au/news/science/2017-10-12/renewable-energy-baseload-power/9033336

Sincerely,

For a company whose business is based on analysis this is a very poor interpretation of the energy market. Renewables are a lifeline for the fossil fuel industry. Simply go to the Large Scale Generators Market and look at the price of a Renewal Energy Certificate approx. $80 a megawatt.

The LCOE is far more complicated than presented here. On the question of batteries do a quick survey of the people in your office and see how many are using battery technology in their own homes.

The South Australian Tesla battery stores enough power to last Adelaide about 3 minutes and is good for about 10 years. The world has wasted billions and billions of dollars on renewable energy for very little gain but the thing that has been most wasted is time. When the Americans decided to put a man on the moon they engaged over 300,000 people and spent somewhere in the vicinity 5% of their GDP to make it happen. Here we are confronted with what is supposed to be the worlds greatest challenge and we are relying on wind turbines. The writer of this article needs to also do some research on the Carbon Cycle and look at the enormous role agriculture is playing in climate change. Read about the role Humus plays in storing carbon and how we are destroying this through farming techniques.

Very nice and pretty graphs and figures there mate, but it’s a shame that those figures are only due to all kinds of government goal seeking intervention in energy and electricity production and supply markets through various forms of regulation, insentivisatiins,goosing, juicing, and generally forcing the price of coal fired power production through the roof, hence massive increases in power bills in recent years. And all this in order to make your religions preferred methods of power production remotely competitive. And if I’m wrong then please tell me why an how we the “lucky country” whom happen to be blessed with massive energy resources in very accessible areas end up with the most or near the most expensive power on the planet??? With the reliability of a third world country??? Now that right there is what you would call peak stupid. And all at a time when our export industrys are being crushed by cheap Asian manufacturers with very cheap power (mainly coal)

We, can only break our necks to please the high priests of the farcical Paris climate agreement, which allows the biggest polluter in the world to go on polluting (china) while we punish what’s left of our industry’s with massive hikes in power costs. Now that is peak INSANE, but that’s religion for you.

Boy did I laugh when you mentioned tesla and how great they are at installing batteries etc, it’s just a shame they won’t be around to back up their warrenty in a few years time because everyone knows they are basically insolvent and have been since day one, even the rating agencies are giving them the boot now. Which is a very relevant point since it seems in your calculations you assume batteries last forever, well no they don’t, And all of the above is exactly why china is expanding coal generation sir, because China has no high priests to please, it’s only dollars and cents, thanks again to your Paris agreement . Gee talk about stupid!!! Need I go on?

Hi Andrew,

The LCOEs (Levelised Cost of Energy) shown are completely un-subsidized and like for like. A LCOE is basically a discounted cash flow calculation of all the costs associated with a plant including capital to build and costs to operate. This calculation does take into account the life-length of the various plants.

The main reason that Australia have expensive electricity prices are chronic mismanagement of the distribution and transmission assets. They were gold-plated to a massive extent which has driven up overall cost of energy. Distribution costs make up around 50% of the total cost of retail electricity and has virtually zero to do with what kind of plant is generating the electricity (actually theoretically, distributed generation like roof-top solar and local battery storage should over time mean less investments needed in transmission and distribution…).

Wholesale electricity costs make up around 35% to the retail price and the main driver of increase here is that gas prices have gone from ~$3/GJ to ~$9-10/GJ as the LNG export facilities are now up and running and gas producers can either sell their gas as LNG or as gas domestically and will of course maximize their profits by demanding a domestic price equal to what they get from exporting. Assuming a heatrate of ~10GJ/MWh (average of a CCGT and OCGT), this increases the cost of gas generated electricity by ~$60-70/MWh.

The last 15% of the cost of retail electricity is made up of marketing and billing costs and retailers margin. This has been reasonably stable over time.

Regarding China building a lot of more coal plants, they have actually put a hold to that over the last 18 months and EIA is projecting that there will be no net increase in China’s coal generation capacity going forward (https://www.eia.gov/todayinenergy/detail.php?id=33092). The same trend can be seen in India where in 2017 solar PV additional generation for the first time overtook coal additional generation (https://renewablesnow.com/news/indian-pv-capacity-additions-surpass-coal-in-2017-mercom-598653/).

I used Tesla as an example on how quick it is to install batteries. We are fully aware of Tesla’s financial position. Batteries are though much more of a plug-in, standardised technology than a thermal plant so even if Tesla is not there in the future, plenty of other players will be and would be able to work on the equipment.

Yes Andreas, gold plating as you say is goosing and juicing as I said, not to mention governments taking “dividends” from state owned power infrastructure which is really another word for tax. But we can rave on all day about the methods they have used to push up the cost of power to the worlds most expensive, and with no regard for the consequences to industry and households across the land. But as I said, it is the method used to fool people like yourself into believing that wind, solar, batteries, etc are cheaper than trusty coal, well maybe they are if you make the alternative more expensive through financial engineering, but that is all it is, it’s not real it’s kind of like our monetary system that enables crazy situations like this to exist. And as you say there will always be someone else ready to replace Teslas broken battery’s in 5 or so years, but maybe it will be a company that makes actual money and doesn’t loose billions every year like tesla, and my guess is that will require a significantly higher price tag for those new batteries. So again there are many juiced and goosed figures that go into your discription of the cost of renewable energy besides the government fakery and fraud. And as very well demonstrated by Tesla, most of the things needed to build solar wind and battery power plants are manufactured and sold at below cost of production, thanks again to free money and government juicing. Which is the total opposite if you try to build a coal plant.

Also the dumping of solar panels on world markets is one of the main complaints made to the WTO by various countries as you probably know.

You may also know that China is lending billions throughout Asia for the construction of coal power plants also.

But all that aside, the net effect of this entire scam of biblical proportions will be further erosion of our already weak ability to value add to our exports as Roger has spoken about recently (the need to value add to exports) which will further weaken our economy and export jobs to Asia, due to ever growing costs of doing business here, all while China laughs at how stupid we are.

Lies, damned lies, and statistics

Why Nations with more renewables have more expensive electricity.

Attempting to understand how electricity coming from the seemingly free wind and sun could lead to a tripling of electricity prices.

Germany — with peak electricity demand of about 83 GW — had rushed in recent years to build “renewable” capacity that had reached about 84 GW, theoretically enough to supply all the electricity they would ever need.

But somehow, Germany still had retained fossil fuel generating capacity of about 108 GW, which is about the same fossil fuel capacity you would want to have to supply 83 GW of peak demand if you had no renewable capacity at all.

Despite spending hundreds of billions of euros on the renewable capacity, they had not been able to get rid of any fossil fuel capacity at all!

They still need all the fossil fuel capacity for backup when the wind does not blow and the sun does not shine.

Despite declining relative costs for wind and solar generators, the electricity they produce is still much more expensive than fossil-fueled and nuclear power.

I remain unconvinced about the LCOE of batteries, there are a lot of variables that affect the actual price now, the most obvious being that the life of the battery is shortened by using it. There are the somewhat unknown costs of disposing of them and then there is the inevitable fall out from when one of them goes up in flames – it will be a fire that will not be forgotten in a hurry. The future cost of the inputs such as lithium to batteries are also a big question. The potential game changer here is the use of another form of energy storage such as hydrogen. Batteries in some ways are really only a temporary measure until we work out how to convert energy into a much more mobile form of energy that more closely resembles oil and/or gas.

CCGT is closed cycle gas turbine for those that were wondering!

What is obvious is that stupid people can only do so much damage ,if you want monumental stuff ups you need people with IQ

That’s the stage we are T