Has the market oversold Aussie retailers?

The prices of most Australian discretionary retail stocks have fallen in sympathy with their overseas counterparts. The question is: are those declines undeserved? If they are, then high quality Australian retailers trading on low multiples could represent a bargain for long-term investors.

We recently wrote an explanation for why we are currently underweight consumer discretionary stocks. The comments we subsequently received pointed out that bearish sentiment is at a low ebb, and reflected in single digit price-to-earnings ratios for even high quality retailers.

Those observations are indeed reasonable and so it now falls on the investor to determine whether positive changes are evident in the world of consumer spending and retail sales.

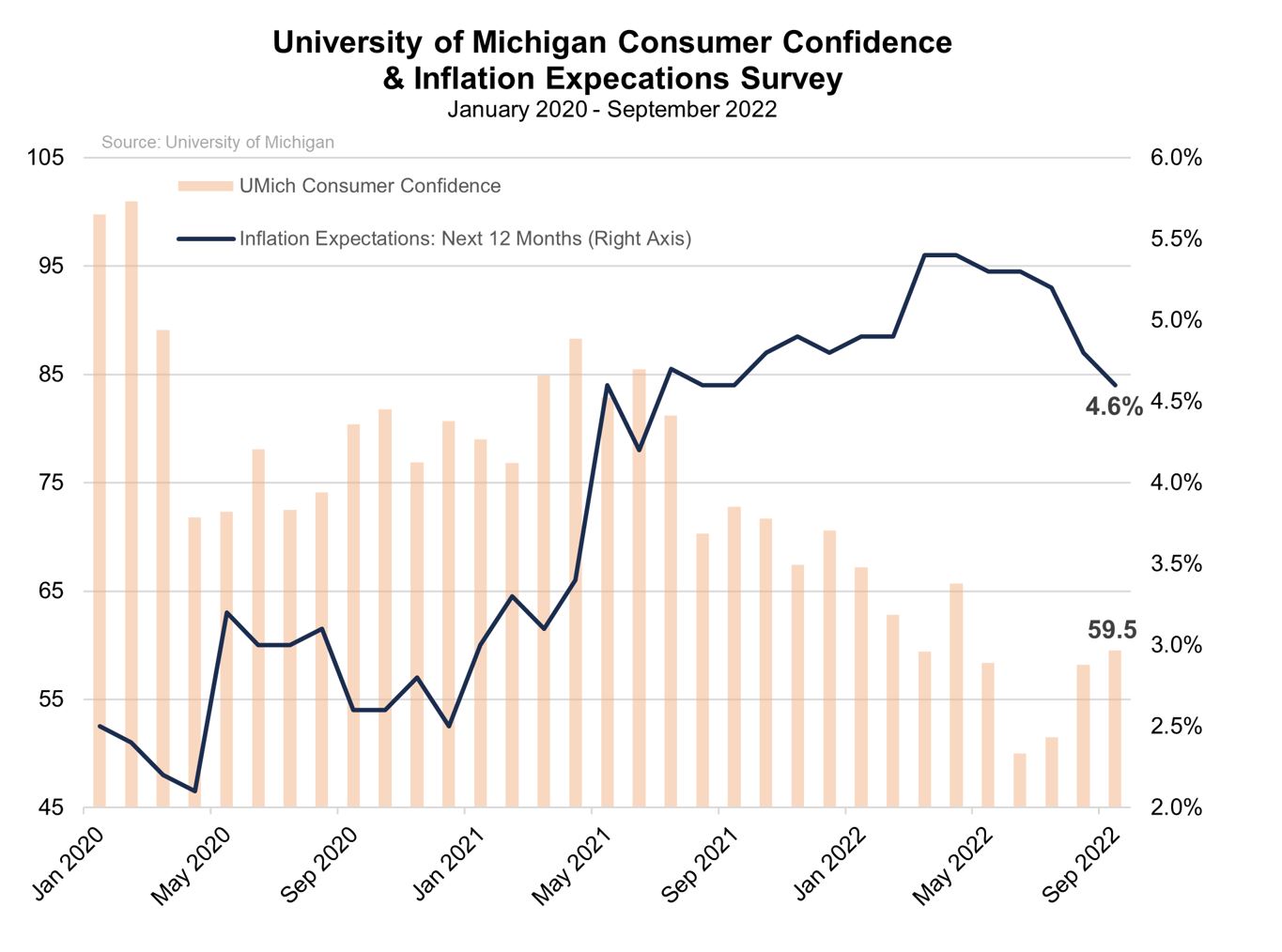

In the U.S., the University of Michigan Consumer Sentiment Gauge has continued to improve. The gauge rose 1.3 points to 59.5 in September’s preliminary reading, up from 58.2 in August. It marked the most robust reading since April and the third consecutive monthly increase.

And, as we have previously mentioned, inflation expectations are continuing to ease. Expectations for the inflation rate for the next twelve months have declined to 4.6 per cent from 4.8 per cent in September. That is the lowest reading in twelve months and the third consecutive decline. The Federal Reserve action on rates is having the desired effect, preventing high current rates of inflation from dangerously feeding into higher expectations for the future.

And, arguably more importantly, inflation expectations for the next five years have fallen to 2.8 per cent, a 14-month low.

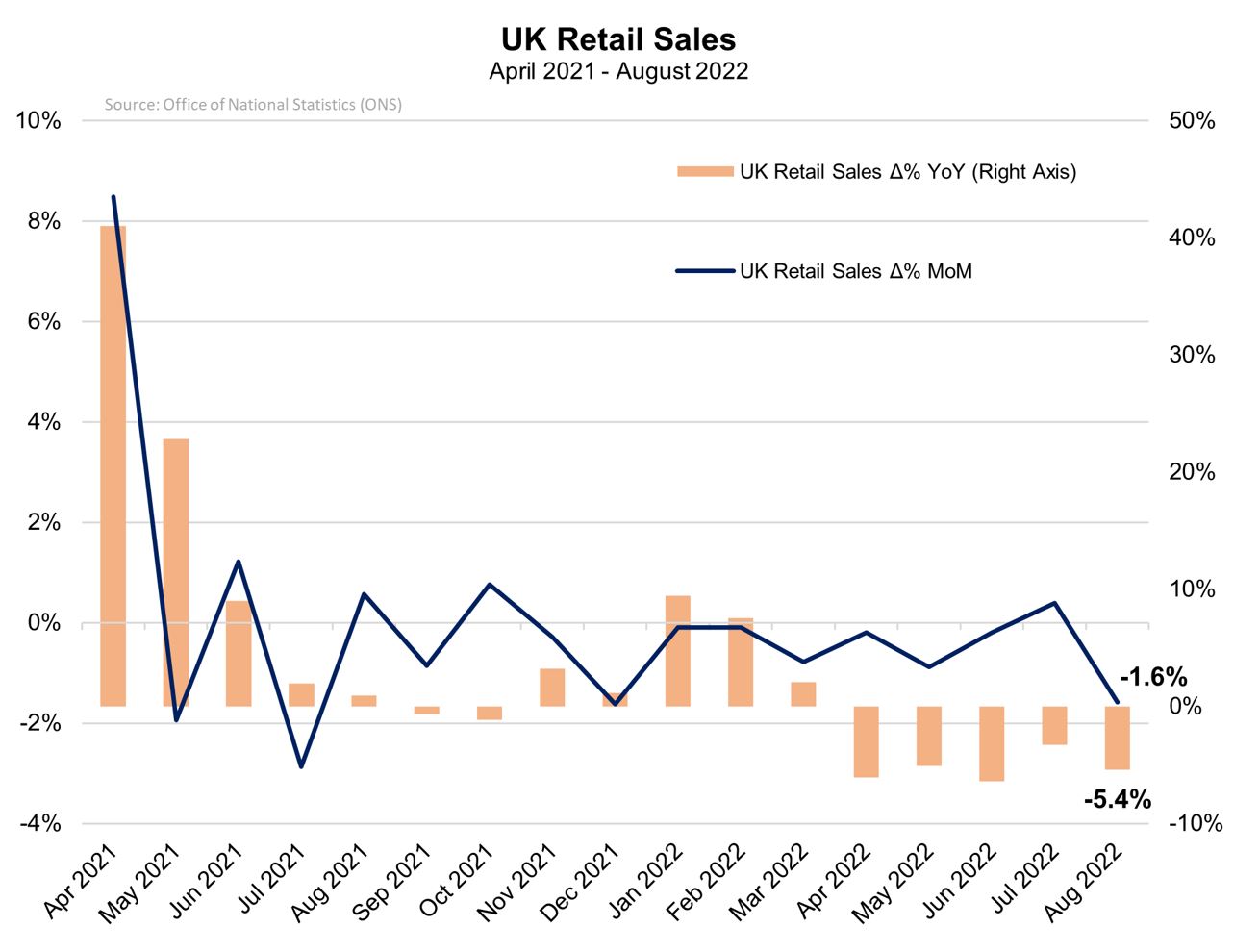

Over in the UK, the picture is less optimistic. Retail sales in August fell into negative territory.

According to the United Kingdom’s Office for National Statistics, August retail sales in the UK fell 1.6 per cent month-on-month. Worryingly, the decline was the ninth in the past ten months. On an annual basis, retail sales fell 5.4 per cent (year-on-year), the fifth negative annual reading in a row.

The Goldman Sachs consumer dashboard for major economies, including the Euro area, Japan, the UK, Canada, and Australia, focuses on seven metrics of consumer health that are relevant for the consumer spending outlook.

Goldman Sachs notes consumer trends remain highly correlated across countries. On the negative side, elevated inflation has eroded real income growth, which has fallen to percentile 30 or less across all economies.

Elevated inflation has also contributed to the drop in consumer confidence, which registers in percentile 30 or less in all economies except the US. Both real income growth and consumer confidence are particularly low in the UK and the Euro area.

Perhaps in contrast to the more recent University of Michigan data, Goldman Sachs report real spending growth has slowed substantially in North America and Europe, but remains solid in Japan and Australia given later reopening and less elevated inflation.

On the positive side, Goldman Sachs reports consumers are benefiting from a very tight labour market. With unemployment rates remaining very low across all economies, support for retail sales is assured, however unemployment has edged up by 0.2 percentage points and 0.5 percentage points in the U.S. and Canada, respectively.

They also note household balance sheets remain strong across all surveyed economies. Household net worth as a share of income ranks in percentile 90 or higher everywhere.

Similarly, they observe debt service ratios remain very low in most major economies after a decade of low interest rates. They are however not as low in the UK and Canada, perhaps explaining the struggle for retail sales in the UK reported above.

Thanks to higher inflation in all countries, real net worth growth is much softer.

When Goldman Sachs averaged their latest percentile-based metrics of consumer health within each country, three groups of countries stood out. On the negative side, their consumer health average registers around percentile 35 in the Euro Area and the UK, down from around 50 three months ago. On the positive side, their consumer health average sits around percentile 60 in Japan and Australia, down only slightly from around 65 three months ago. Finally, the average stands at around percentile 40 in the US and percentile 50 in Canada, down from 70 three months ago.

So it does look like Australian retail stocks have fallen in sympathy with their overseas counterparts. However, those declines might be undeserved, at least for retailers with no overseas exposure. Single digit price-to-earnings ratios for even high quality Australian retailers could represent a bargain if the benefits of global store roll outs offset the weaker stats coming out of those foreign domiciles.