Hardly normal conditions for Harvey Norman

For big-ticket household items, established retailer Harvey Norman (ASX:HVN) is a bellwether company, offering insights into consumer behaviour and retail conditions, particularly in Australia. The company recently released its first-half results, and reactions were mixed.

On the positive side, the company returned to disclosing quarterly sales growth rates. ‘Network’ sales (it sells through company-owned and franchised stores) were still well ahead of pre-COVID levels, up 22 per cent. Meanwhile, management reconfirmed Asia and European expansion plans. Finally, HVN shareholders now own almost $3.94 billion worth of property across Australia, New Zealand, Ireland, Singapore and Slovenia. The latter item is equivalent to $2.30 per share of property net of debt.

The company, however also reported some items analysts and investors will react negatively to, and these arguably outnumber the positives, and are more relevant in the near term.

First, Australian earnings before interest and tax (EBIT) margins were adversely impacted by higher support costs for franchisees. The EBIT margin (EBIT/System Sales), while still higher than the 4.6 per cent prior to COVID, has fallen from a peak of 10.5 per cent, and from last year’s 8.9 per cent, to 7.3 per cent.

Meanwhile, dividends have been reduced and company store inventory is higher at $598 million versus $560 million at the same time last year. Similarly, Franchisee Receivables – used by analysts as a proxy for their inventory – rose 50 per cent to circa $930 million from circa $620 million at the same time last year.

The latter increase is due to a lift in seasonal stock, including barbecues, air-conditioners, and outdoor furniture. In preference to discounting this stock, management has indicated franchisees will need to hold the stock until next season. This suggests they may have already discounted, and further discounts are unreasonable.

The lower sell-through, as indicated by higher inventory, was reflected in like-for-like or same-store sale weakening. First-quarter growth of 11.2 per cent in Australia swung to negative 5.1 per cent in the second quarter. This represents an underperformance compared to JB Hi-Fi and The Good Guys.

Over in New Zealand, positive like-for-like growth of 5.5 per cent in the first quarter reversed to negative 13 per cent in the second quarter, with the company noting “the fall in retail profit for 1H23 was as a result of a decrease in sales turnover, a contraction in gross margin due to discounting and an increase in operating costs.”

At least partly because of all of the above, net debt rose from $62 million to $553 million.

In January, conditions failed to improve. Like-for-like sales in Australia declined 10.4 per cent and New Zealand sales fell 8.5 per cent.

Investors will likely want to know whether conditions have stablised in February but some of the worst flooding and storms in record in New Zealand won’t have helped. In the media, Gerry Harvey was quoted pointing out “February is really our worst month.” Ever the optimist Harvey added, “We’re now coming into March, so March to June we’re trying to figure out what’s going to happen. We are feeling confident it will be OK – not great – because we’ve still got full employment.”

Rising interest rates have had a significant impact on housing sales turnover. By way of example, monthly New Home Sales in Australia have averaged 7,046 units between 1996 and 2023. The highest level of turnover was 16,708 units in March of 2001. The record low of 3,004 units has just been recorded in January of 2023.

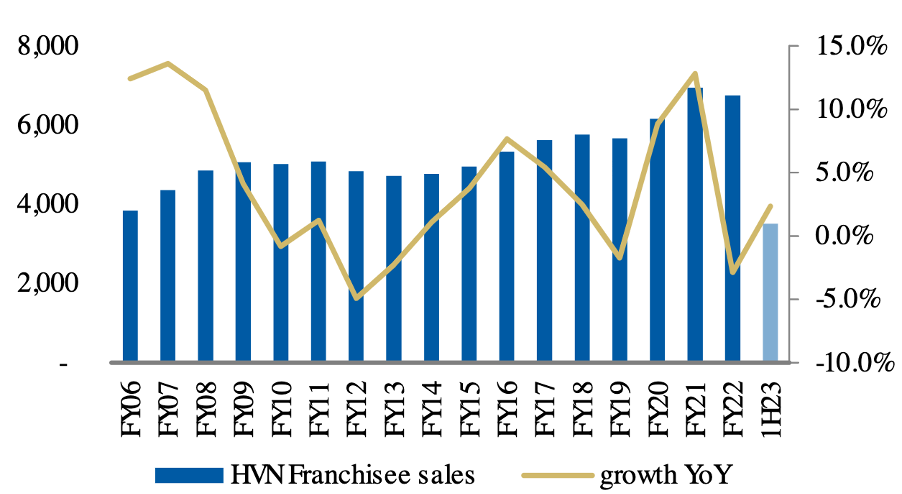

This is a leading indicator for big-ticket household items with new home buyers shopping to fit out their homes after taking possession. Perhaps unsurprisingly, Harvey Norman’s sales reflect this pattern (see Morgan Stanley data plot in Figure 1.), with peak sales in FY21 (which takes in peak new home sales in March ’21). January 2023 sales are now less than nine per cent ahead of pre-COVID levels.

A murky short-term outlook is highly likely, as is pressure on earnings.

Figure 1. Harvey Norman sales

Source: Harvey Norman/MS Australia

Some uncertainty also surrounds how the company will bring inventory down without further discounting and/or an increase in spending on marketing and franchisee support through Harvey Norman-funded discount cards, for example. Remember, styles and tastes change, and new furniture and appliance models will be released, rendering selling old stock difficult. These are the challenges typically faced by a mature incumbent rendering it pro-cyclical.

In terms of estimating a valuation, if the company can sustain a return on equity of 10 per cent over the long term on its $3.50 of equity per share and a long-term average dividend payout ratio of 75 per cent, and if investors are willing to adopt a nine per cent required return, a valuation not far from $4.00 results. But with further pressure on earnings likely to see analysts downgrade their estimates, further share price weakness may increase any perceived margin of safety.